Daily Macro Economy News on July 31

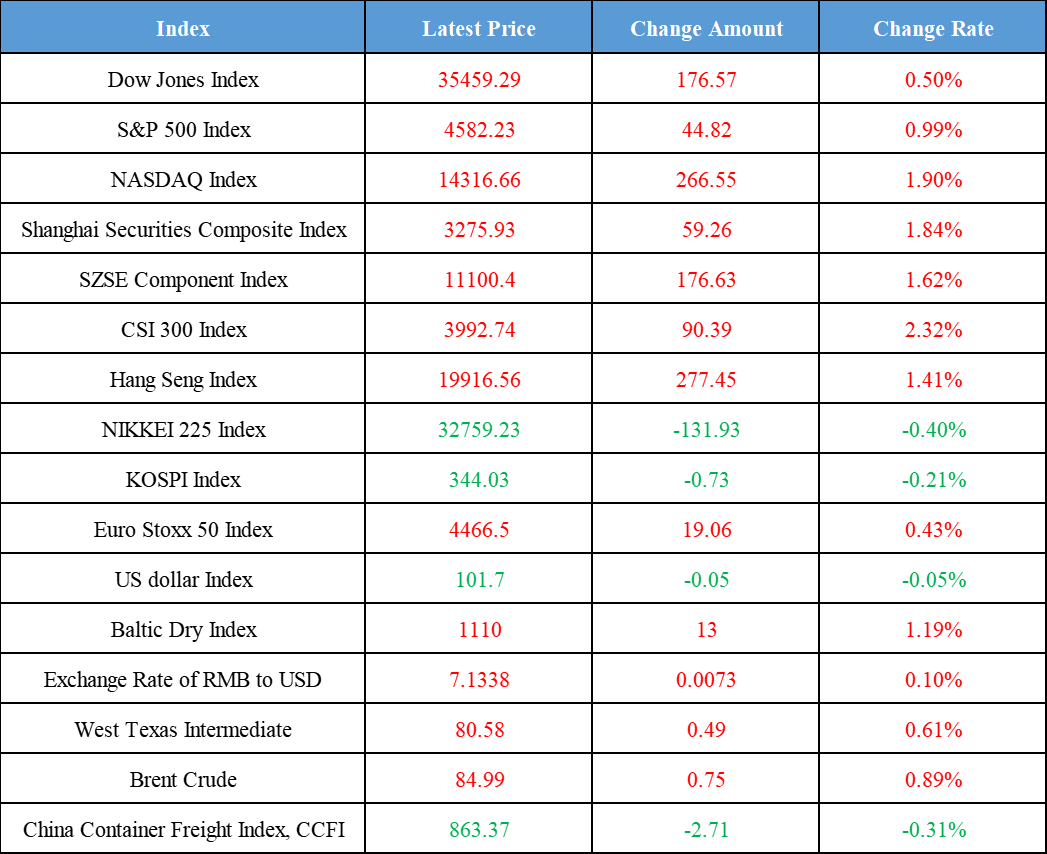

Latest Global Major Index

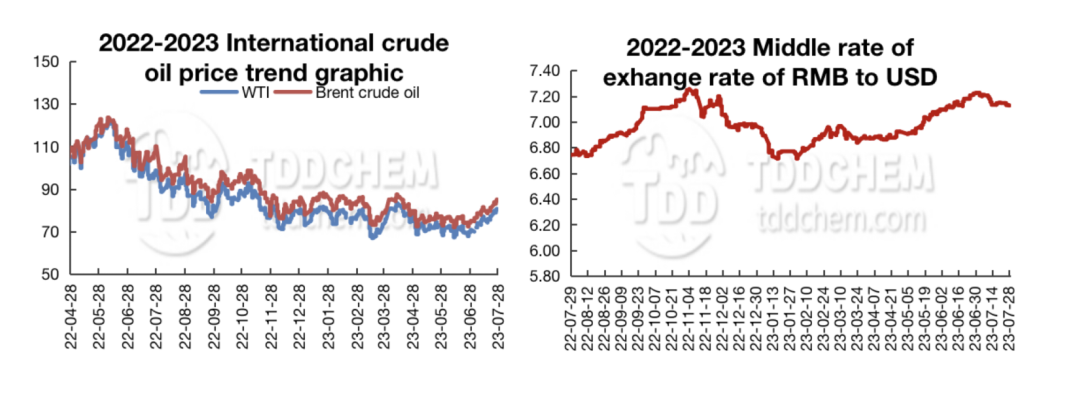

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Ministry of Finance: The total operating income of state-owned enterprises was 410188.02 billion yuan from January to June, up 4.9% year-on-year

2. CCTV Finance: new energy vehicle market share has reached 25.6% by 2022

3. CISA: In June, the purchasing cost of coal and coke of benchmark enterprises continued the downward trend, and domestic iron ore concentrate and pig iron rebounded

4. The State Administration of Taxation said that in the first half of the year, the country added 927.9 billion yuan of tax cuts, fee reductions and tax refunds, and fee reprieves

International News

1. 1、ING Bank: weak U.S. labor costs may strengthen Europe and the United States

2. IEA: Global Coal Use Expected to Remain at Record Levels This Year

3. Biden Administration Proposes Tougher Fuel Economy Standards for Cars

4. UAE announces 4-month moratorium on rice exports

Domestic News

1. Ministry of Finance: The total operating income of state-owned enterprises was 410188.02 billion yuan from January to June, up 4.9% year-on-year

Ministry of Finance: The total operating income of state-owned enterprises amounted to 4,101,882,000,000 yuan from January to June, up 4.9% year-on-year, and the total profit amounted reached 2,377,980,000,000 Yuan, up 5.0% year-on-year. Taxes payable amounted to RMB 2,964.04 billion, down 3.1% year-on-year. At the end of June, the asset-liability ratio of state-owned enterprises was 64.9%, up 0.4 percentage points.

