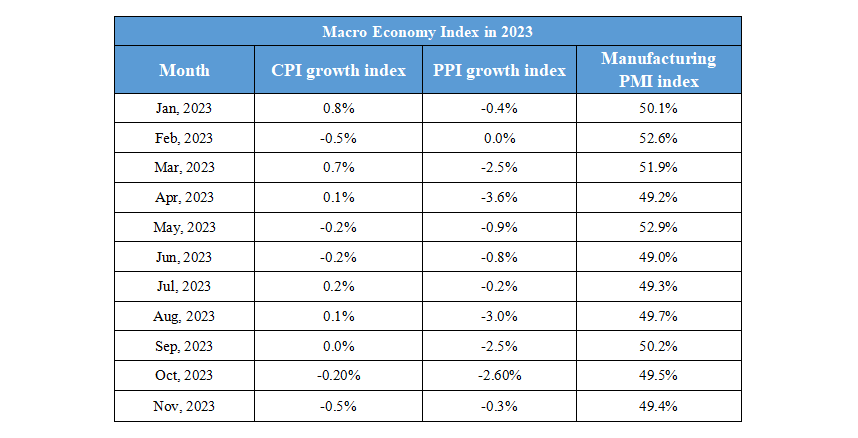

December 29th Macroeconomic Index: China Sets Ambitious New Energy Vehicle Credit Ratios, US Repo Market Shows Year-End Volatility

Daily Macro Economy News

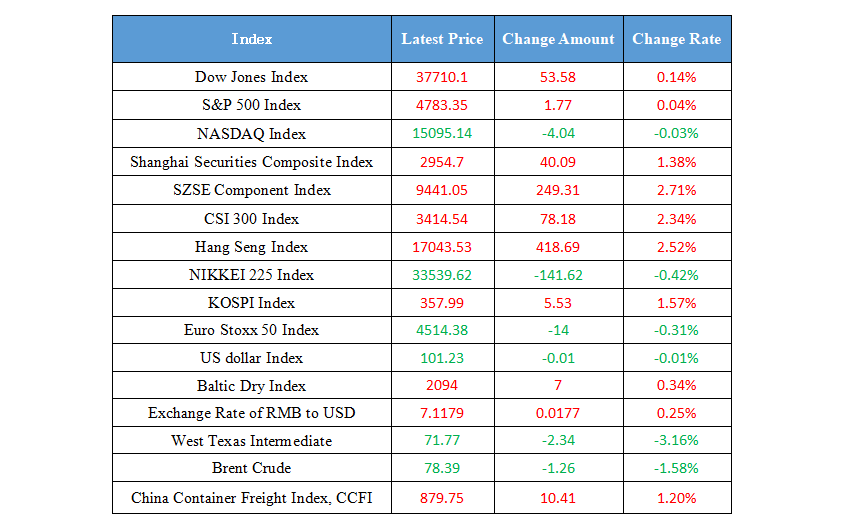

Latest Global Major Index

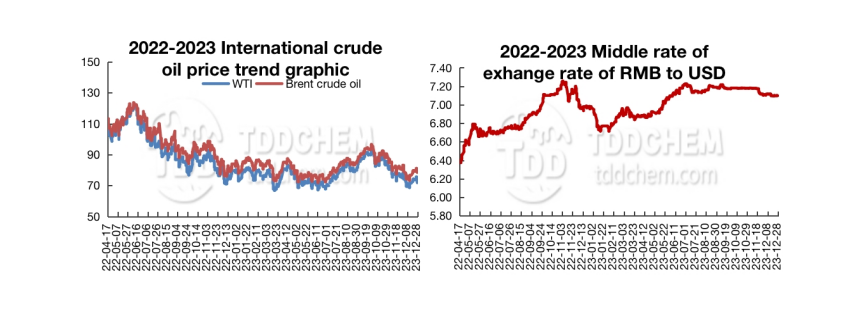

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Ministry of Industry and Information Technology: The credit ratio requirements for new energy vehicles in 2024 and 2025 are 28% and 38% respectively

2. Ministry of Commerce: In 2022, the national economic development zone will achieve a GDP of 14 trillion yuan, accounting for 12% of GDP

3. The largest charging and swapping station in southwest China was officially put into operation

4. Ministry of National Defense: The video call between the Chinese and US militaries has achieved positive and constructive results

International News

1. The pressure of "money shortage" has reappeared, and the volatility of the U.S. repo market at the end of the year rose for the first time in five years

2. Japan's industrial output has declined, indicating that the economic recovery is incomplete

3. U.S. diesel deliveries to Europe will reach a 65-month high

4. Media: The United States proposes that the G7 discuss the confiscation of Russia's frozen assets, but Germany, France and Italy have reservations

Domestic News

1. Ministry of Industry and Information Technology: The credit ratio requirements for new energy vehicles in 2024 and 2025 are 28% and 38% respectively

The Ministry of Industry and Information Technology (MIIT) issued a notice on matters related to the average fuel consumption of passenger cars and the credits management of new energy vehicle for 2024-2025. In 2024 and 2025, the new energy vehicle credit ratio requirements are 28% and 38% respectively. For domestic passenger car manufacturers with an annual production volume of less than 2,000 vehicles and with independent production, R&D and operation, and imported passenger car suppliers authorized by overseas passenger car manufacturers with an import volume of less than 2,000 vehicles, the average fuel consumption of the enterprise decreases by more than 4% compared with the previous year, and the standard value is relaxed by 60% on the basis of the average fuel consumption requirements of enterprises stipulated in GB 27999 "Evaluation Methods and Indicators for Fuel Consumption of Passenger Cars", and the decrease of more than 2% while less than 4% , the standard value is relaxed by 30%.

