Daily Macro Economy News on May,16

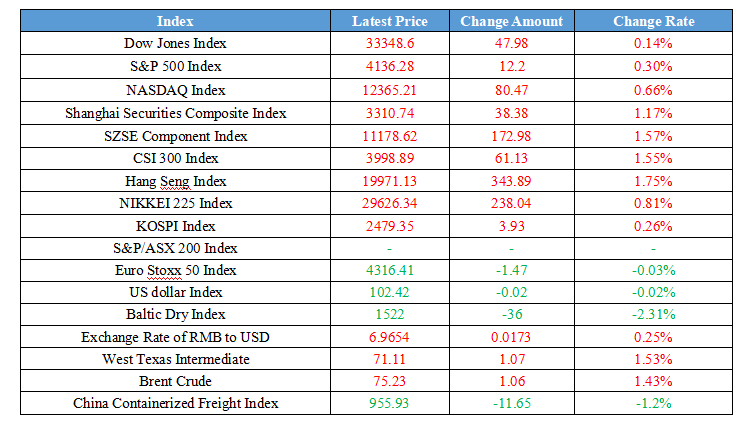

Latest Global Major Index

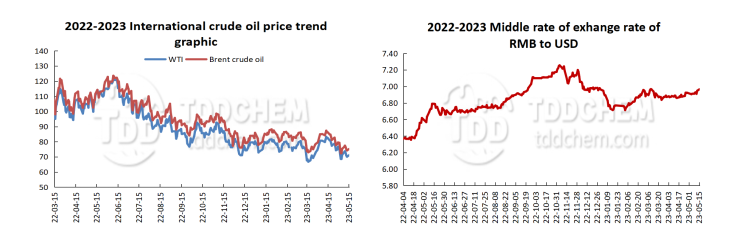

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1、The MLF interest rate remained unchanged in May as the expectation of a rate cut fell through, what signal does the small amount of renewal released?

2、MST: China ranks 11th in the world in innovation indicators in 2022, becoming one of the most innovative countries

3、Commodity prices are under heavy pressure due to the weak demand, but the subsequent downward slope may run slower

4、The public accumulation funds policy is "loosened" again, many places allow withdrawals to pay for the down payment of a house

International News

1、U.S. buys $1 billion in uranium enrichment from Russia. Russian media: Russia accounts for nearly half of the world's production capacity, U.S. has no choice

2、J.P.Morgan Chase & Co: Australian Fed likely to keep rates unchanged for the rest of 2023

3、RBC: U.K. treasuries is expected to end underperformance in short terms

4、Eurozone industrial output falls more than expected in March

Domestic News

1、The MLF interest rate remained unchanged in May as the expectation of a rate cut fell through, what signal does the small amount of renewal released?

Bank of China (BOC) carried out a 125 billion yuan of medium-term lending facility (MLF) operations and a 2 billion yuan of open market reverse repo operations. the MLF rate and a 7-day reverse repo rate were unchanged from the previous period, at 2.75% and 2% respectively. The MLF rate has remained unchanged for nine consecutive months. According to Wind data, on May 15, there will be a 100 billion yuan MLF maturity and a 4 billion yuan reverse repo maturity, so the central bank this month to achieve an MLF net investment of 25 billion yuan, which is to achieve the amount of renewal. BOC also achieves a net withdrawal of 2 billion yuan in the open market. The interviewed experts believe that although the recent price trend is weak, the market interest rates are down faster, but whether the policy interest rate cuts still depend on the progress of economic recovery, the faster downward market interest rates also reduced the demand for MLF excessive quantity renewals. Therefore, this month's MLF excessive quantity renewal keeps the same price, the release of the policy side to continue the signal of stable growth orientation. This year's economic operation is still facing downward pressure, there is still the possibility of interest rate cuts operation during the year.

2、MST: China ranks 11th in the world in innovation indicators in 2022, becoming one of the most innovative countries

Wu Zhaohui, vice minister of the Ministry of Science and Technology, said that China's innovation indicators in the global ranking have jumped from 34th in 2012 to 11th in 2022, successfully becoming one of the most innovative countries. Reviewing the historic changes in China's science and technology undertakings over the past decade, four aspects that significantly have improved. First, the scientific and technological strength has improved significantly, which result in a strong influence on the global innovation map. Second, science and technology innovation support has led the industrial transformation and development, and service quality development capacity has been significantly enhanced. Third, science and technology services for the well-being of people's livelihood, which better meet the needs of the people's better life capacity. Fourth, science and technology support has empowered regional development, innovation highlands can better play the role of leading and providing guidance.

