Daily Macro Economy News on June 28

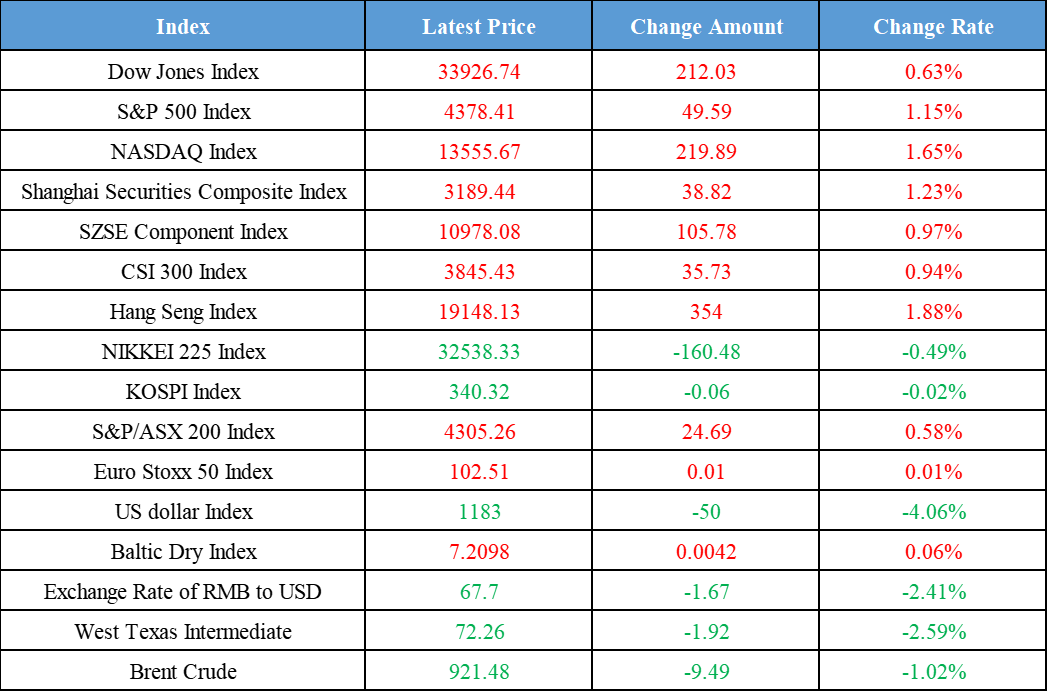

Latest Global Major Index

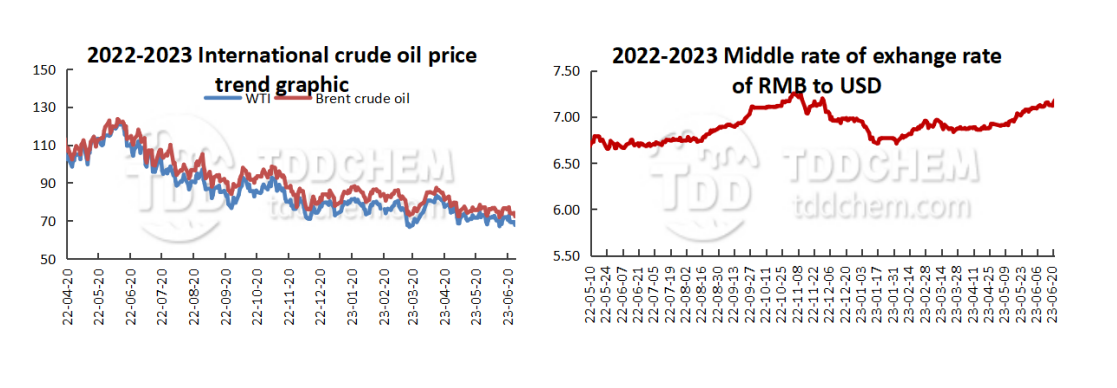

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. State Grid Chairman: China's average electricity price remains low in the world

