Daily Macro Economy News on May,15

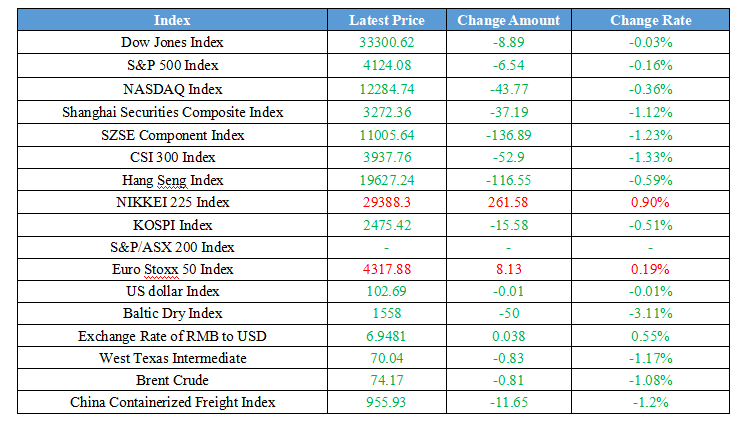

Latest Global Major Index

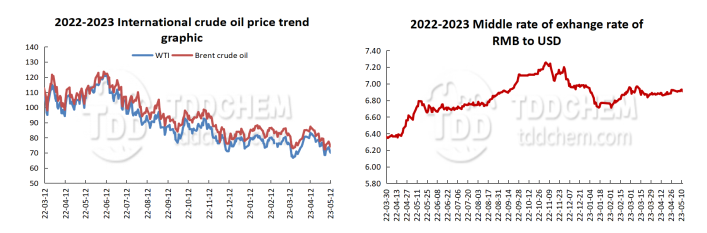

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1、CADA: we will launch the calculation methods of carbon emissions and evaluation standards of its carbon footprints in the Baijiu industry asap by the end of 2023

2、CITIC Securities: The peak of theme trading has passed, market returns to performance-driven

3、Rebar prices continue to fall: steel companies reduce inventory and will cautiously schedule production

4、State-owned central enterprises should increase cooperation with domestic and foreign enterprises of various ownership systems and vigorously promote key core technology research.

International News

1、British media: G7 and EU plan to ban restarting Russian gas pipeline, it will be finalized at the G7 summit

2、Iraq Announces 10 Billion Barrel Increase in Crude Oil Reserves

3、U.S. supermarket chain chief executive says high inflation will lead to economic recession

4、U.S. stocks continue a narrow oscillation as markets don't rush to action amid recession risk

More details:

Domestic News

1、CADA: we will launch the calculation methods of carbon emissions and evaluation standards of its carbon footprints in the Baijiu industry asap by the end of 2023

According to China Alcoholic Drinks Association (CADA), the group seminar of CADA Greenhouse Gas Emissions Calculation Methods and Report Standards of the Baijiu Industry and the Evaluation Standards of Baijiu Products of Carbon Footprints were held on May 13th in Maotai City, Guizhou Province. The meeting reached an agreement that the standard drafting panel will work with related technical schools, universities and experienced enterprises, based on the combination of the Baijiu-brewing situation and the opinions and feedback from representatives, step up to provide classic-cases for references for enterprises of calculation methods of carbon emissions and evaluation standards of its carbon footprints, and launch them as soon as possible by the end of 2023, which can better support the Baijiu industry to realize the carbon peaking and carbon neutrality goals. By doing that, can promote the Baijiu industry to a high-quality development.

2、CITIC Securities: The peak of theme trading has passed, market returns to performance-driven

CITIC Securities research report states that the post-epidemic economic recovery is a gradual and incremental process and it takes time and patience for the flywheel to spin again. Theme trading is a periodic product in the process of downgrading economic expectations. The excessive game has reduced the effectiveness of market pricing, but it has also increased the potential return of performance-driven strategies. The peak of theme trading has passed and it's time to return to the low-level performance-driven sectors. Firstly, the recovery of the service industry turning into comprehensive employment growth and confidence recovery is a gradual process. Currently, the suppressive factors on the economy, such as price, lag and global factors, may gradually ease in the second half. Secondly, as the current economic growth expectations have fallen to the freezing point, the period of theme trading has ended, and the intense competition and consumption within it is difficult to sustain. Lastly, the stock market's characteristic of being driven by existing demand has reached its extreme, lacking the sector effect and restricting the effectiveness of pricing for many high-quality stocks. However, the potential return of long-term performance-driven strategies is constantly increasing, and the market may return to being driven by performance.

