March 7th Macroeconomic Index: Sichuan Issues Consumption Vouchers, Gold Prices Rise, and Railway Transport Surges

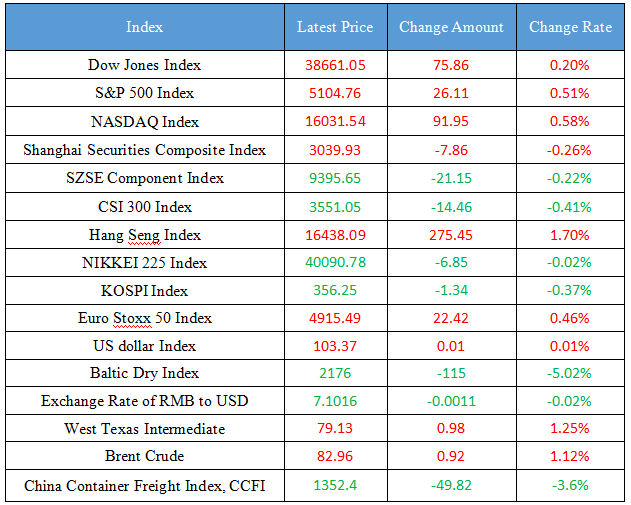

Latest Global Major Index

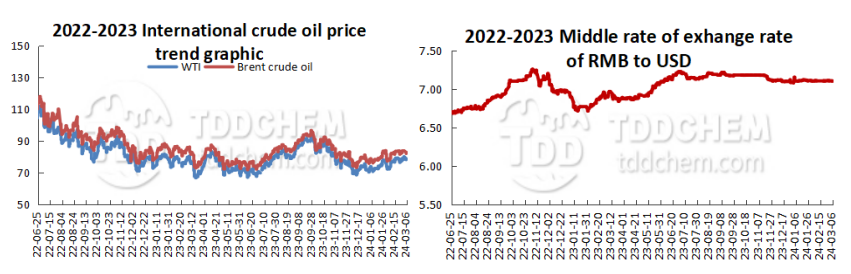

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Sichuan will issue more than 110 million yuan of consumption vouchers

2. The price of domestic pure gold jewelry of many gold jewelry brands exceeded 650 yuan/gram

3. The railway Spring Festival transportation has come to an end the national railway has sent a total of 484 million passengers

4. In January and February, the national energy group made every effort to ensure supply, and many indicators increased significantly year-on-year

International News

1. The global PMI in February was 49.1%, and the global economic recovery was stable

2. Sources: Saudi Arabia adjusts the export price of Arab light crude oil

3. Temasek seeks to sell most of Lanting Energy's assets, and Shell and Saudi Aramco are reportedly shortlisted

4. Sberbank has raised the interest rate on RMB savings since March 6

Domestic News

1. Sichuan will issue more than 110 million yuan of consumption vouchers

Sichuan will issue the 2024 "Shuli Anyi·Yuexi Dragon Year" consumption vouchers targeting at key consumption areas such as retail, home appliances, catering, etc., with provincial and municipal connection and government-enterprise coordination across the province at 10:00 a.m. on March 8 and 10:00 a.m. on March 22 through two platforms, including China UnionPay and Douyin. In addition to the provincial financial contribution of 114.07 million yuan, the voucher issuing platforms also responded positively.

2. The price of domestic pure gold jewelry of many gold jewelry brands exceeded 650 yuan/gram

On March 6, the gold price announced by Laomiao Gold in Shanghai was 648 yuan/gram, and Xie Ruilin announced the price of Chinese mainland pure gold jewelry at 649 yuan/gram. Chow Tai Fook, Chiu Wang Kei, Luk Fook Jewellery and Chow Sang Sang announced the price of domestic pure gold jewellery all exceeded 650 yuan/gram. Among them, the price of pure gold jewelry announced by Chow Sang Sang was 651 yuan / gram, an increase of 15 yuan from March 4.

3. The railway Spring Festival transportation has come to an end the national railway has sent a total of 484 million passengers

The reporter learned from China State Railway Group Co., Ltd. that on March 5, the 40-day 2024 Railway Spring Festival transportation ended successfully, with a number of transportation indicators hitting the best level in history, and transportation was safe, stable and orderly. The national railways have sent a total of 484 million passengers, with an average of 12.089 million passengers per day, a year-on-year increase of 39% and an increase of 18.8% over the same period in 2019, of which 16.067 million passengers were sent on February 17, a record high in the single-day passenger volume of the Spring Festival, and the national railways have sent a total of 395 million tons of goods, maintaining a high level of operation.

