Titanium white market summary in the first half of 2021

Price Analysis

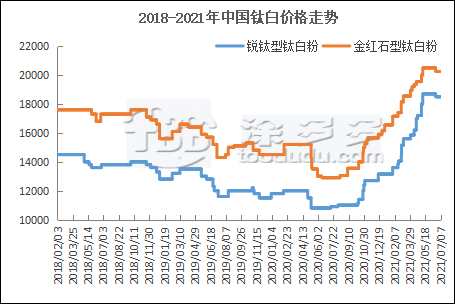

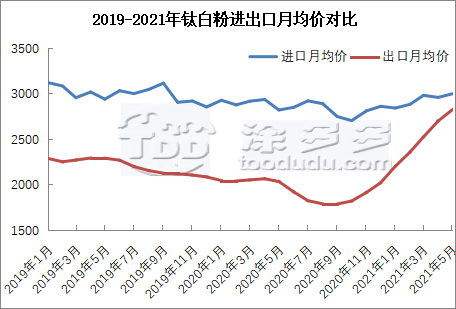

The first half of 2021 China's titanium dioxide market overall upward trend, June market into the off-season, some market prices have 500-1000 yuan / ton drop. Overall, mid-year rutile prices are still higher than the beginning of the year 5700 yuan / ton, anatase prices are higher than 6700 yuan / ton, the beginning of the rutile titanium dioxide supply of tight demand and high profits relative to anatase titanium dioxide, anatase manufacturers to crude products, market supply reduced, because of strong demand, prices continue to rise, so the rate of increase higher than rutile. As of the end of June China rutile titanium dioxide ex-factory price with tax in 18,800-2,500 yuan / ton, anatase titanium dioxide ex-factory price with tax in 17,800-19,000 yuan / ton.

Titanium dioxide continuous January-May prices continue to rise, and the rate of increase, the cumulative increase in 6000-7000 yuan / ton, the market price increase mainly due to: 1ã domestic and foreign downstream market demand recovery, titanium dioxide demand increased; 2ãraw material prices continue to rise, including titanium ore market prices rose by about 500 yuan / ton, the cumulative increase in sulfuric acid prices of about 350 yuan / ton, manufacturers continue to increase the cost pressure There is a certain push on prices.

June titanium dioxide market into the off-season, downstream demand turned weak, raw materials, small and medium-sized titanium ore prices have also declined, coupled with soaring shipping costs and the recovery of foreign titanium dioxide enterprises, export orders have also turned weak, some areas of the price concessions, the downstream wait-and-see mentality is thick, more on-demand procurement, the overall price of weak operation.

Production Analysis

产éåæ

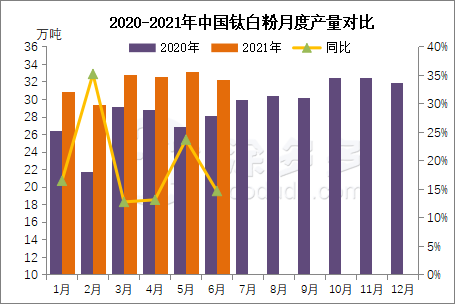

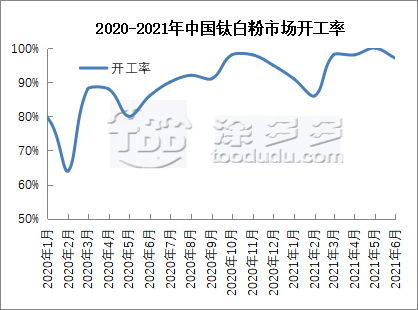

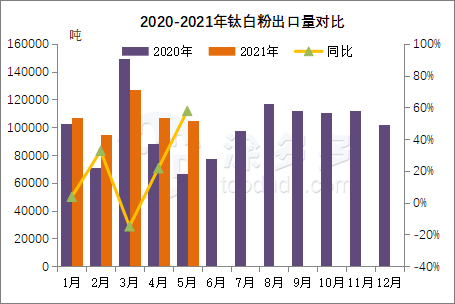

According to TDD statistics, January-June 2021 titanium dioxide production totaled about 1,909,800 tons, an increase of 18.58% over last year, production increased by about 300,000 tons over the same period last year. The first half of the foreign market demand is strong, domestic export orders increased, titanium dioxide manufacturers more than maintain full production; with the market into the off-season, market demand weakened, coupled with environmental protection inspections and other factors, most manufacturers overhaul plans, titanium dioxide production will decline; the second half of either sulfuric acid method or chloride method will have increased new capacity release, titanium dioxide production will also further increase, the annual output is expected to have 12-15% growth.

