October 9th Macroeconomic Index: China's Fund Industry Implements Purchase Restrictions, Major Banks Prepare for Capital Increase

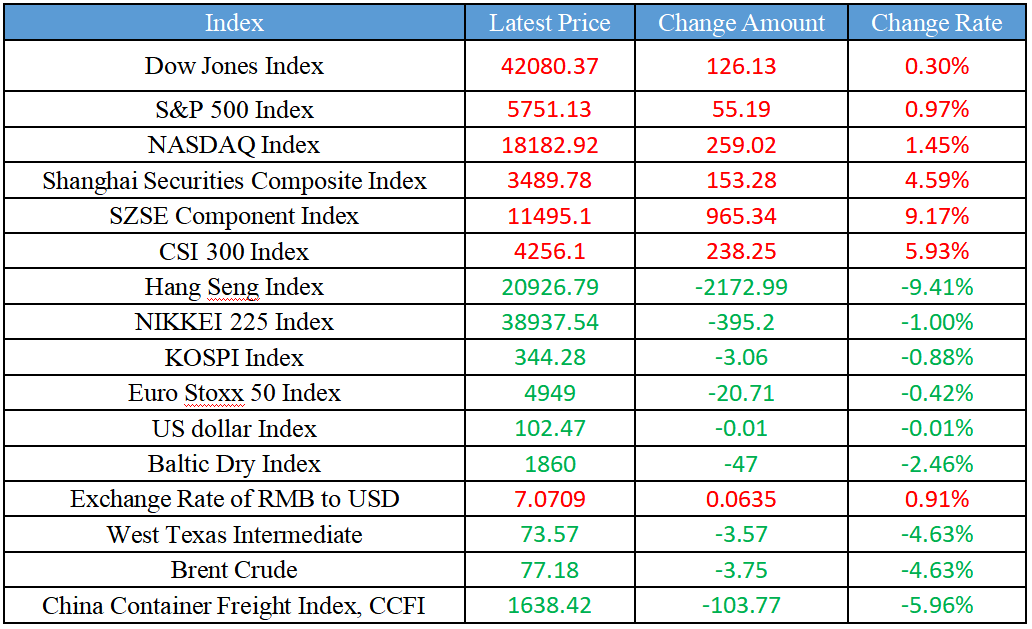

Latest Global Major Index

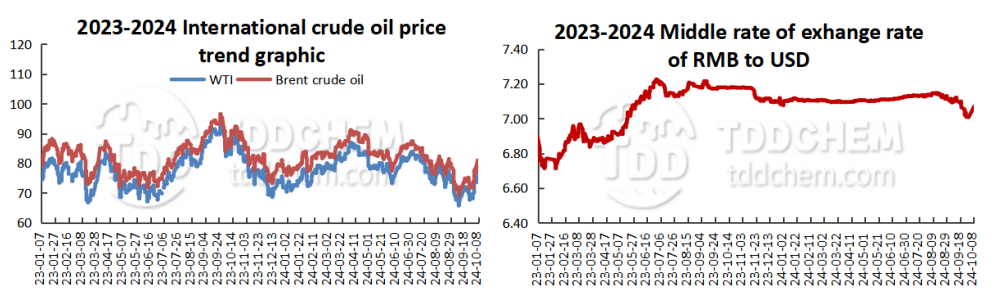

International Crude Price Trend & Exchange Rate of RMB to USD Trend

Domestic News

1. The fund reproduces the intensive "purchase restriction order" to prevent "arbitrage" from diluting the income of holders

2. The six major banks are preparing to increase their capital and are calling for the issuance of special treasury bonds

3. Account opening is still hot after the National Day holiday, and brokerages dispatch personnel across departments to help

4. Funds entered the market quickly, and a number of broad-based ETFs reappeared in huge transactions

5. In October, the list of gold stocks of brokerages was released, and the positive trend of A-shares became a consensus

International News

1. United States National Hurricane Center: "Milton" was upgraded to a category 5 hurricane again

2. Representatives of Hamas and Fatah will hold talks on reconciliation and Gaza

3. The France government passed the parliamentary no-confidence vote

4. United States Department of Defense Spokesperson: Israel's Defense Minister postponed his visit to the United States

5. Israeli air strikes on a building near the Iran Embassy in Syria

Domestic News

1. The fund reproduces the intensive "purchase restriction order" to prevent "arbitrage" from diluting the income of holders

