Daily Macro Economy News on July 13

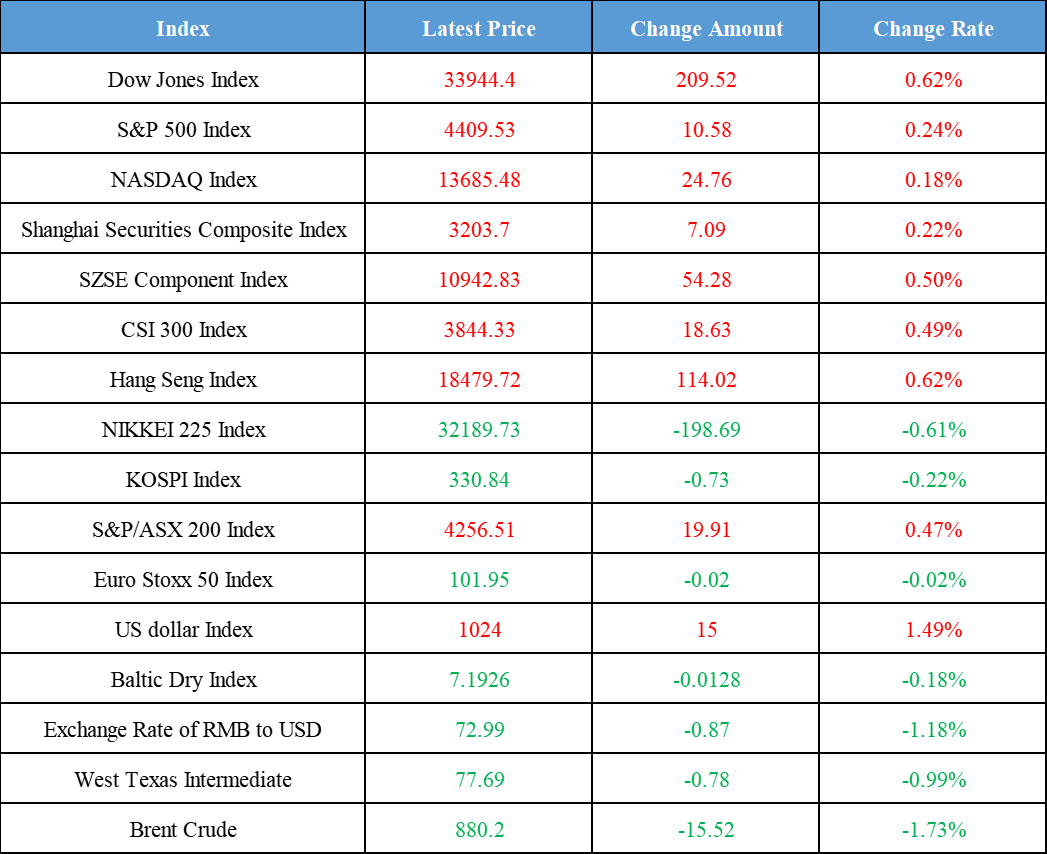

Latest Global Major Index

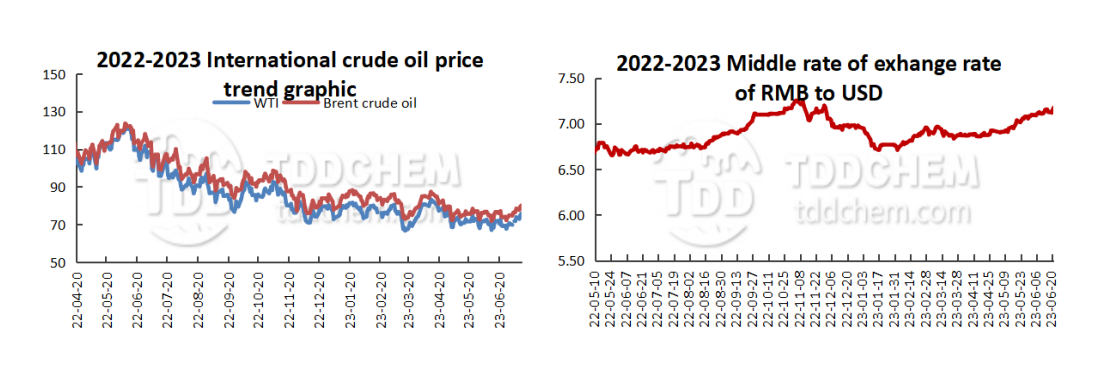

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Shanghai will continue to carry out "five-seasons" to promote theme consumption activities

