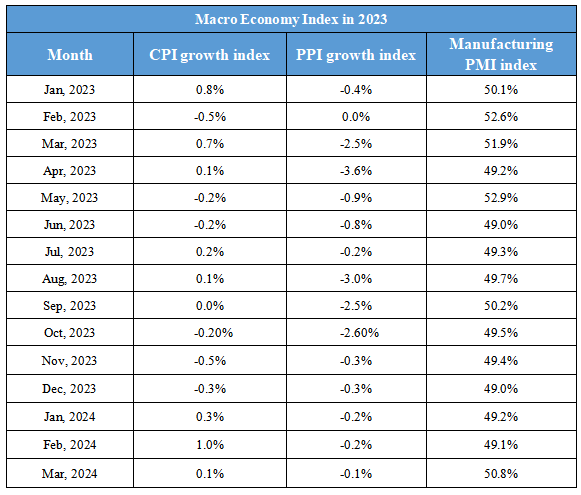

May 9th Macroeconomic Index: China Launches Unemployment Insurance Policies, RRR Cut Expected Before Interest Rate Cut

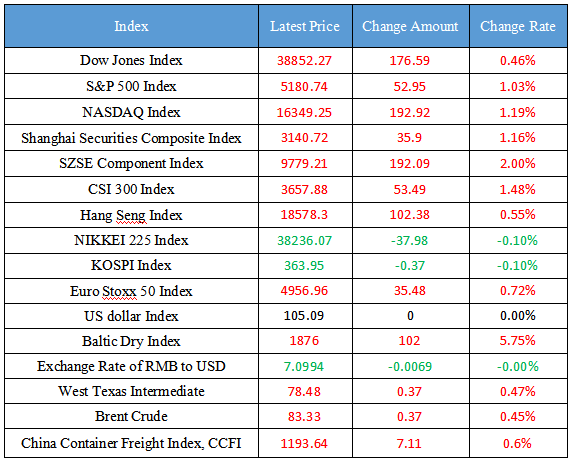

Latest Global Major Index

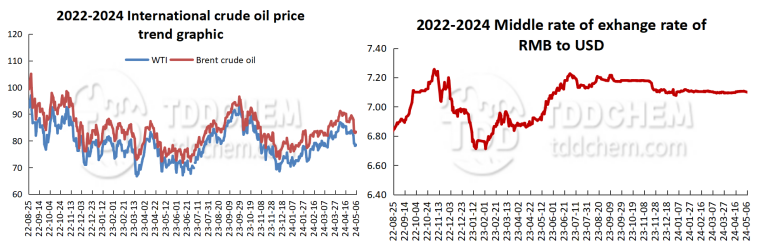

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The Ministry of Human Resources and Social Security and other three departments have launched a package of unemployment insurance policies and measures to help enterprises stabilize jobs

2. The meeting of the Political Bureau of the CPC Central Committee rarely mentioned interest rates and reserve ratios, and the RRR cut is expected to land before the "interest rate cut"

3. The penetration rate of new energy vehicles is more than half, Industry experts: the automobile market may be dual-tracked

4. In the second quarter, the market may be catalyzed by positive policy expectations

5. The National Development and Reform Commission held a symposium to communicate with private enterprises on large-scale equipment renewal

International News

1. ECB Governing Council Vujcic: Eurozone data supports central bank policy easing

2. ECB Governing Council member Villeroy: Central bank digital currencies are needed in both wholesale and retail sectors

3. Danske Bank: Due to the weakness of the Swedish krona, the Central Bank may wait until June to cut interest rates

4. Swissquote Bank: The Australian dollar rose on the back of the RBA's possible interest rate hike signal

5. The Reserve Bank of Australia is likely to raise interest rates, and Australia and the United States have upside potential

Domestic News

1. The Ministry of Human Resources and Social Security and other three departments have launched a package of unemployment insurance policies and measures to help enterprises stabilize jobs

Recently, the Ministry of Human Resources and Social Security, the Ministry of Finance, and the State Administration of Taxation jointly issued the Notice on Continuing the Implementation of the Policy of Unemployment Insurance to Assist Enterprises in Stabilizing Jobs, and launched a package of phased and combined unemployment insurance policies and measures to assist enterprises in stabilizing jobs. It proposes to continue the policy of reducing unemployment insurance premiums to 1% in stages until the end of 2025. By the end of 2024, the policy of returning stable jobs will continue to be implemented for insured enterprises that do not lay off employees or reduce layoffs, and the refund rate for small, medium and micro enterprises shall not exceed 60% of the unemployment insurance premiums actually paid by the enterprises and their employees in the previous year, and the refund ratio for large enterprises shall not exceed 30%. Continue to relax the subsidy policy for skill promotion, and broaden the scope of benefits until the end of 2024. (Ministry of Human Resources and Social Security).

2. The meeting of the Political Bureau of the CPC Central Committee rarely mentioned interest rates and reserve ratios, and the RRR cut is expected to land before the "interest rate cut"

The Politburo meeting held a few days ago proposed that it is necessary to flexibly use policy tools such as interest rates and deposit reserve ratios to increase support for the real economy and reduce comprehensive social financing costs. This is a rare direct mention of interest rates and RRR in Politburo meetings. According to the reporter's comprehensive interview information, under the tone set by the Politburo meeting, the market believes that under the need to cooperate with the issuance of ultra-long-term special treasury bonds, the possibility of the RRR cut being the first to implement is greater than the "interest rate cut"; The "interest rate cut" is likely to lead the LPR down by reducing the deposit rate first, and the policy interest rate will be lowered to promote the recovery of prices, but it still needs to be further observed when it will land. (21 Finance).

