October 21st Macroeconomic Index: Sharp Fluctuations in A-Share Market Increase Equity Arbitrage Risk, LPR Expected to Drop 20 Basis Points

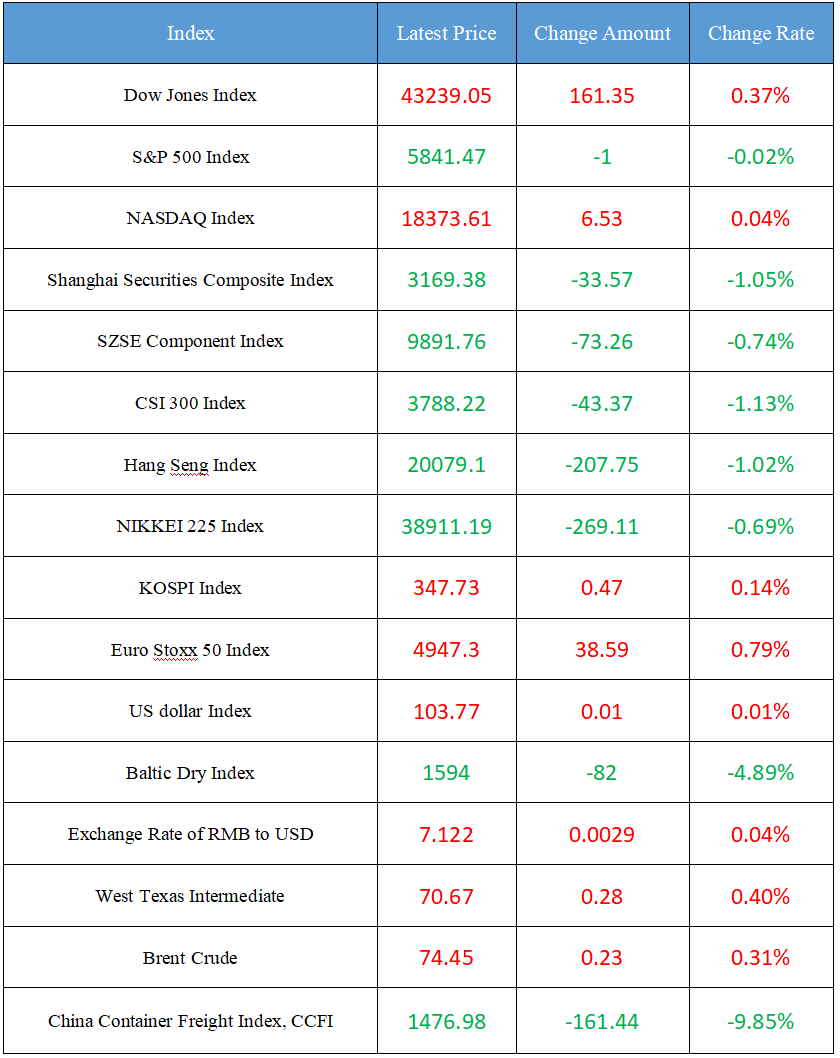

Latest Global Major Index

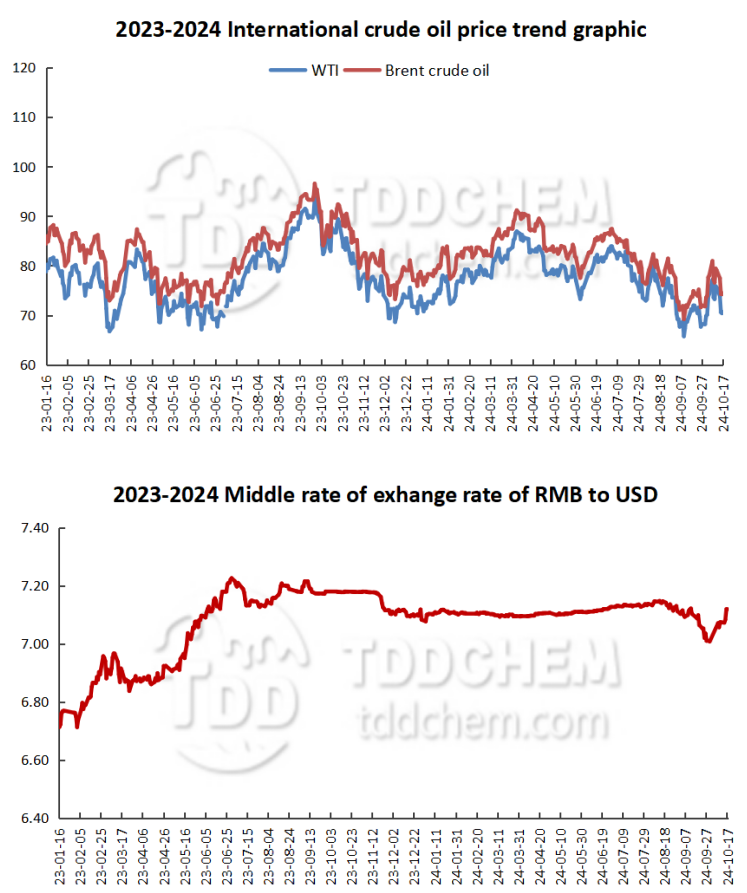

International Crude Price Trend & Exchange Rate of RMB to USD Trend

Domestic News

1. The A-share market fluctuates sharply, and the risk of equity arbitrage strategy is magnified

2. The Chinese and Russian naval ships that just completed the "Northern·Joint-2024" military exercise arrived at a military port in Qingdao

3. A number of banks' wealth management subsidiaries officially announced the early termination of some products

4. In October, the LPR is expected to usher in a downward adjustment of 20 basis points for two term varieties or simultaneously

5. The CPC delegation visited Greece

International News

1. The Israeli army said it would continue to search for other Hamas military commanders

2. The Kenya Senate voted to impeach Vice President Gachagua

3. Yellen: Deficit reduction is necessary to maintain a stable and sustainable path for United States fiscal policy

4. US and Israeli leaders see now as an opportunity to push for the release of the hostages in Gaza

5. Barclays: The options market has fully showed the volatility risk of the United States election

Domestic News

1. The A-share market fluctuates sharply, and the risk of equity arbitrage strategy is magnified

On October 16, a well-known private equity power asset issued an announcement on the suspension of fees, which attracted the attention of the industry. Power Assets announced in its official Weibo that due to the sharp fluctuations in the market, the company's options products have experienced a record drawdown. In order to restore the net value as soon as possible, the company decided to suspend the collection of management fees for its option products in turn after internal discussions. "The characteristics of the option arbitrage strategy are that it usually earns less and has stable performance, but there may be large losses in extreme markets, so it has high requirements for risk control of managers. There are many lessons learned overseas, and the more typical LTCM (long-term capital) is to adopt an arbitrage model and eventually collapse due to huge losses. Private equity sources said. It is worth noting that in the sharp fluctuations in the A-share market last week, in addition to the price changes itself, the volatility of related ETF options and stock index futures options also rose sharply, which brought a lot of challenges to traditional options arbitrage strategies. The OTC options market has encountered more problems and even failed to cash out.