2. Individual business households recovery trend is prominent, in the first half of the year, there are 11.365 million new households nationwide

3. The aviation market recovers and exceeded expectations in the first half of the year, but the industry still needs to reverse the loss

4. Fluorine chemical bottomed out and rebounded, Institutions: AI arithmetic demand to improve manufacturers usher in development opportunities

International News

1. NovatekRussia's second-largest gas producer Novatek said the gas production in the second quarter was 20.4 billion cubic meters

2. Bank of England’s rate hike highlights the pressure on consumers households may have to pay almost £3,000 additional per year

3. Saudi Arabia signs letter of agreement to join treaty of amity and cooperation in Southeast Asia

4. US inflation falls to 3%, core CPI rises less than expected

Domestic News

1. Shanghai will continue to carry out "five-seasons" to promote theme consumption activities

On July 12th, the reporter learned from the fourth "May 5th Shopping Festival" summary of the news briefing that the next step, Shanghai will be based on the annual program of activities to promote consumption, giving full play to the "May 5th Shopping Festival" overflow effect, continue to focus on the theme of "Go Shopping with the tide rises in Shanghai!", focusing on important seasons and festivals, focusing on new customer groups, new scenes and new supply, linking a number of key exhibitions, events, performances, extensive mobilization, and continue to carry out the "five-seasons" to promote theme consumption activities. There will be themes in every season, exhibitions in every month, and scenes in every week, so as to keep the heat and highlights of the consumer market unabated. At the same time, we will accelerate the construction of the Shanghai International Consumption Center against the annual target. (Resource: SSE News)

2. Individual business households recovery trend is prominent, in the first half of the year, there are 11.365 million new households nationwide

the State Administration for Market Regulation held a forum for individual businessmen on July 12th, indicated establishing a regular communication mechanism with individual businessmen, listen carefully to the business situation of the representatives of individual businessmen about their difficulties and demands and suggestions, on the development and introduction of more targeted support policies and measures to promote the sustainable and healthy development of individual businessmen in-depth exchanges. It is understood that in the first half of 2023, the recovery trend of the nation's individual business households is prominent, and the overall development is stable. From the quantitative point of view, there is a large growth in both new establishment and cancellation.In the first half of 2023, the growth rate of new individual business households across the country was obvious, with a total of 11.365 million new households, an increase of 11.3% year-on-year. By the end of June, there were 119 million registered individual business households nationwide, accounting for 67.4 % of the total number of business entities. (Resource: CCTV News)

3. The aviation market recovers and exceeded expectations in the first half of the year, but the industry still needs to reverse the loss

As far as the reporter knows, the aviation market recovers and exceeded expectations in the first half of the year, but the industry still needs to reverse the loss, there is still a way to go from the Civil Aviation Administration of the annual break-even target. For the reasons for the loss, the experts of the China Aviation Association analyzed, first, the international market recovery is relatively lagging behind. It is expected that the international market may need to be fully restored to the pre-epidemic level around the end of next year. Secondly, the diversion effect of high-speed rail is significant. The continuous improvement of the high-speed rail network and the enhancement of service efficiency have a significant impact on civil aviation operations, especially on short- and medium-haul routes. Third, air cargo is gradually returning to normal. With the end of the epidemic's three-year high-growth, high-profit cycle, air cargo is also facing relative excess capacity and declining profits. (Resource: China Business News)

4. Fluorine chemical bottomed out and rebounded, Institutions: AI arithmetic demand to improve manufacturers usher in development opportunities

Fluorine chemical plate strong pull up, Lianchuang shares rose more than 10%. On the news, Lianchuang proposed 500 million yuan to participate in the reorganization of Xinhua Union and will cooperate with Xinhua Union on new materials. At the same time, foreign fluorine chemical giant 3M will withdraw from the fluorine polymers and fluoride liquid business. Its fluoride liquid, for cooling use, the market share accounted for as high as 90%. Institutions believe that the demand for AI computing power to improve. 3M's withdrawal means that the domestic fluorine factory owners are expected to embrace their opportunities. There are a number of listed companies that have laid out fluoride liquid-related products. (Resource: China Business News)

International News

1. NovatekRussia's second-largest gas producer Novatek said the gas production in the second quarter was 20.4 billion cubic meters

Russia's second-largest gas producer Novatek said the gas production in the second quarter was 20.4 billion cubic meters.