3. The penetration rate of new energy vehicles is more than half, Industry experts: the automobile market may be dual-tracked

In the first half of April, the market penetration rate of new energy vehicles in China exceeded 50%, and the market position of fuel vehicles began to waver. In interviews with reporters in the past couples days, many industry experts said frankly that with the implementation of environmental protection regulations and the continuous development of new energy technology, fuel vehicles are bound to innovate and improve in order to maintain their competitiveness in the market. In the future, fuel vehicles will adopt more environmentally friendly and energy-saving designs, or integrate with new energy technologies to adapt to the ever-changing market demand. In the long term, the automobile market may show a dual-track parallel situation, and new energy vehicles and fuel vehicles will compete and coexist in different fields. (CCTV).

4. In the second quarter, the market may be catalyzed by positive policy expectations

The research report of Guojin Securities pointed out that since 2023, the growth rate of the cost of self-produced gold in gold stocks has slowed down, and it is expected that the performance of gold stocks will be better this year under the condition of rising gold prices and relatively stable costs, and gold stocks are expected to usher in the main rising wave market. In the second and third quarters, the price center of copper is expected to rise further when the domestic social inventory is effectively depleted. The expected gap between the electrolytic aluminum sector is still large, and the recent domestic real estate support policies continue to strengthen, and the pessimistic expectations of the equity market for the demand for electrolytic aluminum in the real estate side are expected to be repaired.

5. The National Development and Reform Commission held a symposium to communicate with private enterprises on large-scale equipment renewal

Recently, Zheng Shanjie, Director of the National Development and Reform Commission, presided over the second symposium on large-scale equipment renewal and consumer goods trade-in, and discussed and exchanged views with the heads of private enterprises such as Tianneng Holding Group, Xizi United, United Imaging Group, and Canny Elevator. Zheng Shanjie said that in the next step, the National Development and Reform Commission will strengthen overall coordination, work with relevant departments and local governments to arrange central government investment to support eligible equipment renewal and recycling projects, play a good role in the combination of fiscal, tax, financial and other policies, strengthen factor guarantees, and promote the industry to "new". At the same time, the equipment update will also focus on the field of people's livelihood, improve the quality of public services, improve the comfort of people's lives, and allow enterprises and the masses to share the dividends of China's high-quality development.

International News

1. ECB Governing Council Vujcic: Eurozone data supports central bank policy easing

ECB Governing Council member Vujcic said that the Eurozone economic growth and inflation data were in line with the ECB's estimates, which became the reason to support a rate cut. Vujcic believes that even if the ECB cuts interest rates in June, policy will continue to constrain economic growth.

2. ECB Governing Council member Villeroy: Central bank digital currencies are needed in both wholesale and retail sectors

ECB Governing Council member Villeroy said the central bank should consider using digital currencies in both the wholesale and retail sectors. He said the way they provide central bank money must be adapted to the 21st century to ensure that central bank money retains its fundamental role: that role is not the primary means of payment, but the stability anchor of the financial system. That's why he believes that sooner or later they will need a central bank digital currency for both wholesale and retail purposes. Villeroy said the ECB entered the next phase of the digital euro project last year – preparing for the issuance of the currency in the coming years, although the final decision has not yet been made.

3. Danske Bank: Due to the weakness of the Swedish krona, the Central Bank may wait until June to cut interest rates

At the moment, the market is widely expecting the Riksbank to cut interest rates this week, but Danske Bank believes that the rate cut will wait until June. The Riksbank had said in March that it might cut its policy rate in May or June, but policymakers had to weigh lower-than-expected inflation against the Fed's delay in cutting interest rates and a weaker Swedish krona, as inflationary pressures risked a comeback, Danske said. The Riksbank highlighted that a weaker SEK poses a risk to the inflation outlook and that it may be concerned about the decline in the SEK since its March meeting. The bank may believe that a rate cut at this time could further weaken the SEK, while keeping rates unchanged could provide short-term support.

4. Swissquote Bank: The Australian dollar rose on the back of the RBA's possible interest rate hike signal

The Australian dollar moved higher ahead of the RBA's monetary policy announcement on Tuesday. The bank is expected to keep interest rates unchanged, but the central bank may warn of possible future rate hikes due to recent higher-than-expected inflation. Ipek Ozkardeskaya, senior analyst at Swissquote Bank, said in a note: "AUD/USD has better buying ahead of the RBA's interest rate decision tomorrow. She believes the RBA is likely to raise inflation expectations and warned that the next rate hike is more likely than a rate cut, which could push the AUD/USD to 0.6800-0.7000.

5. The Reserve Bank of Australia is likely to raise interest rates, and Australia and the United States have upside potential

AUD/USD has upside potential this week with the Reserve Bank of Australia (RBA) to hold a policy meeting, and there is widespread speculation that the bank will send hawkish signals or even raise interest rates, as recent data shows that core inflation remains high in Q1. This would make the RBA one of the few other central banks in the world, almost all of which are poised to cut interest rates. Joe Capurso, the economist of the Commonwealth Bank of Australia, expects AUD/USD to consolidate around 0.6600 this week, but could jump above 0.6700 if the RBA resets its tightening bias.

Domestic Macro Economy Index