May 9th Macroeconomic Index: China's NDRC Signs Three Cooperation Documents with France, ICT Market to Reach 84.06 Billion Yuan by 2028

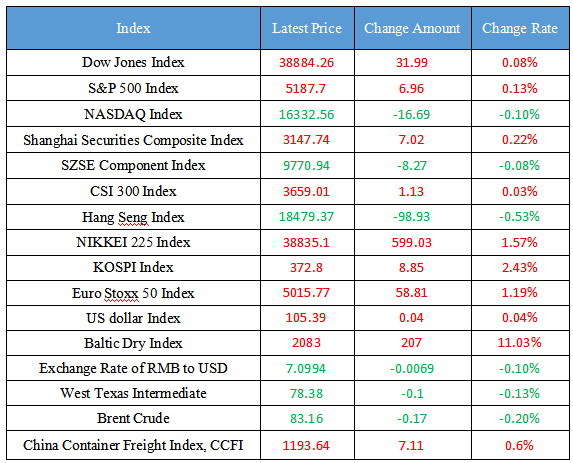

Latest Global Major Index

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The National Development and Reform Commission has reached three cooperation documents with relevant departments and enterprises in France

2. IDC: The ICT market size of China's power industry will increase to 84.06 billion yuan in 2028, with a compound annual growth rate of 8.7%

3. In April, the turnover of China's futures market increased by 28.49% year-on-year

4. China Federation of Things: China's highway logistics freight index increased by 0.33% in April compared with the previous month

5. CNOOC Bozhong 19-6 Gas Field 13-2 Block 5 Well Area Development Project was put into operation

International News

1. The Baltic Dry Bulk Freight Index hit a high of more than six weeks

2. The Russian Federal Government Announces Its Resignation, and the review of the nomination of the new government will be held before the 15th

3. Despite the decline in retail sales, UK consumer confidence is expected to improve

4. Novak: OPEC+ will take action on oil production if necessary

5. Retail trade in the eurozone is recovering as inflation cools

Domestic News

1. The National Development and Reform Commission has reached three cooperation documents with relevant departments and enterprises in France

During President Xi Jinping’s visit to France, the National Development and Reform Commission (NDRC) reached three cooperation documents with relevant departments and enterprises of the French government: 1. The "Letter of Intent between the National Development and Reform Commission of the People's Republic of China and the Ministry of Economy, Finance and Industry and Digital Sovereignty of the French Republic on Strengthening Inter-Sectoral Exchanges and Cooperation" The two sides agreed to carry out policy exchanges in macroeconomic policies, industrial development and green and low-carbon, so as to serve the practical cooperation between the two sides and enhance mutual understanding of each other's economies and policies. 2. The "Letter of Intent on Cooperation between the National Development and Reform Commission of the People's Republic of China and the Ministry of Ecological Transition and Territorial Coordination of the French Republic on Green Development and Ecological Transition" agreed that the two sides will carry out cooperation in the field of green development and ecological transition in accordance with their different national conditions and in accordance with the principles of equality and mutual benefit, so as to contribute to the realization of the Sustainable Development Goals. 3. The Memorandum of Understanding between the National Development and Reform Commission of the People's Republic of China and Airbus on Deepening Cooperation in the Aviation Field agrees to further deepen cooperation in aviation and related emerging fields to jointly promote the healthy and stable development of China's air transport market.

2. IDC: The ICT market size of China's power industry will increase to 84.06 billion yuan in 2028, with a compound annual growth rate of 8.7%

DC recently released the IDC Market Forecast: ICT Market Forecast for China's Power Industry, 2023-2028. IDC predicts that the ICT market size of China's power industry will grow from RMB 58.17 billion in 2023 to RMB 84.06 billion in 2028, with a compound annual growth rate of 8.7%.

3. In April, the turnover of China's futures market increased by 28.49% year-on-year

According to the latest data released by the China Futures Association today (7th), the turnover of the national futures market in April was 56.74 trillion yuan, and the trading volume was 666 million contracts, an increase of 28.49% and a decrease of 1.01% year-on-year, respectively. Among them, industrial silicon futures and options, which mainly serve the photovoltaic industry, have been actively traded and have grown significantly. In April, the cumulative trading volume of industrial silicon futures and options was 8.3314 million hands, an increase of 34.39% month-on-month, and the cumulative turnover was 415.246 billion yuan, an increase of 24.09% month-on-month.

4. China Federation of Things: China's highway logistics freight index increased by 0.33% in April compared with the previous month

The China Federation of Logistics and Purchasing announced today (7th) the China Road Logistics Freight Index for April. In April, the economic operation continued to recover well, the vitality of the highway transport market has been enhanced, and the demand has improved, driving the road logistics freight index to rebound slightly. In April, China's highway logistics freight index was 102.8 points, up 0.33% from the previous month, ending the trend of falling for two consecutive months and ushering in a slight rebound. In terms of models, the index of all models rebounded month-on-month. Among them, the vehicle freight index, which is dominated by bulk commodities and regional transportation, was 103 points, up 0.35% from the previous month. On the whole, the economic operation in April continued to recover well, market demand and enterprise production expansion remained stable and improving, and under the pull of new growth driver and a series of trade-in measures, the vitality of the road transport market has been enhanced and the demand is improving. (CCTV News).

