September 6th Macroeconomic Index: China Tightens IPO Pace, Jiangsu Reduces First Home Down Payments, ECB Faces Dilemma

Daily Macro Economy News

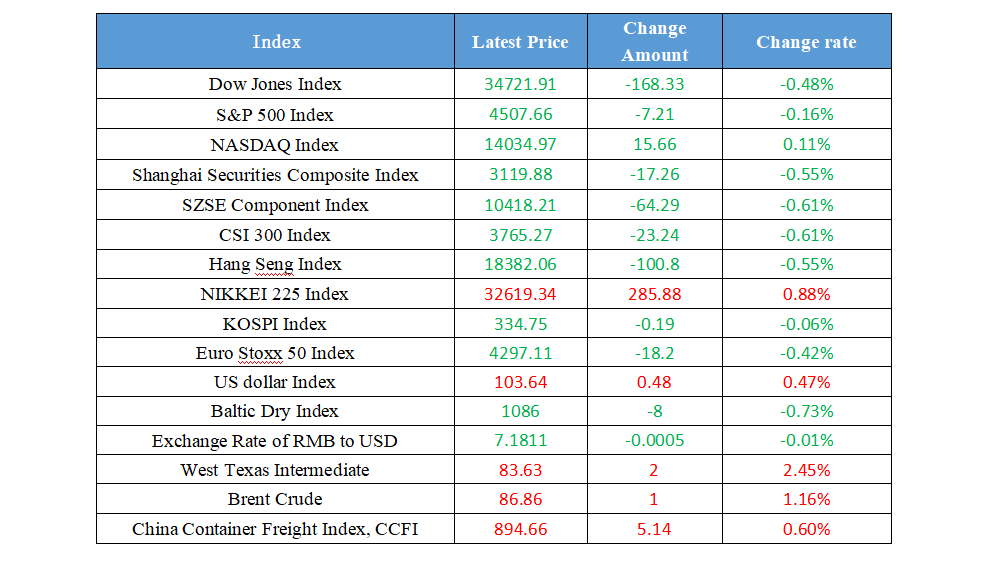

Latest Global Major Index

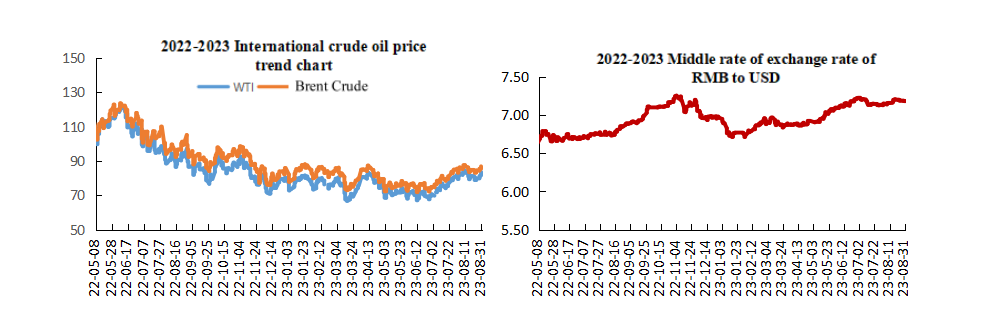

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Jiangsu: Implement policies such as reducing the down payment ratio for the purchase of the first house and "Recognize housing but not recognize loans" for the first home of individuals

2. Some banks in Zhengzhou have lowered their deposit interest rates, with a maximum reduction of 25BP

3. The pace of IPO has tightened in stages: the number of initial public offerings of enterprises fell by 31% in August

4. The State Council issued a notice on raising the special additional tax deduction standards for individual income tax

International News

1. Inflation in the eurozone did not continue to slow down in August, putting the European Central Bank in a dilemma again

2. Institutions: PCE data is approaching, and U.S. stocks are expected to strive for five consecutive gains

3. Jefferies Group: The minutes of the ECB meeting will reveal internal debates, and it is better to pause interest rate hikes in September

4. The Bank of Japan keeps its bond purchase plan in September unchanged

Domestic News

1. Jiangsu: Implement policies such as reducing the down payment ratio for the purchase of the first house and "Recognize housing but not recognize loans" for the first home of individuals

The Jiangsu Provincial Government held a press conference on “several policy measures to promote sustained economy recovery and improvement”. The “28 Measures” have been released, with a focus on expanding effective demand, enhancing development momentum, ensuring and improving people's livelihoods, and optimizing the business environment. In promoting the stable and healthy development of the real estate and construction industries, it is proposed to support the demand for rigid and improved housing. Implement policies such as reducing the down payment ratio for the purchase of the first set of housing and the interest rates on loans for the first and second sets of housing, improving the tax incentives for the purchase of improved housing and recognizing housing but not loans for the first home of individuals, and relaxing the policy of withdrawing housing provident fund for personal first sets of housing, and guiding commercial banks to adjust the interest rates of existing personal housing loans in an orderly manner in accordance with the law.

2. Some banks in Zhengzhou have lowered their deposit interest rates, with a maximum reduction of 25BP

After nationwide commercial banks lowered their deposit nominal rates in early June this year, less than three months later, these banks took the initiative to readjust their deposit nominal rates. On August 31st, reporters visited multiple banks in Zhengzhou and learned that some banks have already lowered or are preparing to lower their fixed deposit interest rates, with the three-year period experiencing the largest reduction, with a maximum reduction of 25BP.

