May 17th Macroeconomic Index: China's Real Estate Measures and Digital Central Bank Plans Advance

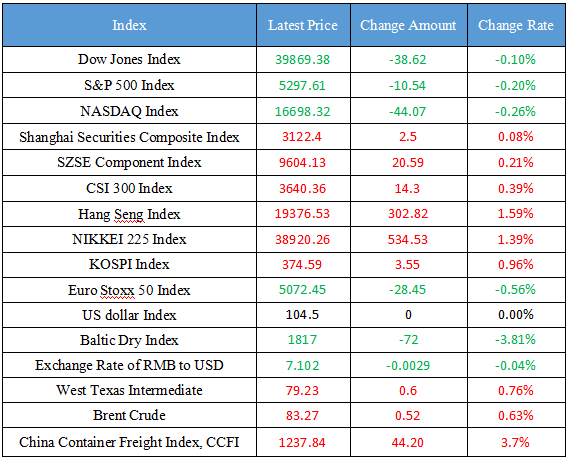

Latest Global Major Index

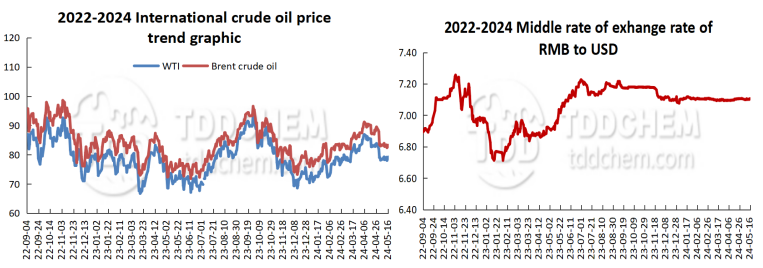

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Multiple Ministries and Commissions set up a joint working group to prepare for the launch of "major measures" in real estate industry

2. Central bank: accelerate the planning and construction of digital central banks

3. Sino-Russian Joint Statement: Jointly promote the implementation of large-scale energy projects by Chinese and Russian enterprises

4. State Post Bureau: In April, the business income of the postal industry reached 132.14 billion yuan, a year-on-year increase of 12.9%

5. National Development and Reform Commission: Accelerate the construction of a new model of real estate development and promote the steady and healthy development of the real estate market

International News

1. Import prices rose the most in two years, exacerbating inflationary pressures of the United States

2. Bank of England member Green: Hope to see more evidence showing that inflation continues to weaken

3. Red Sea shipping disruptions are fragmenting global LNG trade

4. Indonesian officials expect the country's oil and gas investment to grow by 29% in 2024

5. Canada's manufacturing sales fell in March: Investors are waiting for the PCE report, and the low volatility of dollar will only last for a few more weeks

Domestic News

1. Multiple Ministries and Commissions set up a joint working group to prepare for the launch of "major measures" in real estate industry

The real estate sector continues to decline, and policy measures aimed at digesting the stock of properties and optimizing incremental housing are in the pipeline. The reporter confirmed from multiple sources that before the policy briefing in the afternoon, the State Council will organize a real estate work related meeting on the morning of May 17, and relevant measures in the real estate field may be announced at that time. Leaders of the People's Bank of China, the Ministry of Housing and Urban-Rural Development, the State Administration of Financial Supervision and Administration, the Ministry of Finance, local governments, and heads of large financial institutions such as state-owned banks will all attend the meeting. On May 16, some relevant persons in charge of joint-stock banks whose headquarters are not in Beijing have left for Beijing to prepare for the meeting. (Caixin).

