January 19th Macroeconomic Index: China Optimistic About 2024 Consumption, Low Debt and Inflation Provide Policy Space

Daily Macro Economy News

Latest Global Major Index

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. National Bureau of Statistics: remain optimistic about the consumption trend in 2024

2. National Bureau of Statistics: China's government debt level and inflation rate are low, and there are conditions and space for strengthening the implementation of macroeconomic policies

3. National Bureau of Statistics: The import and export of goods are generally stable, and the trade structure continues to be optimized

4. National Bureau of Statistics: The output of automobiles in December was 3.04 million, including 1.141 million new energy vehicles

International News

1. National Australia Bank: The Reserve Bank of Australia is expected to end its interest rate hikes

2. HSBC: Recent factors are difficult to help the Australian dollar, and the decline may expand

3. Goldman Sachs: More foreign funds are expected to pour into the Indian stock market after the Indian election

4. Oil prices fell as the dollar strengthened to offset the supply crisis in the Red Sea

Domestic News

1. National Bureau of Statistics: remain optimistic about the consumption trend in 2024

Kang Yi, Director of the National Bureau of Statistics, said at a press conference that we judge that there are more favorable conditions to support the sustained rebound of consumption, and consumption will still maintain good growth. Supporting factors: First, the consumption potential is still huge. With a population of more than 1.4 billion, the advantages of the super-large market are still obvious, coupled with the integrated development of urban and rural areas, the promotion of urbanization, and the continuous upgrading of consumption structure, all of which provide a broad space for consumption growth. Second, the consumption base has been continuously consolidated. With the continuous recovery of the economy and the overall improvement of the employment situation, residents' income is expected to maintain stable growth, which will strongly support the improvement of residents' consumption capacity. Third, consumption highlights continue to emerge. Fourth, the policy of promoting consumption will continue to exert force. Therefore, we remain optimistic about the consumption trend in 2024.

2. National Bureau of Statistics: China's government debt level and inflation rate are low, and there are conditions and space for strengthening the implementation of macroeconomic policies

Kang Yi, Director of the National Bureau of Statistics, said at a press conference that the policy effects of additional issuance of treasury bonds, tax and fee cuts, RRR and interest rate cuts introduced in 2023 will continue to be released this year. This year, some new measures will be reserved and optimized, and these new incremental measures and stock policies will also be superimposed, all of which will escort the stable operation of the economy. At present, China's government debt level and inflation rate are low, the policy toolbox is also constantly enriched, fiscal, monetary, and other policies have relatively large room for maneuver, and there are conditions and space for strengthening the implementation of macroeconomic policies.

3. National Bureau of Statistics: The import and export of goods are generally stable, and the trade structure continues to be optimized

The total import and export volume of goods for the whole year was 41.7568 trillion yuan, an increase of 0.2% over the previous year. Among them, exports were 23.7726 trillion yuan, up by 0.6 percent, and imports were 17.9842 trillion yuan, down by 0.3 percent. Imports and exports were offset, with a trade surplus of 5,788.4 billion yuan. The import and export of private enterprises increased by 6.3 percent, accounting for 53.5 percent of the total import and export, an increase of 3.1 percentage points over the previous year. Imports and exports to the Belt and Road countries increased by 2.8 percent, accounting for 46.6 percent of the total imports and exports, an increase of 1.2 percentage points over the previous year.

4. National Bureau of Statistics: The output of automobiles in December was 3.04 million, including 1.141 million new energy vehicles

In terms of products, in December, the output of 383 products out of 620 products increased year-on-year. Among them, 108.5 million tons of steel, up 1.5 percent year-on-year, 157.93 million tons of cement, down 0.9 percent, 6.59 million tons of ten non-ferrous metals, up 7.3 percent, 2.72 million tons of ethylene, up 0.1 percent, 3.04 million automobiles, up 24.5 percent, including 1.141 million new energy vehicles, up 43.7 percent, power generation of 829 billion kilowatt hours, up 8.0 percent, and crude oil processing 60.11 million tons, up 1.1 percent.

International News

1. National Australia Bank: The Reserve Bank of Australia is expected to end its interest rate hikes

The National Australia Bank changed its forecast for the RBA, saying that interest rates are now expected to have peaked at the current 4.35%. The bank had previously expected the RBA to raise interest rates in February. Gareth Spence, head of Australian economics at National Australia Bank, said the RBA is now expected to keep interest rates unchanged until November and then gradually cut rates by 125 basis points by the end of 2025, bringing the cash rate to 3.1%. He said there was no reason for further rate hikes as the RBA has been reluctant to raise interest rates and the Q4 CPI data is likely to provide some breathing room. He added that there are growing signs that goods inflation may come down faster than expected.

