November 13th Macroeconomic Index: China Seeks to Expand Cooperation with Australia, Promotes Financial Reforms

Daily Macro Economy News

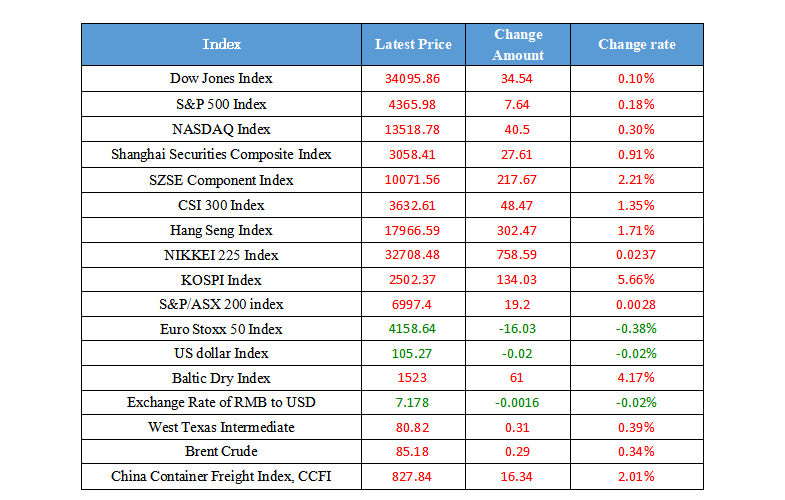

Latest Global Major Index

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. It is necessary to give full play to the potential of the China-Australia Free Trade Agreement and expand cooperation in emerging areas such as climate change and green economy

2. Strive to promote strong financial supervision, risk prevention and high-quality development, and accelerate the construction of a financial power

3. Promote the further marketization of deposit and loan interest rates, and adhere to the method of reform to guide the continuous decline of financing costs

4. In the next stage, efforts should be made to promote the employment of key groups such as young people, especially college graduates, rural labor force, especially those who have been lifted out of poverty, and people with employment difficulties

International News

1. Short-term policy rate expectations do not appear to driving long-term interest rates higher

2. The Monetary Policy Committee believes that it is necessary to maintain a capped interest rate for at least a period of time

3. The RBA's least regrettable move may be to raise interest rates further

4. The United States seeks to repurchase up to 3 million barrels of crude oil in January next year to replenish the SPR

Domestic News

1. It is necessary to give full play to the potential of the China-Australia Free Trade Agreement and expand cooperation in emerging areas such as climate change and green economy

During the meeting with Australian Prime Minister Anthony Albanese, the state leader said that a healthy and stable China-Australia relationship is in the common interests of the two countries and peoples. It is necessary to promote the continuous development of the China-Australia comprehensive strategic partnership. It is necessary to give full play to the potential of the China-Australia Free Trade Agreement, expand cooperation in emerging areas such as climate change and green economy, and safeguard the regional and global free trade system.

2. Strive to promote strong financial supervision, risk prevention and high-quality development, and accelerate the construction of a financial power

The Central Financial Work Commission held a meeting and emphasized that it is necessary to unswervingly follow the path of financial development with Chinese characteristics, focus on promoting strong financial supervision, risk prevention and high-quality development, and accelerate the construction of a financial power. He Lifeng, Director of the Office of the Central Financial Commission and Secretary of the Central Financial Commission, attended the meeting and delivered a speech. He Lifeng met with representatives of foreign members of the International Advisory Committee of the State Administration of Financial Regulation yesterday, and the two sides exchanged views on China's economic situation, financial reform and opening up, and financial supervision.

3. Promote the further marketization of deposit and loan interest rates, and adhere to the method of reform to guide the continuous decline of financing costs

The Monetary Policy Department of the People's Bank of China issued a special column pointing out that the continuous deepening of the market-oriented reform of interest rates will focus on three key points. The first is to improve the formation, regulation and transmission mechanism of market-oriented interest rates, dredge the channels for capital to enter the real economy, and promote the optimization of the allocation of financial resources. The second is to promote the further marketization of deposit and loan interest rates, and persist in using reform methods to guide the continuous decline of financing costs. Third, we will continue to improve the marketization of mortgage interest rates to better support the demand for rigid and improved housing.

4. In the next stage, efforts should be made to promote the employment of key groups such as young people, especially college graduates, rural labor force, especially those who have been lifted out of poverty, and people with employment difficulties

Wang Xiaoping, Minister of Human Resources and Social Security, said that in the next stage, efforts should be made to promote the employment of key groups such as young people, especially college graduates, rural laborers, especially those who have been lifted out of poverty, and people with employment difficulties. Pay attention to bottom-line thinking, improve the risk control system, resolutely prevent and resolve major risks such as large-scale unemployment, and ensure the overall stability of the employment situation.

International News

1. Short-term policy rate expectations do not appear to driving long-term interest rates higher

Fed Governor Cook: Short-term policy rate expectations do not seem to be driving long-term interest rates higher; Commercial real estate prices "could fall substantially" if commercial mortgage default rates lead to sell-offs; The Fed cannot foresee all risks, but it can increase its resilience to shocks; Of particular importance is strengthening the resilience of large banks.

2. The Monetary Policy Committee believes that it is necessary to maintain a capped interest rate for at least a period of time

Bank of England Chief Economist Peal: It's too early to talk about a rate cut; The MPC believes that the limit rate needs to be maintained for at least some time; Considering the interest rate stance in the middle of next year does not seem entirely unreasonable.

3. The RBA's least regrettable move may be to raise interest rates further

The Reserve Bank of Australia (RBA) will announce its interest rate decision today, and the policy-making committee will discuss whether to raise the official cash rate (OCR) further by 25 basis points to 4.35% or extend the pause in rate hikes that has been implemented since July. Since the Q3 CPI data came in higher than expected, the market's interest rate hike expectations have strengthened. However, the RBA's signals were mixed. The bank is likely to believe that the rate hikes over the past year have not yet had a full impact on the economy, and that the factors that stimulated inflation in the Q3 may be temporary and will not slow the pace of inflation in the coming years. However, the RBA's last thing to regret seems to be to raise the OCR further.

4. The United States seeks to repurchase up to 3 million barrels of crude oil in January next year to replenish the SPR

The U.S. is seeking to buy up to 3 million barrels of oil to replenish the country's strategic petroleum reserve, which will be delivered in January 2024, the U.S. Department of Energy said on Monday. "This is the second tender for delivery in January 2024, as the DOE aims to buy oil in a taxpayer's favor," the DOE said in a statement. " Last month, the U.S. government said it wanted to buy 6 million barrels of crude oil for delivery in December and January.

Domestic Macro Economy Index