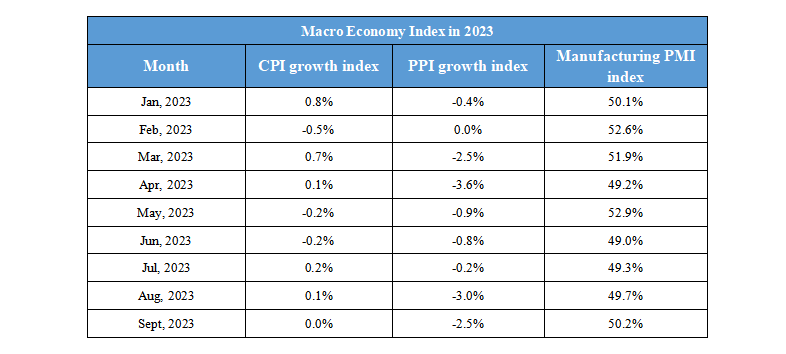

November 13th Macroeconomic Index: China's Central Bank Reaches New High in Net MLF Investment, Stabilizing Growth Signals

Daily Macro Economy News

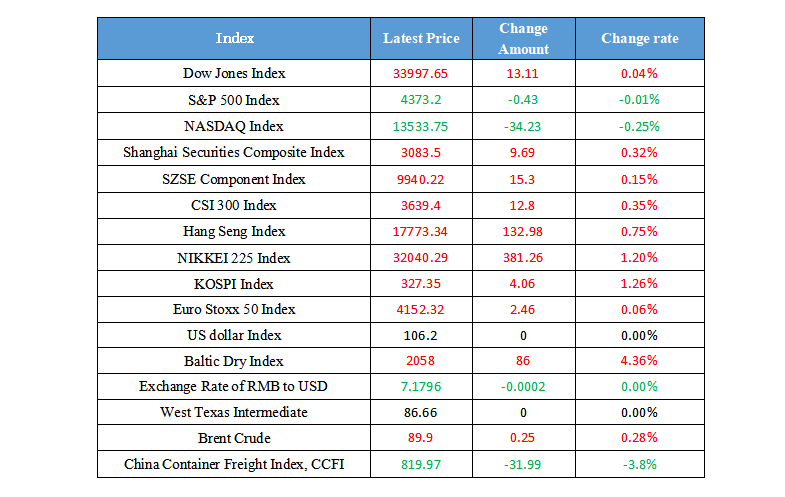

Latest Global Major Index

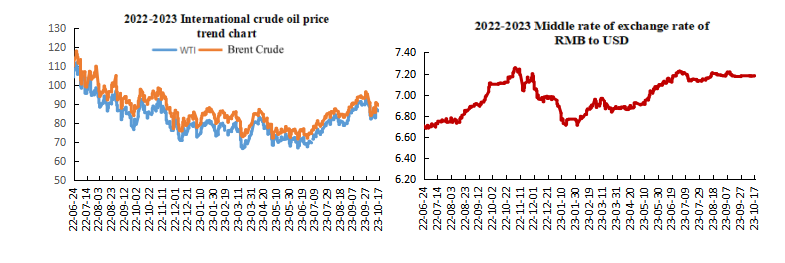

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The net MLF investment of the central bank in October reached a new high within the year, experts: releasing stable growth signals

2. Shanghai Stock Exchange Report: Interest rate reduction and reserve requirement reduction are still in the toolbox

3. The asset size of listed banks in China exceeds 265 trillion yuan

4. The Third Belt and Road Forum for International Cooperation was held today, and the Secretary-General of the United Nations arrived in Beijing

International News

1. ECB Chief Economist Lane: The (eurozone) economy will be in a state of "apparent stagnation" for the rest of 2023

2. Affected by severe drought, the water level of the main tributaries of the Amazon has fallen to its lowest level in 121 years

3. RBA Meeting Minutes: Reiterating the need for further policy tightening

4. Nuevo León, Mexico: Lingong Machinery Group plans to build a new industrial park, generating more than 5 billion US dollars of direct investment and driving about 100 enterprises

Domestic News

1. The net MLF investment of the central bank in October reached a new high within the year, experts: releasing stable growth signals

Since 500 billion yuan of MLF expired in October, the net investment of MLF yesterday was 289 billion yuan, and the net investment scale hit a new high this year, achieving a continuation of excess parity. Experts interviewed believed that the significant increase in MLF in October was directly due to the recent continuous tightening of market funds and the increase in banks' demand for MLF operations. While continuing to release the policy signal of stable growth, MLF can also create favorable conditions for local governments to issue special refinancing bonds and effectively prevent local debt risks. Considering that the central bank has cut interest rates twice this year, the current economic fundamentals are gradually improving, and there is no need for further reduction of policy interest rates in the short term.

