Daily Macro Economy News on July 27

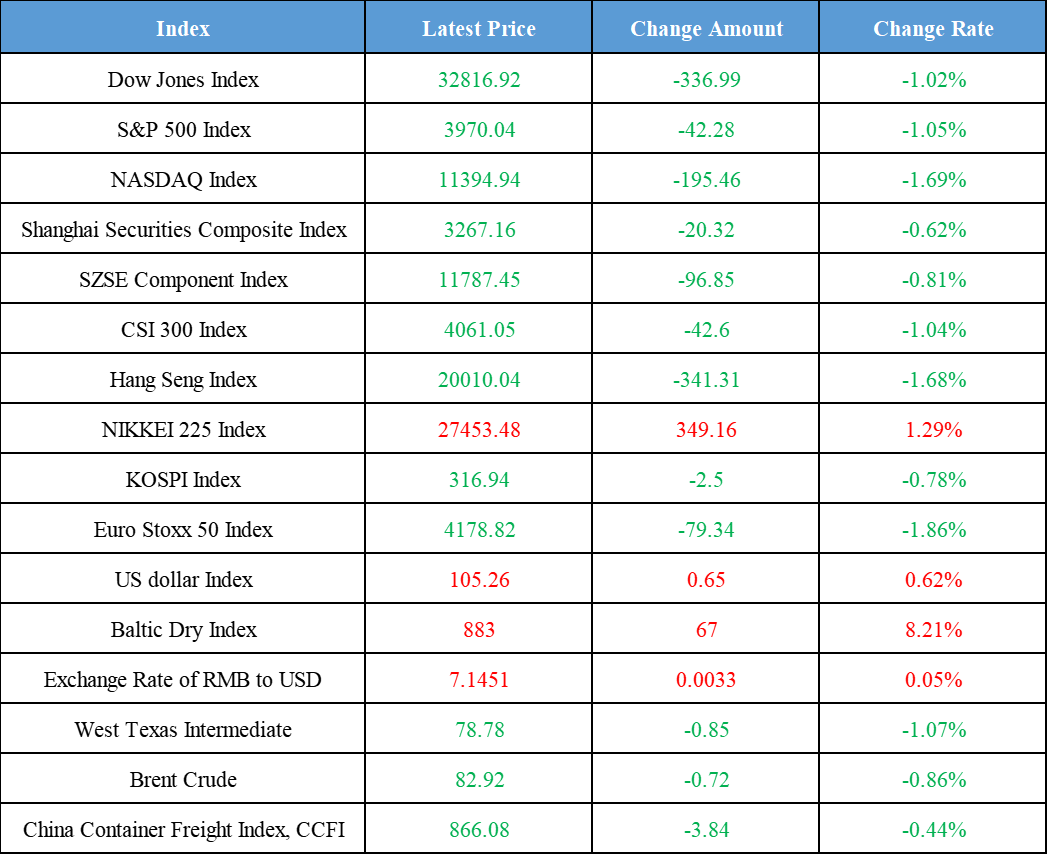

Latest Global Major Index

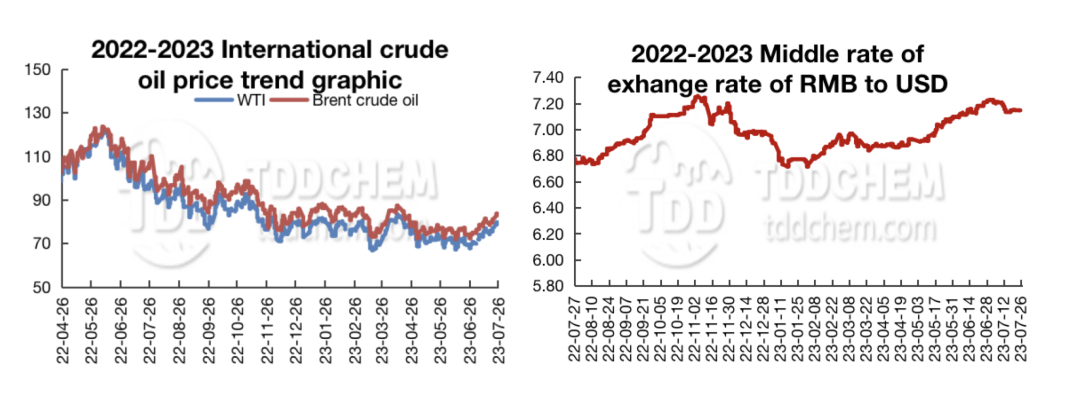

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. National Development and Reform Commission (NDRC): 194.9 billion cubic meters of apparent national natural gas consumption in the first half of the year

2. Three consecutive increases in refined oil prices, 95 gasoline fully into the era of 8 yuan

3. Short-term market favorable support, steel prices remain strong

4. CATL: in the first half of the year, realized operating income of 189.246 billion yuan, up 67.52% year-on-year, net profit of 20.717 billion yuan, up 153.64% year-on-year

International News

1. 1、ING Bank: Decline in Eurozone Bank Lending Exacerbates Risks of ECB Rate Movements

2. Falling Rhine levels threaten Germany's economy and the flow of goods

3. European Gas Prices Continue to Jump as Power Outages Tighten Supplies

4. Asset economist Vantage: euro could weaken as ECB warns of growth risks

Domestic News

1. National Development and Reform Commission (NDRC): 194.9 billion cubic meters of apparent national natural gas consumption in the first half of the year

National Development and Reform Commission Deputy Secretary General Ou Hong said that, according to scheduling statistics, the first half of the country's apparent consumption of natural gas 194.9 billion cubic meters, an increase of 6.7% year-on-year. Since the beginning of summer, the highest single day of power generation with more than 250 million cubic meters of gas, strong support for gas and electricity peak output.

