China titanium ore market analysis in 2020

Titanium Ore Market Price Analysis

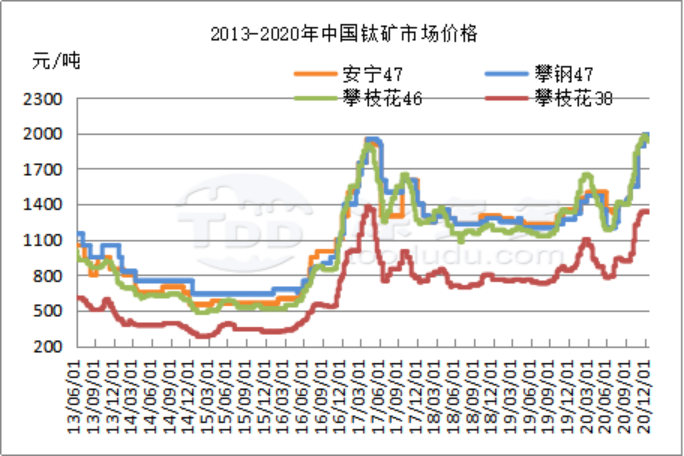

In 2020, China's titanium ore market was up and down, as of the end of the year, including Panzhihua titanium ore prices than at the beginning of the year on the rate of 600 yuan / ton.

January-February up phaseï¼into 2020 titanium ore market affected by the epidemic supply shrinkage prices continue to continue the momentum of the end of 2019 up, in late February 38 titanium ore without tax offer in 1050-1130 yuan / ton, 46, 10 titanium ore without tax offer in 1620-1650 yuan / ton, 20 mine offer 1500-1550 yuan / ton, the price increase of about 300 yuan / ton.

March-June decline phase: the end of February with the normal supply of Pan Steel, in ore and concentrate stocks increased, coupled with the impact of the epidemic in Guangxi region low start rate and titanium white market demand is not good, into March small and medium-sized miners have panic, prices fell off a cliff, prices fell nearly 30% during February. By the end of May market 38 in ore at 750-760 yuan / ton, small and medium-sized plant 10 concentrate at 1150-1200 yuan / ton, the market price than the previous high decline of 400-450 yuan / ton, large plant prices remain high at 1500 yuan / ton, prices higher than the beginning of the year 150 yuan / ton, small and medium-sized plant prices lower than the beginning of the year 150-200 yuan / ton. June market up and down, large plant because High prices, prices have 200 yuan / ton range of downward adjustment, small and medium-sized plants by the cost and supply of some tight prices at the end of June, there are 10-20 yuan / ton rebound.

July-December rising stage: since July, the price of titanium ore began to rise sharply, the price rise is mainly based on the following points: 1, subject to the higher cost of raw ore, enterprise cost pressure, market start-up decline. 2, Xinjiu area road repair affects raw material transportation, the market supply shrink. 3, Fengyuan tailings storage overhaul, the supply of Chinese ore reduced. 4, the overhaul of the major plants in Panxi, titanium ore supply has some reduction. 5, titanium dioxide Market recovery production increase, titanium ore demand increased. 6, titanium white prices declared up, the price of titanium ore prices have a certain drive. 7, the increase in resource tax and Panzhihua set up titanium ore sales platform and other factors, titanium ore in Panxi significantly raised.

Because the price continues to rise and too high, the downstream cost pressure is too large enterprise procurement caution and procurement of other sources of ore increased, from December small and medium-sized enterprises offer some loosening, compared with the beginning of the month down 30-80 yuan / ton, Pangang because of tight supply prices at the end of the month continued to announce an increase of 10 yuan / ton. At the end of the month by the supply reduction and downstream digestion, market prices rebounded by about 50 yuan / ton again. As of the end of December, the large plant in Panxi quoted 2050 yuan / ton without tax, small and medium-sized manufacturers quoted 1930-1960 yuan / ton, the price rose 800 yuan / ton compared with the low point in the year. The increase was 67% in half a year. Market prices have been higher than the 17-year high, prices hit a new price high in the past eight years. Although the price is at a high level, the market is still bullish in the late stage due to supply problems.

