Daily Macro Economy News on August 1

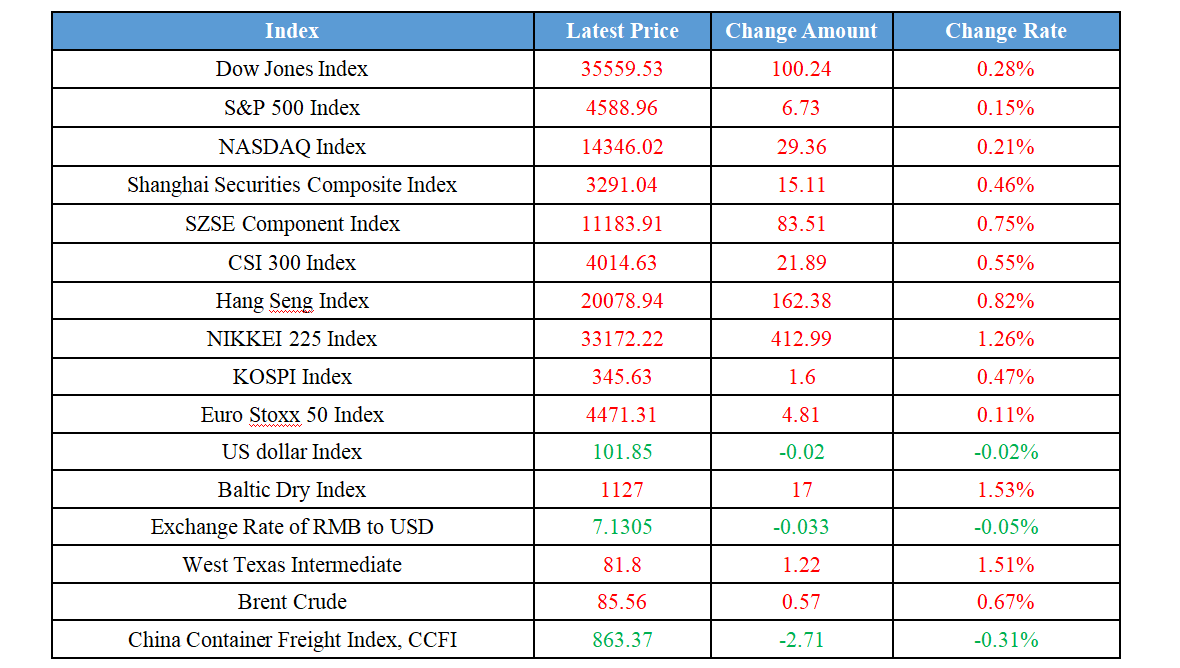

Latest Global Major Index

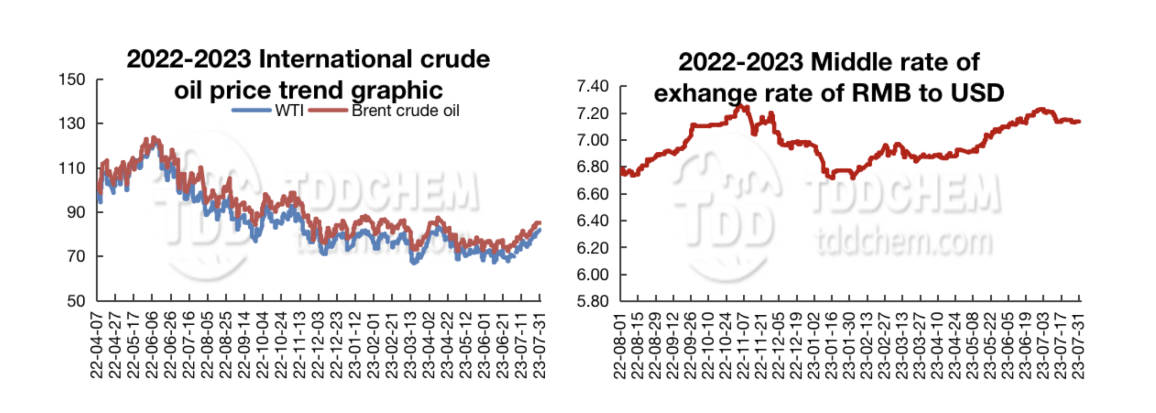

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. NEA: The first half of the domestic energy supply security capacity steadily improved