3、Rebar prices continue to fall: steel companies reduce inventory and will cautiously schedule production

Since mid-March this year, domestic steel prices have been weakening for two consecutive months, with rebar futures prices falling from 4,328 yuan per ton in mid-March to 3,670 yuan per ton on May 13th. The director of a steel enterprise in Tangshan, Hebei province, said that May is generally the time when the peak season of the steel industry turns into the off-season, and the company currently has three production lines producing rebar with a daily output of about 9,000 tons. Due to the impact of the market, the demand for large orders is reduced, and in order to reduce inventory, we are careful to schedule production and produce on demand. The director of the supply department of a steel enterprise in Tangshan, Hebei Province, said that at present, the overall inventory is basically maintained for about 10 to 15 days. Now raw material prices are also falling, steel prices are also falling, and steel mills continue to be on the edge of profit and loss.

4、State-owned central enterprises should increase cooperation with domestic and foreign enterprises of various ownership systems and vigorously promote key core technology research

Zhang Yuzhuo, secretary and director of the State Council State-owned Assets Supervision and Administration Commission (SASAC), visited the central enterprises in Shanghai on May 13th, emphasizing that the state-owned central enterprises should earnestly study and implement the decisions and plans of the Party Central Committee (CPC) and the State Council, strengthen the main position of enterprise science and technology innovation, aim at the frontier of global industry competition, increase cooperation with domestic and foreign enterprises of various ownership, vigorously promote key core technology research and development, climb the peak of science and technology, and seize the high ground of future development. SASAC will further strengthen the top-level design, optimize the assessment, investment, financing, selection of personnel, model innovation and other policy measures, and play a good combination of measures to guide and promote the central enterprises to vigorously develop strategic emerging industries, accelerate the layout of new areas of value creation and new tracks, and create innovation-led modern industrial clusters.

International News

1、British media: G7 and EU plan to ban restarting Russian gas pipeline, it will be finalized at the G7 summit

The G7 and the EU will ban imports of Russian gas on routes where the Russians have cut off supplies, officials involved in the negotiations said, according to the Financial Times. This is the first time since the Russia-Ukraine conflict that Western powers have reportedly blocked trade in pipeline gas. The decision, which will be finalized by G7 leaders at next week's G7 Hiroshima summit, would prevent Russia from resuming pipeline gas exports to countries such as Poland and Germany. Fifteen months after the Russia-Ukraine conflict erupted, Western powers are trying to increase economic pressure on Russia, hoping to ensure that Russia's energy revenues do not increase. A draft G7 statement obtained by the Financial Times suggests that the EU will further reduce its use of Russian energy, “including by preventing the reopening of corridors previously closed due to the weaponization of Russian energy,” at least until “the Russia-Ukraine conflict is resolved”. While these measures are unlikely to immediately affect any gas supplies, they underscore the EU's strong determination to move away from Russian energy dependence.

2、Iraq Announces 10 Billion Barrel Increase in Crude Oil Reserves

Iraqi Oil Minister Hayan Abdel-Ghani has announced that Iraq's proven crude oil reserves have increased by 10 billion barrels and proven natural gas reserves have increased by 8 trillion cubic feet. According to a statement issued by the Iraqi Ministry of Oil on the 12th, Abdel-Ghani announced the above data while attending an event at an oil field near the southern city of Basra. According to OPEC's official website, Iraq has proven crude oil reserves of about 145 billion barrels. The latest reserves data announced by Iraq has not yet been adopted by OPEC.

3、U.S. supermarket chain chief executive says high inflation will lead to economic recession

Fox News reported on May 13th that John Catsimatidis, CEO of the New York-based chain supermarket--Gristides, has warned against the continued high inflation in the United States. He said that if the Federal Reserve continues to raise interest rates, the United States will return to the 1981-era recession, and pointed out that the government needs to change the traditional way of looking at inflation and raising interest rates.

4、U.S. stocks continue a narrow oscillation as markets don't rush to action amid recession risk

U.S. stocks oscillated narrowly this week as investors awaited a signal that the Federal Reserve's rate hike cycle is over. U.S. data released Thursday showed initial jobless claims reached their highest level since October 2021, while PPI rose less than economists had expected, suggesting the tightening policy may finally be having an effect. Newedge Wealth Chief Investment Officer Cameron Dawson said on Friday, “Trading has been flat because we know the risk of a recession is high, but the market is not rushing to act on hard data, which is why the horizontal price oscillation continues.” Wall Street has been viewing 4,200 points as a key resistance level for the S&P 500. The risk is that it will rise higher, Dawson said. “The technicals and popular positions could allow the S&P 500 to rise above that level and make it a very painful trade.”

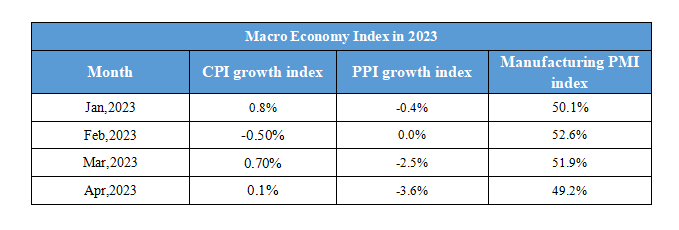

Domestic Macro Economy Index