Imported titanium ore market

In 2020 China's mainstream imports of titanium ore prices overall upward trend, prices than the beginning of the year on the rate of about 50 U.S. dollars / ton, individual titanium ore prices in the second quarter prices have a slight relaxation, the overall rate of decline is not large.

Affected by the epidemic, Rio Tinto, Kenmore Resources and other producers of titanium raw materials production has been affected, including Rio Tinto RBM 2020 H1 titanium raw material production -7% year-on-year, Kenmore Resources ilmenite H1 production fell 19.5%, originally expected to 800,000-900,000 tons in 2020, is now updated to 700,000-800,000 tons, the amount to the Chinese region has also seen a significant decline in the range.

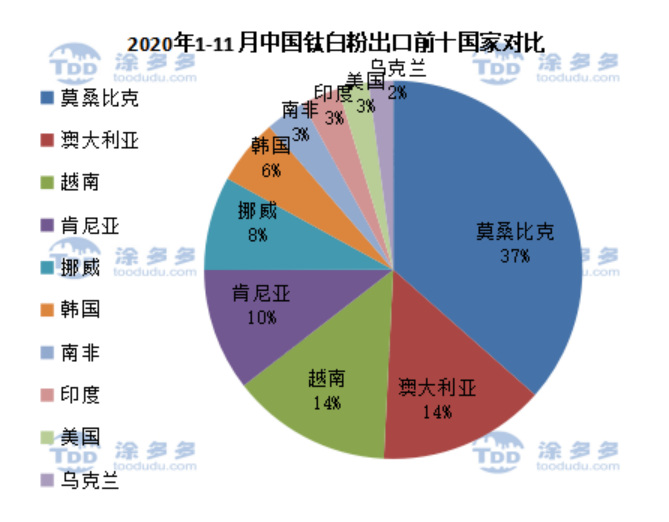

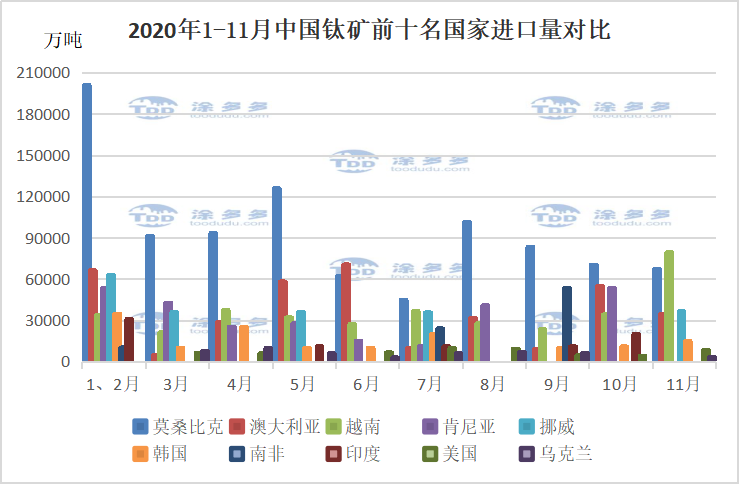

According to customs data, China imported 2.71 million tons of titanium ore from January to November 2020, an increase of about 400,000 or 17.9% over the same period last year, and the annual import volume is expected to be at 3.02 million tons.

The top three importing countries are Mozambique, Australia and Vietnam, accounting for 37%, 14% and 14% of total exports, respectively.

Mainstream countries imported titanium ore in addition to Kenya titanium ore has decreased, the other more than a different range of growth. Among them, Mozambique titanium ore growth for the Great Wall in the mining of gross ore than last year, a significant increase in the import volume of Kenmer resources, including a relatively large reduction.

In April this year, Vietnam's titanium ore export quota liberalization, Vietnam's titanium ore imports also appeared a relatively large increase; Finland's titanium white plant shut down, since last year, Norway's titanium ore began to flow into China, Norway's titanium ore imports increased significantly; Ukraine's titanium ore by foreign downstream production cuts, this year also to the domestic more substantial growth.

