August 7th Macroeconomic Index: China's Market Liquidity Abundant, US Trade Deficit Narrows, and Oil Prices Recover

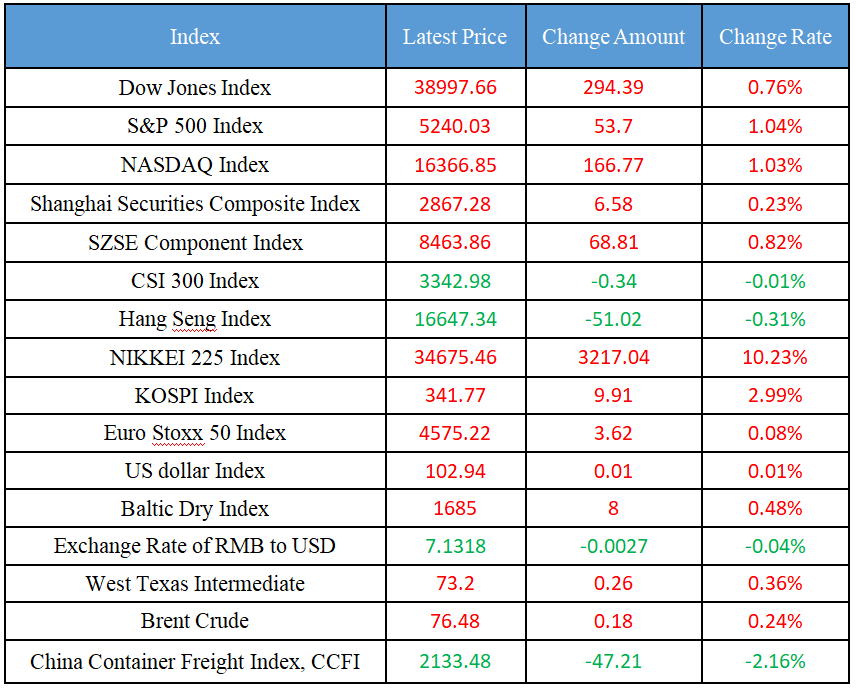

Latest Global Major Index

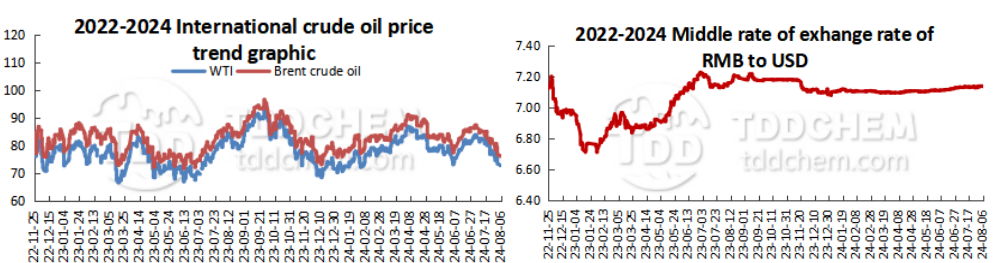

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. At the beginning of August, market liquidity remained reasonable and abundant, and the central bank received more than one trillion yuan in four trading days

2. In the first half of 2024, 1.128 million affordable housing units have been built and raised across the country

3. The National Development and Reform Commission and other three departments: study and improve the time-based electricity price policy for electric vehicle charging and explore the discharge price mechanism

4. Huadong Heavy Machinery plans to terminate the 6 billion photovoltaic project, and many shares of the photovoltaic concept reached the limit! Two listed companies responded

5. Ministry of Transport: In July, the passenger volume of urban rail transit increased by 9.4% month-on-month and 7.6% year-on-year

International News

1. The probability that the Fed will cut interest rates by 50 basis points in September is 71.5%

2. US stocks closed: the Nasdaq rose 1% and the China Concept Index rose 3%

3. United States' trade deficit narrowed in June as exports rebounded

4. Netherlands International: After experiencing a global market sell-off, oil prices once recovered from some of losses

5. Japan's stock market rebounded strongly, and Benchmark stock index has posted their biggest gains since October 2008

Domestic News

1. At the beginning of August, market liquidity remained reasonable and abundant, and the central bank received more than one trillion yuan in four trading days