5. CNOOC Bozhong 19-6 Gas Field 13-2 Block 5 Well Area Development Project was put into operation

On May 7, China National Offshore Oil Corporation (CNOOC) announced that the development project of Well Area 5 in Block 13-2 of Bozhong 19-6 Gas Field was put into production. The project is located in the central part of the Bohai Sea, with an average water depth of about 23 meters, and the main production facilities include one wellhead platform, and 10 development wells are planned to be put into production. It is expected to achieve peak production of about 5,800 barrels of oil equivalent per day in 2026. CNOOC owns 100% equity of the project and acts as the operator.

International News

1. The Baltic Dry Bulk Freight Index hit a high of more than six weeks

The Baltic Dry Bulk Index extended its rally on Tuesday, hitting its highest level in more than six weeks, supported by a rise in the Large Vessel Freight Index. The Baltic Dry Index rose 207 points, or 11.03%, to 2,083 points, the highest level since March 25. The capesize freight index rose 21.2% to 3,239. The average daily profit of capesize vessels rose by $4,698 to $26,864. The Panamax freight index rose 65 points, or about 3.5%, to 1,949 points. The average daily profit of Panamax ships rose by $593 to $17,545. The Supramax bulk carrier freight index rose 3 points to 1461 points. Jefferies analysts said, “The dry bulk market continues to outperform expectations. In the major loading regions of Australia (iron ore), Brazil (iron ore) and West Africa (bauxite), spot activity on capesize vessels remains high.”

2. The Russian Federal Government Announces Its Resignation, and the review of the nomination of the new government will be held before the 15th

On the 7th local time, Russian Prime Minister Mishustin signed a government resolution to remove the current government from power. Chairman of the Russian Federation Council (the upper house of parliament) Matviyenko said on the same day that the nomination and deliberation of ministers of the new Russian government will be carried out by May 15. The inauguration ceremony of Russian President Vladimir Putin was held in the Kremlin on the 7th, and Putin was sworn in as the eighth President of the Russian Federation. According to the law, after the inauguration of the President, the government of the Russian Federation will announce its resignation. The Prime Minister, Deputy Prime Minister and Ministers will continue to work in an acting capacity pending approval from the new Government. (CCTV).

3. Despite the decline in retail sales, UK consumer confidence is expected to improve

Lindsay James, investment strategist at Quilter Investors, said in a note that the British Retail Consortium's data on the decline in UK retail sales for April should not come as a surprise to retailers because of the early Easter weekend in March and the heavy rainfall over the same period. However, consumer confidence is likely to pick up as the market is pricing in a high probability that the central bank will cut interest rates for the first time in August. James added that the UK economy is also expected to show early signs of improvement in Friday's GDP data, while headline CPI will fall further later this month, and these factors should influence the decision to cut interest rates by the end of the summer, gradually easing the pressure on consumers.

4. Novak: OPEC+ will take action on oil production if necessary

According to Interfax, Russian Deputy Prime Minister Alexander Novak said on Tuesday that OPEC+, an organization of major oil producers, has agreed to act on oil production if necessary. He also said that there is no need to predict further moves by OPEC+ and that they will depend on market conditions. OPEC+ has not yet begun formal negotiations on extending the 2.2 million b/d voluntary oil cut until after June, but three sources from the alliance's oil producers said they could continue to cut production if demand fails to pick up.

5. Retail trade in the eurozone is recovering as inflation cools

Eurozone retail sales rebounded in March, in line with a slowdown in price increases. Data released on Tuesday showed retail sales rose 0.8% in March from the previous month, a figure slightly higher than economists' expectations, reversing a downward trend in February. The increase was driven by higher spending on fuel and food, while other non-food sales were flat. Inflation in the region was 2.4% in March, a sharp cooling compared to the highs of previous years. Consumer confidence has now risen to its highest level in two years, while domestic spending is likely to boost eurozone growth further this year, helping to offset weaker business investment and sluggish industrial output.

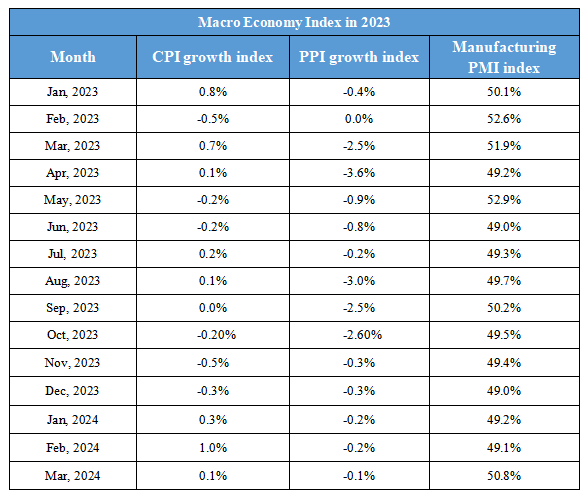

Domestic Macro Economy Index