2. Three consecutive increases in refined oil prices, 95 gasoline fully into the era of 8 yuan

The National Development and Reform Commission issued a news release that since 24:00, domestic gasoline prices and diesel prices were raised by 275 yuan / ton and 260 yuan / ton. Converted liter price, No. 92 gasoline and No. 0 diesel were raised by 0.22 yuan, No. 95 gasoline was raised by 0.23 yuan. With a tank capacity of 50 liters of small private car calculations, the owners of a full tank of fuel will cost about 10.5 yuan; for a full load of 50 tons of large logistics vehicles, every average driving 100 kilometers, fuel costs increased by about 8.8 yuan. After the price adjustment, most areas of the country's diesel prices and 92 gasoline retail price of 7.2-7.3 yuan / liter or so. 95 gasoline is generally in the 8 yuan / liter or more, fully into the "8 yuan era".

3. Short-term market favorable support, steel prices remain strong

Gangguwang said that the total social inventory of building materials in 31 cities across the country 7.6238 million tons, an increase of 101,000 tons over last week, an increase of 1.33%, the macro-policy tone, the second half of the real estate, infrastructure, finance, capital investment in a variety of areas such as full bloom, mobilize the market confidence in consumer spending, the short-term market is favorable to support the steel prices strong, but the off-season effect, the demand for a slow turnaround, whether downstream terminal Or traders, hoarding willingness is not strong, short-term steel prices in the macro support as well as crude steel production "flat control" production restrictions under the disturbance, the overall strong run.

4. CATL: in the first half of the year, realized operating income of 189.246 billion yuan, up 67.52% year-on-year, net profit of 20.717 billion yuan, up 153.64% year-on-year

Contemporary Amperex Technology Co.,Limited (CATL) : in the first half of the year, the realization of operating income of 189.246 billion yuan, an increase of 67.52% year-on-year, net profit of 20.717 billion yuan, an increase of 153.64% year-on-year. The company's Kirin batteries to achieve mass production delivery, sodium batteries announced the debut of the first model, and actively promote the application of electric ships, electric aircraft in the field of new power.

International News

1. ING Bank: Decline in Eurozone Bank Lending Exacerbates Risks of ECB Rate Movements

Bank lending to households and businesses continued its downward trend in June, suggesting that the transmission of interest rate hikes has not weakened, Colin, a senior economist at Holland International Group, said in a report. He said this adds to the debate about rate hikes at the European Central Bank after Thursday's meeting, especially in an already weak economic environment. The annual growth rate of bank lending to businesses fell to 1.7% in June from 2.1% in May, and to households fell to 3% from 4%, while consumer lending grew at a negative rate on a year-on-year basis in June and business lending stagnated, Colin said. He added that the outlook for the future was bleak and that further tightening of credit standards could lead to weaker investment later this year and early next year, increasing the risk of a recession.

2. Falling Rhine levels threaten Germany's economy and the flow of goods

Water levels in the Rhine are currently falling, and the waterway, which is vital to the flow of goods and the German economy, could be jeopardized in the summer. According to the German Federal Institute of Hydrology, the water level at Kaub, a key checkpoint between Koblenz and Mainz, fell to 90 centimeters on Monday, the lowest level so far this year. Rainfall in recent days has raised the water level, but there are renewed concerns that this year's sense of a dry summer could pose challenges to navigation in the waterways. Last summer, the waterway was virtually impassable for barges carrying industrial products, coal and diesel fuel due to the dry weather, with water levels dropping to around 30 centimeters at one point, also affecting Germany's economic growth.

3. European Gas Prices Continue to Jump as Power Outages Tighten Supplies

European gas prices rose for a fifth straight day, the longest streak since April, as power outages tightened global supplies while parts of the country are being battered by hot weather.

4. Asset economist Vantage: euro could weaken as ECB warns of growth risks

The euro will continue to come under pressure if recent weak data makes it likely that the European Central Bank will raise interest rates further after Thursday's widely expected 25 basis point hike, Jamie Dutta, market analyst at Vantage, said in a report. He said the weak growth outlook would pose a challenge to members of the governing council who are primarily concerned about high inflation. Volatility should increase as the Fed's policy meeting precedes the ECB, the analyst said. He expects the ECB to emphasize a data-dependent, meeting-by-meeting stance.

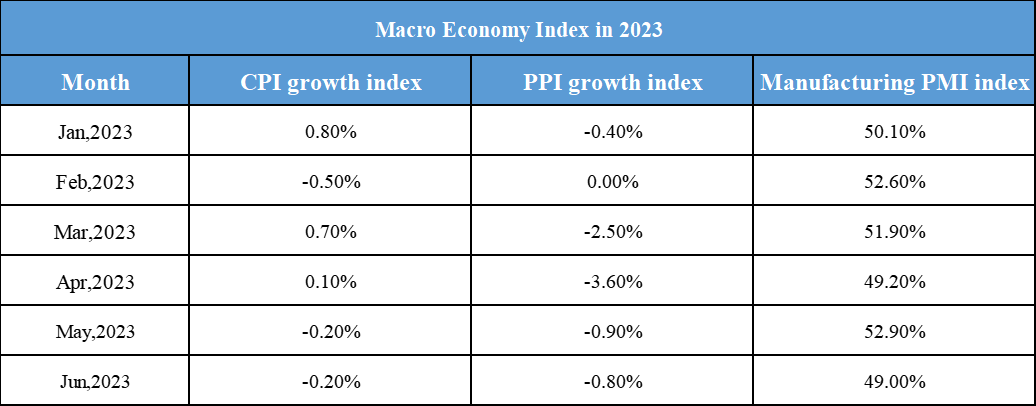

Domestic Macro Economy Index