August 14th Macroeconomic Index: MSCI China Flagship Index Adjusts, Gold Prices Surge, and OPEC+ Output Exceeds Targets

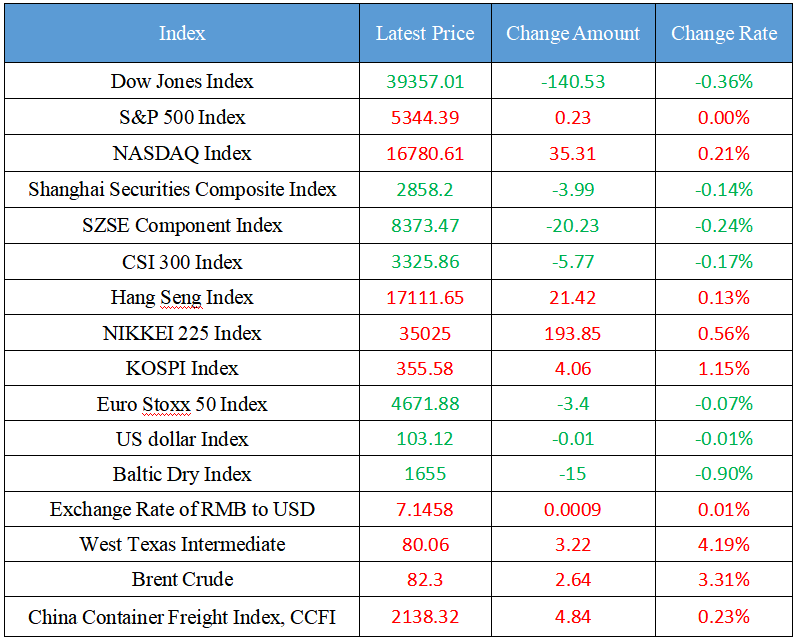

Latest Global Major Index

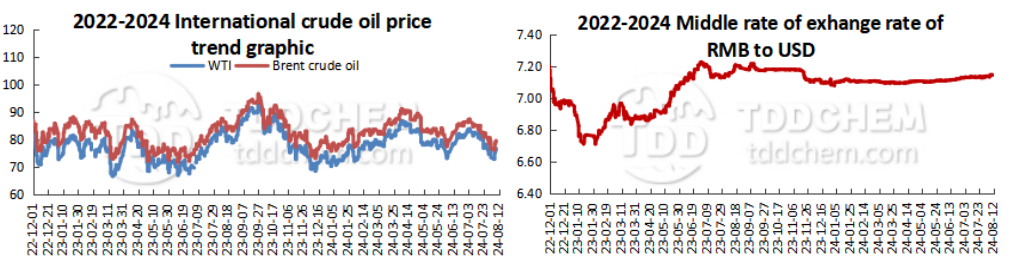

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. MSCI China Flagship Index Adjustment: Inclusion of Huaneng Hydropower, and 60 stocks are excluded

2. China Electricity Council: It is expected that the spot price of coal will continue to fluctuate and run weakly in the later period, and it does not yet have the conditions for a sharp decline

3. Institutions: The maximum maturity scale of urban investment bonds this year will occur in August

4. Stop long-term bond market? A number of agencies responded

5. The first high-speed double-block sleeper rail and small prefabricated component co-linear intelligent production line in China was officially put into operation

International News

1. Gold is approaching a record high, driven by safe-haven capital inflows

2. The probability that the Fed will cut interest rates by 50 basis points in September is 48%

3. OPEC+ output exceeded target in July, and Russia and other countries have all exceeded it

4. OPEC lowered its forecast for global oil demand before planning to gradually increase supply

5. The adjustment of Indonesia's palm oil export policy is expected to be further delayed

Domestic News

1. MSCI China Flagship Index Adjustment: Inclusion of Huaneng Hydropower, and 60 stocks are excluded

MSCI has announced the results of its August Index Review. Among them, the MSCI China Index newly included two stocks, Huaneng Hydropower and Shenghong Technology, and excluded 60 stocks such as Emma Technology, AVIC Industry and Finance, China Baoan, and China Film. Since the MSCI China Index is included within the MSCI Emerging Markets Index, a stock's entry into the MSCI China Index means that it enters the MSCI Global Standard Index Series, which provides a large amount of passive money to track.

