Titanium product market outlook for Q3

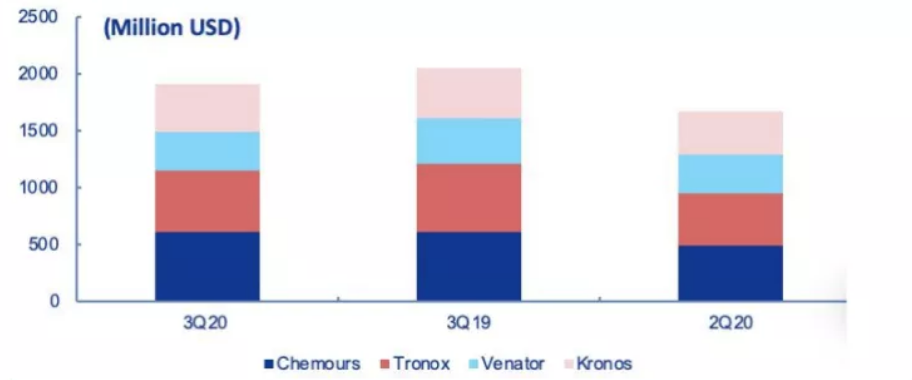

Market demand from abroad has exceeded demand expectations. Data collected from Chemours, Tronox, Venator, and Kronos have shown that their Q3 data on revenues are 1.915 Billion USD, down from last year by 6.61%, but an increase of 14.12%. Demand is slowly recovering; however, it still has not reached the same level compared to the previous year. Enterprise demand has all but exceeded demand expectation.

Titanium ore prices have steadily increased, larger enterprises aren't really pressured by much, however. From January to September, the average prices for Titanium dioxide in the North American market are around 2644 USD/ton, a reduction of 1.3% compared to last year. Rutile, however, is always in short supply, and the prices of Rutile are still increasing. Rutile prices have been around 1247 USD/Ton, an increase of 17.3% compared to last year.

The near future demand for Titanium dioxide is looking great as more companies are planning to recover. During the summer of this year, in July, Rutile Titanium Dioxide hit a new low of just 12,500 RMB/Ton, and it caused small to medium enterprises to lose money. Since August, the prices have bounced up to an average of 14,600 RMB/ton. But raw materials procurement pressure is still high.