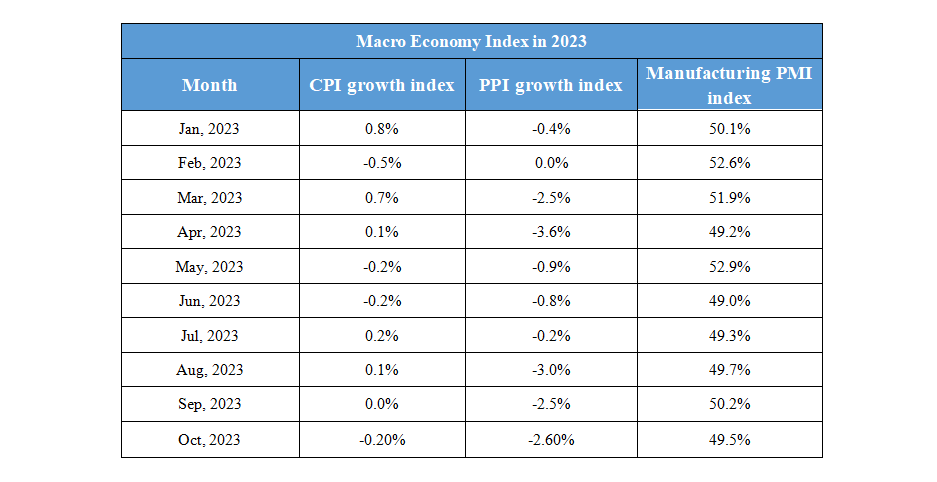

December 7th Macroeconomic Index: China's Economy Rebounds, Foreign Investors Optimistic About Bond Market

Daily Macro Economy News

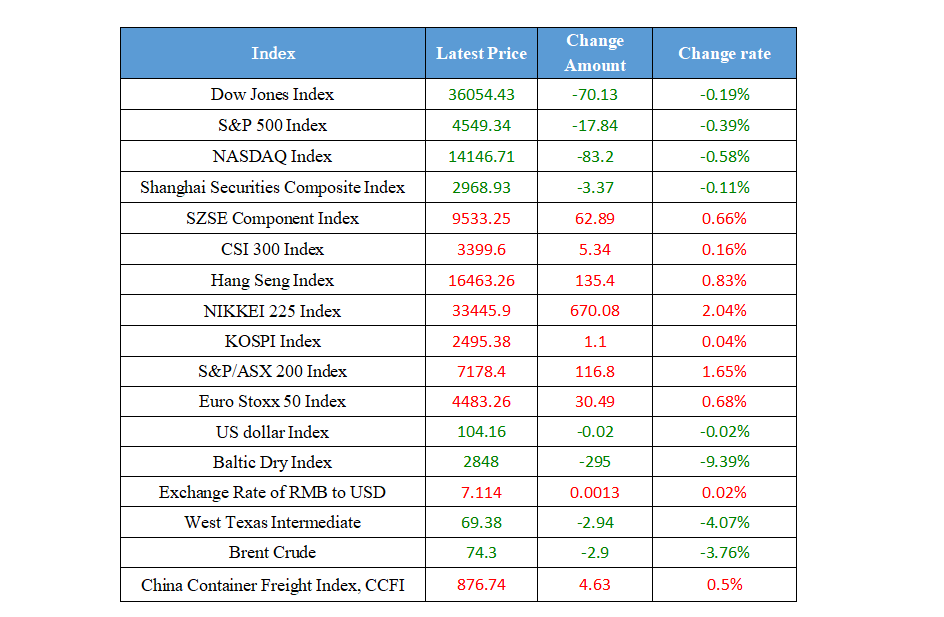

Latest Global Major Index

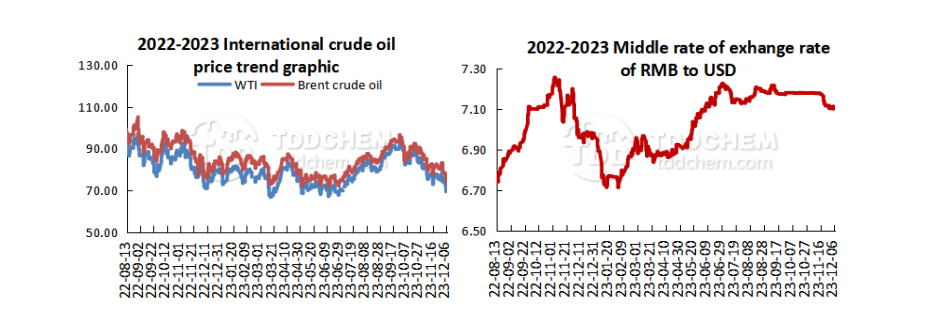

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Economic Daily: The "red line" of 1 billion tons is a bottom line

2. The front page of China Securities News: Strengthen the balanced supply of credit, and there is room for RRR and interest rate cuts

3. Foreign investors continue to be optimistic about China's bond market and have been net buyers of Chinese bonds for 9 consecutive months

4. China's economy is rebounding and the future development prospects are bright

International News

1. CEO of JPMorgan: If I were a U.S. official, I would shut down the cryptocurrency industry

2. Saudi Crown Prince: Saudi Arabia and Russia have very good prospects for expanding cooperation

3. Concerns about oversupply in the United States and doubts about the prospect of OPEC+ production cuts caused WTI crude oil fell below the $70 mark

4. The U.S. Department of Defense announced $175 million in military assistance to Ukraine

Domestic News

1. Economic Daily: The "red line" of 1 billion tons is a bottom line

Recently, the four departments jointly issued the "Guiding Opinions on Promoting the Green Innovative and High-quality Development of the Oil Refining Industry", which clearly stated that by 2025, the domestic crude oil one-time processing capacity will be controlled within 1 billion tons. The introduction of the new policy is conducive to curbing the disorderly expansion of refining capacity, avoiding excessive construction and waste of resources, and promoting the transformation and upgrading of the industry to extend and strengthen the chain. In short, the "red line" of 1 billion tons is a bottom line, which is related to the realization of the "dual carbon" goal and the high-quality and sustainable development of the economy and society. While strictly controlling the new refining capacity, the only way is to promote the transformation and upgrading of the industry.

