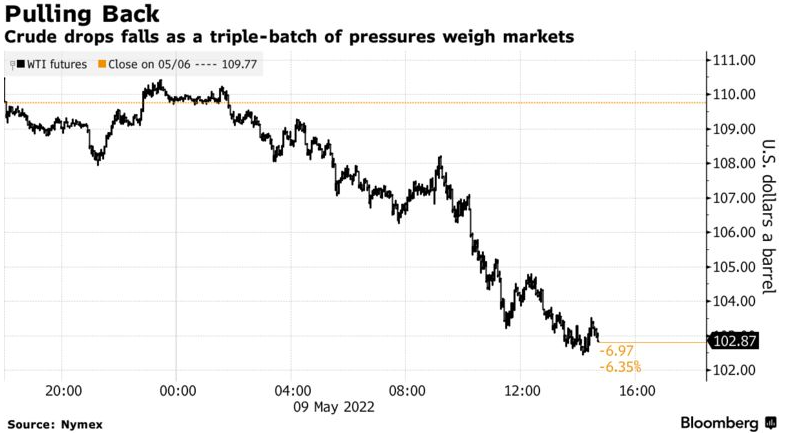

Oil Suffers Biggest Blow Since March Amid Stock Market Rout

Oil crumpled under the weight of a broader market selloff as the European Union softened some of its proposed sanctions on Russian crude to appease potential holdouts.

West Texas Intermediate futures in New York dropped over $6 a barrel, the most since the end of March. The EU looked set to weaken its sanctions package on Russia, while Saudi Arabia cut its prices in a sign of flagging demand in top importer China. Equity markets retreated on concern over how much the Federal Reserve will have to boost rates to tame inflation.

“The less-prohibitive sanctions plan on Russian oil may take less of its supply offline and highlights the complexity of sanctions against Russian energy,” said Rohan Reddy, director of research at Global X Management. “The pushback from some EU members like Hungary and Slovakia could mean the EU may need to go back to the drawing board on its initial sanctions proposal.”

Crude has had a tempestuous 2022 as

Russia’s invasion of Ukraine upended global commodity markets, lifting prices.

The U.S. and the U.K. have already moved to ban imports of Russian fuel in

response, but the weekend pledge by the G-7 will increase the pressure on

Moscow further. Wider markets have also been roiled by the Federal Reserve’s

aggressive rate hike path, adding volatility to crude trading.

Oil will continue to be “rangebound because

there’s still not enough supply for the market currently,” Reddy said. “Barring

a major COVID-19 spread, a supply shortfall will still exist.”

The EU will drop a proposed ban on its

vessels transporting Russian oil to third countries, but will retain a plan to

prohibit insuring those shipments, according to documents seen by Bloomberg and

people familiar with the matter. Over the weekend the leaders of the Group of

Seven countries made a vow to ban imports from Russia. But most nations cutting

Russian purchases have so far stressed the need for orderly change, allowing

much of the rest of the year to wind down.

Beyond the ongoing war, Saudi Arabia cut

prices for buyers in Asia as Covid-19 lockdowns in China weigh on consumption

in the top importer. State-controlled Saudi Aramco lowered prices for the first

time in four months, dropping its key Arab Light grade for next month’s flows

to $4.40 a barrel above the benchmark.

Still, oil markets remain in backwardation,

a bullish pattern marked by near-term prices commanding a premium to those

further out. The spread between Brent’s two nearest December contracts touched

$13.99 a barrel, close to the level seen in the initial weeks after Russia

began its invasion.