November 13th Macroeconomic Index: China's GDP Grows 4.9% Year-On-Year in Q3, Economic Fundamentals Improve

Daily Macro Economy News

Latest Global Major Index

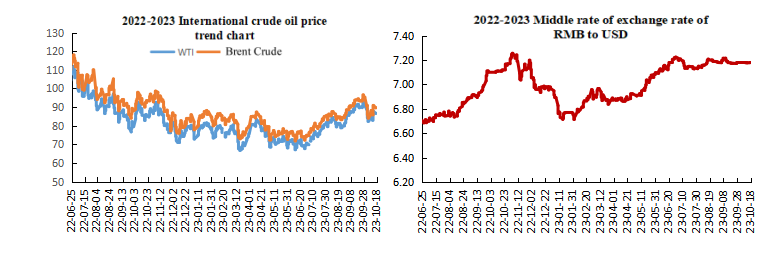

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Economic fundamentals have improved significantly, and the exchange rate is stable and strongly supported

2. National Bureau of Statistics: Prices maintain moderate growth indicating that the overall demand of China's economy is stable

3. China's GDP increased by 4.9% year-on-year in the third quarter

4. The General Administration of Customs released data: China's aquatic products imports from Japan "back to zero" in September

International News

1. The International Monetary Fund expects the Asia-Pacific region to grow by 4.6% this year

2. The EU plans to impose stricter regulations on the most powerful AI-generated models

3. RBA President: Very wary of upside risks to inflation expectations

4. Consumer spending is slowing down due to the impact of the Federal Reserve's interest rate hike

Domestic News

1. Economic fundamentals have improved significantly, and the exchange rate is stable and strongly supported

The Financial Times, the central bank's leading media, pointed out in a commentary article that the trend of the exchange rate mainly depends on economic fundamentals, and with the continuous improvement of fundamental conditions, the foundation for the "stability" of the RMB exchange rate is more solid. The subsequent economic recovery momentum is strong, which supports the future trend of the RMB exchange rate. The trend of domestic economic transformation and upgrading continues, the number of merits increases, and the ability of sustainable development continues to increase. In September, the cumulative investment in high-tech industries increased by 11.4% year-on-year, and the output of new energy vehicles, charging piles and clean energy power generation maintained rapid growth. The combination of macro policies will further show its effectiveness, and the policy synergy will continue to consolidate the momentum of economic recovery. In the medium and long term, the Chinese market and RMB assets are still highly attractive, and the supply and demand of the foreign exchange market are further balanced.

2. National Bureau of Statistics: Prices maintain moderate growth indicating that the overall demand of China's economy is stable

Sheng Laiyun, deputy director of the National Bureau of Statistics, said that the changes in China's price index, especially the changes of CPI, have obvious structural characteristics, and the core CPI is relatively stable. This year's consumer price index (CPI), from the beginning of the year to the present, if viewed from a year-on-year perspective, is falling. However, from the trend of the food price index, in the first quarter, food prices rose by 3.7% year-on-year, and the increase fell back to 1.2% in the second quarter. However, in the third quarter, affected by the sharp year-on-year decline in pig prices, the food price index declined, which had an important impact on the trend of the consumer price index. In the industrial products consumption price index, crude oil prices, especially international crude oil prices, fluctuate, which also have an important impact on the price trend. Excluding the impact of food and energy, the core CPI is generally stable, with the core CPI rising 0.7% year-on-year in the first three quarters of this year, with little monthly fluctuation. Generally speaking, prices have maintained moderate growth indicating that the overall demand of China's economy is stable, and a relatively balanced supply and demand relationship is also conducive to keeping low prices.

3. China's GDP increased by 4.9% year-on-year in the third quarter

On October 18, data from the National Bureau of Statistics showed that the GDP in the first three quarters was 913027 billion yuan, an increase of 5.2% year-on-year compared to constant prices. From the perspective of industry, the added value of the primary industry was 5637.4 billion yuan, a year-on-year increase of 4.0%; the added value of the secondary industry was 35.3659 trillion yuan, an increase of 4.4%; The added value of the tertiary industry was 50.2993 trillion yuan, an increase of 6.0%. Sheng Laiyun, deputy director of the National Bureau of Statistics, stated that if the annual expected target is to be completed, it can guarantee the completion of the annual expected target of about 5% as long as the growth rate in the fourth quarter is more than 4.4%.

4. The General Administration of Customs released data: China's aquatic products imports from Japan "back to zero" in September

In the monthly report on China's import and export statistics just released today by the General Administration of Customs, there is no record of "fish and other aquatic invertebrates" imported by China from Japan in the various category table of commodities imported from some countries (regions) in September. In August, China imported 149 million yuan of this category of goods from Japan. The data also shows that in the first eight months, China imported a total of 2.085 billion yuan from Japan, exactly the same as the cumulative data for the first nine months just released today, which means that China did not import any aquatic products from Japan throughout September. In the Express by the General Administration of Customs released today, there was no data recorded on China's imports of meat, fish and other aquatic invertebrate products from Japan in September.

International News

1. The International Monetary Fund expects the Asia-Pacific region to grow by 4.6% this year

On October 18, local time, the International Monetary Fund released the Asia-Pacific Regional Economic Outlook Report. The report predicts that the Asia-Pacific region will grow by 4.6% in 2023. Compared with the expected 3% world economic growth this year, the Asia-Pacific region remains an attractive part and is expected to contribute about two-thirds of world economic growth. The report predicts that China's economy will grow by 5% in 2023. In addition, the three fastest growing economies in Asia-Pacific region in 2023 were Samoa (8%), Fiji (7.5%) and India (6.3%).

2. The EU plans to impose stricter regulations on the most powerful AI-generated models

According to media reports, the EU is considering a three-tier approach to monitoring generative AI models and systems as one part of the effort to regulate this rapidly evolving technology. These three levels will set the rules for different underlying models and require more external testing of the most powerful technologies. The EU is expected to become the first Western government to impose mandatory rules on AI.

3. RBA President: Very wary of upside risks to inflation expectations

RBA President Bullock: The RBA will do everything it can to keep inflation low and stable. The RBA is looking to improve communication [on monetary policies]. There are challenges in avoiding the de-anchoring of inflation expectations. If inflation is above target for a longer period of time, it will be more difficult to control inflation expectations. Be very wary of upside risks to inflation expectations. Population growth is helping to boost consumption. We don't see the full impact of (rising) interest rates on consumption. Households under stress are likely to have room to use their savings. The hope is that economic activity can slow down while avoiding economic disruption. Those small financial institutions may not be able to meet requirements of mortgage payments. The housing market "surprised me slightly".

4. Consumer spending is slowing down due to the impact of the Federal Reserve's interest rate hike

Bank of America CEO Brian Moynihan said the Fed's rate hikes aimed at curbing inflation have succeeded in slowing U.S. consumer spending. The bank's executives noted that the situation for U.S. consumers is generally healthy, while also pointing to a slowdown in consumer spending. "Inflation remains tough, especially for middle-income families in terms of goods and services, where groceries and gasoline have become more expensive," Moynihan noted. This puts pressure on consumer confidence. However, he said consumers’ balances in bank are still higher than that in the pandemic period, but are slowly starting to decline.

Domestic Macro Economy Index