On October 8, a number of funds issued announcements related to large-scale subscription business, and different companies have different attitudes towards purchase restrictions. According to the analysis of industry insiders, the fund took purchase restrictions after the rise, to a large extent, out of the need to ensure performance. Some industry participates also said that when the market is good, the fund adopts purchase restrictions, which may be used to control the scale of products and avoid rapid expansion in a short period of time. Because when the fund size is too large, it is easy to form a certain constraint on the rebalancing operation, especially when the product size exceeds the fund manager's previous circle of competence, which may bring unpredictable large fluctuations in the net value of the fund. The purchase restriction is conducive to resolving the problem of "the ship is difficult to turn around" of the fund, and is also conducive to restricting the arbitrage behavior of investors to buy through the fund due to the suspension of individual stocks, so as to avoid the loss of the original fund share holders.

2. The six major banks are preparing to increase their capital and are calling for the issuance of special treasury bonds

According to the article, the state plans to increase the core Tier 1 capital of six large commercial banks, and the discussion on issuing special treasury bonds to inject capital into large state-owned commercial banks has revived. "As a way to supplement core Tier 1 capital, special treasury bonds have priority compared to other bonds, are usually guaranteed by national credit, have low cost, and can directly enhance the core capital of banks." Tian Lihui, President of the Financial Development Research Institute of Nankai University, said. The market deems that at present, China's foreign exchange reserves are sufficient, and at the same time, 5 of the six major banks are global systemically important banks, with a high degree of internationalization, and it is also a feasible channel to directly inject capital with foreign exchange reserves in the global interest rate reduction cycle. According to the analysis of industry insiders, if the current method of raising funds through additional stock issuance is adopted, the rights and interests of the original shareholders, especially small and medium-sized shareholders, will be harmed. Therefore, a more feasible way in the future is to carry out additional issuances in a step-by-step and slow manner according to the capital replenishment pressure of different banks when the stock price is in an upward channel.

3. Account opening is still hot after the National Day holiday, and brokerages dispatch personnel across departments to help

On the first trading day after the National Day, the turnover of the Shanghai and Shenzhen stock markets was close to 3.5 trillion yuan, hitting a record high, and investors' account opening continued to be hot. A number of brokerages reported that due to the shortage of online two-way video witness account opening yesterday, they also needed to dispatch manpower from other departments to help. In addition, when opening an account for new investors, risk reminders and investor education can not be saved, and when brokerages open accounts, they will also remind investors to invest with spare money, use leverage carefully, and do not blindly follow the trend. It is understood that there are a number of brokerages that have doubled the number of new accounts opened recently, and the trend of younger investors is obvious - "post-00s" and "post-90s" have entered the market, including many students.

4. Funds entered the market quickly, and a number of broad-based ETFs reappeared in huge transactions

On October 8, the ETF market reproduced a huge number of transactions, with the total turnover of all ETFs reaching 598.157 billion yuan, continuing to hit a record high, of which the turnover of equity ETFs reached a historically rare 348.528 billion yuan, an increase of more than 9 times compared with the daily average of 33.744 billion yuan in early September. While the trading volume hit a record high, the broad-based ETF also saw a rare batch rise. On the same day, among the broad-based ETFs investing in the A-share market, 91 had a daily limit, and Guotai Junan Securities Research Report believes that the historical data of the past 12 years found that during the market rebound period, the average yield of the allocation index may be higher than that of the allocation stocks. In terms of the allocation of major industries, participating in the rebound by allocating industry ETFs tends to witness higher yield than buying individual stocks directly in the industry.

5. In October, the list of gold stocks of brokerages was released, and the positive trend of A-shares became a consensus

As of October 8, a total of 229 gold stocks have been recommended by 38 brokerages, and 51 gold stocks have been recommended by two or more brokerages. Among them, the gold stock with the most recommended times is CATL, which has been recommended by 10 brokerages and temporarily ranks first on the recommendation list; followed by Midea Group, which was recommended by 7 brokerages; BYD was recommended by 6 brokers, and Luxshare Precision was recommended by 5 brokers. Looking ahead, brokerage analysts generally believe that factors such as the continuous expansion of the market space for the implementation of incremental policies and the strong willingness of incremental funds to enter the market have brought continuous impetus to the overall market recovery.

International News

1. United States National Hurricane Center: "Milton" was upgraded to a category 5 hurricane again

On October 8, local time, the United States National Hurricane Center said that Hurricane "Milton" had been upgraded to a Category 5 hurricane again and was moving towards the coastline of Florida. Milton had previously weakened to a force 4 level, but its wind speed has now once again exceeded the level 5 threshold. Hurricane centers have also extended storm surge and hurricane warnings on the east coasts of Florida and Georgia.

