October 22nd Macroeconomic Index: Copper Prices Expected to Rise, Qualcomm Launches New Chip, and International Nuclear Disarmament Faces Challenges

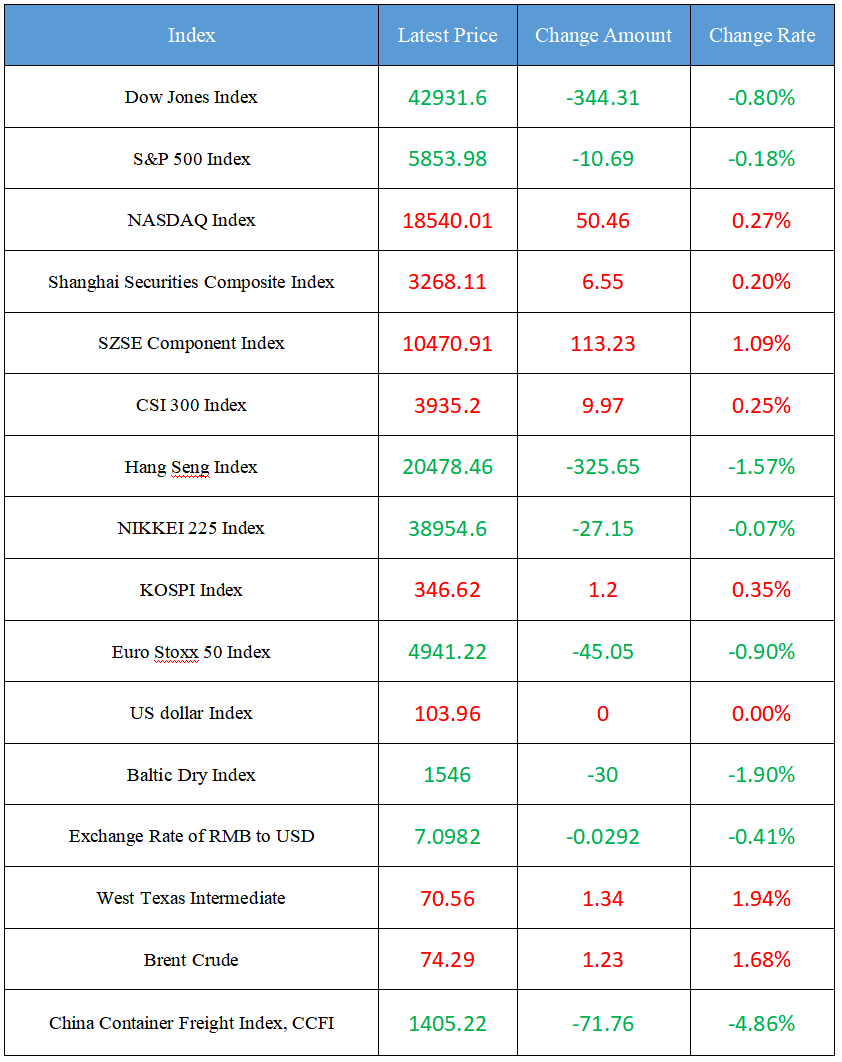

Latest Global Major Index

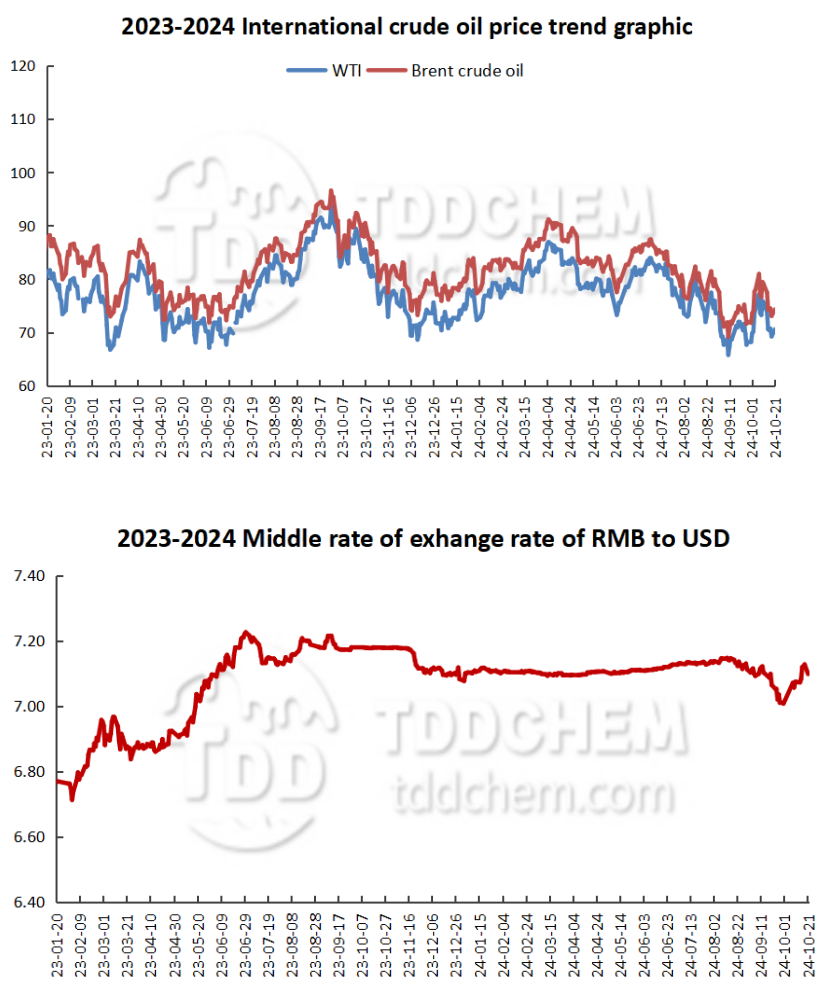

International Crude Price Trend & Exchange Rate of RMB to USD Trend

Domestic News

1. The peak season of copper consumption is advanced, and copper prices may fluctuate upward in the fourth quarter

2. China's Ambassador for Disarmament: International nuclear disarmament is facing unprecedented and severe challenges

3. Qualcomm launched a new version of the smartphone chip to turn to self-development

4. Credit risk is cleared in stages, and investment confidence in the convertible bond market has picked up

5. M&A and restructuring in the A-share market are surging, and emerging industries have become the main areas of mergers and acquisitions

International News

1. Schmid of the Fed tends to slow down the pace of interest rate cuts

2. The Cybercab press conference was hit by another storm. The producer of "Blade Runner 2049" sued Tesla

3. Suspected of sexually assaulting Palestinian prisoners, United States launched the review to the Israel Defense Forces

4. The southern part of Beirut in Lebanon was attacked by Israeli airstrikes

5. The Israeli army demanded that some residents of the southern suburbs of Beirut in Lebanon be evacuated as soon as possible

Domestic News

1. The peak season of copper consumption is advanced, and copper prices may fluctuate upward in the fourth quarter

According to data from Shanghai Ganglian, the spot inventory of domestic electrolytic copper began to decline in June, and downstream consumption gradually recovered. Zhao Kaixi, a non-ferrous metals analyst at Tongguan Jinyuan Futures, believes that the downstream consumption of copper this year is characterized by the early arrival and delayed end of the peak season. Since September, the domestic copper downstream consumption has gradually improved, although the inventory rebounded slightly after the National Day holiday, but the peak season consumption of 'Golden September and Silver October' is expected to drive domestic copper into a low inventory state. In the view of CICC's commodity team, the demand for "Golden September and Silver October" this year is better than expected, among which the demand for home appliances, automobiles and power grids is more impressive. The pivot in copper prices is expected to remain in the range of US$9,500 to US$10,000 per tonne in the fourth quarter.