2. Ministry of Commerce: In 2022, the national economic development zone will achieve a GDP of 14 trillion yuan, accounting for 12% of GDP

The Ministry of Commerce announced the results of the assessment and evaluation of the comprehensive development level of national economic and technological development zones in 2023. In 2022, the national economic development zone will achieve a GDP of 14 trillion yuan, accounting for 12% of GDP. As of the end of 2022, there were 1,765 manufacturing enterprises with a main business income of more than 3 billion yuan in the eastern national economic development zones and more than 1.5 billion yuan in the central and western national economic development zones, a significant increase from the previous year.

3. The largest charging and swapping station in so0uthwest China was officially put into operation

It was learned from Sinopec that the largest charging and swapping station in southwest China, Sinopec Bihao large-scale charging and swapping station, was officially put into operation in Chengdu. The station is equipped with 120 charging spaces and 1 battery swap station, with a maximum charging power of 480KW, and can achieve a range of 400 kilometers in 10 minutes at the fastest speed, meeting the charging needs of various vehicles.

4. Ministry of National Defense: The video call between the Chinese and US forces has achieved positive and constructive results

Senior Colonel Wu Qian, Director of the Information Bureau of the Ministry of National Defense and Spokesperson of the Ministry of National Defense: On the evening of December 21, Liu Zhenli, member of the Central Military Commission and chief of staff of the Joint Staff Department of the Central Military Commission, had a video call with Chairman of the Joint Chiefs of Staff Brown to have a frank and in-depth exchange of views on the implementation of the important consensus and issues of common concern at the San Francisco summit between the two heads of state, and achieved positive and constructive results. In the next step, we hope that the United States and China will work in the same direction and earnestly promote the healthy and stable development of the relations between the two forces on the basis of equality and respect. Regarding the specific exchange projects, the defense departments of the two countries are maintaining communication and coordination, and we will release information in due course.

International News

1. The pressure of "money shortage" has reappeared, and the volatility of the U.S. repo market at the end of the year rose for the first time in five years

As the Federal Reserve continues to promote liquidity out of the financial system, year-end trading in the U.S. overnight funding market is volatile for the first time in five years. Volatility in the overnight repo market has started to rise recently, with the repo rate reaching as high as 5.53%, closing at 5.32% on Tuesday, according to Curvature Securities. The last time the repo market fluctuated around the end of the year was in 2018. Stress in the funding market usually intensifies at the end of the year, and banks tend to reduce their activities to strengthen their balance sheets in order to meet regulatory requirements. Their retreat has forced market participants to either look for alternative sources of financing or risk paying higher funding costs. But unlike in the previous five years, when the market relied on central banks for additional liquidity, traders are wary of additional pressures as repo rates soared last month following the recent rebound in the treasury market. Watch for signs of further funding constraints in the coming days.

2. Japan's industrial output has declined, indicating that the economic recovery is incomplete

Japan's industrial output fell in November for the first time in three months, while retail sales rose more than expected, suggesting that the its recovery from the summer's worst contraction since the pandemic is not complete. Japan's industrial output fell 0.9% in November from the previous month, while retail sales rose 1% from the previous month, about double analysts' expectations, data showed. The reports point to an uneven recovery in Japan. In contrast to the manufacturing sector showing signs of expansion, weaker performance appeared in the services sector and retail sector.

3. U.S. diesel deliveries to Europe will reach a 65-month high

US diesel exports with 10ppm sulphur content to the European Union and the United Kingdom hit the second-highest level this year in December and are on track to surpass the July high, data showed that the Panama Canal issue shifted U.S. products to European buyers. The EU and the UK imported about 785,000 tonnes of diesel with 10ppm sulphur from the US between December 1 and 26, the highest volume imported from the US in five months, Vortexa data showed. Planned imports of ultra-low sulfur diesel in December will bring total U.S. exports to the two regions to 960,000 mt by the end of the month, the highest since July 2018.

4. Media: The United States proposes that the G7 discuss the confiscation of Russia's frozen assets, but Germany, France and Italy have reservations

Germany, France, Italy and the European Union have reservations about the idea of the United States proposing to confiscate $300 billion worth of Russian assets, arguing that it is necessary to first assess the legality of the measure, citing sources, the Financial Times on December 28. The United States has proposed that the G7 countries establish a joint working group to explore how to seize $300 billion assets frozen by Russia. The United States, with the support of the United Kingdom, Japan and Canada, has proposed to prepare a scenario for the confiscation of Russian assets for the possible G7 meeting at the end of February 2024. The European Union, the United Kingdom and France stressed that obtaining confiscated funds is not easy and insufficient to meet Ukraine's reconstruction needs. In addition, the countries noted that the seizure of Russian assets should not be detrimental to the provision of financial support to Kyiv in 2024.

Domestic Macro Economy Index