3、Commodity prices are under heavy pressure due to the weak demand, but the subsequent downward slope may run slower

Downward pressure on the economy has increased and commodity prices are under heavy pressure due to the weak demand. From the U.S. economic data, consumer momentum has shown a weakening trend, the job vacancy rate fell, the labor market marginal run weak, manufacturing PMI is located below the entrepreneurs’ confidence threshold for six consecutive months, and the U.S. economy has shown signs of decline. From the domestic data, following the downward of manufacturing PMI, domestic inflation and credit data also weakened in various degrees in April. Reflecting the slope of domestic fundamentals recovery has slowed down, the market's concern about the momentum of economic recovery brought about by the adjustment pressure on metal prices, but the follow-up on the continuation of growth stabilization policies may heat up expectations, thus forming a support for metal prices. Thus, the downward slope of commodity prices may run slower.

4、The public accumulation funds policy is "loosened" again, many places allow withdrawals to pay for the down payment of a house

The public accumulation funds policy has been gradually "loosened" nationwide, and on May 15, we found that many places such as Zhengzhou, Yinchuan, Guizhou, Nanjing and Xiamen have officially announced that they support the withdrawal of public accumulation funds to cover the down payment for purchasing a house. In recent years, the favorable public accumulation funds policies have been launched continuously, from the previous support to increase the loan amount, reduce the down payment ratio, and down the first suite loan interest rate, to now allowing the withdrawal of public accumulation funds as a down payment. Analysts pointed out, it is expected more adjustment policies for the public accumulation funds will give full play to the public accumulation funds in the housing market.

International News

1、U.S. buys $1 billion in uranium enrichment from Russia. Russian media: Russia accounts for nearly half of the world's production capacity, U.S. has no choice

The U.S. bought $1 billion in uranium enrichment from Russia over the past 2022, despite economic sanctions imposed on the country, Sputnik reported, citing the Wall Street Journal. In the area of uranium enrichment, the report said, the U.S. government “has apparently failed to find an alternative”. Uranium enrichment is the fuel the nuclear power plant to generate electricity, which accounts for 1/5 of overall power generation in the U.S. While the U.S. has a shortage of uranium conversion and enrichment capacity and is still dependent on Rosatom ( a Russian atomic energy corporation) for 1/4 of its uranium enrichment needs, according to industry experts. The U.S. government's economic sanctions against Russia have deliberately avoided this area of uranium enrichment. The report also mentions that Russia holds about 40 percent of the global uranium conversion market share and 46 percent of global uranium enrichment production capacity.

2、J.P.Morgan Chase & Co: Australian Fed likely to keep rates unchanged for the rest of 2023

Ben Jamran, chief economist at JPMorgan Australia, said the Australian Fed's policy meeting minutes due out tomorrow will continue to emphasize its data-dependent stance on monetary policy, but at the same time, the minutes will also reiterate that policy effects need to experience a long lag to work and that inflationary pressures are starting to subside. Jamran added that the May meeting is the first meeting after the Australian Fed's assessment report was released, although not mentioned in the statement, it is expected to include some reference to the assessment results in the minutes. Although the Australian Fed unexpectedly raised rates by 25 basis points this month, it also softened its stance in its forward guidance and is now likely to leave policy rates unchanged for the remainder of 2023.

3、RBC: U.K. treasuries is expected to end underperformance in short terms

The underperformance of U.K. treasuries relative to U.S. treasuries and German treasuries are expected to end in the near term, Royal Bank of Canada (PBC) capital markets analysts said in a report. The May monetary policy adopted by Bank of England (BOE) at the meeting marked a turning point. The main reason for the previous underperformance of U.K. treasuries was better-than-expected economic data, said RBC. After BOE raised its expectations for the British economy, the upcoming economic data will hardly bring surprises. In addition, the supply of U.K. treasuries in the market is expected to fall for the rest of the second quarter, thus causing U.K. treasury yields to fall.

4、Eurozone industrial output falls more than expected in March

Eurozone industrial output is weaker than expected in March, reversing the growth achieved so far this year, indicating that rising interest rates and rising inflation are putting pressure on investment that is hitting the manufacturing sector. Data released today showed that industrial output data fell 4.1 percent in March from a year earlier, after growing 1.5 percent in February. The decline in industrial output was driven by capital goods (products used to develop other goods), which fell 15.4%. Other components also declined, with intermediate goods down 1.8%, energy down 0.9%, and nondurable consumer goods down 0.8%. However, the production of durable consumer goods increased by 2.8%.

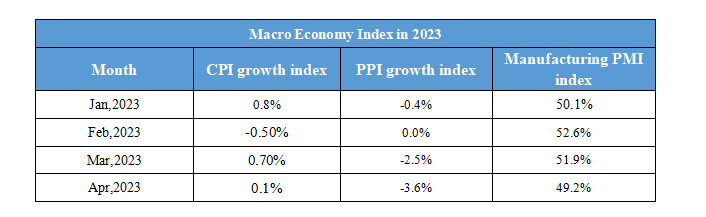

Domestic Macro Economy Index