2. China Electricity Council: It is expected that the spot price of coal will continue to fluctuate and run weakly in the later period, and it does not yet have the conditions for a sharp decline

Recently, the high temperature in eastern China has continued, and the daily coal consumption of power plants has increased month-on-month, but the rainfall in many places has a certain alleviating effect on the demand for cooling electricity. The overall production and sales of major domestic coal producing areas are balanced, and the coal price at the pit mouth is slightly reduced in some areas. In terms of ports, the coal storage of power plants has always been much higher than that of the same period last year, and the speed of destocking is slow, considering that the beginning of autumn has passed, the cost of imported coal has fallen, and the output of clean energy such as hydropower has increased, and the demand for spot procurement of power plants is not high. But at the same time, due to the inversion of shipping prices, the shipment volume of port traders has always hovered at a low level. Based on the overall judgment, it is expected that the spot price will continue to fluctuate and run weakly in the later period, but it is in the peak summer high consumption stage, and it does not yet have the conditions for a sharp decline.

3. Institutions: The maximum maturity scale of urban investment bonds this year will occur in August

On August 12, the reporter learned from Modern Consulting, a third-party urban investment research institution, that as of the end of July 2024, the scale of the stock of urban investment bonds in the whole market was 16.07 trillion yuan, a decrease of 2.61% from the previous month, mainly divided into incorporation bonds, company bonds, medium-term notes, general short-term financing bonds, ultra-short-term financing bonds, privately raised company bonds and directional orientation tool (PPN). The agency predicts that in the next year, the repayment scale of China's urban investment bonds is expected to be about 4.36 trillion yuan, a decrease of 3.33% from the previous month, and on the whole, the total maturity scale is significantly smaller than that of the previous year, with a maximum maturity scale of 529.813 billion yuan, which will occur in August 2024. This is followed by September 2024 and March 2025.

4. Stop long-term bond market? A number of agencies responded

On August 12, the bond market pulled back deeply, and the yields of all maturities rose across the board. On the same day, it was rumored in the market that many market makers did not conduct long-term bond market-making transactions. The reporter learned that some brokerages are still continuing to make markets, and many banks have stopped making long-term bonds. The person in charge of market-making of proprietary interest rate bonds of a brokerage firm in Beijing told reporters that it has not accepted any market-making transactions of long-term interest rate bonds today. "We have not received guidance and voluntarily stopped trading long-term bond market-making." The person said. Several brokerage market makers in Shanghai said they were continuing to conduct market-making transactions. The person in charge of a number of Shanghai securities firms said that the market-making transactions of interest rate bonds of all maturities are still being done, but the current market liquidity is low.

5. The first high-speed double-block sleeper rail and small prefabricated component co-linear intelligent production line in China was officially put into operation

On August 12, China's first high-speed double-block sleeper rail and small prefabricated component co-linear intelligent production line was officially put into operation at the construction site of the Chongqing-Kunming high-speed railway of China Railway Construction Bridge Bureau, marking a new step in the intelligent transformation of China's high-speed rail construction and laying a solid foundation for the opening and operation of the Chongqing-Kunming high-speed railway. Located in Yanjin County, Yunnan Province, the intelligent production line is an intelligent production line independently designed in China, integrating digital simulation, smart robots, Internet of Things, big data and other technologies, and undertaking the production of more than 500,000 double-block sleepers and 600,000 small components of the Chongqing-Kunming high-speed railway.

International News

1. Gold is approaching a record high, driven by safe-haven capital inflows

Gold prices rose more than 1.7% on Monday, hitting their highest level since Aug. 2 and approaching an all-time high of $2,483. Traders await this week's United States inflation data, which could provide more information on the Fed's path of rate cuts. Jim Wycoff, senior analyst at Kitco Metals, said: "What we are seeing in the gold and silver markets today is some price support from the bullish technical charts, with some technical buying triggered. "There is also some safe-haven demand due to heightened tensions in the Middle East," Wycoff said. On Monday, Israel forces continued operations near the southern Gaza city of Khan Younis. Meanwhile, Ukraine troops rushed across the Russia border last Tuesday.