2. Central bank: accelerate the planning and construction of digital central banks

The People's Bank of China held the 2024 Science and Technology Work Conference, and Zhang Qingsong, member of the Party Committee and Deputy Governor of the People's Bank of China, attended the meeting and delivered a speech. The meeting pointed out that it is necessary to accelerate the planning and construction of the digital central bank, continue to enhance the ability of network security and data security, further promote the application and digital transformation of financial technology, and continuously strengthen the supply and implementation of financial standards, so as to provide strong scientific and technological support for the construction of a strong central bank, the establishment and improvement of an independent, controllable, safe and efficient financial infrastructure system, and the "five major articles". (People's Bank of China)

3. Sino-Russian Joint Statement: Jointly promote the implementation of large-scale energy projects by Chinese and Russian enterprises

China-Russia Joint Statement on Deepening the Comprehensive Strategic Partnership of Coordination in the New Era: Continue to consolidate China-Russia strategic energy cooperation and achieve high-level development, so as to ensure the economic and energy security of the two countries. Efforts should be made to ensure the stability and sustainability of the international energy market, and maintain the stability and resilience of the global energy industry chain and supply chain. Carry out cooperation in oil, natural gas, liquefied natural gas, coal, power and other fields in accordance with market principles, ensure the stable operation of relevant cross-border infrastructure, and ensure the smooth flow of energy transportation. We will work together to promote the implementation of large-scale energy projects by Chinese and Russian companies, and deepen cooperation in promising areas such as renewable energy, hydrogen energy and carbon markets. (CCTV News)

4. State Post Bureau: In April, the business income of the postal industry reached 132.14 billion yuan, a year-on-year increase of 12.9%

The State Post Bureau announced the operation of the postal industry in April 2024. In April, the business income of the postal industry reached 132.14 billion yuan, a year-on-year increase of 12.9%. Among them, the revenue of express delivery business reached 109.44 billion yuan, a year-on-year increase of 15.7%. From January to April, the business income of the postal industry reached 526.51 billion yuan, a year-on-year increase of 11.3%. Among them, the express delivery business revenue totaled 421.13 billion yuan, a year-on-year increase of 16.9%. In April, the revenue of postal industry's delivery business reached 15.22 billion pieces, a year-on-year increase of 20.4%. Among them, the express delivery business volume completed 13.70 billion pieces, a year-on-year increase of 22.7%.

5. National Development and Reform Commission: Accelerate the construction of a new model of real estate development and promote the steady and healthy development of the real estate market

The Party Group of the National Development and Reform Commission of the Communist Party of China wrote an article entitled "Further Comprehensively Deepening Economic System Reform and Promoting Chinese-style Modernization with High-quality Development". Improve the supervision system for real estate enterprises, promote the construction of affordable housing, accelerate the construction of a new model of real estate development, and promote the steady and healthy development of the real estate market. Coordinate the resolution and stable development of local debt risks, establish a long-term mechanism for preventing and resolving local debt risks, and establish a government debt management mechanism that is compatible with high-quality development. Comprehensively strengthen financial supervision, improve the risk settlement responsibility mechanism with consistent rights and responsibilities, and improve the basic system of the investor-oriented capital market. Strengthen security capacity building in key areas, improve the coordinated guarantee mechanism for grain production, purchase, storage, and marketing, accelerate the planning and construction of a new energy system, accelerate the construction of a data-based system, and build a large country reserve system, so as to effectively maintain the security and stability of industrial and supply chains.

International News

1. Import prices rose the most in two years, exacerbating inflationary pressures of the United States

US imported goods prices rose for the fourth consecutive month in April, the fastest pace in two years, reflecting persistently high U.S. inflation. The U.S. import price index rose 0.9% month-on-month in April, three times what economists expected. Growth is also comprehensive and is not concentrated in the energy sector. The U.S. government said import prices, excluding fuel, also rose 0.7 percent. The cost of imports, which has steadily declined in 2022 and 2023, has risen this year. Other inflation measures have proven sticky, forcing the Fed to postpone plans to cut interest rates in the near term. In addition, the import price index rose by 1.1% year-on-year, continuing to accelerate from March, after recording declines for 13 consecutive months. U.S. inflation seems to have stayed in the low-to-mid range of 3%, well above the Fed's 2% target. It is unlikely to lower interest rates, which are currently at 23-year highs, until inflation slows further.