3. The pace of IPO has tightened in stages: the number of initial public offerings of enterprises fell by 31% in August

According to recent market conditions, the CSRC gradually tightened the pace of IPO in July and August 2023. The IPO financing amount in July decreased by 8.3 billion yuan compared to the amount of June, a decrease of 18%. In August, the number of IPO approvals, initial public offerings and initial listings issued by the CSRC decreased by 4, 10 and 4 respectively compared to July, with a decrease of over 10%. Among them, the number of corporate initial public offerings decreased by 31%.

4. The State Council issued a notice on raising the special additional tax deduction standards for individual income tax

The State Council has decided to increase the following three special additional deduction standards for personal income tax, including the care of infants and young children under the age of 3. Firstly, the special additional deduction standard for infant care under the age of 3 will be increased from 1000 yuan per month to 2000 yuan per month. Secondly, The standard for special additional deductions for children's education has been increased from 1000 yuan per month to 2000 yuan per month. Thirdly, the special additional deduction standard for supporting the elderly has been increased from 2000 yuan per month to 3000 yuan per month. Among them, the only child is deducted at a standard fixed amount of 3000 yuan per month; The non-only child and his or her siblings shall share the deduction amount of 3000 yuan per month, and the amount shared by each person shall not exceed 1500 yuan per month.

International News

1. Inflation in the eurozone did not continue to slow down in August, putting the European Central Bank in a dilemma again

Inflation in the eurozone stopped slowing in August, which is a warning signal for European Central Bank officials as they need to weigh whether inflationary pressures are too stubborn to risk suspending interest rate hikes. Affected by energy, the euro area recorded an annual CPI rate of 5.3% in August, which is unchanged from the previous month. Although ECB Executive Director Schnabel expressed concerns about the economic slowdown earlier, inflation is also a factor of concern, exacerbating the dilemma faced by ECB policymakers this month. For ECB officials, the last important thing is the ECB's economic expectations. The ECB’s economic forecast for June shows that inflation will still exceed the 2% target (expected to be 2.2%) by 2025, with greater potential price pressures than those on food and energy.

2. Institutions: PCE data is approaching, and U.S. stocks are expected to strive for five consecutive gains

Amidst the release of key inflation data, US stock index futures rose early Thursday, and Wall Street seems to be working hard to achieve a fifth consecutive day of gains. Stephen Innes, managing partner of SPI Asset Management, stated that the weakening of employment data is one of the most critical factors in inflation normalization, which has led to a significant shift in the outlook for US interest rates in the near future and triggered a rise in the stock market and other high-risk assets. Personal consumption expenditure is one of the most favored inflation indicators by the Federal Reserve, so investors hope it can show that price pressures have not recovered and support the Fed's less hawkish optimistic stance in the coming months.

3. Jefferies Group: The minutes of the ECB meeting will reveal internal debates, and it is better to pause interest rate hikes in September

The European Central Bank will release the minutes of its July monetary policy meeting at 19:30 tonight. Mohit Kumar, Chief European Financial Economist at Jefferies Group, said that the minutes should clarify internal debates about the prospects for further interest rate hikes. He said in a report that the minutes released today should further clarify the debate between hawks and doves. Although the ECB has reason to raise interest rates by another 25 basis points, it’s best to wait for more data and suspend rate hikes in September. If our view of future economic data weakness is correct, then suspending rate hikes in September should pave the way for the ECB to end its current rate hike cycle.

4. The Bank of Japan keeps its bond purchase plan in September unchanged

After expanding the scope of medium- and long-term bonds purchases in August, the Bank of Japan maintained the scale and frequency of bond purchase plan in September despite low volatility. On July 28, the BOJ adjusted the yield curve control plan and expanded the bond purchase range in August. The yield of 10-year treasury bond can rise to 1% at most. The bond purchase plan in September is the same as in August, and the specific operations are as follows: for bonds with a remaining maturity of 1 year or more, purchase 150 billion yen and operate once; 1-3 year bonds with an amount of 350 billion to 650 billion yen and four operations; for bonds with a remaining maturity of 3-5 year bonds, with an amount of 400-750 billion yen and four operations; for bonds with a remaining maturity of 5-10 year bonds with an amount of 450 billion to 900 billion yen, with four operations; for bonds with a remaining maturity of 10-25 year bonds with an amount of 100 billion to 500 billion yen, with four operations; for bonds with a remaining maturity of 25 or more bonds, with an amount of 50 billion to 350 billion yen, with three operations.

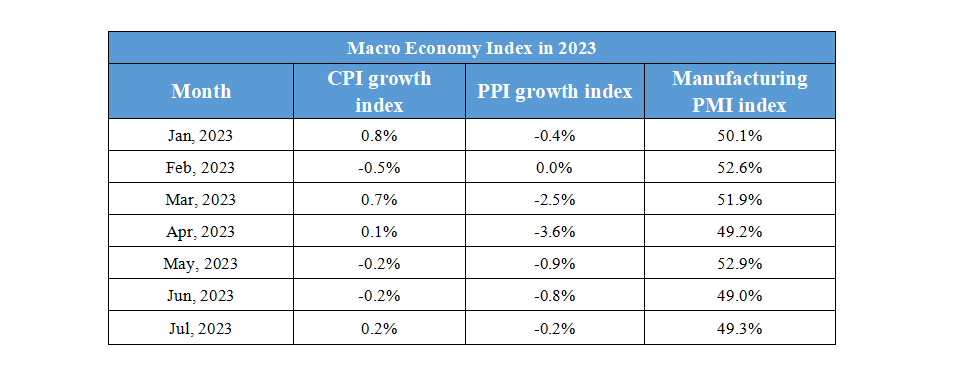

Domestic Macro Economy Index