Daily Macro Economy News on July 20

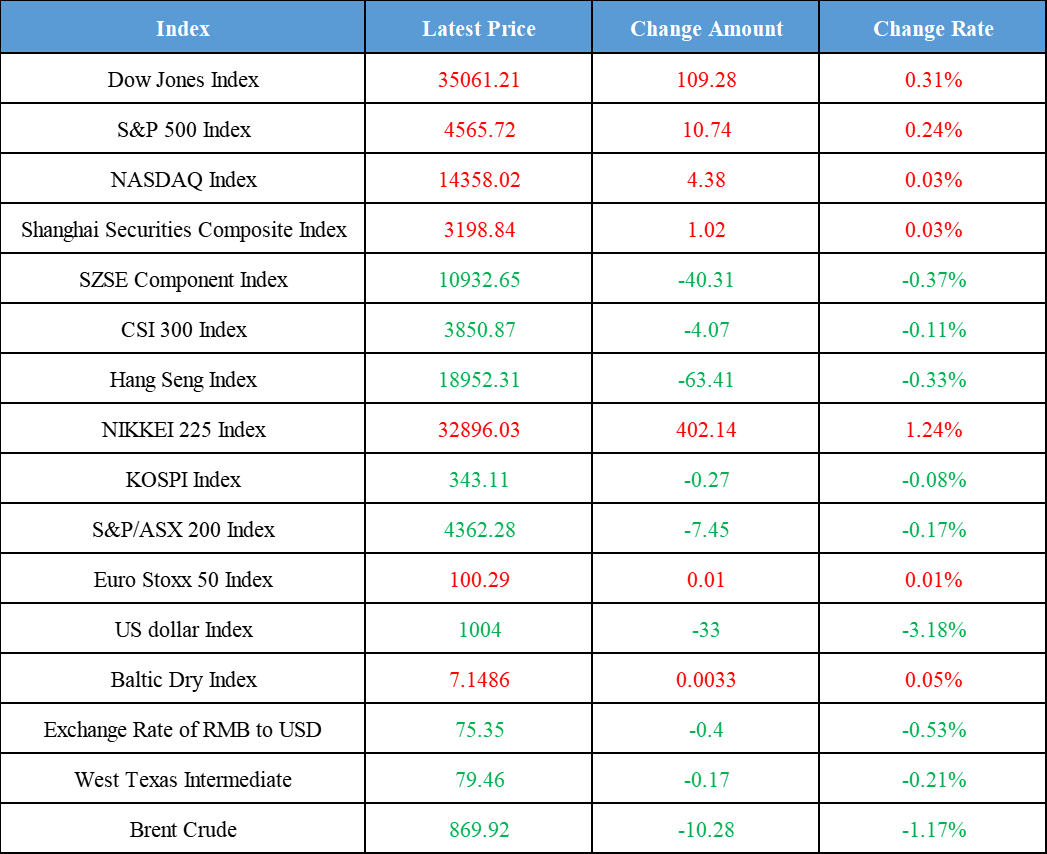

Latest Global Major Index

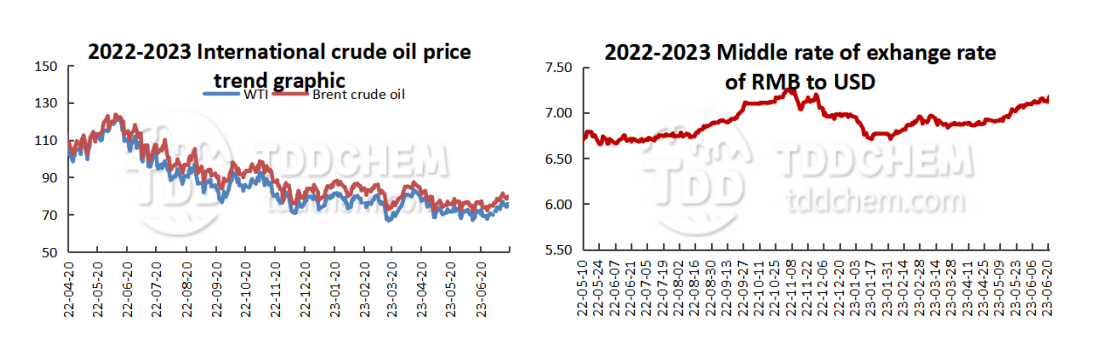

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The ministry of finance: Actively planning targeted, pragmatic and practical tax incentives

2. MOFCOM: Further Relaxing Restrictions on Foreign Investors' Strategic Investments in Listed Companies

3. The World's Largest Liquid Air Energy Storage Project Begins Construction

4. Yankuang Energy: Q2 commercial coal sales of 29.43 million tons, up 5.85% year-on-year

International News

1. Bank of America survey: European stocks likely to fall before rallying

2. The total US new housing starts fall in June after spiking in previous month

3. Zelenskyy Says Ukraine Considering Escorts for Grain Flotillas

4. US Mortgage Rates Fall Back Below 7%, But Remain High

Domestic News

1. The ministry of finance: Actively planning targeted, pragmatic and practical tax incentives

Wei Yan, deputy director of the Ministry of Finance Taxation Department, said at a press conference on fiscal revenue and expenditure in the first half of 2023 that, as a next step, the Ministry of Finance in the implementation of a number of policies that have been introduced this year on the basis of the changes in the situation, to strengthen the policy reserves, and actively plan targeted, pragmatic and practical tax incentives, focusing on the main business to alleviate difficulties, and continue to enhance the development of kinetic energy, optimize the economic structure, and promote the economy to continue to rebound and improve. The economy will continue to rebound and improve. (Resource: Securities Times)