2. Shanghai Stock Exchange Report: Interest rate reduction and reserve requirement reduction are still in the toolbox

The article pointed out that as the exchange rate and inflation level tend to stabilize, many market participants believed that China's monetary policy still has space. Monetary policy would cooperate with fiscal policy, and the process of easing credit would continue until the end of the year, continuing to consolidate the momentum of economic recovery. Wang Qing, chief macro analyst of Oriental Jincheng, deemed that, after taking into comprehensive account of the next credit release and special refinancing bond issuance needs, it was expected that MLF would continue to increase significantly before the end of the year. At the same time, from the perspective of optimizing the liquidity structure of banks and reducing the cost reduction of banks, it was also possible to reduce the reserve requirement rate again before the end of the year.

3. The asset size of listed banks in China exceeds 265 trillion yuan

According to the “2023 Chinese Listed Bank Analysis Report” released by the China Banking Association(CBA) on the 16th, the asset scale of 59 Chinese listed banks has exceeded 265 trillion yuan, which is the main force of the banking industry to support the real economy. The report shows that at present, China's listed banks include 6 large state-owned banks, 10 joint-stock banks, 30 urban commercial banks and 13 rural commercial banks. In 2022, the balance of corporate loans of 58 listed banks that disclosed annual reports exceeded 84 trillion yuan, a year-on-year increase of 12.5%; Corporate loans from listed banks account for nearly 60% of the total loan scale.

4. The Third Belt and Road Forum for International Cooperation was held today, and the Secretary-General of the United Nations arrived in Beijing

The third Belt and Road Forum for International Cooperation was held in Beijing on October 17-18. At noon on the 17th, UN Secretary-General António Guterres arrived in Beijing by plane to attend the third Belt and Road Forum for International Cooperation that was held today.

International News

1. ECB Chief Economist Lane: The (eurozone) economy will be in a state of "apparent stagnation" for the rest of 2023

The eurozone economy will be at "significant stagnation" for the rest of 2023. The ECB will keep interest rates high for as long as possible. Inflation still has the upside risk, and the ECB needs to remain open to further policy action. Inflation is expected to fall back to 2% in 2025. Only after being convinced that inflation will fall to 2% can the ECB begin to normalize interest rate policies. The ECB is still some distance from meeting its policy targets and needs to pay attention to the situation related to the wage agreement.

2. Affected by severe drought, the water level of the main tributaries of the Amazon has fallen to its lowest level in 121 years

According to the relevant department of Manaus, the capital of the Brazilian state of Amazonas, due to severe drought, the water level of the Negro River, the main tributary of the Amazon River, has dropped to 13.59 meters, breaking the previous record of the lowest water level of 13.63 meters in 2010, which is also the lowest water level recorded in 121 years since the river began hydrological records in 1902.

3. RBA Meeting Minutes: Reiterating the need for further policy tightening

At the meeting in October, it was considered whether to raise interest rates or to stand still, and finally decided that it would be more appropriate to stand still. The RBA kept its policy rate unchanged at 4.1% in October, in line with expectations. Before the meeting in November, employment data, CPI data and economic forecasts from Fed employees will be available. Whether or not to tighten policy depends on the data and risks to the economic outlook. It is unlikely to accept that the CPI will return to target later than expected. House price performance may mean that policies are not as strict as thought. The recent exchange rate decline in the AUD to USD has eased monetary conditions to some extent, albeit to a limited extent.

4. Nuevo León, Mexico: Lingong Machinery Group plans to build a new industrial park, generating more than 5 billion US dollars of direct investment and driving about 100 enterprises

According to a statement on the website of the Mexican state of Nuevo León, the governor of the state, Garcia, said on October 16 that China Lingong Machinery Group plans to build an industrial park on the outskirts of Monterrey, the capital of the state, and "the investment project is expected to drive about 120 enterprises, generate more than $5 billion direct industrial investment, and create more than 7,000 local jobs." The statement pointed out that the investment project of Lingong Machinery Group aims to build three major industrial clusters, which are used for processing and manufacturing, warehousing logistics and business support services. The project will start land acquisition this month, with the planning and construction phase in December, and the first phase is expected to be completed in July 2024.

Domestic Macro Economy Index