September 6th Macroeconomic Index: Commodity Market Concerns Rise During 'Golden September and Silver October', RMB Internationalization Advances

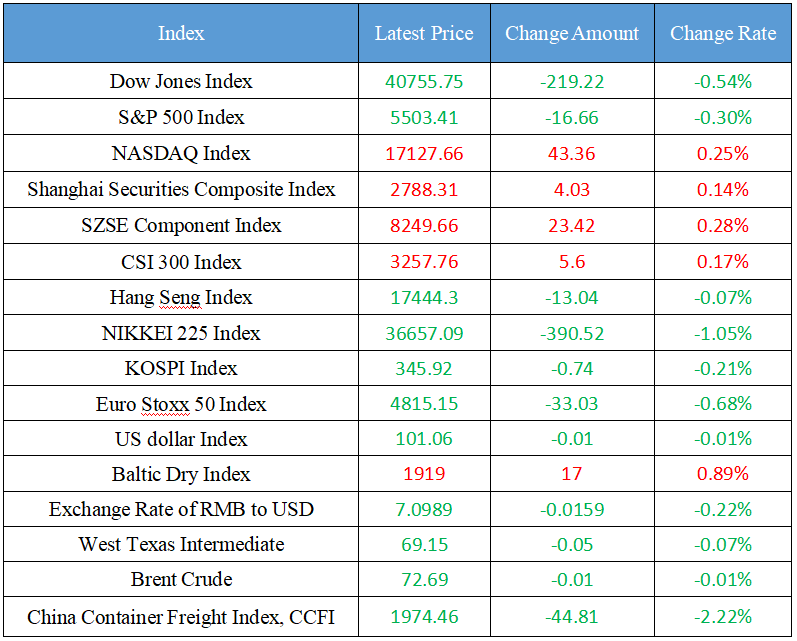

Latest Global Major Index

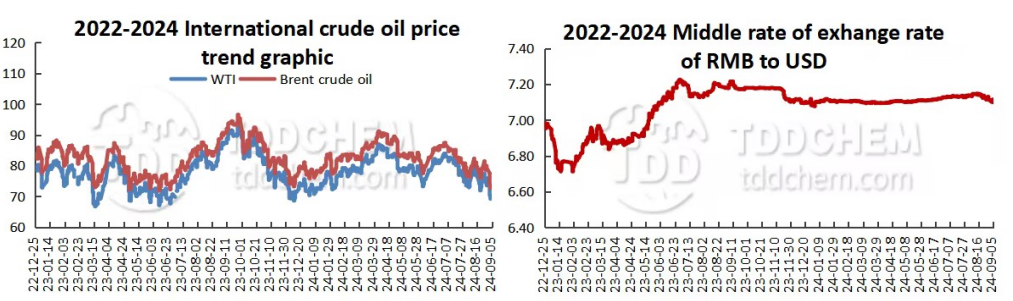

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The peak season of "Golden September and Silver October" is coming, and the commodity market is significantly concerned

2. Experts suggest that the internationalization of RMB should be steadily and solidly promoted

3. The number of cases of civil compensation for market manipulation has increased, and the three-dimensional accountability signal is obvious

4. The merger of Guotai Junan and Haitong Securities is a major and unprecedented innovation

5. The acceleration of the RWA process is expected to broaden the cross-border financing channels for mainland enterprises

International News

1. Hunter·Biden, the son of the US president, pleaded guilty to nine tax charges

2. Trump's potential Treasury Secretary candidate Paulson: The Federal Reserve is expected to cut interest rates to as low as 2.5% by the end of 2025

3. Germany Iver Institute for Economic Research: Germany's economic growth will stagnate

4. The handover ceremony was held at the France Prime Minister's Office. Michel·Barnier was officially appointed as the Prime Minister

5. Intel intends to reduce its stake in Mobileye to recoup funds

Domestic News

1. The peak season of "Golden September and Silver October" is coming, and the commodity market is significantly concerned