2. The front page of China Securities News: Strengthen the balanced supply of credit, and there is room for RRR and interest rate cuts

Financial data in November will be released soon. Experts expect that new credit in November may increase less than the same period last year, and the year-on-year growth rate of social financing scale and stock is expected to rise. In the context of strengthening the balanced supply of credit, the credit performance is expected to be supported by the end of this year. In the next stage, monetary policy will continue to make efforts to stabilize growth, and there is room for RRR and interest rate cuts. Zhang Wei, chief analyst of fixed income at Founder Securities, believes that the recent increase in the supply pressure of government bonds has had an impact on the capital side, and the possibility of the People's Bank of China cutting the reserve requirement ratio still exists due to the impact of factors such as bank credit in December may exceed the level of the same period in previous years.

3. Foreign investors continue to be optimistic about China's bond market and have been net buyers of Chinese bonds for 9 consecutive months

Foreign investors continue to be optimistic about China's bond market, and have been net buyers of Chinese bonds for nine consecutive months, with a cumulative net purchase of nearly 1 trillion yuan since 2023, and as of the end of October, a total of 1,110 foreign institutions have invested in China's bond market, with an average increase of about 100 new companies per year since 2017. Overseas institutions cover more than 70 countries and regions, and hold a total of 3.3 trillion yuan of Chinese bonds, an increase of nearly 200% from the end of 2017.

4. China's economy is rebounding and the future development prospects are bright

China's economy is rebounding and the future prospects are bright. Since 2023, China's economy has overcome difficulties and challenges, withstood downward pressure, and moved forward in a tortuous manner; economic development still has more favorable conditions and supporting factors, and its contribution to global economic growth will reach one-third this year; China's economy is resilient, full of potential, and has wide room for maneuver, and the fundamentals of long-term improvement have not changed and will not change, and the market expectations and development confidence of private enterprises have been further enhanced.

International News

1. CEO of JPMorgan: If I were a U.S. official, I would shut down the cryptocurrency industry

JPMorgan’s CEO Dimon said at the annual Wall Street supervisory hearing of the U.S. Senate Banking Committee that he would shut down the cryptocurrency industry if he had the power of the U.S. government officials. Dimon has long slammed digital currencies, which he previously called "Ponzi schemes" and "fraud." His latest remarks come amid a series of hacks and scandals in the crypto industry. Senator Elizabeth Warren, Democrat of Massachusetts, joined Republicans and banking leaders in pointing the finger at the cryptocurrency industry at the hearing. "Today's terrorists have a new way to circumvent the Bank Secrecy Act: cryptocurrency," Warren said. "Dimon and the head of other banking institutions, such as the CEO of Bank of America, said they have put safeguards in place to prevent terrorists and other illegal actors from taking advantage of their institutions.

2. Saudi Crown Prince: Saudi Arabia and Russia have very good prospects for expanding cooperation

On December 7, local time on December 6, Saudi Crown Prince and Prime Minister Mohammed bin Salman held talks with visiting Russian President Putin. During the talks, Putin said that the friendly relations between Russia and Saudi Arabia cannot be hindered. At the same time, Putin invited Mohammed to visit Moscow and received consent. Putin proposed to exchange views on the regional situation and said that Russia and Saudi Arabia could cooperate closely in the field of fertilizers. Saudi Crown Prince and Prime Minister Mohammed bin Salman said that Putin was a special guest for Saudi Arabia. Saudi Arabia and Russia have been successful in cooperation in the fields of energy, trade and investment, and the two countries have very good prospects for expanding cooperation.

3. Concerns about oversupply in the United States and doubts about the prospect of OPEC+ production cuts caused WTI crude oil fell below the $70 mark

On December 7, WTI crude oil fell below the $70 per barrel mark for the first time since July this year, and the great U.S. exports volume and doubts about whether OPEC+ can achieve its production cut plan have caused concerns about oil oversupply. Oil prices have continued to fall since OPEC+ announced further production cuts last Thursday, underscoring the organization's difficulties in balancing the market in the first quarter. U.S. crude oil exports are close to a record 6 million b/d, according to estimates from Ship Tracking Company. In addition, Saudi Arabia cut its official selling price for Asian customers by the most on Tuesday since February.

4. The U.S. Department of Defense announced $175 million in military assistance to Ukraine

On December 7, local time on December 6, the U.S. Department of Defense announced a new batch of military aid worth $175 million to Ukraine, including air defense equipment, artillery shells and anti-tank weapons. According to a statement released by the Ministry of Defense, the latest fund allocation was made available as part of the $6.2 billion presidential grant mandate that was reinstated in June, following a reassessment of the total value of the items that have been provided to Ukraine. As of the end of November, there was about $5.75 billion left in the fund. The U.S. Department of Defense said on June 20 that it had overestimated the value of ammunition, missiles and other equipment it had aided Ukraine by $6.2 billion due to bookkeeping errors.

Domestic Macro Economy Index