2. China's Ambassador for Disarmament: International nuclear disarmament is facing unprecedented and severe challenges

On October 21, local time, China's Ambassador for Disarmament Shen Jian said in his keynote speech on nuclear disarmament in the First Committee of the 79th Session of the United Nations General Assembly that the current lack of strategic mutual trust between major countries, the tense geopolitical situation, and the escalation of regional conflicts are facing unprecedented and severe challenges to the international nuclear disarmament process. All countries should work together to reduce nuclear risks, promote nuclear disarmament and prevent nuclear proliferation, and maintain world peace and security. Shen Jian said that China believes that the international community should uphold the vision of common, comprehensive, cooperative and sustainable security, practice true multilateralism, respect each other's legitimate security concerns, and jointly advance the international nuclear arms control process.

3. Qualcomm launched a new version of the smartphone chip to turn to self-development

Qualcomm said at an event in Hawaii on Monday that the latest version of the Snapdragon series will include its own Oryon processor design. Qualcomm says the chip will be 45% faster than the previous generation and consumes less energy. Qualcomm's decision to pivot to in-house processor design is part of CEO Cristiano Amon's investment in in-house technology. Under the previous leadership, the Snapdragon series became more reliant on the Arm Holdings Plc design.

4. Credit risk is cleared in stages, and investment confidence in the convertible bond market has picked up

The data shows that since the bottom of the previous period, the Shanghai Composite Index has risen by 20%, and the China Securities Convertible Bond Index has also risen by nearly 10%. Especially when the market has continued to fluctuate and adjust recently, the rise of the CSI Convertible Bond Index has even exceeded the rise of the Shanghai Composite Index, demonstrating the increased confidence of investors in the convertible bond market. A number of analysts said that the recovery of the convertible bond market is in line with the situation of the equity market. As an asset with both equity and debt properties, convertible bonds have attracted much attention from the market after the extreme market sentiment has recovered. The unique risk-return characteristics of convertible bonds make convertible bonds defensible in market shocks, and at the same time, they can share the benefits when the market rises.

5. M&A and restructuring in the A-share market are surging, and emerging industries have become the main areas of mergers and acquisitions

According to statistics, as of October 21, more than 100 listed companies have disclosed the progress of major restructuring events since September this year, and nearly 50 companies have since October, compared with less than 10 in the same period last year. It is found that the recent mergers and acquisitions in the A-share market have two major characteristics: first, "innovative" M&A cases continue to emerge, such as cross-border mergers and acquisitions, "snake swallowing elephants", "quasi-backdoor", etc.; Second, emerging industries have become the main areas of mergers and acquisitions, such as semiconductors and innovative drug industries. Wang Xiao, a professor at the Central University of Finance and Economics, believes that mergers and acquisitions are not only a powerful tool for leading and chain-level listed companies to become bigger and stronger, but also an important way for unlisted high-quality enterprises to enter the capital market, so as to solve the problem of IPO phased tightening and activate the primary market, which can be described as "killing multiple birds with one stone".

International News

1. Schmid of the Fed tends to slow down the pace of interest rate cuts

Kansas Fed President Schmid, a member of the 2025 FOMC committee, said he leaned towards slowing the pace of rate cuts, given the uncertainty about how low the Fed should eventually cut rates. In his first public speech since August, Schmid said he wanted the policy cycle to be "more normalized" and that the Fed would adjust "moderately" to maintain economic growth, price stability and full employment. Slowing the pace of rate cuts, he said, would also allow the Fed to find a so-called neutral level, where policy neither drags down nor stimulates the economy. "In the absence of major shocks, I am optimistic that we can achieve such a cycle, but I believe that policy will be approached in a cautious and gradual manner," Schmid said. Speaking about the labor market, Schmid said: "My view is that what we are seeing is a normalization, not a serious deterioration. ”