The current commodities began to enter the traditional "Golden September and Silver October" consumption season, but its recent market performance was unexpected, not only did not appear expected rally, but also showed a significant downward trend, the Wenhua Commodity Index once hit a new low since June last year. Industry participates said that the marginal weakening of macro drivers at home and abroad is the main reason for the significant decline in the commodity market this round. As domestic real estate and infrastructure demand has not yet stabilized, it has little effect on the non-ferrous metals and building materials market. In addition, as overseas recession trading continues to be priced, pessimistic market appetite may drag down the performance of commodity markets during the "Golden September and Silver October" period. However, trading opportunities for some varieties such as precious metals are relatively certain.

2. Experts suggest that the internationalization of RMB should be steadily and solidly promoted

"Steadily and solidly promoting the internationalization of the RMB can be promoted from the following aspects." Huang Qifan, academic advisor of the China Finance 40 Forum and former Mayor of Chongqing, said at the meeting that the first measure is to continue to promote China's cross-border trade to be priced and settled in RMB. The second is to continue to improve services and provide cross-border RMB settlement services for new business formats and models such as cross-border e-commerce. Third, we will continue to expand opening up and provide more convenient investment and financing services for "bringing in" and "going overseas." Huang Qifan said that China's promotion of RMB internationalization is not to replace the US dollar in the world, but to maintain the stability of global industrial and supply chains.

3. The number of cases of civil compensation for market manipulation has increased, and the three-dimensional accountability signal is obvious

Recently, there has been an increase in the number of civil compensation cases of manipulation of the securities market. In the view of market participants, the increase in the number of civil compensation cases for market manipulation has obvious signals of three-dimensional accountability for market manipulation, which has three main significance: first, to recover losses for damaged investors and protect the legitimate interests and rights of investors; Second, the landing cases will provide a reference for the judicial interpretation of civil compensation for market manipulation and accelerate the issuance of judicial interpretations. Finally, three-dimensional accountability will further increase the cost of market manipulation, purify the capital market ecology, and boost investor confidence.

4. The merger of Guotai Junan and Haitong Securities is a major and unprecedented innovation

Under the guidance of the policy, the pace of integration of small and medium-sized brokerages has accelerated significantly this year, but the merger of head brokerages has remained in the "rumor" stage. The merger of Guotai Junan Securities and Haitong Securities is the first merger and reshuffle of a leading securities firm since the implementation of the new "Nine National Articles", and it is also the largest A+H bilateral market absorption merger in the history of China's capital market and the largest integration case of A+H listed securities firms. Coupled with the latest "Guotai Junan + Haitong", there have been 7 mergers and acquisitions in the securities industry this year, including "GLSC + CMBC", "Czbank + Guodu", "West + GRZQ", "Pingan + Founder Technology", "CPIC + Naura" and "Guosen + Vanward".

5. The acceleration of the RWA process is expected to broaden the cross-border financing channels for mainland enterprises

RWA (Real World Assets - tokenization) is becoming a new trend for cross-border financing for enterprises. Recently, LongShine Group, an A-share listed company, cooperated with Ant Digital to complete the first domestic RWA based on new energy entity assets in Hong Kong, with an amount of about 100 million yuan. This is also one of the four tokenization-themed cases in the progress of the HKMA Sandbox project. Globally, a number of international financial institutions such as BlackRock, JPMorgan Chase, and Citibank have laid out in the RWA field for the first time, and the entry of giant enterprises has also opened up more imagination space for RWA. Yu Jianing, Co-chairman of the Blockchain Committee of China Communications Industry Association, told reporters that this successful case of LongShine Group demonstrates the great potential of RWA tokenization in practical applications, and also provides a model effect for other mainland enterprises to explore similar paths.