2. Bank of England’s rate hike highlights the pressure on consumers households may have to pay almost £3,000 additional per year

UK households renewing their mortgage agreements may have to pay almost £3,000 additional a year after benchmark lending rates soared to a 15-year high, the Bank of England has warned. The Bank of England's Financial Stability Assessment report, published today, shows that by the end of 2026, more than four million mortgage holders will face higher interest rates when they renew their contracts. The figures highlight the pressure on households from the Bank of England's fastest series of interest rate rises in 30 years. The Bank of England said that at current rates, the cost of a typical household's mortgage will increase by £220 a month in the second half of 2023, equating to an increase of £2,640 a year. By the end of 2026, around one million households will see their monthly payments increase by more than £500. Some are using savings to pay off their loans, which reduces the amount of mortgage they have to refinance. The Bank of England also warned that a mass exodus of buy-to-let landlords facing higher mortgage costs could hit house prices.

3. Saudi Arabia signs letter of agreement to join treaty of amity and cooperation in Southeast Asia

On July 12th local time, during the 56th ASEAN Foreign Ministers' Meeting and Series of Meetings in Jakarta, the capital of Indonesia, Saudi Arabia's Foreign Minister Faisal, on behalf of Saudi Arabia, signed a letter of agreement to accede to the Treaty of Amity and Cooperation in Southeast Asia (TAC) with ASEAN. Saudi Arabia became the 51st country to join the treaty. In response, Indonesian Foreign Minister Retno said that accession to the Treaty of Amity and Cooperation in Southeast Asia demonstrates Saudi Arabia's firm identification with ASEAN values and principles, its commitment to cooperation with ASEAN and its dedication to contributing to peace and stability in Southeast Asia.

4. US inflation falls to 3%, core CPI rises less than expected

US inflation fell to its lowest level in more than two years in June, signaling greater success by the Federal Reserve in curbing price pressures. Data released Wednesday by the U.S. Bureau of Labor Statistics showed CPI rose 3% in June from a year earlier. the quarterly CPI rose 0.2% on a monthly basis in June. The monthly core CPI rate, which excludes food and energy, rose 0.2% in June. The annualized unquartered core CPI rate for June, which economists consider a better indicator of underlying inflation, rose 4.8 percent, which is the lowest level since the end of 2021 but is still well above the Federal Reserve's target.

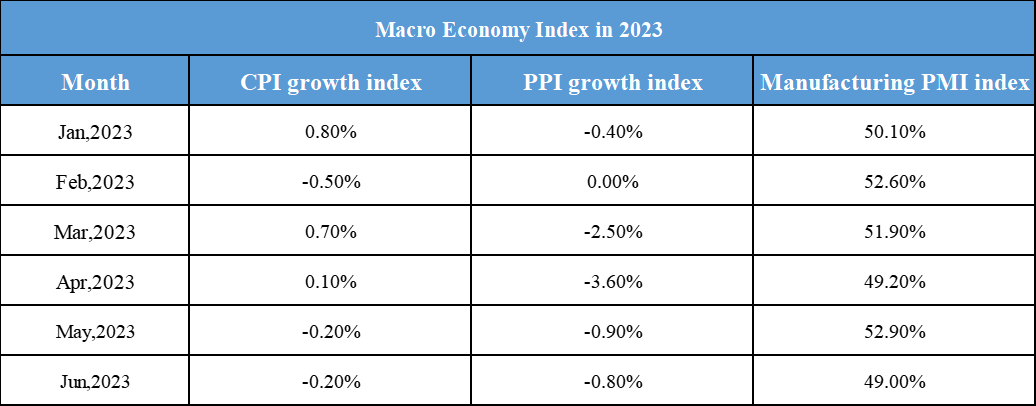

Domestic Macro Economy Index