Daily Macro Economy News on May,12

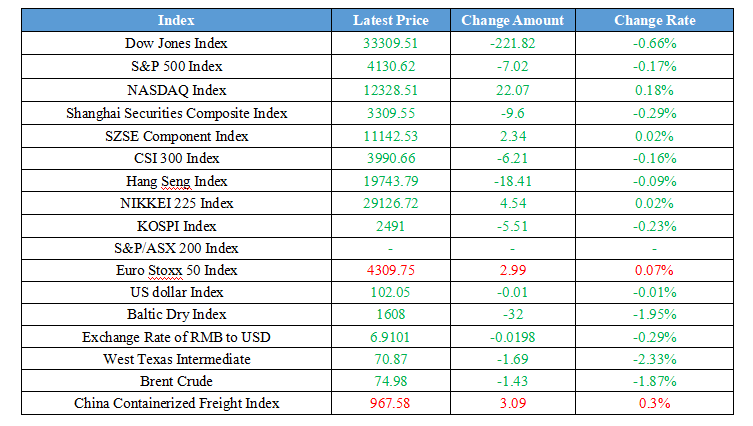

Latest Global Major Index

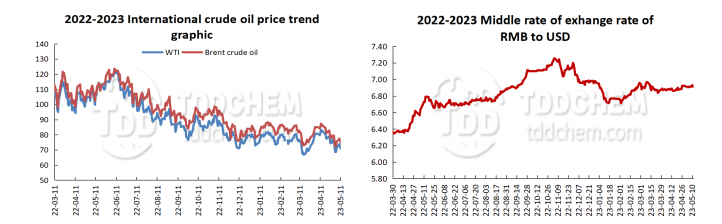

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1、MARA deploys the improvement work of large-area soybean production

2、NFSRA: appropriately raise the minimum purchase price level of wheat and rice

3、MOC: 21 pilot free trade zones in the first quarter import and export volume reached 1.8 trillion yuan, up 6.6% year-on-year

4、The domestic commodity futures night session ended with a general decline in energy and chemical products

International News

1、According to Morgan Stanley, BOE should be cautious in raising interest rates

2、There is a big chance that BOE will raise interest rates at least one more time

3、BOE raised interest rates by 25 basis points to 4.5%, leading to a dramatic upward expectation of GDP and is expecting a slowdown in inflation

4、The UK treasury bond yields have slightly increased due to the hawkish policy adopted by BOE

Domestic News

1、MARA deploys the improvement work of large-area soybean production

On May 10th, the Ministry of Agriculture and Rural Affairs (MARA) in Qiqihar, Heilongjiang Province, held a national soybean yield promotion conference, it pointed out that this year is the first year of the implementation of soybean yield improvement action, all localities need to deeply understand the extreme importance of sustained improvement of soybean production capacity and self-sufficiency, and effectively enhance the sense of responsibility, sense of urgency, and to push technology to improve yields as a key work to grasp and continue to crack the constraints of soybean yields improvement.

Resource: MARA

2、NFSRA: appropriately raise the minimum purchase price level of wheat and rice

The State Council Information Office held a series of press conferences on the morning of May 11 on the theme of "Authoritative departments give a speech on the opening" to introduce the situation of "guaranteeing food security and securing China's food reserve". Lu Jingbo, deputy director with the National Food and Strategic Reserves Administration (NASRA), said at the conference in order to stabilize food production and strengthen the foundation of food security, the relevant departments of the state take into account the production cost of grain, market supply and demand, domestic and international prices, industrial development and other factors to appropriately raise the minimum purchase price of wheat and rice, of which the minimum purchase price of wheat has been raised for three consecutive years, early indica rice for four consecutive years before the medium and late indica rice has also been raised for three consecutive years.

Resource: CNN

3、MOC: 21 pilot free trade zones in the first quarter import and export volume reached 1.8 trillion yuan, up 6.6% year-on-year

Shu Jueting, the Ministry of Commerce spokeswoman, addressed on May 11 at the Ministry of Commerce (MOC) regular press conference, said that in the first quarter of this year, foreign trade and foreign investment in the pilot free trade zones achieved faster growth. 21 pilot free trade zones import and export volume reached 1.8 trillion yuan, an increase of 6.6%, higher than the national foreign trade growth rate of 1.8 percentage points. Among them, exports of 794.9 billion yuan, an increase of 8.5%, imports of 103.63 billion yuan, an increase of 5.2%. Actual utilized foreign investment of 71.9 billion yuan, an increase of 22.1%, 17.2 percentage points higher than the national growth rate of actual utilized foreign investment. The total import and export volume and actual utilization of foreign investment in the free trade zone accounted for 19.4% and 18.1% of the 21 provinces, autonomous regions and cities respectively. This year is the 10th year of the construction of the Pilot Free Trade Zone, the Ministry of Commerce will hold a series of activities to help domestic and foreign enterprises better understand the innovative initiatives of the Pilot Free Trade Zone.

