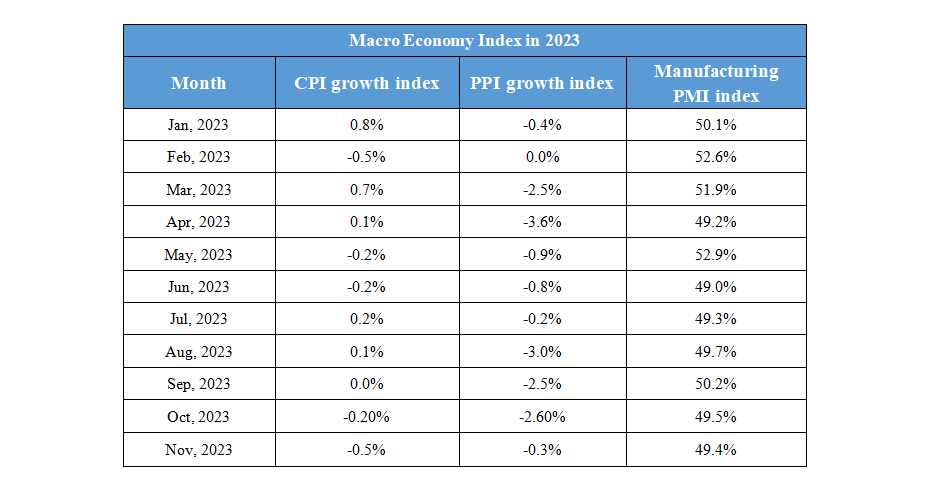

January 10th Macroeconomic Index: China Sees Surge in New Tax-Related Business Entities, Grain Purchases, and Oil Production

Daily Macro Economy News

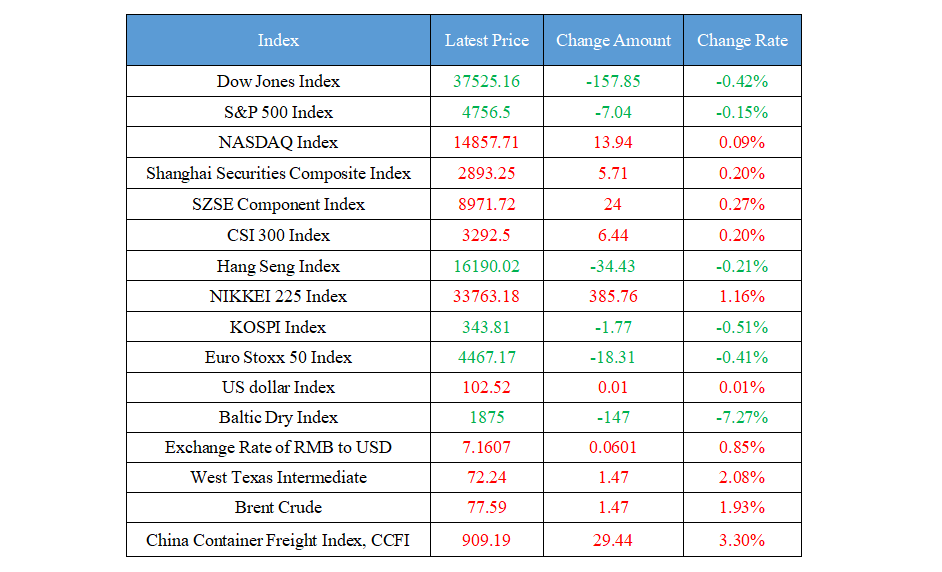

Latest Global Major Index

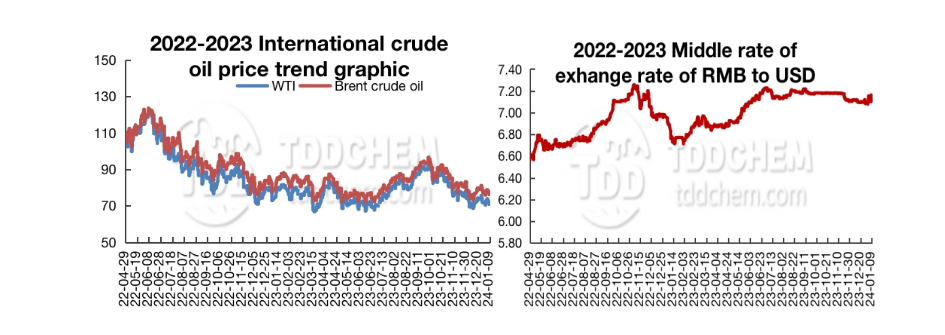

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. State Taxation Administration: In the first 11 months of 2023, there were more than 15 million new tax-related business entities nationwide, a year-on-year increase of 25.4%

2. In 2023, more than 400 million tons of grain was purchased, and the purchase of autumn grain was stable

3. In 2023, domestic oil and gas production equivalent exceeded 390 million tons

4. National Health Commission: From January to August 2023, the total number of consultations and treatments in medical and health institutions nationwide was 4.52 billion, a year-on-year increase of 5.3%

International News

1. S&P Global Ratings: The situation in the Red Sea does not affect Russia to continue to be India's largest crude oil supplier

2. Cuba will raise domestic fuel prices significantly

3. South Korea's unemployment rate is expected to rise to 3.0%, and the slowdown in hiring in the service sector will affect the job market

4. Citi Bank: Australia's retail sales growth in November may push the Fed to raise interest rates further

Domestic News

1. State Taxation Administration: In the first 11 months of 2023, there were more than 15 million new tax-related business entities nationwide, a year-on-year increase of 25.4%

According to the latest data from the State Taxation Administration, in the first 11 months of 2023, 15.151 million business entities went to the tax department to handle tax-related matters such as tax identification, invoice collection, and tax declaration, a year-on-year increase of 25.4% and an average growth of 11.9% in two years. Among them, in 2023, there was 10.557 million active tax households that received invoices and have income declarations, accounting for 69.7%, an increase of 3.1 percentage points compared with 2022, and tax-related business entities are active.

