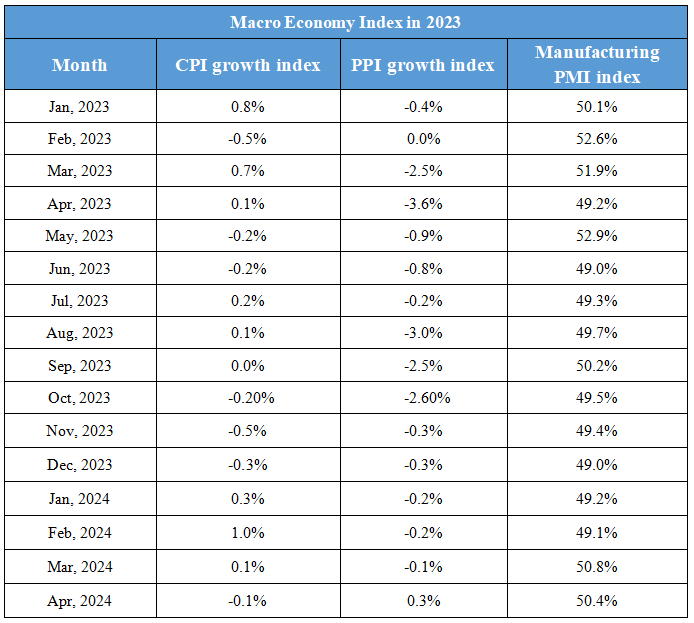

May 14th Macroeconomic Index: China's Coking Coal Prices Surge Over 34%, Railway Freight Volumes Rise

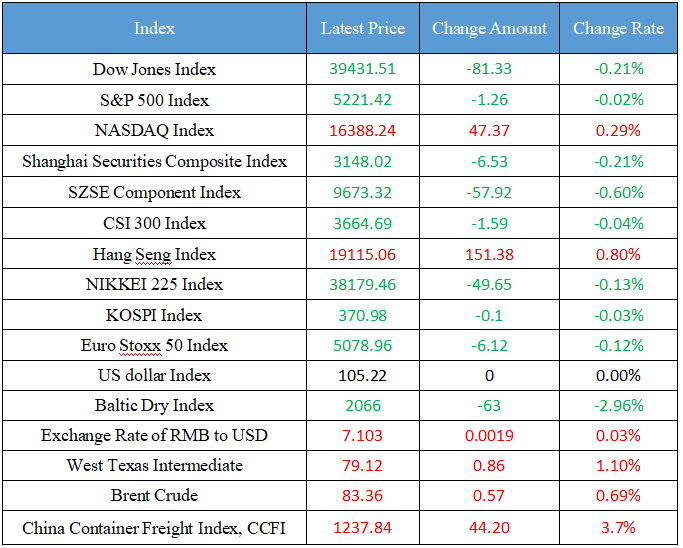

Latest Global Major Index

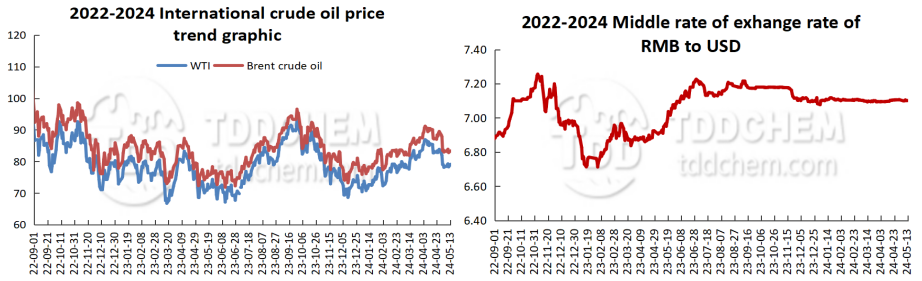

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. China's coking coal demand has increased and the price has increased by more than 34%

2. China has invested nearly 900 billion yuan to promote the construction of national key ecological function zones

3. Ministry of Transport: Last week, the national railway transported a total of 75.301 million tons of goods, an increase of 0.54% month-on-month

4. The Central Bank: support the further optimization of the "Swap Connect" mechanism

5. Since the "14th Five-Year Plan", the Agricultural Development Bank has invested a total of 1.74 trillion yuan in integrated loans in the Yangtze River Delta

