August 6th Macroeconomic Index: China's Domestic Consumption Boosted, International Crude Prices and Exchange Rates Fluctuate

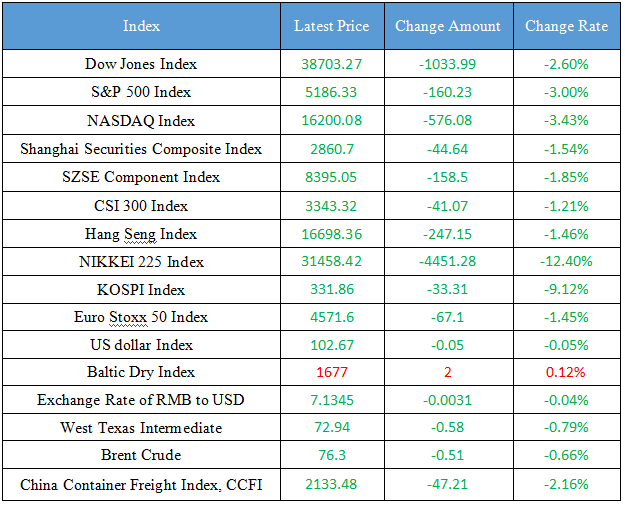

Latest Global Major Index

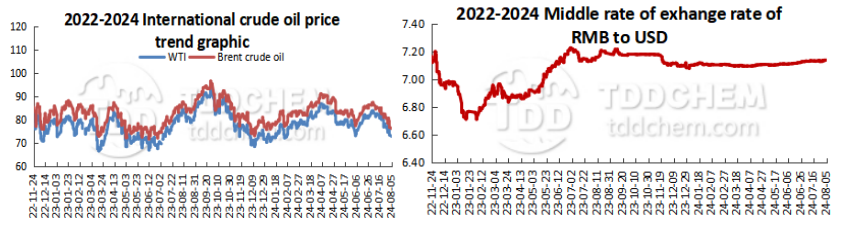

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Economic Daily: Coordinate supply and demand together to boost consumption, and increase the support for consumer credit and the issuance of consumption vouchers

2. Dig deep into the front line to explore opportunities, and foreign asset management giants actively investigate the Chinese market

3. The State Food and Material Reserves Administration and the Agricultural Development Bank of China signed a strategic cooperation agreement

4. Shenzhen Energy signed a comprehensive cooperation agreement with HUAWEI CLOUD

5. The Chinese Embassy reminds Chinese citizens to be cautious when going to Lebanon in the near future

International News

1. The Bank of Japan raised interest rates, triggering an appreciation of the yen. Against this backdrop, overseas investors began to sell stock index futures

2. Fed officials continue to weaken the impact of employment data in July

3. Fed's Goolsbee: Economic growth is still quite stable, and the Fed will not overact

4. United States 2-year and 10-year treasury yields ended inverted situation

5. Source: Libya's largest oil field has completely stopped production

Domestic News

1. Economic Daily: Coordinate supply and demand together to boost consumption, and increase the support for consumer credit and the issuance of consumption vouchers

According to the article, it will take some time for the consumer market to fully recover due to many problems such as the slowdown in the growth rate of residents' income, the lack of willingness of consumption, and the single consumption scene. To this end, it is necessary to make concerted efforts from both supply and demand, and expand consumer demand based on multiple dimensions while developing new quality productive forces to increase effective supply. Give full play to the role of policy guidance and support, and formulate more precise and effective policy measures. For example, we will increase consumer credit support and the issuance of consumption vouchers, lower the consumption threshold, and promote consumer demand; Strengthen the construction of infrastructure and public service facilities, and improve the carrying capacity of consumption.

2. Dig deep into the front line to explore opportunities, and foreign asset management giants actively investigate the Chinese market

With the acceleration of the opening up of China's capital market, more and more overseas asset management giants have entered the Chinese market, and some of their investment teams have also gathered in China to explore investment opportunities in the industry. For example, AllianceBernstein, a world-renowned asset management company, has been conducting grassroots research in the Chinese market for 15 years since 2009. Through in-depth research and observation of industry changes, foreign institutions have tapped many potential investment opportunities. In its view, there are more industries with hope for a reversal of fundamentals, including semiconductors, new energy, automation, construction machinery and other fields, and artificial intelligence is also worth paying attention to as the main line of investment for a long time in the future.

3. The State Food and Material Reserves Administration and the Agricultural Development Bank of China signed a strategic cooperation agreement

Recently, the State Food and Material Reserves Administration and the Agricultural Development Bank of China signed a strategic cooperation agreement in Beijing. According to the agreement, the two sides will carry out cooperation in 10 aspects, including policy-based regulation and control of grain, cotton and oil purchase, market-oriented purchase and sale of grain and oil, high-quality development of domestic soybean industry, important agricultural products and material reserves, and rejuvenate grain and reserves based on sci-tech, and continuously improve the level and effectiveness of cooperation.