2. The probability that the Fed will cut interest rates by 50 basis points in September is 48%

According to CME's "Fed Watch": the probability of a 25 basis point rate cut by the Fed in September is 52%, and the probability of a 50 basis point rate cut is 48%. The probability of a cumulative 50 basis point rate cut by November is 35.6%, the probability of a cumulative rate cut of 75 basis points is 49.3%, and the probability of a cumulative rate cut of 100 basis points is 15.1%.

3. OPEC+ output exceeded target in July, and Russia and other countries have all exceeded it

OPEC said in its monthly report that OPEC's 12 members produced 26.75 million b/d of oil in July, up 185,000 b/d from June, with Saudi Arabia, Iraq and Iran increasing production and Libya falling. Non-OPEC+ countries produced 14.16 million b/d in July, down 68,000 b/d from June, with Russia, Kazakhstan and South Sudan all down. Specifically, Russia's oil production fell by 26,000 b/d to 9.089 million b/d in July from 9.115 million b/d in June. However, according to the target set by OPEC+, Russia's output in July should have reached 8.978 million b/d, or a decrease of 111,000 b/d. Russia's energy ministry said last week that in July, "Russia's July output was 67,000 b/d above the target set by the OPEC+ deal due to one-time problems with supply plans, and the output in August and September should make up for that." In addition, the data showed that Iraq exceeded the target by 321,000 b/d, Kazakhstan exceeded the target by 95,000 b/d, and OPEC+ beat the July oil target by 84,000 b/d.

4. OPEC lowered its forecast for global oil demand before planning to gradually increase supply

OPEC lowered its forecast for global oil demand this year and next today, as the group and its allies prepare to decide on planned supply growth for the next quarter. OPEC cut its forecast for global demand growth by 135,000 b/d in 2024, according to its monthly report. This is the first major change to the forecast, which is still much higher than other forecasts in the oil industry. Under Saudi’s leadership, OPEC and its partners must decide in the coming weeks whether to move forward with plans to gradually resume production starting in October. At an assessment meeting earlier this month, the alliance reiterated that it could "pause or reverse" production increases, "depending on current market conditions". But even with the cuts, the group still believes oil consumption will grow at a "healthy" pace by 2.1 million b/d this year, averaging 104.3 million b/d.

5. The adjustment of Indonesia's palm oil export policy is expected to be further delayed

According to foreign media reports, market participants said that the long-awaited Indonesian export tariffs and special taxes on palm oil and its derivatives and scraps, as well as the adjustment of obligations in the domestic market, are facing further delays. Traders, suppliers and buyers of biofuel material have been closely monitoring potential changes, particularly the adjustment of export duties and special taxes on palm oil mill wastewater (Pome) oil and used edible oil (UCO). Indonesia's trade ministry had expected to finalize the changes earlier this month, but market participants now expect that the announcement could be delayed until after the swearing-in of Indonesia's new government in September or October. But everyone agrees that the actual timeline is difficult to predict.

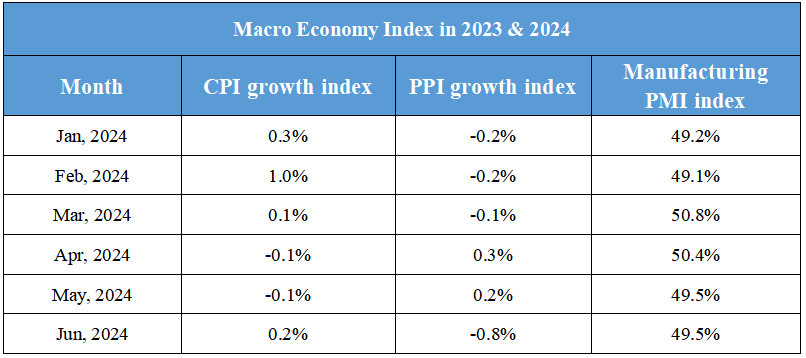

Domestic Macro Economy Index