2. Total iron ore of 20.338 million tons arrival at China's 45 ports, down 2.955 million tons YoY

3. SASAC Further Standardizes ESG Disclosure for Central Enterprise-Held Listed Companies

4. The Fifth Private Economy Rule of Law Construction Summit held

International News

1. Eurozone CPI expected to slow in July, supporting ECB to pause rate hike in September

2. European gas prices expected to record a 25% drop in July

3. Russia drilling for oil at a record pace this year

4. German Import Prices Fall Due to Sharp Decline in Energy Prices

Domestic News

1. NEA: The first half of the domestic energy supply security capacity steadily improved

National Energy Administration (NEA) this morning released the first half of 2023 energy situation, renewable energy development. In the first half of this year, the domestic energy supply security capacity steadily improved, energy green low-carbon transformation accelerated, and the national energy supply and demand overall stable and orderly. Industrial energy use as a whole continued the growth trend. Coal and natural gas consumption grew steadily, and the consumption of refined oil products grew faster. Domestic production of crude coal, crude oil, and natural gas increased steadily, by 4.4%, 2.1%, and 5.4% respectively year-on-year. Meanwhile, the fulfillment rate of medium- and long-term contracts for electric coal maintained a high level, and the supply of electric coal was stable and orderly. In the first half of the year, China's renewable energy continued to maintain good momentum of development, non-fossil energy installed capacity reached 1.38 billion kilowatts. New energy storage installed capacity continues to grow rapidly, the new installed capacity in the first half of the year is equivalent to the total installed capacity in previous years.

2. Total iron ore of 20.338 million tons arrival at China's 45 ports, down 2.955 million tons YoY

From July 24th to July 30th, China's 47 ports of iron ore arrivals totaled 20.903 million tons, a decrease of 3.904 million tons. China's 45 ports of iron ore arrivals totaled 20.338 million tons, a decrease of 2.955 million tons. Six ports in the north of the total amount of 9.678 million tons of iron ore arrivals, a decrease of 1.011 million tons.

3. SASAC Further Standardizes ESG Disclosure for Central Enterprise-Held Listed Companies

The reporter learned from the Research Center of SASAC that the General Office of SASAC issued the "Notice on Transmitting Central Enterprises Holding Listed Companies ESG Special Report Preparation and Research" on July 25th, and up to now, the "Notice" has been issued to all central enterprises and local state-owned SOEs, in order to help central enterprises holding listed companies to release high-quality, investor-recognized ESG reports, and to promote the high-quality development of China's ESG. According to the reporter's understanding, the Notice is to implement the "Work Program for Improving the Quality of Listed Companies Held by Central Enterprises" issued by the SASAC in 2022, which requires central enterprises to explore the establishment of a sound ESG system, and strive for the disclosure of ESG special reports of listed companies held by central enterprises by 2023, which will provide a "full coverage".

4. The Fifth Private Economy Rule of Law Construction Summit held

The Fifth Private Economy Rule of Law Summit was held in Beijing on the 31st. Zhang Jun, President of the Supreme People's Court, Ying Yong, Prosecutor General of the Supreme People's Procuratorate, Gao Yunlong, Vice Chairman of the CPPCC National Committee and Chairman of the All-China Federation of Industry and Commerce, attended. Gao Yunlong said that it is necessary to comprehensively study and implement the spirit of the 20th CPC National Congress and the spirit of General Secretary Xi Jinping's important speech when he visited members of the Democratic Construction and Federation of Industry and Commerce sectors participating in the 14th session of the CPPCC National Committee and took part in the joint group meeting, to solidly push forward the deployment of the central government to promote the development and growth of the private economy and to strengthen the safeguard of the rule of law for the private sector, to stimulate the private entrepreneurs to build up the rule of law for the private sector and to strengthen the compliance management, and to start a The Federation of Industry and Commerce and the Public Prosecution, Law and Justice organs to communicate with the working mechanism, continue to focus on the needs and expectations of private enterprises, with high-quality rule of law services to escort the private economy to a broader stage.