Since August, the central bank's reverse repo has been small and gradually shrinking. On August 1, August 2 and August 5, the central bank carried out reverse repurchase of 10.37 billion yuan, 1.17 billion yuan and 670 million yuan respectively, and achieved a net withdrawal of 882.51 billion yuan after hedging the maturity amount, and after superimposing 215.65 billion yuan on August 6, the central bank accumulated a net withdrawal of 1,098.16 billion yuan in the four trading days in early August. Zhou Maohua, a macro researcher at the financial market department of Everbright Bank, said that in August, the central bank will continue to flexibly use a variety of monetary policy tools to protect the capital side, and the market liquidity is expected to continue to remain reasonable and abundant.

2. In the first half of 2024, 1.128 million affordable housing units have been built and raised across the country

The Ministry of Housing and Urban-Rural Development conscientiously implements the decisions and arrangements of the Party Central Committee and the State Council, implements various support policies in conjunction with relevant departments, organizes on-site meetings, strengthens policy training, and guides and urges all localities to increase the construction and supply of affordable housing. In 2024, the country plans to build 1.704 million units (houses) of affordable housing. As of the end of June, 1.128 million affordable housing units had been built and raised across the country, accounting for 66.2% of the annual plan, with an investment of 118.3 billion yuan. In the next step, the Ministry of Housing and Urban-Rural Development will continue to urge all localities to implement specific projects, pure land locations and project funds, promote the acceleration of project start-up, and ensure the completion of annual plan tasks.

3. The National Development and Reform Commission and other three departments: study and improve the time-based electricity price policy for electric vehicle charging and explore the discharge price mechanism

The National Development and Reform Commission and other three departments issued the "Action Plan for Accelerating the Construction of a New Power System (2024-2027)". Strengthen the integration and interaction between electric vehicles and the power grid. Make full use of the energy storage resources of electric vehicles and comprehensively promote intelligent and orderly charging. Support the interactive exploration of the integration of vehicles, piles, stations and networks, study and improve the time-based electricity price policy for electric vehicle charging, explore the discharge price mechanism, and promote the participation of electric vehicles in the interaction of the power system.

4. Huadong Heavy Machinery plans to terminate the 6 billion photovoltaic project, and many shares of the photovoltaic concept reached the limit! Two listed companies responded

Photovoltaic concept stocks rose and strengthened on August 6. Quanwei Technology, Junda shares and other shares rose by the limit, and Huadong Heavy Machinery, Foster and others rose by more than 5%. Huadong Heavy Machinery responded, "The stock price is only a short-term increase, and investors need to grasp last night's announcement", and the overall decline in the price of the industrial chain is due to the rapid expansion of photovoltaic production capacity and oversupply in the past two years. Foster said that the company's production and operation are normal. The announcement of East China Heavy Machinery is good for the photovoltaic industry, the overall demand of the industry is good, and it is in the stage of elimination and clearing, and high-quality production capacity can continue to maintain its advantages.

5. Japan's stock market rebounded strongly, and Benchmark stock index has posted their biggest gains since October 2008

According to data released by the Ministry of Transport, in July 2024, a total of 54 cities in 31 provinces (autonomous regions and municipalities directly under the central government) and the Xinjiang Production and Construction Corps opened and operated 311 urban rail transit lines, with an operating mileage of 10,339.4 kilometers, 3.5 million actual trains, 2.87 billion passenger trips, and 1.72 billion station visits. In July, passenger volume increased by 250 million passengers month-on-month, an increase of 9.4 percent, and a year-on-year increase of 200 million passengers, an increase of 7.6%. In July, the average passenger intensity of the country's total operating mileage was 8,960 passengers per kilometer per day, an increase of 5.5% month-on-month and 1.6% year-on-year. There were no new lines opened this month. Among them, there are 271 large-volume lines such as subway, light rail and urban express rail, with an operating mileage of 9,642.1 kilometers, with a passenger volume of 2.82 billion passengers and 1.68 billion station visits, 7 medium-volume lines such as monorail and maglev, with an operating mileage of 202.5 kilometers, with a passenger volume of 38.47 million passengers and 27.71 million station arrivals, and 33 low-volume lines such as trams and automatic guided tracks. The operating mileage is 494.8 kilometers, with 11.21 million passengers and 10.63 million inbounds.