International News

1. Institutions reduce their exposure to emerging markets and bet on significant fluctuations in the world's major currencies

2. The world's largest traders are bidding fiercely for the Australian cotton "crown" to change owners

3. The Bank of Japan reduced bond purchases and the yen strengthened in the short term

4. Unicredit Bank: Once the Bank of England starts to cut interest rates, the subsequent rate cuts will be quite fast

5. Capital Macro: OPEC+ will face the risk of declining market share if it doesn't increase oil production

Domestic News

1. China's coking coal demand has increased and the price has increased by more than 34%

Since the beginning of this year, coking coal prices have shown a "V" shaped trend. At the beginning of the year, the futures price remained at about 1,700 yuan per ton, and after bottoming out in early April, it rebounded, from the lowest price of 1,400 yuan per ton on April 1 to the highest price of 1,889 yuan per ton on May 7, with a maximum increase of more than 34%. Industry insiders said that coking coal is mainly used for blast furnace ironmaking, and the price depends on the prosperity of downstream iron and steel enterprises. The reporter learned that the growth rate of industrial steel is obvious, and the profit of steel mills per ton of steel has increased. (CCTV Finance).

2. China has invested nearly 900 billion yuan to promote the construction of national key ecological function zones

The reporter learned from the Ministry of Ecology and Environment that up to now, China has invested nearly 900 billion yuan in transfer payment funds to increase the protection of soil and water conservation, water conservation, windbreak and sand fixation and biodiversity maintenance in national key ecological function areas, involving about 4.84 million square kilometers in 810 counties, accounting for 50.4% of the land area. In order to improve the accuracy of monitoring and evaluation, the Ministry of Ecology and Environment has established a county-level ecological environment monitoring network integrating "sky and ground". For natural ecological types such as woodland, grassland, and water wetland, high-resolution satellite remote sensing images are used to carry out monitoring. Combined with local natural ecological changes, the use of UAV remote sensing for detailed investigation has achieved systematic, three-dimensional and dynamic monitoring. At present, 85.8% of the counties in China's key ecological function areas are in the first and second excellent state of ecological quality, which is 22.9 percentage points higher than the national average. (CCTV News)

3. Ministry of Transport: Last week, the national railway transported a total of 75.301 million tons of goods, an increase of 0.54% month-on-month

According to the monitoring and summary data of the Office of the Leading Group for Logistics Guarantee and Smooth Work of the State Council, from May 6 to May 12, the national freight logistics operated in an orderly manner, including: the national railway transported a total of 75.301 million tons of goods, an increase of 0.54% month-on-month; The cumulative number of trucks on highways nationwide was 55.045 million, an increase of 29.04% month-on-month; The cumulative cargo throughput of the monitored ports was 252.01 million tons, down 4.74% month-on-month, and the container throughput was 6.048 million TEUs, an increase of 2.8% month-on-month; Civil aviation has guaranteed a total of 114,000 flights (including 4,147 cargo flights, including 2,480 international cargo flights and 1,667 domestic cargo flights), a decrease of 4.31% month-on-month.

4. he Central Bank: support the further optimization of the "Swap Connect" mechanism

The People's Bank of China promotes the strategic deployment of China's financial market opening up, first, to enrich product types, launch interest rate swap contracts with the settlement date of the international money market as the payment cycle, in line with the international mainstream trading varieties, to meet the diversified risk management needs of domestic and foreign investors. The second is to improve the supporting functions, launch contract compression services and supporting historical value contracts, so as to facilitate participating institutions to manage the business scale of duration contracts, reduce capital occupation, and activate market transactions.

