April 29th Macroeconomic Index: Hainan Strengthens Financial Support for Green Smart Appliances and NEVs, Central Bank Tightens Payment Supervision

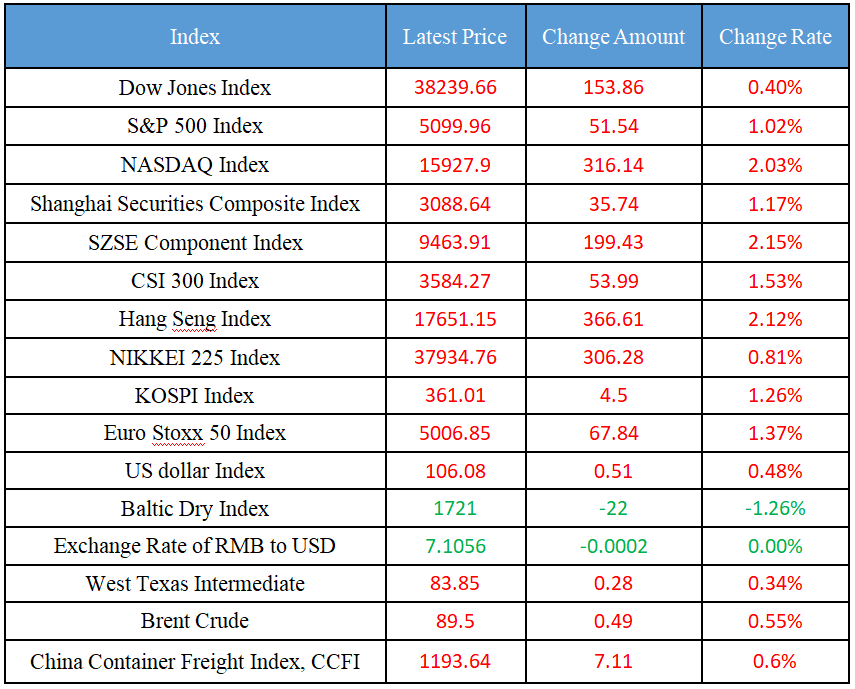

Latest Global Major Index

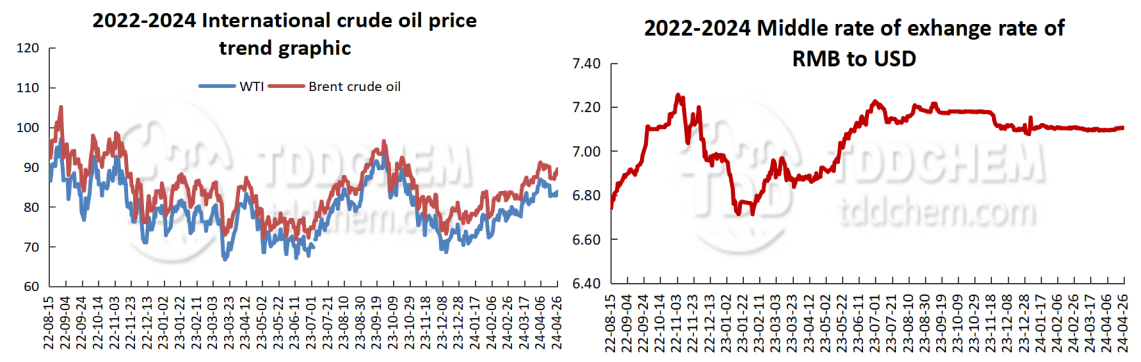

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Hainan: Financial support for the production of green smart home appliances and new energy vehicles will be strengthened

2. The central bank: comprehensively strengthen payment supervision and management, and firmly adhere to the red line of reserve fund supervision

3. Cinda Securities: The downstream manufacturing industry is expected to continue to perform strongly, and the margin of the middle and upper stream will improve

4. The four Departments jointly held a financial work promotion meeting of large-scale equipment renewal and consumer goods trade-in

International News

1. Russia extended the fertilizer export quota system to the end of November

2. Fed Mouthpiece: Speculation about rising neutral rates could cause the Fed to delay rate cuts

3. Russia announced that it will temporarily cancel some coal export tariffs from May to August

4. Due to the depreciation of the yen, the number of foreign tourists visiting Japan has been increasing recently

Domestic News

1. Hainan: Financial support for the production of green smart home appliances and new energy vehicles will be strengthened