International News

1. Eurozone CPI expected to slow in July, supporting ECB to pause rate hike in September

Institutions expect eurozone inflation to slow in July, supporting the possibility of the ECB pausing its rate hike in September, while also limiting the upside for German bund yields and the euro. Headline CPI growth is expected to fall to 5.3% year-on-year from 5.5% in June. This would be the lowest level since January 2022. Core inflation is also expected to fall from 5.5% to 5.4%, which is likely to be more welcome news as core inflation has proven to be stickier than headline inflation data. Eurozone GDP data will also be released, with modest growth of 0.2% expected in the second quarter after the economy stagnated in the first quarter.

2. European gas prices expected to record a 25% drop in July

European natural gas prices may post one of the biggest one-month declines of the year as subdued industrial activity and strong inventories offset concerns about a summer demand spike. Benchmark natural gas futures prices rose on Monday, but gas prices are still expected to post a decline of about 25 percent in July, having fallen more than 60 percent so far this year. The slump in natural gas prices reflects the easing of gas tensions on the continent. However, the European gas market remains fragile. Supply disruptions, a cold winter, or increased competition for Asian liquefied natural gas could push prices higher. Consulting firm Energy Aspects said that any further tightening of the global LNG supply balance could push prices higher due to concerns over European LNG supplies.

3. Russia drilling for oil at a record pace this year

Rosneft is drilling at a record pace this year, even though the country has agreed to a longer production cut with OPEC+. Between January and June, Russian rigs drilled 14,700 kilometers of production wells, 6.6% higher than planned and 8.6% more than in the same period in 2022, according to foreign data. Ron Smith, an oil and gas analyst at Moscow-based brokerage BCS, said last year "set a post-Soviet-era record for production drilling, and given the current data, I expect production to hit another record." Despite Russia ordering oil companies to cut production by 500,000 barrels a day, they have accelerated drilling, with the initial cuts lasting only a few months.

4. German Import Prices Fall Due to Sharp Decline in Energy Prices

The cost of energy imports in Germany in June 2023 fell by 44.9% year-on-year and 6.6% sequentially. This was a significant contributor to the fall in the overall price index both year-on-year and year-on-year. Natural gas had the largest impact on the year-on-year rate of change in energy prices, which fell 50.6% year-on-year and 15.5% sequentially. Other imported energy prices also declined significantly from a year earlier: electricity prices fell by 57.6%, hard coal by 53.6%, mineral oil by 40.2%, and crude oil by 38.8%.

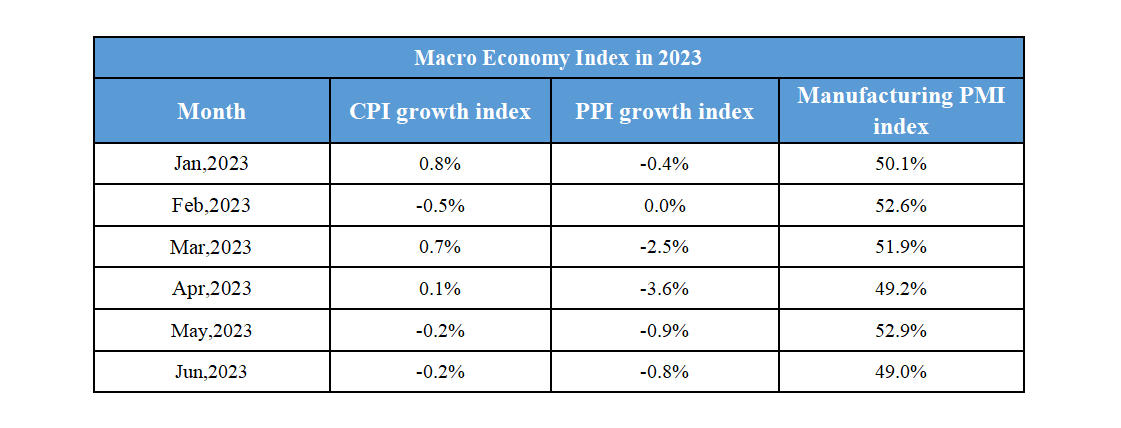

Domestic Macro Economy Index