Production Analysis

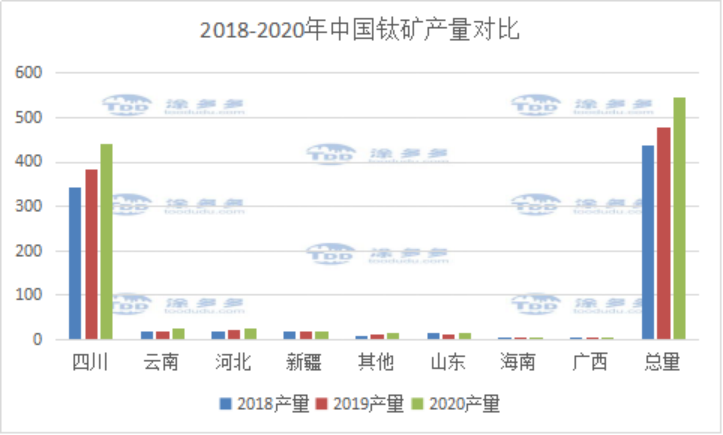

According to TDD statistics, China's titanium ore production in 2020 is 5.45 million tons, an increase of 11.2% compared with last year, of which the Panzhihua region increased at 13.4%, accounting for 80.6% of the total domestic production. Affected by the epidemic and other influences, Xinjiang titanium mineral production has declined, other regions due to better demand for titanium ore, more than a different range of growth.

Downstream market analysis

According to TDD statistics, from January to November 2020, China's titanium dioxide production of about 3,166,200 tons, an increase of 10.75%, the annual output of titanium dioxide is expected at 3.46 million tons, an increase of about 310,000 tons over last year; January-November titanium sponge production of about 101,900 tons, an increase of 31.05% over the same period last year, the annual output of titanium sponge is expected at about 110,000 tons, an increase of about expected in 26,000 tons. Terminal titanium products production increased, the demand for titanium ore increased significantly, the overall tight supply of titanium ore.

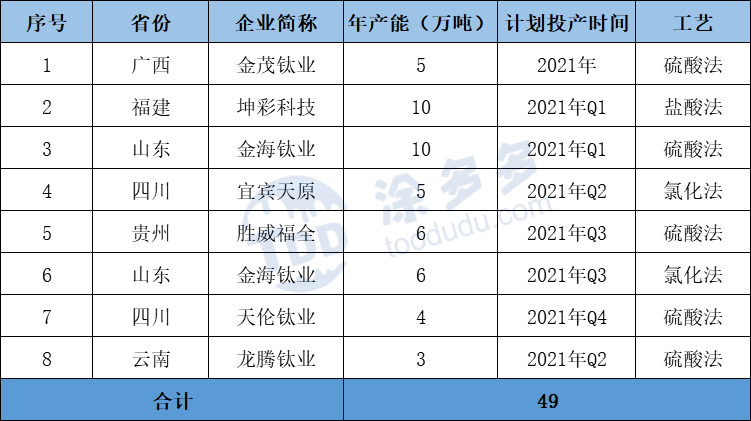

At present, the market under construction titanium dioxide, titanium slag, titanium tetrachloride, titanium sponge project is still more, this article no longer one by one account. According to Tuoduo incomplete statistics 2021 plans to put into operation titanium dioxide enterprises 8 enterprises, with a total production capacity of 490,000, is expected in 2021 China's titanium dioxide production and then 30-40 million tons of growth, the demand for titanium ore will also have a large increase.

Market Forecast

The market demand for titanium ore in China will continue to increase significantly in 2021, and the overall supply of the market has also increased due to the improved demand for market prices. Imported titanium ore is expected to increase in 2021 Mozambique titanium ore, the amount of domestic titanium ore will also increase, but due to resource-based issues, the increase is also expected to be limited, 2021 titanium ore market is still positive, the price will also continue to go up.