November 13th Macroeconomic Index: China's Import and Export Trade Continues to Decline, IMF Raises GDP Forecast

Daily Macro Economy News

Latest Global Major Index

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Promote the concentration of state-owned capital in important industries and key areas related to national security and the lifeline of the national economy

2. In October, China's total import and export trade value of goods reached 3.54 trillion yuan, with a monthly growth rate of 0.9%, which has decreased year-on-year for four consecutive months since June

3. It is expected that the actual GDP will increase by 5.4% and 4.6% respectively this year and next year

4. Focus on strategic emerging industry, future industry and technological innovation, especially breakthroughs in key core technologies, and be a well-rounded long-term capital, patient capital and strategic capital

International News

1. The Federal Reserve of Australia raised interest rates by 25 basis points to 4.35%, the highest level since November 2011, in line with market expectations and ending four consecutive unchanged policies

2. The PPI of the Eurozone decreased by 12.4% year-on-year in September, marking the largest decline in history and the fifth consecutive month of decline

3. The United States announces a one-year extension of national emergency against Iran

4. Digital payments of large US technology companies may face strong regulation

Domestic News

1. Promote the concentration of state-owned capital in important industries and key areas related to national security and the lifeline of the national economy

The Third Meeting of the Central Commission for Comprehensively Deepening Reform (CCCDR) emphasized the need to promote the concentration of state-owned capital in important industries and key fields that are related to national security and the lifeline of the national economy, as well as in public services, emergency capabilities, public welfare areas that are related to the national economy and people's livelihood, and in forward-looking strategic emerging industries. Strengthen the supervision of industries sections with natural monopoly attributes such as electricity, oil and gas, and railways, promote relevant enterprises to focus on their main responsibilities and main businesses, and increase state-owned capital’s investment in network infrastructure; Supervise the scope of conducting monopolistic and competitive business in natural monopoly sections and links, and prevent the use of monopoly advantages from extending to upstream and downstream competitive sections and links. The meeting also emphasized the need to increase efforts to focus on addressing prominent ecological and environmental issues.

2. In October, China's total import and export trade value of goods reached 3.54 trillion yuan, with a monthly growth rate of 0.9%, which has decreased year-on-year for four consecutive months since June

The year-on-year growth rate of China's foreign trade import and export in October turned positive! According to data released by the General Administration of Customs, the total import and export trade value of China's goods in October was 3.54 trillion yuan, with a monthly growth rate of 0.9%, which has decreased year-on-year for four consecutive months since June. Among them, exports decreased by 3.1%, while the previous value decreased by 0.6%; Imports increased by 6.4%, while the previous value decreased by 0.9%. According to the China Customs Trade Prosperity Statistics Survey, the proportion of enterprises expressing optimism about future imports and exports has increased, and the positive development trend of China's foreign trade has further emerged.

3. It is expected that the actual GDP will increase by 5.4% and 4.6% respectively this year and next year

The IMF has raised its forecast for China's economic growth, predicting that the real GDP will grow by 5.4% and 4.6% respectively this year and next, an increase of 0.4 percentage points compared to previous estimates. The IMF pointed out that China will not experience deflation, and as the output gap continues to narrow, core inflation is expected to rise to 2.1% by the end of 2024.

4. Focus on strategic emerging industry, future industry and technological innovation, especially breakthroughs in key core technologies, and be a well-rounded long-term capital, patient capital and strategic capital

The Party Committee of the State Property Committee of the State Council held a meeting and emphasized that state-owned central enterprises should focus on strategic security, industry leadership, national economy and people's livelihood, public services and other functions, and focus on strategic emerging industries and future industries, technological innovation, especially breakthroughs in key core technologies to be well-rounded long-term capital, patient capital, and strategic capital. We need to strengthen risk prevention and control in key areas and strictly regulate the development of financial derivative business.

International News

1. The Federal Reserve of Australia raised interest rates by 25 basis points to 4.35%, the highest level since November 2011, in line with market expectations and ending four consecutive unchanged policies

The Federal Reserve of Australia raised interest rates by 25 basis points to 4.35%, the highest level since November 2011, in line with market expectations and ending four consecutive unchanged policies. The Federal Reserve of Australia stated that raising interest rates is to ensure that inflation can return to its target level; It is expected that inflation will be around 3.5% by the end of 2024.

2. The PPI of the Eurozone decreased by 12.4% year-on-year in September, marking the largest decline in history and the fifth consecutive month of decline

The PPI of the Eurozone fell by 12.4% year-on-year in September, marking the largest decline in history and the fifth consecutive month of decline. It is expected to decline by 13%, with a previous value drop of 11.5%. In September, the PPI increased by 0.5% month on month, exceeding the expected 0.3%, with a revised value of 0.6%.

3. The United States announces a one-year extension of national emergency against Iran

The White House has issued a statement announcing that an executive order signed by the United States on November 14, 1979 implement the order to extend the national emergency state for Iran for one year until November 14, 2024. It is reported that the President of the United States can declare a national emergency and impose sanctions on governments, organizations, enterprises, political parties, or individuals of other countries on the grounds of national security.

4. Digital payments of large US technology companies may face strong regulation

The top consumer finance regulatory body in the United States proposed on Tuesday to regulate the digital payment and smartphone wallet services of technology giants, stating that they are comparable in scale and scope to traditional payment methods but lack consumer protection. The proposal by the Consumer Financial Protection Agency (CFPB) will place companies such as Alphabet (GOOG. O), Apple (AAPL. O), PayPal (PYPL. O), and Block's CashApp under the supervision of similar banks. CFPB's inspectors will examine the privacy protection, executive behavior, and they will inspect whether they are compliance with laws and prohibit unfair and fraudulent behaviors. An official from CFPB stated that if the proposal is finalized, it will cover approximately 17 companies, with a total annual payment of over $13 billion.

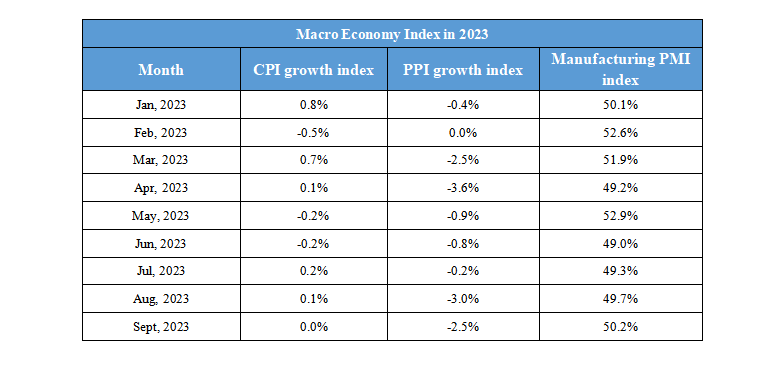

Domestic Macro Economy Index