2. Minister of MIIT: The operating income of industrial SMEs above the scale exceeded 80 trillion yuan at the end of last year

3. Xin Baoan from State Grid: The proportion of electric energy in China's terminal energy consumption has reached 27%

4. China Mobile: 5G new call strategy products will be commercialized on a network-wide scale this year

International News

1. US natural gas has been pushed to a three-month high due to the export demand and high temperatures

2. Martins Kazaks: Central Bank may continue to raise interest rates after July even if the economy slows

3. Bond market bets on a US recession are heating up as the US and Japan are near the interpose spaces

4. New Zealand fine-tunes the central bank's monetary policy

Domestic News

1. State Grid Chairman: China's average electricity price remains low in the world

At the Annual Meeting of The New Champions of the World Economy Forum on June 27th, the State Grid Chairman and Party Secretary Xin Baoan said that in the process of promoting energy transformation, the relationship between transformation, supply assurance, development, and price stability should be well-handled. "At present, China's average electricity prices are always low in the world, with residential and agricultural electricity (the electricity prices) remaining at the lowest level. At the same time, the level of safe operation of the power grid and the reliability of power supply has increased significantly."

(Resource: The Paper)

2. Minister of MIIT: The operating income of industrial SMEs above the scale exceeded 80 trillion yuan at the end of last year

June 27, the 18th China International SME Expo and the second SME International Cooperation Summit Forum, Minister of Industry and Information Technology (MIIT) Jin Zhuanglong said that the number of Chinese small and medium-sized enterprises has exceeded 52 million at the end of 2022, an increase of 9.1% over the end of 2021, and the operating income of industrial SMEs above the scale exceeded 80 trillion yuan. Innovation capacity has been significantly enhanced, with more than 80,000 specialized and special new enterprises cultivated and nearly 9,000 small giant enterprises. The role of stable chain and strong chain is outstanding, SMEs are widely distributed in various industries and fields, and more than 40% of little giant firms are gathered in the field of new materials, new generation information technology, new energy vehicles, and intelligent network-connected vehicles, more than 60% are deeply engaged in industrial basic fields, and more than 90% are supporting suppliers of well-known domestic and foreign large enterprises, playing an important role in supporting steady economic growth and maintaining the stability of the global industrial chain supply chain.

(Resource: The Paper)

3. Xin Baoan from State Grid: The proportion of electric energy in China's terminal energy consumption has reached 27%

On June 27th, the Annual Meeting of The New Champions of the World Economy Forum and the 2023 Summer Davos Forum was held. State Grid Chairman Xin Baoan pointed out that electricity is a clean and efficient secondary energy source, and should increase the proportion of electricity in terminal energy consumption. It is crucial for China to promote the transformation. "We have actively carried out activities to replace coal with electricity, replace oil and gas with electricity to increase the proportion of electric energy in end energy consumption. At present, the proportion of electric energy in China's end energy consumption has reached 27%. It will be further increased in the future."

(Resource: CBN daily)

4. China Mobile: 5G new call strategy products will be commercialized on a network-wide scale this year

China Mobile's Deputy General Manager of the Planning and Construction Department, Bian Yannan, revealed a number of 5G business innovation progress and commercial schedule at the China Mobile Technology Innovation Forum on the 27th. Among them, the 5G new call strategy products will be commercialized on a network-wide scale this year. The schedule shows that 5G new calls have been commercially tested in pilot provinces in June this year and will be commercially launched in the first batch of 14 provinces and the second batch of 17 provinces in October and December respectively. 5G+satellite network convergence will be completed in December this year with base station on-satellite prototype and satellite convergence network prototype and will be completed by next year with satellite interoperability pilot, base station on-satellite verification, and satellite convergence network prototype verification. By next year, we will complete the pilot of star-ground interoperability, base station onboard verification, and prototype verification of the star-ground converged network.