Hainan Province issued a large-scale equipment renewal and consumer goods trade-in implementation plan, which mentioned that it is necessary to implement the policy of re-lending for scientific and technological innovation and technological transformation, and promote the early implementation and early results of the policy. Encourage banking institutions to enrich green loan products, increase medium and long-term loans for the manufacturing industry, strengthen financial support for the production of green smart home appliances and new energy vehicles, innovate consumer loan services, reasonably determine the term and credit line of automobile loans, and support the trade-in of consumer goods. Make good use of the accounts receivable financing service platform to improve the convenience and availability of financing for suppliers in equipment renewal and consumer goods trade-in transactions. Support eligible enterprises related to equipment renewal and trade-in of consumer goods to be included in the pilot high-quality enterprises for high-level opening up of cross-border trade.

2 The central bank: comprehensively strengthen payment supervision and management, and firmly adhere to the red line of reserve fund supervision

The People's Bank of China held the 2024 Payment and Settlement Work Conference, which required that the Regulations on the Supervision and Administration of Non-bank Payment Institutions should be conscientiously implemented, payment supervision should be comprehensively strengthened, regulatory capacity building should be strengthened, the red line of reserve fund supervision should be firmly maintained, and a healthy and orderly payment market should be built. It is necessary to balance risk prevention and control with the optimization of services, and steadily promote the precise governance of the "capital chain" involving fraud and gambling. Payment infrastructure should focus on its main responsibilities and main business, ensure that the central bank performs its duties, and maintain the bottom line of safety. It is necessary to deepen international cooperation and openness in the field of payment, and optimize RMB cross-border payment services.

3. Cinda Securities: The downstream manufacturing industry is expected to continue to perform strongly, and the margin of the middle and upper stream will improve

Cinda Securities Research Report pointed out that the downstream manufacturing industry is expected to continue to perform strongly, and the middle and upper reaches of the margin will improve. (1) Downstream manufacturing profits are expected to continue to perform strongly in the context of policy support and better exports. (2) Commodity prices strengthened as a whole in April, and the prices of cement and rebar, including domestic pricing, also showed signs of stabilizing and rebounding, and the profit proportion of the middle and upstream industries may improve marginally. (3) In the environment of sluggish domestic demand, the increase in the price of upstream raw materials may squeeze the profits of the downstream consumer goods industry, and it may be necessary to be wary of the decline in the profitability of downstream consumer goods.

4. The four Departments jointly held a financial work promotion meeting of large-scale equipment renewal and consumer goods trade-in

In order to implement the decisions and deployments of the Party Central Committee and the State Council, and implement the requirements of the Action Plan for Promoting Large-scale Equipment Renewal and Consumer Goods Trade-in, on April 26, the People's Bank of China, the National Development and Reform Commission, the Ministry of Finance, and the State Administration of Financial Supervision jointly held a meeting to promote large-scale equipment renewal and consumer goods trade-in finance. The meeting emphasized that promoting large-scale equipment renewal and trade-in of consumer goods will benefit both the current and the long-term, stabilize growth and promote transformation, and benefit both enterprises and people's livelihood. It’s necessary to adhere to the market-oriented, government-guided, insist on encouraging the advanced enterprises and eliminating the backward ones, adhere to the guidance of standards, and improve in an orderly manner. On the basis of following the laws of the market, the government has introduced incentive policies, and financial institutions have made their own decisions, taken their own risks, and issued loans in accordance with the principles of market and rule of law, so as to effectively improve the ability and quality of financial support for large-scale equipment renewal and consumer goods trade-in.

International News

1. Russia extended the fertilizer export quota system to the end of November

On April 28, local time, the Russian government website announced a resolution to extend the fertilizer export quota system. The current round of fertilizer export quota system is valid from June 1 to November 30, 2024. The total export quota exceeded 19.7 million tons, including more than 12.4 million tons of nitrogen fertilizer and about 7.3 million tons of compound fertilizer. The Russian government emphasizes that the implementation of the fertilizer export quota system is aimed at ensuring an adequate supply of fertilizers in the Russian domestic market and ensuring national food security. Previously, the Russian government implemented a fertilizer export quota system valid until May 31, 2024, with a total quota of 16.9 million tons. On April 5, 2022, Russian President Vladimir Putin instructed the Russian government to extend the quota system for the export of certain types of fertilizers if necessary after holding a conference on the development of agriculture, fisheries and related industries.