2. The Chinese and Russian naval ships that just completed the "Northern·Joint-2024" military exercise arrived at a military port in Qingdao

On the morning of October 17, a formation of Chinese and Russian naval vessels that had completed the task of the "Northern·Joint - 2024" exercise arrived at a military port in Qingdao, and a Russian Navy warship formation composed of the large anti-submarine ship "Admiral Tributs" and the large anti-submarine ship "Admiral Panteleev" will pay a three-day goodwill visit to Qingdao.

3. A number of banks' wealth management subsidiaries officially announced the early termination of some products

A number of wealth management products ended their operations ahead of schedule. According to incomplete statistics, since October, a number of wealth management subsidiaries such as CMB Wealth Management, Huaxia Wealth Management, Everbright Wealth Management, and CNCBI Wealth Management have announced the early expiration of many of their products. Li Keying, executive director of the financial business department of Oriental Jincheng, said that there are two main reasons for the early termination of wealth management products: one is to trigger the early termination clause. Some wealth management products will have an early termination clause when designing the contract. The second is the take-profit/stop-loss strategy based on market conditions. Most of the above-mentioned wealth management products are structured wealth management products, and from the perspective of the reasons for termination, they were all terminated early due to the triggering of the knock-out event.

4. In October, the LPR is expected to usher in a downward adjustment of 20 basis points for two term varieties or simultaneously

With the recent interest rate cuts, the new LPR (Loan Prime Rate) to be released in October is expected to usher in a downward adjustment. Wang Qing, chief macro analyst of Oriental Jincheng, said that it is expected that the LPR of the two maturity varieties will be reduced by 20 basis points in October. First, the central bank cut its policy rate, the 7-day reverse repo rate, by 20 basis points. As the pricing basis of the current LPR quotation, the reduction of the policy rate will directly lead to the follow-up adjustment of the LPR. With the successive introduction of a package of incremental policies, macro policies are in full force in the direction of stable growth, and the LPR reduction is in line with the general direction of the current macro policy, which is a key link in the transmission of the central bank's "strong interest rate cut" to the real economy.