International News

1. US natural gas has been pushed to a three-month high due to the export demand and high temperatures

The US natural gas futures closed at $2.791 per million British thermals on Monday, the highest level since March, Price Futures Group analyst Phil Flynn said that reduced drilling activity, the increased demand for liquefied natural gas (LNG) exports, and hot weather boosted cooling demand, driving natural gas prices higher. Data provider Refinitiv expects LNG export demand to rise from 11 billion cubic feet per day last week to 11.5 billion cubic feet per day this week and 12.6 billion cubic feet per day next week. The US power plants are expected to consume 41.1 Bcf/d of natural gas this week, up from 38.5 Bcf last week, and to grow to 44.5 Bcf/d next week. increased LNG exports and power plant demand are expected to drive total U.S. natural gas demand to 97.9 Bcf/d this week and 102 Bcf/d next week, up from 94.7 Bcf/d last week.

2. Martins Kazaks: Central Bank may continue to raise interest rates after July even if the economy slows

ECB Governing Council member Martins Kazaks said on Tuesday that the European Central Bank (ECB) may continue to raise interest rates after its next meeting, despite the slowdown in the economy as inflation remains too high. The latest economic survey paints a picture of a deteriorating economy for the eurozone and its economic powerhouse in the region, Germany, which is starting to sense the effects of rising borrowing costs. But Martins Kazaks said the eurozone economy is expected to simply slow or stagnate, but no contract, and that shouldn't stop the ECB's efforts to fight the inflation. He joins a growing number of policy hawks who predict that next month's rate hike won't be the last, arguing that the risk of doing too little outweighs the risk of doing too much. He said, however, that the timing and how much a rate hike will be adopted will depend on the data. In addition, he opposed market bets that the ECB will cut interest rates in the first half of next year. He believes that the first rate cut will be "much later" than the market expects.

3. Bond market bets on a US recession are heating up as the US and Japan are near the interpose spaces

The degree of inversion of US long- and short-term Treasury bonds returned to the largest since March, the market is betting on a US recession, affecting the dollar performance, while the US and Japan, which were affected by the previous dollar strength, are also close to the interpose spaces, and investment banks expect that there may be significant volatility recently.

4. New Zealand fine-tunes the central bank's monetary policy

New Zealand's Finance Minister Robertson said they have fine-tuned the New Zealand Federal Reserve's monetary policy. He said the terms of reference and charter of the central bank's monetary policy committee remain basically unchanged following the first five-year review, with only minor changes to the monetary policy framework, and that the current monetary policy framework “remains consistent with their objectives”. According to Robertson, these minor changes will improve clarity, align the language with the New Zealand Fed's bill, and provide context for the relationship between monetary and fiscal policy. The price stability target has been changed to bring the language within monetary policy in line with the bill. In addition, the changes will require the MPC to "achieve and maintain" future inflation between 1% and 3% per annum in the medium term, rather than "maintain" it at a specified level.

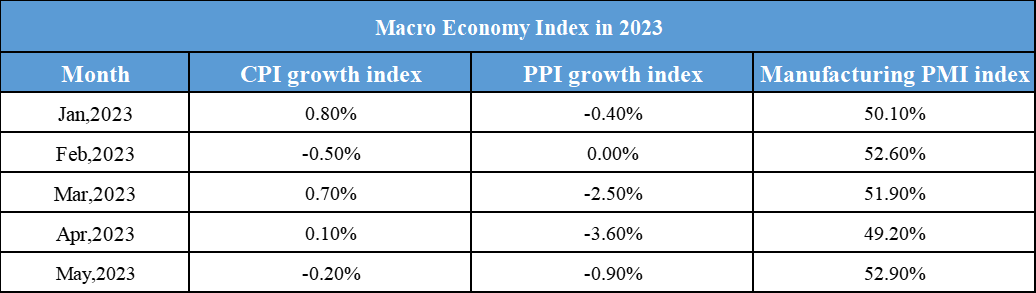

Domestic Macro Economy Index