2. MOFCOM: Further Relaxing Restrictions on Foreign Investors' Strategic Investments in Listed Companies

Zhu Bing, director of the Department of Foreign Investment Management of the Ministry of Commerce, said that we will promote a reasonable reduction of the negative list of foreign investment access, and further cancel or relax the restrictions on foreign investment access. Deepen the construction of the Comprehensive Demonstration Zone for the Expansion and Opening Up of the National Service Industry, take the initiative to launch a new batch of innovative pilot initiatives against the rules, regulations, management and standards related to the high-standard economic and trade agreements, and steadily expand the systematic opening up in the field of service industry. Revise the Measures for the Administration of Strategic Investment in Listed Companies by Foreign Investors, and further liberalize the restrictions on strategic investment in listed companies by foreign investors. (Resource: ChinaNet)

3. The World's Largest Liquid Air Energy Storage Project Begins Construction

Recently, by the China Green Development Investment Group Co., Ltd. invested in the construction of Qinghai Province, 60,000 kilowatts / 600,000 kilowatt-hours of liquid air energy storage demonstration project in the city of Golmud officially started. After the completion of the project, it will become the world's first power generation in the field of liquid air energy storage, the world's largest energy storage demonstration project. The project adopts a new generation of compressed air energy storage technology, based on low-temperature air liquefaction and cold storage technology, the electricity will be stored in the form of atmospheric pressure, low-temperature, high-density liquefied air, the project adopts all the localized equipment. The energy storage power of the project is 60,000 kilowatts, and the amount of stored electricity is 600,000 kilowatt-hours, with a dynamic investment of 1.568 billion yuan and an investment of 645 million yuan in energy storage, which is expected to be completed in 2024.

4. Yankuang Energy: Q2 commercial coal sales of 29.43 million tons, up 5.85% year-on-year

Yankuang Energy released the main operating data announcement for the second quarter of 2023, the company's commercial coal sales in the second quarter was 29.43 million tons, an increase of 5.85% year-on-year.

International News

1. Bank of America survey: European stocks likely to fall before rallying

Bank of America's monthly survey of European fund managers shows that European stock markets are likely to fall in the short term before rebounding. About 66% of the investors surveyed expect the stock market to fall in the next few months; 82% of the investors surveyed expect the earnings per share of European companies will fall in the case of slowing economic growth and receding inflation. Nonetheless, 55% of respondents expect European stocks to rise over the next 12 months, up from 52% a month ago. Bank of America said banking stocks are back in favor with investors, becoming the most popular sector for the first time since February's banking turmoil in the U.S. and Europe, followed by pharmaceuticals and insurance. Real estate remained the most underappreciated sector, followed by autos and chemicals.

2. The total US new housing starts fall in June after spiking in previous month

The total number of U.S. new housing starts fell in June after soaring in May, suggesting that builders are struggling to fill the void left by declining home inventories in the resale market. Data released on Wednesday showed that new home starts fell at an annualized monthly rate of 8 percent to 1.43 million units last month, compared with market expectations of 1.48 million. Total building permits slipped 3.7% to 1.44 million. However, permits to build single-family homes increased to the highest level in a year.

3. Zelenskyy Says Ukraine Considering Escorts for Grain Flotillas

Ukraine is studying options to get the grain corridor working again, including the possibility of providing escorts for grain convoys, Interfax quoted President Zelenskyy as saying. Zelenskyy said some shipowners and traders had told him they were willing to take the risk of using the grain corridor if the state allowed them to do so. Zelenskyy said he was waiting for a response from the Ministry of Infrastructure and the military.

4. US Mortgage Rates Fall Back Below 7%, But Remain High

US mortgage rates fell back below 7 percent last week, largely erasing the previous week's gains. According to data released Wednesday by the Mortgage Bankers Association (MBA), the 30-year fixed mortgage rate dipped 20 basis points to 6.87% for the week ended July 14, and the refinance application index rose 7.3% quarterly. Even with the recent pullback, mortgage rates remain extremely high, dampening demand. The purchase mortgage application index fell 1.3%, and the overall gauge of mortgage applications rose just 1.1%. The market generally expects the Federal Reserve to resume raising interest rates later this month, but it is unclear whether the real estate market will need to prepare for further rate hikes in the coming months. Following a rapid deterioration last year, home sales have stabilized slightly of late, but higher mortgage rates continue to limit growth momentum.

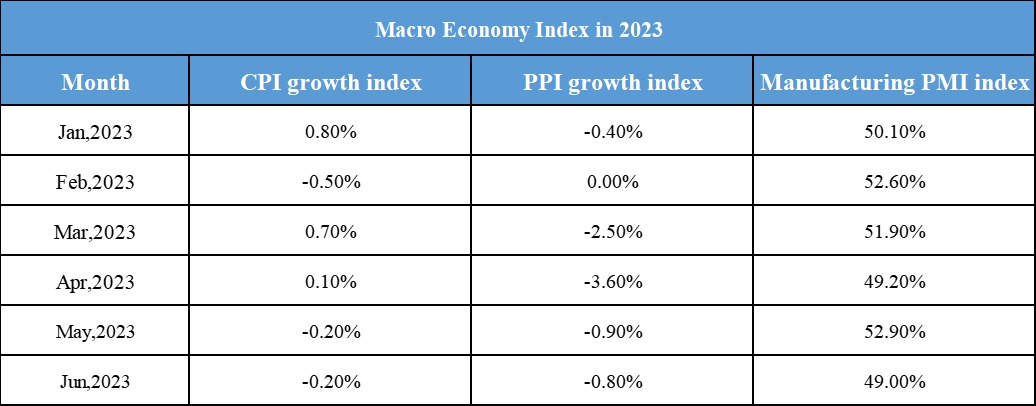

Domestic Macro Economy Index