International News

1. The probability that the Fed will cut interest rates by 50 basis points in September is 71.5%

According to CME "Fed Watch": the probability of a 25 basis point rate cut by the Fed in September is 28.5%, and the probability of a 50 basis point rate cut is 71.5%. The probability that the Fed will cut interest rates by 50 basis points by November is 19.3%, the probability of a cumulative rate cut of 75 basis points is 57.6%, and the probability of a cumulative rate cut of 100 basis points is 23.2%.

2. US stocks closed: the Nasdaq rose 1% and the China Concept Index rose 3%

US stocks closed on Tuesday, with the Dow initially closing up 0.76% or 280 points, the S&P 500 up 1% and the Nasdaq up 1%. Apple (AAPL. O) fell 1%, and Nvidia (NVDA. O) rose 3.7%, and TSMC (TSM. N) rose nearly 5%. The Nasdaq China Golden Dragon Index closed up 3%, while New Oriental (EDU. N) rose 13%, and JD.com (JD. O) rose 2%, while Alibaba (BABA. N) up 1%.

3. United States' trade deficit narrowed in June as exports rebounded

United States' trade deficit narrowed in June for the first time in three months, as exports of goods and services rose the most since earlier this year. United States Commerce Department data on Tuesday showed that the trade deficit in goods and services narrowed 2.5% from the previous month to $73.1 billion; Exports increased by 1.5% and imports by 0.6%. Adjusted for inflation, the merchandise trade deficit narrowed to $91.4 billion in June, the lowest level in three months. Exports of goods grew broadly, including commercial aircraft, natural gas and other petroleum products, and the export of automobiles. Imports were boosted by the growth of pharmaceuticals and capital goods.

4. Netherlands International: After experiencing a global market sell-off, oil prices once recovered from some of losses

Oil prices fell on Monday on fears of weak demand and a sharp sell-off in global markets, briefly recovering some of their losses on Tuesday. Netherlands International analysts said in a note: "Investors have been exiting commodities in recent weeks, and the positioning data highlights this. While oil fundamentals still look supportive, speculative sentiment is deteriorating. "Heightened fears of a full-scale war in the Middle East and data on a rebound in United States services activity in July are currently providing some support for prices. In addition, analysts said that reports that Libya's largest oil field, Sharara, had completely shut down production due to on-site protests, also offset some of the macro bearishness.

5. Source: Libya's largest oil field has completely stopped production

Japan stocks rebounded strongly on Tuesday after plunging into a bear market on Monday. The Nikkei 225 and Topix rebounded nearly 10% to post their biggest gains since October 2008; Export stocks such as technology companies and automakers soared after the yen fell about 1% against the dollar. The sharp volatility in the stock market triggered the circuit breaker mechanism in Nikkei futures, while the index's implied volatility fell from its highest level since 2008. Hideyuki Ishiguro, chief strategist at Nomura Asset Management, said: "The panic sell-off may be over, but the market may still be on a rollercoaster ride today as the restlessness in global markets remains high. ”

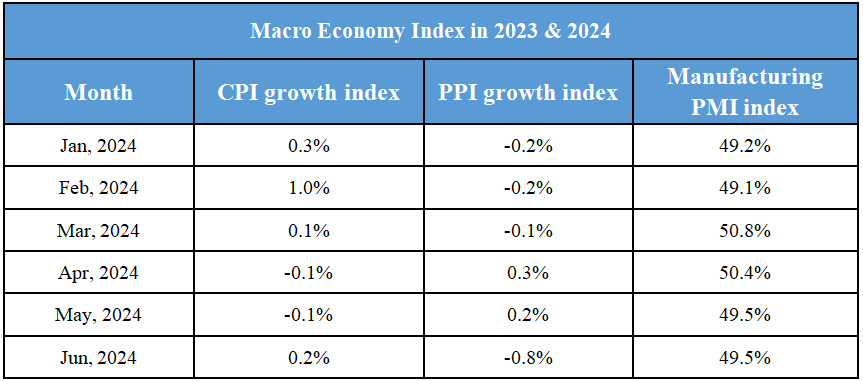

Domestic Macro Economy Index