4. In January and February, the national energy group made every effort to ensure supply, and many indicators increased significantly year-on-year

It was learned from the National Energy Group that in January ~ February 2024, the National Energy Group had an improved organization and scheduling, maintaining a continuous and stable supply of energy, a year-on-year increase of 4.7% in commercial coal resources, a peak level of 50 million tons in self-produced coal for 29 consecutive months, and the power generation exceeded 205.84 billion kWh, a year-on-year increase of 9.6%, and a heat supply of 187.93 million GJ, a year-on-year increase of 13.3%, providing strong support for the sustainable and healthy development of the economy and society.

International News

1. The global PMI in February was 49.1%, and the global economic recovery was stable

The China Federation of Logistics and Purchasing today (6th) released the global manufacturing purchasing managers' index for February. Judging from the index change, in the first two months of this year, the recovery of the global manufacturing industry was relatively stable, but it still maintained a low growth pattern. The global manufacturing purchasing managers' index was 49.1% in February, down 0.2 percentage points from the previous month, and remained stable above 49% for two consecutive months, higher than the average of 47.9% in the fourth quarter of last year. Cai Jin, vice president of the China Federation of Logistics and Purchasing, said that from the perspective of the global manufacturing index, it is relatively stable, but it also reflects that there are still many uncertain factors, and the overall operation of the global economy is still relatively weak.

2. Sources: Saudi Arabia adjusts the export price of Arab light crude oil

Saudi Arabia, the largest oil exporter, raised the official selling price of its flagship Arabian Light crude to Asia in April, in line with expectations, trade sources said. Saudi Aramco set the OSP of Arabian Light crude for April shipments to Asia at a premium of $1.70 per barrel to the average Oman-Dubai average, slightly higher than the previous premium of $1.50. This price change is in line with market expectations. Saudi crude exports to northwestern Europe were cut by 60 to 70 cents a barrel in April, while crude exports to the United States were little changed.

3. Temasek seeks to sell most of Lanting Energy's assets, and Shell and Saudi Aramco are reportedly shortlisted

Temasek has put energy giants such as Shell and Saudi Aramco on a shortlist to bid for most of the assets of Temasek's LNG trading company Pavilion Energy, according to people familiar with the matter. Temasek is in the process of evaluating the company's bid for Pavilion Energy's assets, which do not include the latter's gas pipeline business. The final round of bidding is likely to take place in the coming weeks, and Temasek will announce the winner if the price is right. It is unclear how many bids Temasek has received and the financial terms involved.

4. Sberbank has raised the interest rate on RMB savings since March 6

Kirill Chalyov, first deputy chairman of the board of directors of Sberbank, told reporters that Sberbank has raised the interest rate on RMB deposits again since March 6, and the current annual profit is up to 4.07%. He mentioned that before that, the maximum annual interest rate for three-year deposits was 3.52%. Chalyov added: "The tenor of RMB deposits is from 1 month to 3 years. The minimum deposit is 10,000 RMB. (Sputnik)

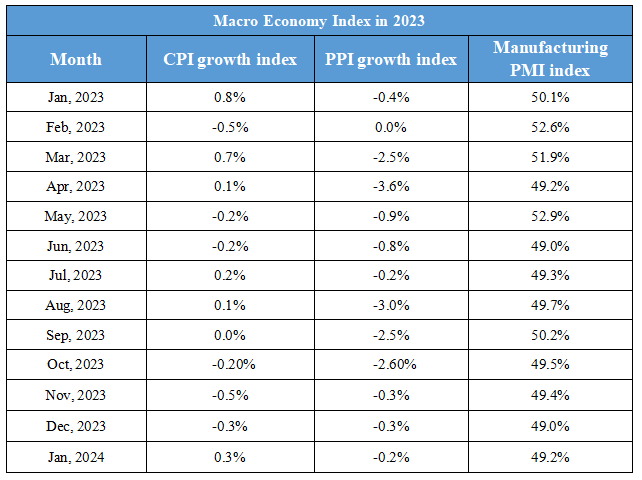

Domestic Macro Economy Index