2. HSBC: Recent factors are difficult to help the Australian dollar, and the decline may expand

HSBC currency strategist Lenny Jin said the Aussie could extend losses as risks tilt the market towards withdrawing bets on the Fed's interest rate cuts, and a slow recovery in some Asian countries is unlikely to help the Aussie in the short term. Jin said they believe the recent sell-off is not an underestimation of fundamentals, but rather a correction of the significant overvaluation of AUD FX accumulated in November and December 2023. The AUD/USD fair value is expected to be in the range of 0.6290-0.6667, implying a further decline of 1.1-1.2% to the midpoint of the range.

3. Goldman Sachs: More foreign funds are expected to pour into the Indian stock market after the Indian election

Goldman Sachs strategists said India could see an acceleration in foreign capital inflows into its $4.4 trillion stock market once the national elections are over. Sunil Koul, an Asia-Pacific equity strategist at Goldman Sachs, said that the proportion of Indian equities held by global funds is still underweight, and the proportion of global mutual funds with total assets of about $2.4 trillion in investment in India is nearly 150 basis points lower than historical levels. In addition, India's post-election "policy continuity" will see the Indian stock market grow at a compound annual return rate of 15% this year and next.

4. Oil prices fell as the dollar strengthened to offset the supply crisis in the Red Sea

Oil prices fell on Wednesday as a stronger dollar limited demand for dollar-denominated crude, though rising risks of supply disruptions amid heightened conflict in the Red Sea capped losses. Daniel Hynes, senior commodities strategist at ANZ, said in a note that the drop in oil prices was "triggered by slightly hawkish rhetoric from central bankers". The market's lack of reaction to near-term geopolitical risks suggests that it is not taking into account the threat of supply disruptions. However, although there has been no loss of production so far, this has indirectly tightened the market by pushing more supply onto the water.

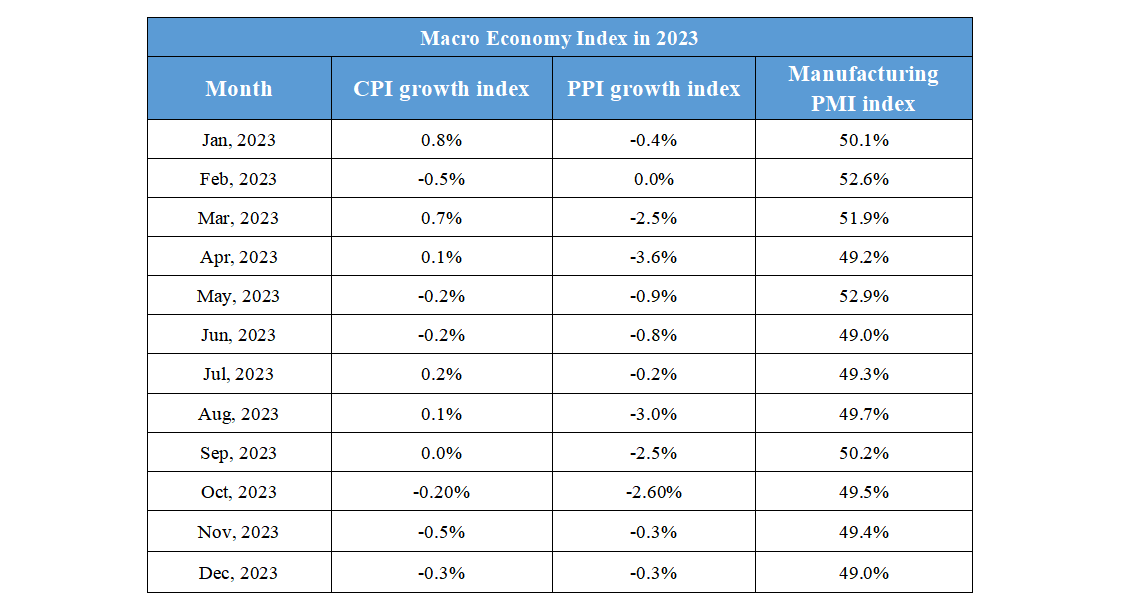

Domestic Macro Economy Index