2. Representatives of Hamas and Fatah will hold talks on reconciliation and Gaza

Egypt sources said that a delegation of the Palestinian Islamic Resistance Movement (Hamas) had arrived in Cairo and would hold talks with representatives of the Palestinian National Liberation Movement (Fatah) on reconciliation and Gaza issues.The Hamas delegation, led by senior official Khalil·Haya, will hold talks under the auspices of Egypt and aim to promote reconciliation between the two Palestinian factions, Hamas and Fatah. The main topics of the talks included the current situation in the Gaza Strip and the future of the Rafah crossing between the Gaza Strip and Egypt. Israel currently controls the Gaza Strip side of the Rafah crossing.

3. The France government passed the parliamentary no-confidence vote

On October 8, local time, the France National Assembly voted on a no-confidence motion of government led by Prime Minister Barnier by left-wing parliamentarians, but the vote was not passed. France's National Assembly has a total of 577 seats. At the day's vote, 197 MPs supported the no-confidence motion, failing to meet the minimum of 289 votes required for its pass. On the 4th of this month, 192 left-wing members of the National Assembly submitted a no-confidence motion in the government. They oppose the Barnier government's policies related to taxation and other related policies, and consider the appointment of Barnier as Prime Minister a "negation" of the results of the National Assembly elections.

4. United States Department of Defense Spokesperson: Israel's Defense Minister postponed his visit to the United States

According to Singh, deputy spokesperson for the United States Ministry of National Defense, confirmed at a regular press conference on the afternoon of October 8 local time that Israel Defense Minister Gallant, who was originally scheduled to meet with United States Defense Minister Austin in Washington on October 9 local time, has postponed his visit to the United States. Singh said the Pentagon "just received a notification from Israel." According to a number of Israel media reports, Israel Prime Minister Benjamin Netanyahu "restricted" Gallant's United States trip, saying that Gallant's visit to the United States would only be approved after he spoke with United States President Joe Biden.

5. Israeli air strikes on a building near the Iran Embassy in Syria

On the evening of October 8, local time, the Damascus area of Syria's capital was attacked by Israel, and the air strike site was close to the Iran Embassy in Syria. According to Iran media reports, after the airstrike, the Iran embassy in Syria condemned the Israeli airstrike, saying that none of the dead and wounded in the attack were Iran citizens.

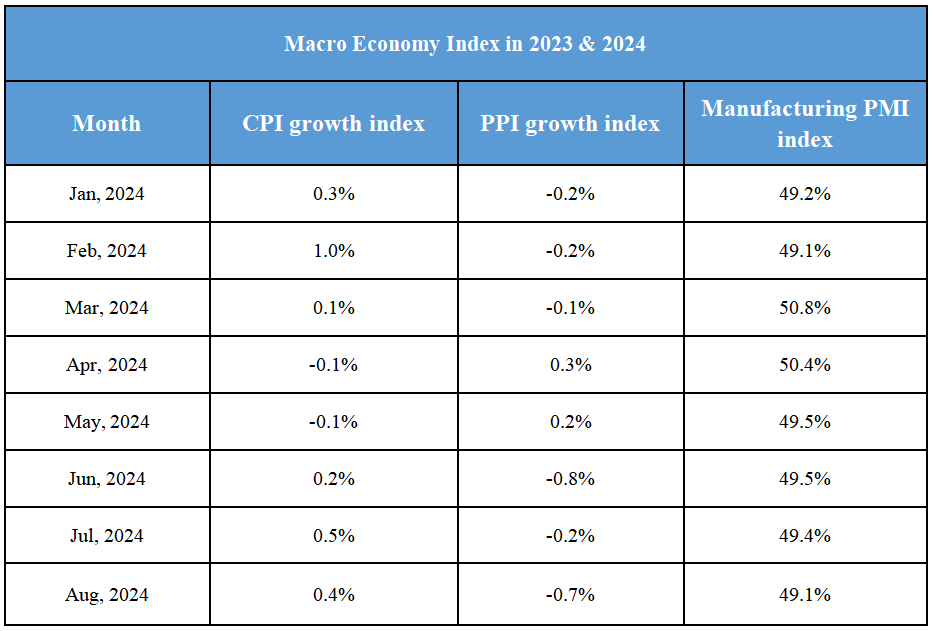

Domestic Macro Economy Index