2. Fed Mouthpiece: Speculation about rising neutral rates could cause the Fed to delay rate cuts

In the debate over whether and when the Fed will cut interest rates, another important debate is unfolding: where will interest rates go in the long run? The neutral rate, sometimes referred to as "r*" or "r-star", cannot be directly observed, only extrapolated. Every quarter, Fed officials forecast long-term interest rates, which are actually their estimates of the neutral rate. Some now see a case for a rise in the neutral rate and the potential to change a wide range of asset prices. Because the economy is strong and inflation is "weak". But the current debate over the neutral rate may not have any short-term impact on the Fed, as the current rate is higher than almost all estimates of the neutral rate. This means that current interest rates are dampening economic growth and price increases, and nominal interest rates are more likely to fall rather than rise in the future. If the U.S. economy continues to be strong and inflation stubborn, it could spark speculation about a rise in the neutral rate, leading to the perception that the current rate is not as tight. From this point of view, there is even less reason for the Fed to cut interest rates.

3. Russia announced that it will temporarily cancel some coal export tariffs from May to August

On April 28, local time, the Russian government said that it decided to cancel export tariffs on thermal coal and anthracite from May 1 to August 31 this year. The decision is aimed at supporting domestic coal industry enterprises. The Russian government has imposed flexible export tariffs on coal since March 1, and the tariff rate is linked to the ruble exchange rate. Depending on the ruble exchange rate, the tax rate varies from 4% to 7%. If the ruble is less than 80 to 1 against the dollar, the tariff is 0. Currently, the ruble is trading at an exchange rate of about 92 to 1 against the dollar.

4. Due to the depreciation of the yen, the number of foreign tourists visiting Japan has been increasing recently

Due to the depreciation of the yen, the number of foreign tourists visiting Japan has been increasing recently. According to the estimates of the Japan National Tourism Organization, the number of visitors to Japan exceeded 3 million for the first time in March, the highest level in a single month. The weakening yen boosted the spending of inbound tourists on luxury goods, and hotel prices rose by nearly 30% compared to the same period last year.

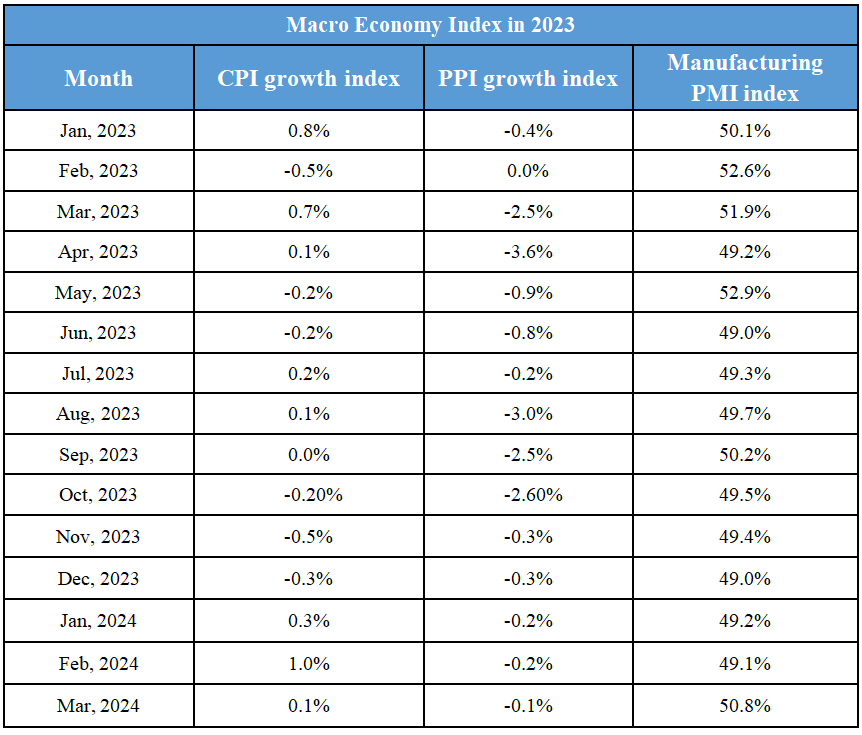

Domestic Macro Economy Index