2. CCTV Finance: new energy vehicle market share has reached 25.6% by 2022

CCTV Finance: the market share of new energy vehicles in 2022 has reached 25.6%. However, the speed of talent training in the field of after-sales maintenance has not kept up with the development of the front-end industry. Consumers reflect that it is easy to buy a car but difficult to repair it. Experts introduced that the number of proprietary maintenance workstations and technicians should account for about one-fifth of the total compared with traditional fuel vehicles, and the status quo is far from meeting the market demand.

3. CISA: In June, the purchasing cost of coal and coke of benchmark enterprises continued the downward trend, and domestic iron ore concentrate and pig iron rebounded

CHINA IRON & STEEL ASSOCIATION (CISA): In June, the benchmark enterprise coal and coke purchasing cost ring continued the downward trend, and domestic iron ore concentrate and pig iron rebounded. 1-6 months, coking coal purchasing cost fell 17.66% year-on-year; metallurgical coke fell 25.07% year-on-year; domestic iron ore concentrate fell 7.15% year-on-year, imported powder ore fell 3.84% year-on-year; scrap steel fell 19.65% year-on-year.

4. The State Administration of Taxation said that in the first half of the year, the country added 927.9 billion yuan of tax cuts, fee reductions and tax refunds, and fee reprieves

The State Administration of Taxation said that in the first half of the year, the country's new tax reductions and tax rebates 927.9 billion yuan, of which two batches of continuation of the optimization of innovative tax incentives 583.2 billion yuan, 316.7 billion yuan of tax credits and tax refunds, and 28 billion yuan of other policies, which strongly reduce the burden of the main body of the business to stimulate the vitality of the market to promote high-quality development and provide active support.

International News

1. ING Bank: weak U.S. labor costs may strengthen Europe and the United States

Chris Turner, a currency market analyst at ING Bank, said in a report that the euro could strengthen against the dollar if the quarterly U.S. second-quarter labor cost index, to be released later, is weak and could lower the Federal Reserve's interest rate expectations. He said, "If our forecasts today are correct, we could see the euro rise to the 1.1000-1.1150 range against the dollar over the next few sessions."

2. IEA: Global Coal Use Expected to Remain at Record Levels This Year

According to the Wall Street Journal, world coal use this year is likely to be roughly on par with record highs in 2022, the International Energy Agency (IEA) said, setting back efforts to curb climate change by limiting the use of polluting fossil fuels. After the disruptions of the New Crown outbreak and the Russia-Ukraine war, coal markets have returned to a pre-New Crown outbreak pattern characterized by falling demand in the U.S. and Europe, offset by growth in Asia. Last year, coal consumption soared to a record high of nearly 8.4 billion tons after the Russian-Ukrainian fighting triggered a spike in natural gas prices.

3. Biden Administration Proposes Tougher Fuel Economy Standards for Cars

Federal regulators are proposing stricter fuel economy standards for light-duty cars and trucks, the Wall Street Journal reports. The National Highway Traffic Safety Administration (NHTSA) on Friday proposed new fuel-economy standards for model years 2027 through 2032, which set the number of miles a U.S. vehicle must get per gallon of fuel. By 2032, automakers would have to sell a portion of light-duty cars and trucks that average 58 miles per gallon, up from the 49 miles per gallon currently required for the 2026 model year. The agency's proposal does not mandate that automakers offer electric vehicles, but could force the auto industry to dramatically increase electric vehicle sales to comply. NHTSA said it will hear comments on the proposal over the next 60 days before finalizing the rule.

4. UAE announces 4-month moratorium on rice exports

On July 28, local time, the UAE Ministry of Economy announced that the UAE will suspend the export and re-export of rice with immediate effect. According to the relevant resolution, the country will suspend rice exports for four months. The decision includes a ban on the export and re-export of rice imported into the UAE from India after July 20, 2023, and applies to all rice varieties, including brown rice, fully polished or semi-polished rice. According to local media reports in the UAE, the move is aimed at ensuring adequate supply of rice in the local market.

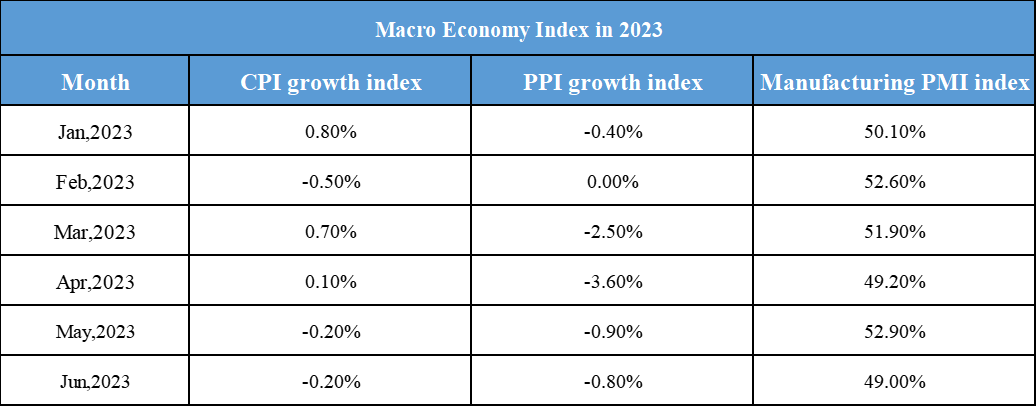

Domestic Macro Economy Index