International News

1. Hunter·Biden, the son of the US president, pleaded guilty to nine tax charges

Hunter·Biden, the son of President Biden of United States, pleaded guilty to nine counts in his federal tax case. Previously, Hunter·Biden was charged with nine federal tax offenses last December, including failing to file and pay taxes, tax evasion, and filing false or fraudulent tax returns, with three felonies and six misdemeanors on nine counts. The indictment alleges that Hunter·Biden failed to pay at least $1.4 million in federal taxes over four years from 2016 to 2019 and evaded tax assessments for the 2018 tax year by filing false returns around February 2020.

2. Trump's potential Treasury Secretary candidate Paulson: The Federal Reserve is expected to cut interest rates to as low as 2.5% by the end of 2025

Billionaire John·Paulson said the Fed waited too long to cut interest rates and expected the bank to cut interest rates in the coming months. Mr. Paulson, 68, is one of Mr. Trump's potential candidates for Secretary of the Treasury if he wins and is known for his aggressive shorting of mortgage bonds before the 2008 financial crisis. In an interview, Paulson said "my best prediction" would be to have the federal funds rate "around 3%, maybe 2.5%" by the end of next year. He said the rise in real interest rates suggests that the Fed is lagging behind in easing monetary policy.

3. Germany Iver Institute for Economic Research: Germany's economic growth will stagnate

Germany Iver Institute for Economic Research released an autumn economic forecast report pointing out that the Germany economy will still fall into crisis due to cyclical factors and structural factors. Inflation-adjusted gross domestic product is expected to stagnate this year after the economy contracted by 0.3% last year, the Iver Institute for Economic Research said in a statement. Compared with the summer economic forecast released by the institute, the growth forecast for this year has been lowered by 0.4 percentage points, and Germany economic growth will stagnate. In addition, Germany's economic growth forecast for 2025 was revised down by 0.6 percentage points.

4. The handover ceremony was held at the France Prime Minister's Office. Michel·Barnier was officially appointed as the Prime Minister

The France Prime Minister's Office held a handover ceremony, and Michel· Barnier officially replaced Gabriel·Attar as the Prime Minister of the France government. Earlier in the day, France President Emmanuel Macron appointed Michel·Barnier as the new France Prime Minister. The 73-year-old belongs to the France right wing and has served as a government Minister several times and as a European commissioner twice. Since 2016, he has been the EU's chief negotiator for United Kingdom Brexit.

5. Intel intends to reduce its stake in Mobileye to recoup funds

According to people familiar with the matter, Intel (INTC. O) is considering the sale of its autonomous driving computing company, Mobileye Global (MBLY. o) stakes, which is part of a comprehensive evaluation of its strategy. Intel may reduce its 88% stake in Mobileye on the open market or through sales to third parties. Mobileye will hold a board meeting later this month where Intel's plans will be discussed. Last year, Intel sold a stake in Mobileye, cashing out about $1.5 billion. If Intel continues to use the sale of its stake in Mobileye to raise funds, the latter will be in a difficult time. Mobileye's stock price is down about 71% this year, with a market value of about $10.2 billion, and the company is facing a third straight year of losses.

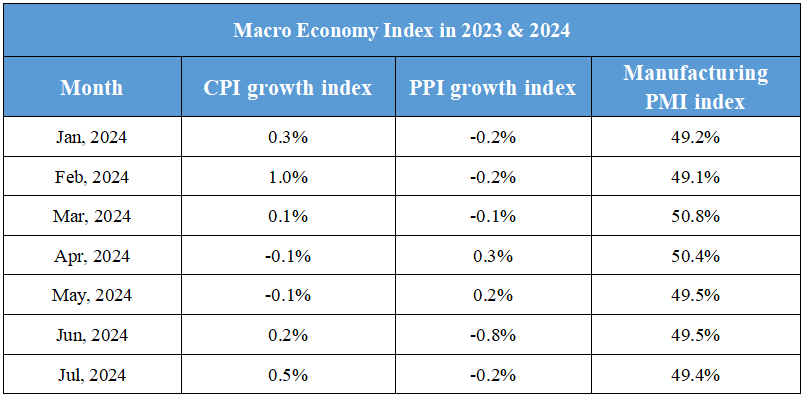

Domestic Macro Economy Index