1,204

November 18, 2024, 3:31 PM

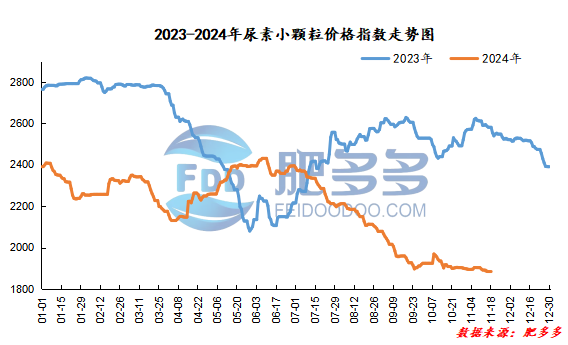

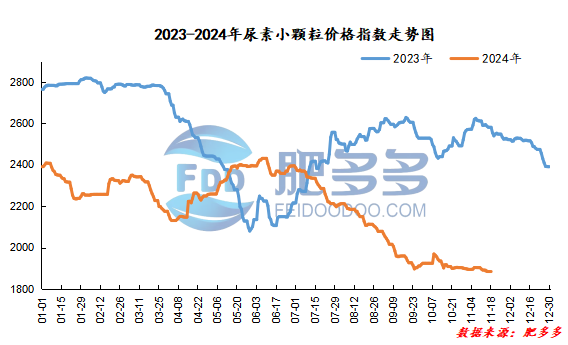

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on November 18 was 1,881.68, a decrease of 2.27 from last Friday, a month-on-month decrease of 0.12% and a year-on-year decrease of 27.11%.

Urea futures market:

Today, the opening price of the urea UR501 contract is 1770, the highest price is 1782, the lowest price is 1755, the settlement price is 1768, and the closing price is 1773. The closing price is 9 lower than the settlement price of the previous trading day, down 0.51% month-on-month. The fluctuation range of the whole day is 1755-1782; the basis of the 01 contract in Shandong is 17; the 01 contract has reduced its position by 1438 lots today, and so far, it has held 182327 lots.

Today, urea futures prices mainly rebounded with the market environment bottomed out. Today's urea futures prices opened lower and bottomed out due to the decline in market sentiment at night last Friday. Coupled with the simultaneous weakening of spot prices, the overall market sentiment remains weak. However, there is still support for the previous low price, and expectations of narrowing costs and supply and demand gaps cannot be completely falsified. In the short term, the overall market still lacks actual driving forces. The logic of excess fundamentals of urea itself is strongly suppressed. In the short term, we will wait and see whether there are new negative or contradictory eruptions. Before that, futures prices may remain low and narrow. Mainly.

Spot market analysis:

Today, the price of urea in China has stabilized and declined, and the market has been weak and stable. Currently, downstream operators basically maintain a just-needed purchasing model.The fundamentals of market supply and demand remain loose, with no obvious breakthroughs in the short term, and the market continues to fluctuate at a low level.。

Specifically, prices in Northeast China have stabilized at 1,870 - 1,930 yuan/ton. Prices in East China have been lowered to 1,780 - 1,820 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 1,780 - 1,950 yuan/ton, and the price of large particles has been lowered to 1,810 - 1,940 yuan/ton. Prices in North China have been lowered to 1,700 - 1,910 yuan/ton. Prices in South China have been lowered to 1,950 -2020 yuan/ton. Prices in the northwest region are stable at 1,900 - 1,920 yuan/ton. Prices in Southwest China are stable at 1,860 - 2,150 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers have received small orders, high inventories fluctuate, and pressure still exists. Current production only maintains a weak balance between production and sales, and the removal of warehouses has yet to be improved. Urea companies in some main production and marketing areas have reduced prices slightly to absorb orders, and market prices have loosened slightly, and enterprises have stabilized prices. Small price adjustment. In terms of the market, the market situation continues to develop the trend of easing supply and demand, and prices fluctuate at a low level. Currently, only changes in export policies will change the trend of China's urea market. If there is no clear news on exports, it will be difficult for China's urea industry to have a large increase and the market will be weak and difficult to change. In terms of supply, short-term maintenance is not yet concentrated, and Nissan continues to fluctuate at a high level. Although gas companies have parking expectations next month, the current unit maintenance volume of urea companies is relatively small, corporate inventories are rising at a high level, and short-term industry supply is still sufficient. In terms of demand, due to environmental warnings in some areas, procurement follow-up has been limited. Only procurement in the Northeast market has an increasing trend. During the off-season of agricultural demand, most of the demand for reserves is mainly the demand for reserves; the operating rate of downstream compound fertilizers has rebounded, but the overall improvement rate has been relatively slow, and follow-up has been limited; Industrial demand The plate industry has been affected by the backlog of finished products, and the operating rate has dropped. Currently, most purchases maintain appropriate follow-up on dips, and the market is running in a stalemate and fluctuations. There has been no major improvement in the overall demand for urea.

On the whole, China's urea companies currently have high inventories, downstream demand follow-up is lukewarm, and the market supply and demand fundamentals remain loose. It is expected that urea market prices will continue to be under pressure and weak consolidation in the short term.