Resource: China Securities Taurus APP

4、The domestic commodity futures night session ended with a general decline in energy and chemical products

The domestic commodity futures night session ended with a general decline in energy and chemical products. Soda ash fell 2.77%, rubber fell 2.37%, and asphalt fell 1.96%. The black series showed general falling trends, with iron ore falling 2.25%. Agricultural products showed mixed gains and losses, with soybeans No.2 futures rising 2.32%, soybeans No.1 futures rising 1.82%, and palm oil falling 1.6%. Basic metals fell in general, with Shanghai copper falling 2.76%, Shanghai nickel falling 1.98%, Shanghai tin falling 1.85%, Shanghai zinc falling 1.35%, Shanghai aluminum falling 1.21%, and Shanghai lead falling 0.23%.

International News

1、According to Morgan Stanley, BOE should be cautious in raising interest rates

Mike Bell, a Global Market Strategist at Morgan Stanley, said that the pressure on household spending caused by rising mortgage rates has put the Bank of England (BOE) in a tricky situation after its recent rate hike. He said that by the end of 2023, there will be 1.4 million fixed-rate mortgages coming up for maturity, forcing these households to refinance at higher rates. Bell added that this will reduce household spending, suppressing inflation pressure and increasing the likelihood of an economic recession. Bell believes that BOE should keep rates at 4.5%, and if it raises rates before the tightening effect is seen, it may damage the economy more than what is required to bring inflation down to target levels.

2、There is a big chance that BOE will raise interest rates at least one more time

Commerzbank has stated that the Bank of England (BOE) opening the door to further rate hikes today is dependent on the sustainability of inflation, and unlike the Federal Reserve, there have been no clear signs of BOE will pause rate hikes. Commerzbank predicts that BOE will not raise rates further, but this ultimately depends on the data. However, the statement has not tried to dispel speculation about further rate hikes, indicating that there is a big chance of at least one more rate hike.

3、BOE raised interest rates by 25 basis points to 4.5%, leading to a dramatic upward expectation of GDP and is expecting a slowdown in inflation

The Bank of England (BOE) raised interest rates by 25 basis points to 4.5% on Thursday, marking its 12th consecutive rate hike and pushing borrowing costs to their highest level since 2008. BOE no longer predicts an economic recession and has significantly raised its GDP growth forecast, marking the biggest increase since 1997. However, the Bank of England expects inflation to decrease more slowly than previously thought, mainly due to the unexpected, sustained rise in food prices. Most Bank of England policymakers believe that there is a "significant" upside risk to these inflation forecasts. Taking this into account, it is expected that inflation will not significantly drop below its target at any point in the next few years, even if interest rates rise by another 25 basis points or more. BOE is concerned that recent strong wage growth may turn into a long-term problem for the economy.

4、The UK treasury bond yields have slightly increased due to the hawkish policy adopted by BOE

As expected, the Bank of England (BOE) raised its policy rate by 25 basis points with 7 votes not in favor and 2 votes in favor, leaning towards hawkishness policy adoption. The report stated that if high inflation persists, further interest rate hikes will be necessary. This prediction is based on the terminal rate market pricing of 4.8%, so it seems that another rate hike is now inevitable. The World Bank also noted that the predicted economic growth increase is the highest in 25 years. In comparison to the pre-report level, UK government bond yields have increased by approximately 2 basis points along the curve.

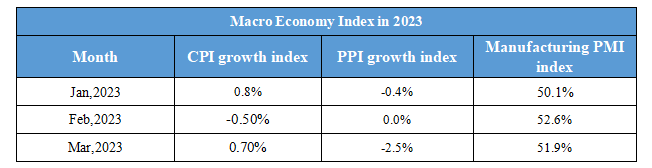

Domestic Macro Economy Index