2. In 2023, more than 400 million tons of grain was purchased, and the purchase of autumn grain was stable

The reporter learned today (9th) from the National Grain and Material Reserve Work Conference that in 2023, more than 400 million tons of grain was purchased throughout the year. Up to now, the main producing areas have purchased nearly 120 million tons of autumn grain in the new season in 2023, and the national autumn grain procurement is stable and orderly, and the purchase progress is faster than that of the previous year. At present, there is about 60% autumn grain was purchased, the purchase of mid-to-late period indica rice in the south has entered the final stage, and the purchase of corn in North China and corn, soybean, japonica rice and other grain varieties in Northeast China is being concentrated on the increase. Since the launch of autumn grain in 2023, the supply of major autumn grain varieties has been sufficient, the market operation has been generally stable, and the total purchase of autumn grain in 2023 will reach the highest level in recent years.

3. In 2023, domestic oil and gas production equivalent exceeded 390 million tons

In 2023, domestic oil and gas production exceeded 390 million tons, maintaining a rapid growth momentum of 10 million tons for seven consecutive years. The average annual growth rate reached 11.7 million tons of oil equivalent, forming a new peak period of production growth. Crude oil production reached 208 million tons, an increase of more than 3 million tons compared with 2022, and a significant increase of nearly 19 million tons compared with 2018, further consolidating the fundamentals of long-term stable production of 200 million tons of domestic crude oil. The sharp increase in marine crude oil production has become a key increment, with the output exceeding 62 million tons, accounting for more than 60% of the country's oil production for four consecutive years. Shale oil exploration and development has progressed steadily, and onshore deep-ultra-deep exploration and development has continued to make significant discoveries. The output of natural gas reached 230 billion cubic meters, maintaining the momentum of increasing production by 10 billion cubic meters for seven consecutive years.

4. National Health Commission: From January to August 2023, the total number of consultations and treatments in medical and health institutions nationwide was 4.52 billion, a year-on-year increase of 5.3%

According to the National Health Commission, from January to August 2023, the total number of visits to medical and health institutions nationwide was 4.52 billion (excluding data from clinics, infirmaries, and village clinics), a year-on-year increase of 5.3%. The number of hospital visits was 2.75 billion, a year-on-year increase of 3.0%, of which 2.30 billion were public hospitals, a year-on-year increase of 2.6%, and the number of private hospitals was 450 million, a year-on-year increase of 5.2%. There were 1.56 billion person-times in primary medical and health institutions (excluding clinics, infirmaries, and village clinics), a year-on-year increase of 10.6%, of which 600 million person-times were in community health service centers (stations), a year-on-year increase of 20.9%, and 790 million person-times were in township health centers, a year-on-year increase of 2.9%.

International News

1. S&P Global Ratings: The situation in the Red Sea does not affect Russia to continue to be India's largest crude oil supplier

S&P Global Commodity Insights pointed out that tensions in the Red Sea are unlikely to weaken Russia's position as a major supplier of crude oil to India. Despite a series of attacks on merchant ships on trade lanes, oil shipments from Russia to India were not affected. The route plans of suppliers dealing with Indian refineries remained unchanged. Last year, Russia became India's largest supplier of crude oil, accounting for more than a third of its imports. S&P said this trend is likely to continue in early 2024. Despite the threat of a Red Sea crisis, India's demand for Russian crude has remained resilient and no known changes has been detected so far.

2. Cuba will raise domestic fuel prices significantly

On January 8, local time, Cuba's Minister of Finance and Prices, Vladimir Regro Alle, told the media that Cuba will raise fuel prices from February 1 this year. At that time, the price of B90 petrol will rise to 132 pesos per litre and B94 petrol rise from 30 pesos per litre to 156 pesos per litre. At the same time, diesel prices will rise accordingly. In addition, 28 new petrol stations that accept credit cards and fuel tickets will be opened in Cuba. Alai said that the purpose of the increase in fuel prices is to regulate the market.

3. South Korea's unemployment rate is expected to rise to 3.0%, and the slowdown in hiring in the service sector will affect the job market

South Korea's unemployment rate is likely to climb to 3.0% in December from 2.8% in the previous month due to a slowdown in hiring in the services sector. The rate has risen from a record low of 2.4% in August and remains low compared to the post-pandemic average of 3.3%. Employment in December is estimated to be 15,000 fewer (seasonally adjusted) than that in November, compared with a decrease of 79,000 in November. Hiring in the services sector is likely to slow down further, although the sector is likely to remain a key job creation market. Manufacturing payrolls are likely to shrink again this month. Despite the signs of weakness, the job market remains fairly resilient, giving the Bank of Korea room to keep its policy rate tight for longer.

4. Citi Bank: Australia's retail sales growth in November may push the Fed to raise interest rates further

Citi economist Faraz Saeed said the strong growth in retail sales in Australia in November could be a necessary condition for the RBA to raise interest rates further in February. Retail sales rose 2.0% month-on-month, leaving the RBA unable to convincingly justify not tightening policy based on concerns about economic growth. Still, the Fed has set a high threshold for tightening, and another surprise upside in inflation, especially in service prices, may be needed to raise rates by another 25bp in February.

Domestic Macro Economy Index