5. Since the "14th Five-Year Plan", the Agricultural Development Bank has invested a total of 1.74 trillion yuan in integrated loans in the Yangtze River Delta

According to data recently released by the Agricultural Development Bank of China, since the "14th Five-Year Plan", the Agricultural Development Bank has invested a total of 1.74 trillion yuan in integrated loans in the Yangtze River Delta, and the loan balance at the end of April 2024 was 1.71 trillion yuan, an increase of 723.6 billion yuan from the end of the "13th Five-Year Plan". The relevant person in charge of the Agricultural Development Bank said that in terms of serving national food security and ensuring the supply of important agricultural products, since the "14th Five-Year Plan", the Agricultural Development Bank has accumulated 353.6 billion yuan of various loans for grain, cotton and oil in the Yangtze River Delta region, and the balance of loans at the end of April 2024 is 188.2 billion yuan; In terms of serving agricultural modernization, since the "14th Five-Year Plan", the Agricultural Development Bank has accumulated 301 billion yuan of loans for agricultural modernization, with a balance of 300.7 billion yuan, a net increase of 208.5 billion yuan from the beginning of the period. (Xinhua News Agency)

International News

1. Institutions reduce their exposure to emerging markets and bet on significant fluctuations in the world's major currencies

A stronger dollar has been driving the carry trade for G10 currencies as traders tend to steer clear of emerging markets with more volatility. A measure of the G10 currency trading strategy by institutions is on track for its best half-year performance in 14 years, which is up nearly 6% since January this year. In contrast, the carry trade index, which tracks eight emerging markets, was flat. After several months of trading in a narrow range, the policy divergence of major central banks is gradually becoming a more exciting backdrop for G10 currency volatility. Institutions such as Allspring, GAM Investments, and TD Securities are betting on significant volatility in the world's major currencies and reducing exposure to emerging markets. The carry trade is part of its appeal, mainly driven by a stronger dollar and weaker currencies such as the Swedish krona and Swiss franc, which may start cutting interest rates earlier in response to central banks.

2. The world's largest traders are bidding fiercely for the Australian cotton "crown" to change owners

Louis Dreyfus and Olam Agri Holdings, two of the world's largest crop traders, are in a bid to buy Namoi Cotton, Australia's largest cotton processor. Since January this year, two bidders have been bidding upwards, with the buying spree pushing Namoi's share price up more than 50 percent. Olam Agriculture's latest offer for Namoi is around $144 million, but given what has been the case over the past four months, this is unlikely to be its last bid. Gerald Smith, an agricultural adviser at the USDA's diplomatic service in Canberra, said: "At the end of the day, these companies want to diversify their risk geographically. He added that investing in Australian cotton was attractive due to Australia's proximity to Asia. According to the Australian Cotton Industry Organisation, there are 41 processing plants in Australia. Namoi owns 10, while Olam's Queensland Cotton Company owns nine, including two joint ventures. Louis Dreyfus Company has 3.

3. The Bank of Japan reduced bond purchases and the yen strengthened in the short term

The Bank of Japan (BOJ) bought fewer government bonds in its regular operations on Monday than on April 24 to reduce its presence in the government bond market. The move could push Japanese bond yields higher, potentially narrowing the huge yield gap between Japan and the United States, which has previously weakened the yen. Immediately after the BOJ's announcement, the yield on benchmark 10-year government bonds rose, while the yen strengthened in the short term. The Bank of Japan said it would buy 425 billion yen ($2.7 billion) of 5-10 year government bonds, compared with 475.5 billion yen last month.

4. Unicredit Bank: Once the Bank of England starts to cut interest rates, the subsequent rate cuts will be quite fast

Unicredit noted that we think the BOE's MPC decision on June 20 will be a delicate balance, depending on the data released between now and then, including two inflation reports. However, we still expect the BOE to cut rates for the first time in August, as it doesn't take much time to move on the side of caution. Given that headline inflation has fallen below 2% this spring, the labor market has deteriorated further, and GDP growth has slowed, this could lead to the MPC continuing to cut rates at a fairly rapid pace after it has started cutting rates.

5. Capital Macro: OPEC+ will face the risk of declining market share if it doesn't increase oil production

Capital Economics said that if OPEC+ does not start to increase oil production, it risks losing its oil market share. Earlier this year, OPEC+ extended the agreement to voluntarily cut production to avoid oversupply and support oil prices. For now, they will decide on the next policy move at their upcoming meeting in June. However, Capital Economics analysts said that Brent crude recently fell below $84 a barrel, indicating that the oil market is not as constrained as OPEC+ would like. OPEC+ members may feel that it’s not the right time to start increasing production now. However, if this is not done, the group risks further losing market share as non-members expand production.

Domestic Macro Economy Index