Daily Macro Economy News on June 30

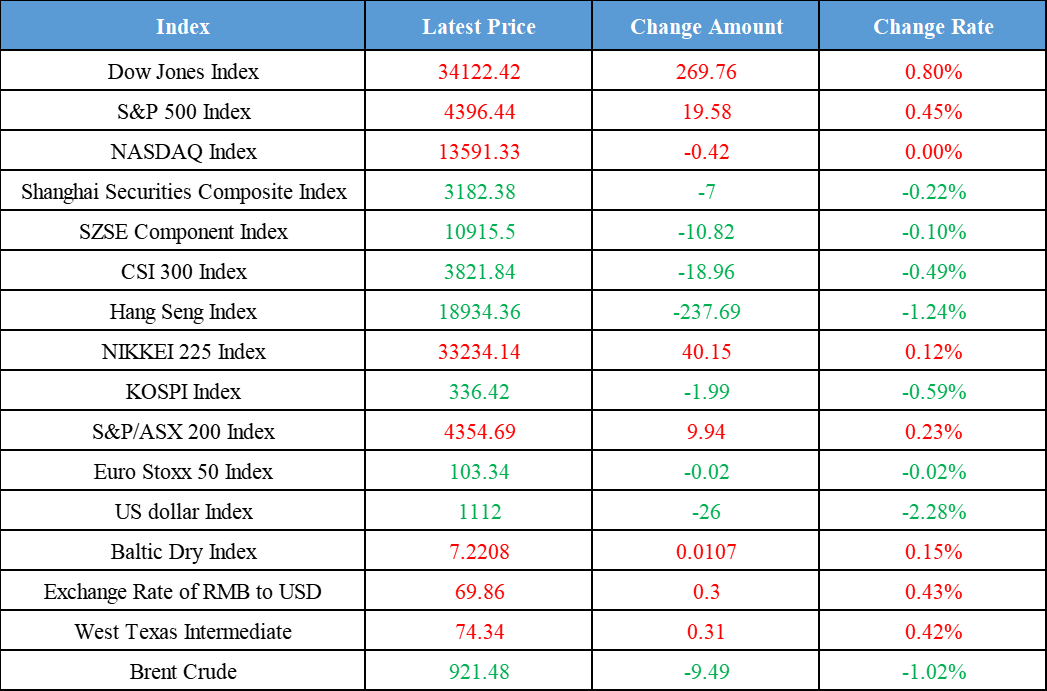

Latest Global Major Index

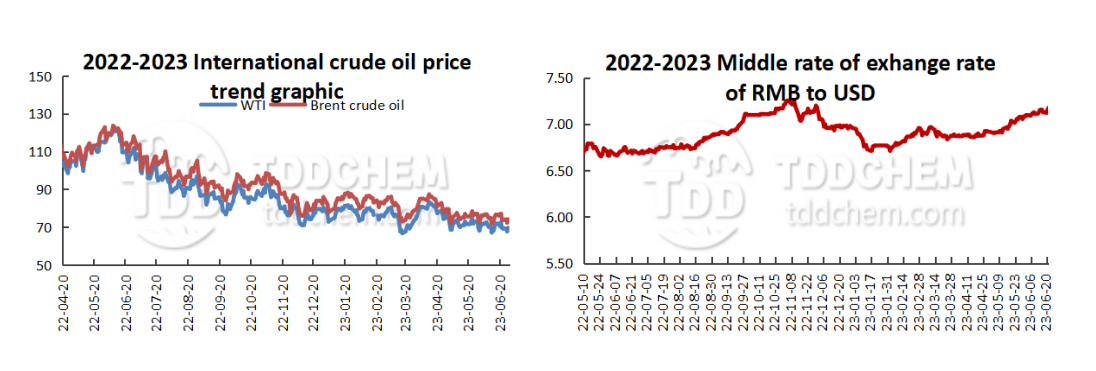

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Central Meteorological Station: from June 29th, Beijing, Tianjin, Hebei, Shandong, Henan, and other places will have a new round of hot weather

2. Tesla Model 3 battery will be upgraded with 66-degree lithium manganese iron phosphate batteries

3. China Silicon Industry: N-type monocrystalline silicon wafer prices are down 5.65% week-on-week, G12 monocrystalline silicon wafer prices are down 7.67% week-on-week

4. China's first A-type "Chinese standard" subway which reaches 80 km/h unveiled today

International News

1. The Riksbank expects policy rates to average 3.75% in the third quarter of 2023

2. Yen volatility diverges, 1-month options indicator rises

3. South Korean inflation is expected to touch a 21-month low in June as weakness emerges

4. Eurozone bond yields move higher on upside risk from German CPI data

Domestic News

1. Central Meteorological Station: from June 29th, Beijing, Tianjin, Hebei, Shandong, Henan, and other places will have a new round of hot weather

According to the Central Meteorological Station June 29 news, since June this year, China's high-temperature weather mainly affects North China, Huang Huai areas, and other places. The average high-temperature days in Beijing, Tianjin and Hebei this year since June is 11 days, 6 days more than the same period of the year, and has reached a record high since 1961. It is expected that in the next two weeks, North China, Huang Huai areas will remain hot weather, mainly showing two rounds of high-temperature process. From June 29th to July 2nd, Beijing, Tianjin and Hebei, north and central Henan, Western Shandong, and other places can reach a maximum temperature of 37 ~ 39 ℃, some areas can exceed 40 ℃, some areas in northern Hebei will be close to or break the record of the same period in history, the intensity and duration of the high-temperature process are similar to the temperature in June 21st-24th. From July 6th to 9th, Inner Mongolia Central, Beijing, Tianjin and Hebei, Shandong, north-central Henan and other places still remain high-temperatures, some areas will reach a maximum temperature of about 40 ℃.

