Daily Macro Economy News on May,10th

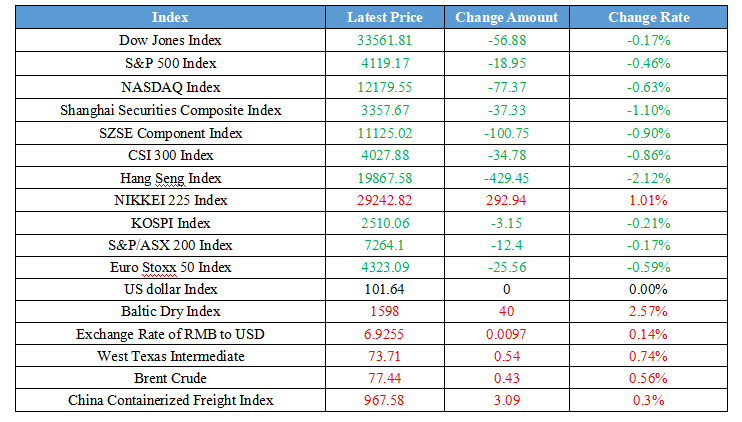

Latest Global Major Index

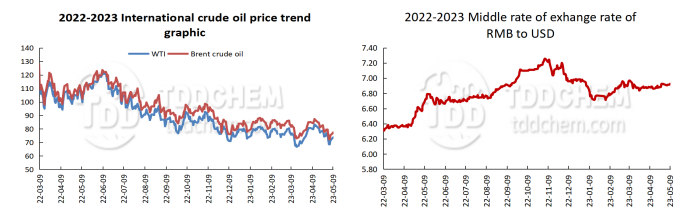

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1、The NEA held a launch deployment meeting on frequent power outages special campaign

2、SHFE: Promoting the listing of alumina futures, synthetic rubber futures and options, LNG futures and options, container freight index futures

3、The MIIT and other four departments jointly issued an announcement: Since July 1st, it will start the full implementation of the China VI emission standards in stage 6b nationwide

4、SHFE and INE Futures Exchange issued a notice: carries out market makers’ recruitment for futures and options varieties

International News

1、UK mortgage rates at risk of rising again as BOE keeps raising rates

2、Industrial Bank: Bank of England's hawkish rate hike could keep the pound on an uptrend

3、Williams from Fed said that they have not indicated any sign of stopping raising interest rates since the high inflation

4、ECB Governing Councilor Joachim Nagel believes that interest rates should rise further

Domestic News

1、The NEA held a launch deployment meeting on frequent power outages special campaign

On May 8, the National Energy Administration (NEA) held a launch deployment meeting on frequent power outages special campaign, to organize all detached agencies nationwide to carry out a special campaign on frequent power outages. The meeting pointed out that frequent power outages have long plagued people’s life and production, and it is not only an unsolved livelihood problem over the years, but also the "hard bone" obstacle that stands in the way of the power industry development. Based on multiple in-depth investigations, the NEA party group decided to carry out a special campaign on frequent power outages, tracking down the reason for frequent power outages comprehensively, focusing on solving the outstanding issues out of people's strong will, and establishing a sound long-term mechanism.

2、SHFE: Promoting the listing of alumina futures, synthetic rubber futures and options, LNG futures and options, container freight index futures

According to the Shanghai Futures Exchange (SHFE) news on May 9, the SHFE successfully held its 12th general meeting recently. The meeting pointed out that efforts were made to build a high-quality product system. Improve the existing variety sequence, and promote the listing of alumina futures, synthetic rubber futures and options, LNG futures and options, and container freight index futures. Improve the comprehensive business platform, promote the online swap and basis difference business, and enrich the futures bonded warehouse receipts business.

3、The MIIT and other four departments jointly issued an announcement: Since July 1st, it will start the full implementation of the China VI emission standards in stage 6b nationwide

The auto industry ushered in big news. The Ministry of Industry and Information Technology and other five departments jointly issued an announcement, from July 1st, it will start the full implementation of the China VI emission standards in stage 6b nationwide. That means it is strictly prohibited from the production, import and sale of vehicles that do not meet the China VI emission standards in stage 6b. Among them, some of the Realistic Demand Ecosystem test (i.e. RDE test) report results for "monitoring only" and other light vehicles applied to VIb models, given a six-month sales transition period, allowing sales until December 31. According to the data, as of the end of January 2023, there were more than 1.89 million vehicles in stock that did not meet RDE requirements, including more than 2 million purchased parts in stock.

4、SHFE and INE Futures Exchange issued a notice: carries out market makers’ recruitment for futures and options varieties

Shanghai Futures Exchange (SHFE) and INE Futures Exchange issued a notice to carry out the recruitment of market makers’ for futures and options varieties. The recruitment of futures varieties include gold, silver, crude oil, etc. The recruitment of options varieties includes copper options, crude oil options, etc. The application requirements includes net assets of not less than RMB 50 million, etc.

International News

1、UK mortgage rates at risk of rising again as BOE keeps raising rates

The Bank of England (BOE) indicates it will continue its efforts to control double-digit inflation. U.K. mortgage rates have recently started to rise again. Property experts warn that mortgage rates could climb further if the market remains firm on bets that BOE will continue to raise rates to a maximum of 5 percent. Some banks are starting to push up home loan prices again in anticipation that BOE will raise interest rates again this week. This will put pressure on households already struggling with the cost of living crunch and create new trouble for Prime Minister Rishi Sunak. Mortgage rates reflect movements in swap rates, which reflect the market's expectations of the future movement of interest rates at BOE. Under normal circumstances, mortgage rates would rise in line with the Bank's key interest rate.

2、Industrial Bank: Bank of England's hawkish rate hike could keep the pound on an uptrend

Economists at Industrial Bank expect the Bank of England (BOE) to adopt a hawkish policy this week, so the pound will continue to be at a high level. The economists from Industrial Bank say this week's FOMC meetings could continue to support the pound and counter the bearish seasonal trend. At the same time, following the release of higher-than-expected payrolls and inflation data last month, a divergence cannot be ruled out, namely the possibility of some members calling again for a 50 basis point rate hike. Overall, we forecast that the BOE will raise rates by 25 bps to 4.50% this week and will again assess the possibility of a terminal rate of 4.50% after the meeting.

3、Williams from Fed said that they have not indicated any sign of stopping raising interest rates since the high inflation

The Fed has made "amazing progress" in monetary policy. The Fed needs to set monetary policy based on data, if needed, the Fed will raise rates again. There is no reason to cut rates this year, and will not speculate on how the Fed will handle defaults, which is difficult to determine how tight credit will affect interest rates. The financial conditions are clearly tightening, no concerns about the overall banking system, and clearly see signs of tighter credit conditions affecting the economy.

4、ECB Governing Councilor Joachim Nagel believes that interest rates should rise further

ECB Governing Councilor Joachim Nagel believes that interest rates should rise further. ECB Governing Councilor Martins Kazaks said that the ECB may not end up raising interest rates in July. ECB Governing Councilor Bostjan Vasle said inflation is becoming increasingly problematic and the goal is to reach the 2% inflation target and achieve a soft landing for the economy, which means further interest rate hikes are needed.

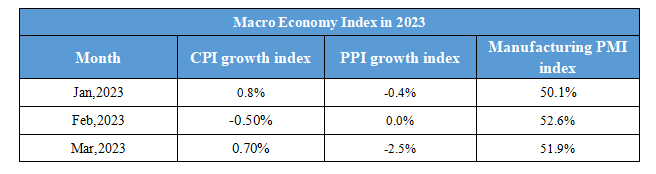

Domestic Macro Economy Index