4. Shenzhen Energy signed a comprehensive cooperation agreement with HUAWEI CLOUD

According to Huawei China's Weibo news, on August 5, Shenzhen Energy Group Co., Ltd. and Huawei Technologies Co., Ltd. signed a comprehensive cooperation agreement at the Energy Building and held the opening ceremony of the Artificial Intelligence Innovation Lab for the energy industry. Li Yingfeng, Chairman of Shenzhen Energy, Ouyang Huiyu, President of Shenzhen Energy, Zhang Ping'an, Executive Director of Huawei and CEO of Huawei Cloud, Li Jiguang, General Manager of Huawei Power System Dept, and Chen Hang, General Manager of Huawei Cloud Shenzhen, attended the ceremony. Guo Zhidong, Executive Vice President of Shenzhen Energy, and Du Yang, Deputy General Manager of Huawei Shenzhen Government and Enterprise Affairs, signed the agreement on behalf of both parties.

5. The Chinese Embassy reminds Chinese citizens to be cautious when going to Lebanon in the near future

In recent days, the conflict between Lebanon and Israel has continued to escalate, with air strikes in Beirut, the capital of Lebanon, causing a large number of casualties. The current security situation in Lebanon is serious and complex. On August 5, local time, the Ministry of Foreign Affairs and the Chinese Embassy in Lebanon reminded Chinese citizens to pay close attention to the development of the local situation and travel to Lebanon cautiously in the near future, reminding Chinese citizens and institutions in Lebanon to maintain high vigilance and strengthen security precautions and emergency preparedness. In case of emergency, please call the police and contact the Chinese Embassy in Lebanon for assistance.

International News

1. The Bank of Japan raised interest rates, triggering an appreciation of the yen. Against this backdrop, overseas investors began to sell stock index futures

The main factors for the sharp decline in Japanese stocks are the appreciation of the yen. The Bank of Japan raised interest rates, triggering a rise in the yen. Against this backdrop, overseas investors began to sell stock index futures, etc. The second is the expectation of a recession in the United States. United States new non-farm economy fell to 114,000 in July, below expectations of 175,000. Third, the semiconductor sector fell. The weight of semiconductor is about 20% in Nikkei index, and concerns are escalated about semiconductor export controls by the United State, and the Japanese semiconductor sector is under pressure.

2. Fed officials continue to weaken the impact of employment data in July

Fed's Daly said there is concern that the current balance showed in the jobs report could deteriorate, but we don't see that at the moment. July's jobs report reflected a large number of temporary layoffs as well as the impact of the hurricanes. Watch closely to see if the next job market report reflects the same dynamics, or if there is a reversal.

3. Fed's Goolsbee: Economic growth is still quite stable, and the Fed will not overact

Fed's Goolsbee reiterated that the Fed's job is not to react to a month of weaker labor data. Weaker-than-expected jobs data on Friday sparked recession fears and contributed to the rout of global stock markets. He said there are some alarming indicators, but economic growth continues to remain at fairly stable levels, and "when you see weaker-than-expected while seemingly not recession-based employment data, you should look ahead at the economy trend." If the economy is above normal level, then the situation is different. In my opinion, we need to respond more forcefully. Goolsbee stressed that the margin of error for the monthly employment data is 100,000, so don't jump to conclusions. Asked about the market's call for an emergency rate cut, Goolsbee said options including rate hikes and rate cuts had been on the table, and that the Fed would take steps to fix it if the economy deteriorated.

4. United States 2-year and 10-year treasury yields ended inverted situation

United States 2-year treasury yield has fell below the 10-year yield for the first time since July 2022, after a prolonged inversion of the U.S. Treasury yield curve, breaking the longest record in history, putting its reputation as an early warning indicator of economic problems to the test, and United States stocks continued to hit new highs until mid-July.

5. Source: Libya's largest oil field has completely stopped production

Libya's largest oil field, Sharara, was shut down on Monday after being forced to taper over the weekend, according to two people familiar with operations. The field was ordered to cut production last Saturday, and it is unclear why the cuts are made. The Libya government said on Sunday that shutting down the project was "political blackmail," but did not elaborate. A letter from oilfield operator Akakus Oil was cited by some local media outlets as saying that the reason for the closure of the Sharara oil field was due to protests about improving socio-economic conditions. Other news outlets blamed Saddam Hussein·Haftar, the son of military man Khalifa·Haftar, whose Libya National Army controls much of the east and south part and has imposed blockades in the region in recent years.

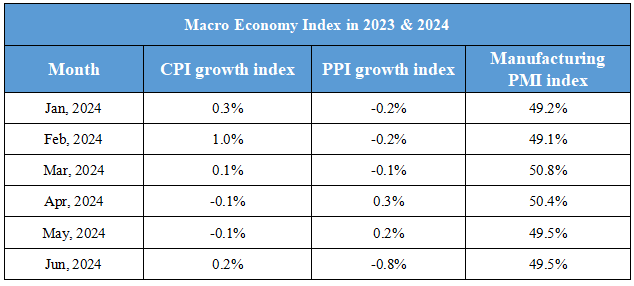

Domestic Macro Economy Index