2. The Cybercab press conference was hit by another storm. The producer of "Blade Runner 2049" sued Tesla

On Monday, film and television studio Alcon Entertainment sued Tesla (TSLA. O) and Warner Bros. Discovery (WBD. O), accusing them of using images from the movie Blade Runner 2049 to promote Tesla's new driverless taxi, the CyberCab. Warner Bros. is the distributor of Alcon's Blade Runner 2049, which won two Oscars in 2018. Alcon said it had rejected Warner Bros.' request to use images of the company's movies at Tesla's Oct. 10 online launch event, but Tesla then used movie-like, AI-generated images in its robotaxi campaign. Previously, Tesla's stock price showed a significant downward trend after the Cybercab conference, reflecting that investors and the market are still cautious about the commercialization prospects of the new products.

3. Suspected of sexually assaulting Palestinian prisoners, United States launched the review to the Israel Defense Forces

On October 21, local time, it was learned that two Israel officials and two United States officials said that United States had launched a review of the Israel National Defense Force units. A United States official said the review focused on the Israel Defense Forces' "Unit 100," which guards detainees from Gaza. Several members of the force are currently on trial in Israel on suspicion of sexually assaulting a Palestinian detainee.

4. The southern part of Beirut in Lebanon was attacked by Israeli airstrikes

On the evening of October 21, local time, it was learned from Lebanon that the Jnah area south of Beirut in Lebanon was attacked by Israeli airstrikes. It is reported that the location of the attack is close to the Rafiq·Hariri Public Hospital. The Jnah region belongs to the transition zone from the city of Beirut in Lebanon to the southern suburbs of Beirut. Earlier, the Israeli army spokesman issued a number of evacuation orders, requiring residents in some specific areas in the southern suburbs of Beirut in Lebanon to evacuate as soon as possible.

5. The Israeli army demanded that some residents of the southern suburbs of Beirut in Lebanon be evacuated as soon as possible

On the evening of October 21, local time, Israel Defense Forces Arabic spokesman issued a number of evacuation orders on social media, requiring residents in some specific areas in the southern suburbs of Beirut in Lebanon to evacuate as soon as possible. The spokeman also attached satellite maps of local communities, saying that Israeli forces would soon take action against targets.

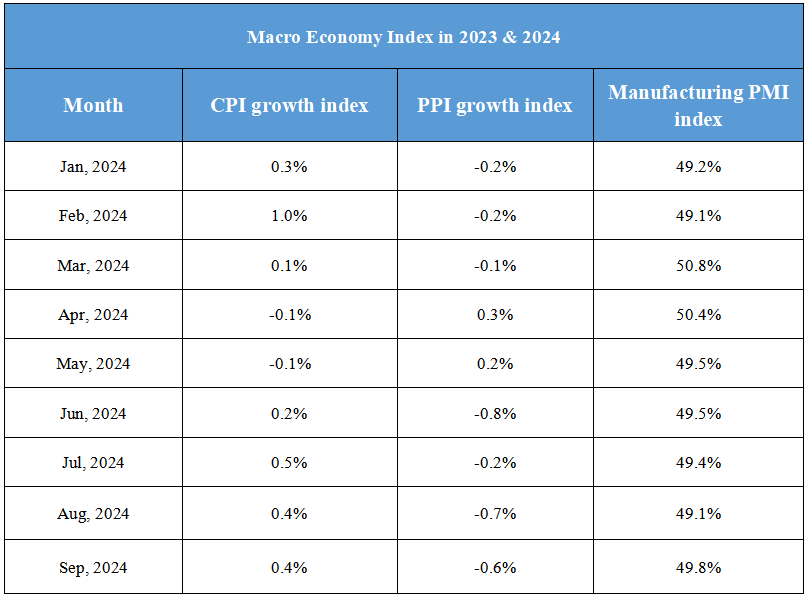

Domestic Macro Economy Index