2. Tesla Model 3 battery will be upgraded with 66-degree lithium manganese iron phosphate batteries

Learned from a number of informed sources, Tesla's domestic Model 3 facelift will continue to upgrade the battery pack, especially the base model rear-wheel drive version will be upgraded from 60kWh (degrees) to 66kWh, using CATL’s M3P new lithium iron phosphate batteries. Tesla has always had the practice of upgrading the battery with each revision, and previously, the standard range version of the domestic Model 3 has been upgraded from 55kWh to 60kWh. this upgrade from 60kWh to 66-degree is also in the company's product planning line. In addition, the source revealed that the 66kWh battery pack is not only for the facelifted Model 3, but will also be a platform solution that can also be used for the Model Y facelift thereafter.

(Resource: 36 Kr)

3. China Silicon Industry: N-type monocrystalline silicon wafer prices are down 5.65% week-on-week, G12 monocrystalline silicon wafer prices are down 7.67% week-on-week

China Silicon Industry of China Non-Ferrous Metals Industry Association released this week’s monocrystalline silicon wafers prices on June 29th, the average price of N-type monocrystalline silicon wafers was 2.84 yuan/chip, down 5.65% from the previous week, the average price of M10 monocrystalline silicon wafers was 2.75 yuan/chip, down 0.73% from the previous week, and the average price of G12 monocrystalline silicon wafers was 3.97 yuan/chip, down 7.67% from the previous week.

4. China's first A-type "Chinese standard" subway which reaches 80 km/h unveiled today

China's first A-type "Chinese standard" subway which reaches 80 km/h was unveiled in Guangzhou this morning (June 29th), which was jointly developed by China Railway Changke Corporation and Guangzhou Metro Group, with 28 key components realized independently, featuring advanced intelligence, green energy saving, safety, and comfort, creating a "standardized" subway platform adapted to China's needs and advanced technology. It is the latest independent innovation in the field of metro in China and will lay the foundation for the subsequent interconnection of metro vehicles and interchangeability of spare parts.

(Resource: CCTV News)

International News

1. The Riksbank expects policy rates to average 3.75% in the third quarter of 2023

The Riksbank expects the policy rate to average 3.75% in the third quarter of 2023, compared to the previous forecast of 3.60%. The policy rate is expected to average 4.05% in the second quarter of 2024, compared to the previous forecast of 3.65%.

2. Yen volatility diverges, 1-month options indicator rises

The 1-month options indicator for the yen cross rallied on Thursday, with implied volatility on the July 28 Bank of Japan policy decision rising 96 basis points to 10.69%, the highest level in four weeks. The risk reversal indicator rebounded 65 basis points to -1.46 vol, which showed the most bullish sentiment on the yen since June 2nd. Short-term indicators were steady, with the one-week risk index at 31 basis points, supporting the possibility of downside as traders are not eager to hedge against the risk of intervention by Japanese officials in the spot market, although USDJPY USD/JPY is now trading near the 145 handle.

3. South Korean inflation is expected to touch a 21-month low in June as weakness emerges

South Korea's inflation rate is expected to hit a 21-month low in June. The median forecast in a survey of institutional economists shows its CPI is expected to rise only 2.8% year-on-year in June, the smallest upward since September 2021, following a 2.8% year-on-year rise in CPI in May. Shinyoung Securities economist Cho Yong-gu said the decline in energy and agricultural prices (this year) and the high base of last year's comparison should soften South Korea's inflation. However, Bank of Korea officials warned that inflation could pick up later to reach an average of 3.5% in 2023.

4. Eurozone bond yields move higher on upside risk from German CPI data

Eurozone bond yields are slightly higher after falling the previous day, with today's focus on German inflation data. Analysts at UBS said that with Germany set to release CPI data for June, the public will keep their attention on inflation developments in the eurozone and their related impact on monetary policy. The mild weakness in fixed-income markets following the release of German inflation data for North Rhine-Westphalia suggests a slight upside risk to German national inflation data and highlights the high sensitivity of the issue. Analysts expect the bond yield curve to flatten if German inflation unexpectedly rises.

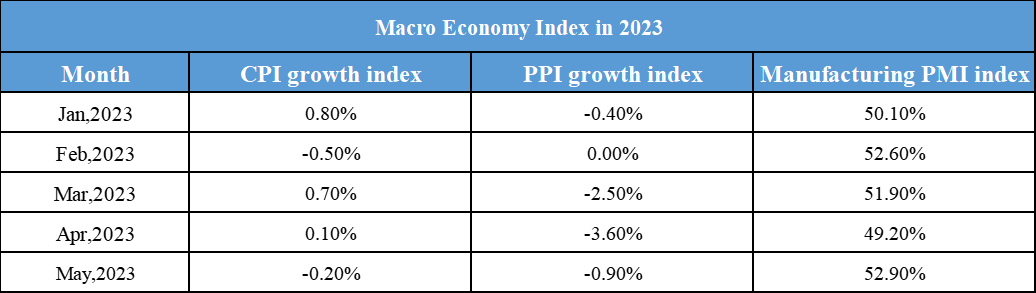

Domestic Macro Economy Index