Since 2021, manufacturers more than maintain full production, January to continue the trend of the end of 2020 rise, manufacturers start normal, February due to the impact of the Spring Festival holiday, the market start than the decline of 4.77%, March-May the global market is robust, companies more than maintain full production, June, some manufacturers have overhaul, the market started a small reduction in production, the overall production than last year is still elevated.

Import and export data analysis

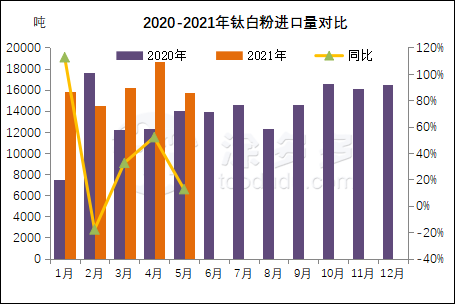

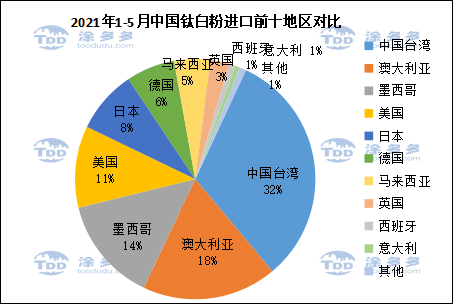

According to customs data, January-May cumulative imports of about 81,000 tons, up 27.32% year-on-year, compared with January-May 2020 imports increased by about 17,400 tons, the recovery of domestic market demand coupled with the titanium dioxide market prices are bullish, the first half of the import volume has increased.

The top three import regions from January to May are Taiwan, Australia and Mexico, accounting for 32%, 18% and 14% respectively.

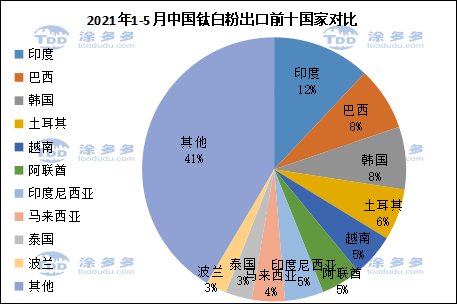

2021 January-May cumulative exports of about 540,000 tons, an increase of 13.01% year-on-year, compared with 2020 January-May cumulative exports increased by 62,200 tons. The first half of the foreign market demand is strong, the market export orders soared, March exports also reached a certain new high in the past two years; global economic upturn, foreign market demand is still strong, titanium dioxide exports to maintain a relatively large increase, into May-June, because of soaring shipping costs, foreign titanium dioxide rose relatively slowly, domestic titanium dioxide prices compared to foreign titanium dioxide no price advantage, export orders have also declined, is expected to June exports There is a decline in the market after adjustment, exports are expected to enhance again, the annual export volume continues to maintain steady growth.

The top three export countries in January-May are India, Brazil and South Korea, accounting for 12%, 8% and 8% respectively; the outbreak of the epidemic in India in the first half of the year, April and May exports of Indian countries slightly reduced, but the overall export impact of the market is not significant.

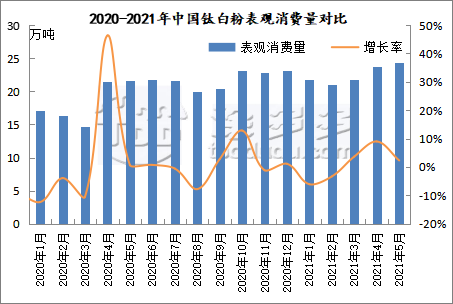

Apparent consumption

According to data from TDD January-May 2021 China's apparent consumption of titanium dioxide 1.13 million tons, an increase of 24% over the same period last year, market demand growth mainly export growth, compared with the same period last year apparent consumption growth of about 210,000 tons.

Post Market Analysis

Into the June-July titanium dioxide market off-season, the downstream market demand in general, coupled with the terminal cost pressure, titanium dioxide export pressure, market prices have weakened, some prices have been 2,000 yuan / ton drop, the market has no market, prices will continue to weaken, although foreign prices have gone up, but by shipping costs and other cost pressures, export prices remain under pressure, the later high prices will also decline.

Due to the market and environmental protection and other issues, the market overhaul enterprises in July also increased, with the enterprise to inventory pressure and market demand recovery, coupled with the overall supply of raw materials titanium ore and sulfuric acid in a tight situation, foreign RBM shutdown and ILUKA Sierra Gold Red shutdown, raw material prices will continue to be high, will also further promote foreign titanium dioxide prices, is expected to rebound after late August, market prices will stable and rising operation.