Carbon black market trend on 9.28

Sep.28, carbon black market was stable in domestic, the mainstream quotation of carbon black N330 was in the range of 10300-11300RMB/Ton. In cost aspect: some deep-processing products manufactures maintain the willing to purchasing coal tar. The supply of coal tar market was tight, and the price of short-term coal tar market was high, which does not rule out the possibility of rising. The cost end support of carbon black enterprises was strong, and some carbon black enterprises are facing losses. In terms of supply: carbon black production enterprises are not enthusiastic about starting work, and some carbon black production enterprises drag carbon black sample enterprises down to start work in order to control costs and reduce production burden. Downstream: Downstream tire enterprises have strong resistance to high price carbon black, and the procurement has maintained strong demand, with limited turnover of new orders. At present, the carbon black market price is high and firm, and there is a strong wait-and-see mood on the market.

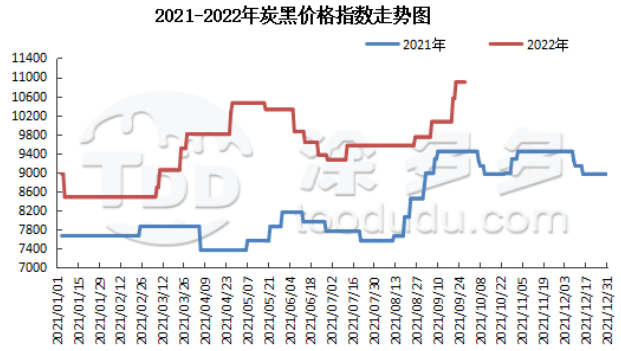

According to Tuduoduo's data, the carbon black price index on September 28 was 10897, which was unchanged from yesterday, with an increase of 0%.

In the short term, the market supply of raw material high-temperature coal tar is still tight, and the cost end of carbon black enterprises has been significantly boosted. In addition, the carbon black production enterprises have not started enough, and the traders on the market are obviously reluctant to sell, and have no intention of shipping at low prices. However, the terminal tire enterprises have poor demand for carbon black, mainly for purchasing, and the overall market transaction atmosphere is light. To sum up, the supply and demand sides in the market maintain a stalemate. It is expected that the carbon black market price will operate at a high level in the short term. In the later stage, attention should be paid to the raw material market and the downstream market dynamics.