5. The CPC delegation visited Greece

At the invitation of the Papandreou Foundation of Greece, Li Xiaoxin, Member of the CPC Central Committee and Director of the Central Editorial Office, led a CPC delegation to Greece from October 15 to 17, where they met with the First Deputy Speaker of the Greek Parliament Prakiotakis, the Deputy Minister of the Interior Hararangboyani, and the former Prime Minister and Honorary Chairman of the Socialist International, Papandreou, to promote the spirit of the Third Plenary Session of the 20th CPC Central Committee. The Greek side spoke positively of the relations between the two countries and inter-party exchanges, and looked forward to strengthening cooperation with China in various fields and boosting the development of state-to-state relations.

International News

1. The Israeli army said it would continue to search for other Hamas military commanders

Israel Defense Forces spokesman Hagari said that Israeli forces killed Palestinian Islamic Resistance Movement (Hamas) leader Yahya·Sinwar during a military operation in the Tersultan area of Rafah city in the southern Gaza Strip on the 16th. At the time of the incident, the Israeli army identified him as a "terrorist" and did not know that he was Sinwar, and there were no Israeli detainees with him at that time. Hagari also said Israel will continue its military operations to strike Hamas's infrastructure and search for Sinwar's brother Mohammed·Sinwar and other Hamas military commanders to eliminate the group's military forces while working to secure the release of Israeli detainees.

2. The Kenya Senate voted to impeach Vice President Gachagua

The Kenya Senate voted to impeach Vice President Rigasi·Gachagua. The 67 senators on the floor voted on each of the 11 charges against Vice President Gachagua, and if more than two-thirds of the votes were cast in favor of any of them, the impeachment would be validated. In the first allegation, a total of 53 votes were cast in favour, more than the two-thirds requirement. On 8 October, the Kenya National Assembly voted 281 in favour to impeach Gachagua, after which the impeachment motion was submitted to the Senate for review and hearing. Under Kenya's constitution, Gachagua will be removed from the vice presidency after the impeachment motion is passed by a two-thirds vote in the National Assembly and the Senate.

3. Yellen: Deficit reduction is necessary to maintain a stable and sustainable path for United States fiscal policy

United States Treasury Secretary Janet Yellen said President Biden's recent budget proposal proposes to reduce the deficit by $3 trillion over the next 10 years, in addition to the $1 trillion already implemented. We believe this is necessary to maintain a stable and sustainable path for United States fiscal policy.

4. US and Israeli leaders see now as an opportunity to push for the release of the hostages in Gaza

United States President Joe Biden spoke by phone with Israel Prime Minister Benjamin Netanyahu and congratulated him on eliminating Sinwar, Axios reported. Israel's Prime Minister's Office said the two leaders agreed that now was the opportunity to push for the release of the hostages, and they would work together to do so.

5. Barclays: The options market has fully showed the volatility risk of the United States election

Barclays said the implied volatility of the S&P 500 index for the upcoming United States election is 1.8%, a level of risk that has been fully priced in by the market. Derivatives strategists such as Stefano Pascale say the VIX is trading at about twice the 1-month S&P 500's actual volatility, reflecting election-related price volatility. The VIX is a relatively high percentage of the S&P 500's actual volatility compared to previous elections and is unlikely to move higher.

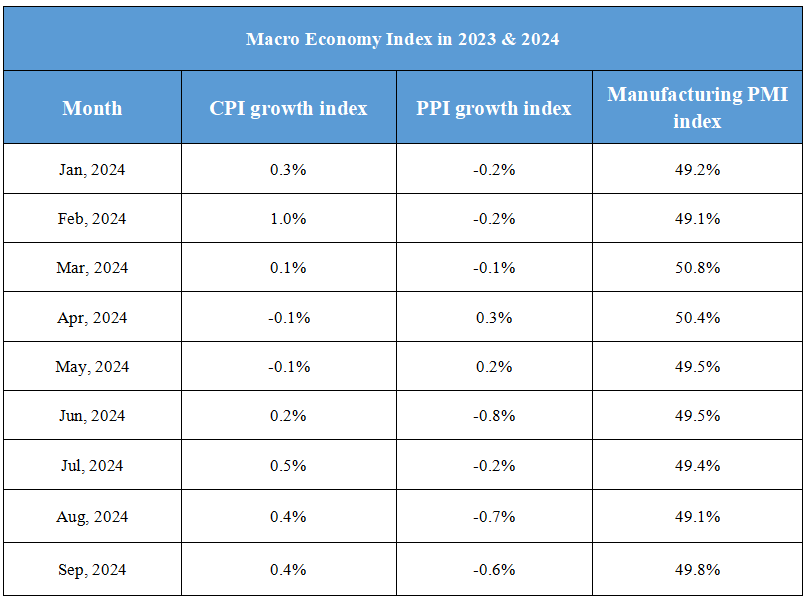

Domestic Macro Economy Index