2. Bank of England member Green: Hope to see more evidence showing that inflation continues to weaken

BoE monetary policy commissioner Green said the BoE should wait for more conclusive evidence that strong inflationary pressures are becoming less stubborn before cutting interest rates. Green said there was more uncertainty about the extent to which persistent inflation would ease than the impact of the Bank of England's high interest rates on the economy. "Considering how long we have to maintain restrictive policy before we can ease it, I think the burden of proof is on the continued weakening of inflation," she said. Last week, Green, along with a majority of members of the Bank of England's Monetary Policy Committee, voted in favour of keeping the Bank Rate at 5.25%, although two members supported a rate cut. In April, she said that interest rate cuts in the UK should be "some way off" due to persistent inflationary pressures.

3. Red Sea shipping disruptions are fragmenting global LNG trade

Since mid-January, Houthi attacks have reduced the number of LNG tankers passing through the Red Sea to zero, and the global LNG market is becoming increasingly fragmented as a result. In order to save on transportation costs, traders have to look for sources closer to the place of production. When fuel demand rises before next winter, shipping costs will also rise. This fragmentation will make it more challenging to transfer supply between regions in the event of a power outage at an export plant or a sudden spike in demand. This could lead to higher LNG prices or a widening of the spread between Europe and Asia.

4. Indonesian officials expect the country's oil and gas investment to grow by 29% in 2024

Indonesian investment in the oil and gas sector is expected to grow by 29% in 2024, according to Dwi Soetjipto, president of Indonesia's oil and gas regulator SKK Migas. Indonesia is ramping up drilling and exploration after global giants Shell and Chevron recently withdrew from the region. At a time when fossil fuel projects are facing growing financing challenges, Indonesia is looking to reverse the declining oil production. Soetjipto said 40 percent of the investments planned this year will come from foreign companies, including Eni, ExxonMobil and BP. Growth in oil and gas investment is expected to reach $17 billion in 2024, more than double the 13% growth rate in 2023.

5. Canada's manufacturing sales fell in March: Investors are waiting for the PCE report, and the low volatility of dollar will only last for a few more weeks

Investors raised bets on the Federal Reserve to cut interest rates, which are now expected to be cut twice, according to data released on Wednesday showing a slowdown in U.S. inflation. The U.S. dollar index edged higher on Thursday after falling 0.75% on Wednesday. Some analysts said Fed officials would want to see evidence of downward inflation before supporting a rate cut, which was also mentioned by Fed's Kashkari on Wednesday. Francesco Pesole, FX strategist at ING Bank, said: "Actually, there is not so much to be optimistic about. Inflation is moving in the right direction, but it is still not at a level that would allow the Fed to cut interest rates. Pesole said investors are currently awaiting the release of PCE data in late May. My current view is that we may just default to a few more weeks of low volatility, lack of direction and range-bound volatility. ”

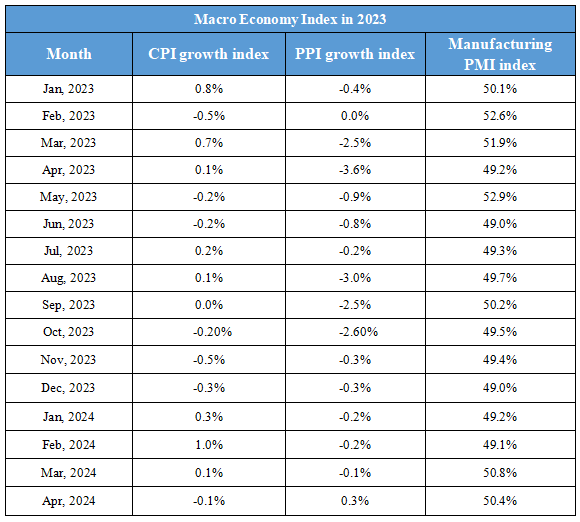

Domestic Macro Economy Index