Titanium sponge market analysis in the first half of 2021

1.Price Analysis

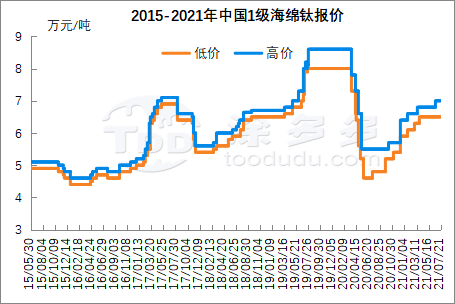

2021 first half of the overall price of titanium sponge was a steady rise in the trend, the continuation of the second half of 2020 up, the price to maintain a slightly higher; downstream market demand is strong, coupled with the release of new production capacity in the first half of the first half of titanium sponge volume and price rise.

In 2021, the coal prices experienced a sharp increase throughout the year, although they remained lower than those in 2020. The prices continued to show volatility, with overall levels trending downward. Meanwhile, due to increased production capacity in the latter part of the year, the prices of coal saw a decline in the second half of the year.

The first-class titanium sponge market offer 64,000 yuan / ton at the beginning of the year, as of now the first-class titanium sponge market offer 70,000 yuan / ton, the year than at the beginning of the cumulative price increase in 15-19,000 yuan / ton, the market price increase is mainly driven by raw material supply tension and high prices, the first half of the cumulative price of magnesium ingot up about 3,700 yuan / ton , titanium tetrachloride cumulative price increase of about 1,000 yuan / ton, the increase in raw material costs The price must rise; and military market demand is strong, the civilian market demand recovery, titanium sponge overall market demand increased.

At the beginning of the year, the city's coal price was 6.4 yuan/ton, while the price of coal in the regulated market city was 7 yuan/ton. Throughout the year, the coal price showed an upward trend of 1.5 to 1.9 yuan/ton compared to the beginning of the year. The city's coal prices increased mainly due to supply and demand factors, as well as changes in market expectations. By the end of the year, the estimated price per ton reached approximately 3700 yuan, while the discount coal price was around 1000 yuan/ton, reflecting a significant increase.

Furthermore, other cities also experienced increased volatility, with the market being influenced by various factors, and coal prices in these regions also saw increases.

Please note that the translation aims to convey the general meaning, and if there are any specific terms or concepts that require additional explanation, feel free to ask.

2.Production Analysis

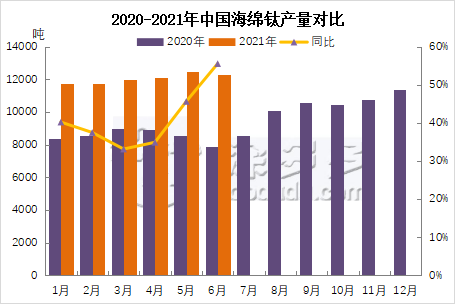

According to TDD statistics, January-June 2021 titanium sponge production in 72,400 tons, an increase of 40.90% over the same period last year, an increase of about 21,000 tons, monthly production than last year have a large increase in production, a significant increase in production mainly for the market new and old capacity release.

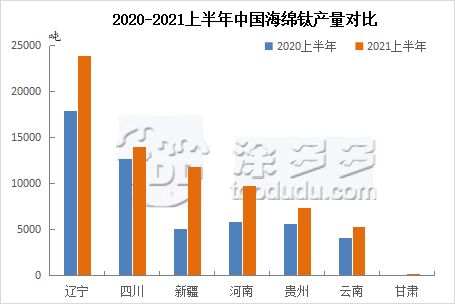

The largest increase in the first half of the year is the Xinjiang increase of 134%, followed by Henan increase of 68% and Liaoning increase of 33%; new areas are Gansu.

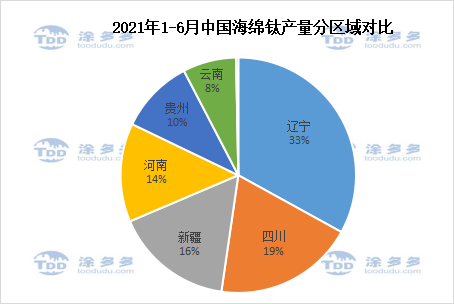

The top three regions of domestic production of titanium sponge in the first half of 2021 are Liaoning, Sichuan and Xinjiang, accounting for 33%, 19 and 16% of total domestic production respectively.

3.mport and export data

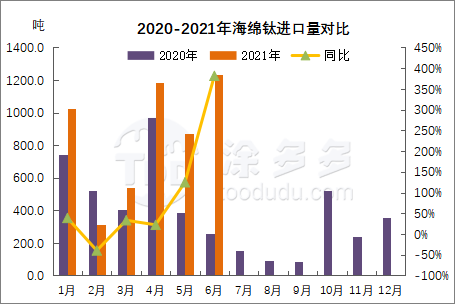

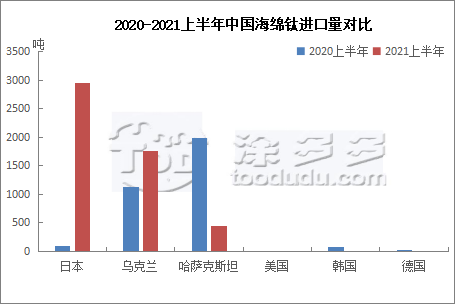

According to TDD statistics: from January to June 2021, China's titanium sponge imports accumulated about 5170.3 tons, an increase of 57.51% over the same period last year, an increase of about 1887.7 tons.

Import countries are mainly Japan, Ukraine, Kazakhstan, of which imports of Japan increased by a large margin.

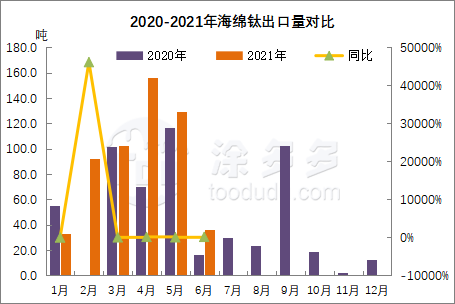

The cumulative export from January to June 2021 is about 550 tons, an increase of about 52.97% or about 190.48 tons compared with last year.

Export regions are mainly South Korea, Taiwan, Switzerland and Sweden, with the largest increase in South Korea.

4.Post Market Forecast

Titanium sponge domestic market demand is good, the release of new production capacity, the market supply and demand is relatively stable, the actual transaction price of titanium sponge is low, enterprises are under pressure, low profits; Rio Tinto RBM force majeure factors caused by shutdown and ILUKA plans to shut down Sierra rutile project in November, and then the domestic chloride titanium dioxide new production capacity put into operation, titanium chloride raw materials will be tight, titanium raw material prices will continue to be high Titanium sponge prices will continue to run firm in the late.