August 14th Macroeconomic Index: China's New Home Sales Decline Narrows, US PPI Rises Less Than Expected

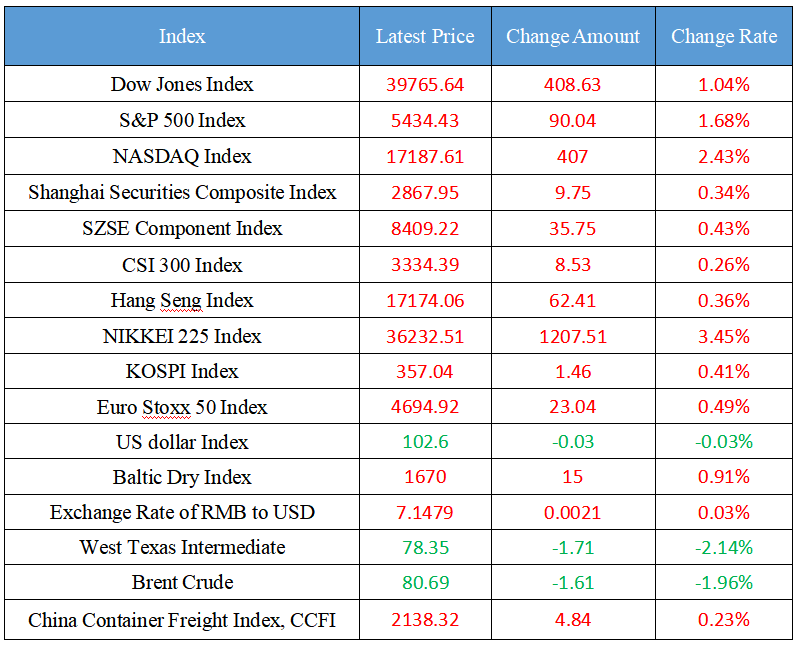

Latest Global Major Index

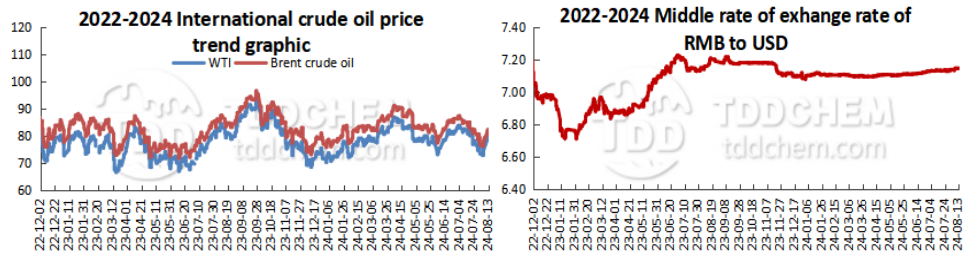

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Big news in the venture capital circle: the national venture capital fund led the establishment of aviation

2. Report: The year-on-year decline in the transaction volume of new homes in China's 50 cities has narrowed for five consecutive months

3. Chinese ships damaged the Baltic gas pipelines? The Ministry of Foreign Affairs responded

4. Xiaopeng Motors: The SOP delivery of the acquisition of the asset of Didi's smart car development business took place on August 13, 2024

5. A number of securities firms have been fined and the regulatory situation is obvious

International News

1. In the face of trade tensions, Chinese and American officials will meet to discuss financial issues

2. United States PPI rose less than expected in July

3. Nomura: Amid tensions in the Middle East, the yen's weakness will be temporary

4. Optimism of small business in the United States rose to its highest level since February 2022

5. Bank of America survey: The yen is still undervalued after rising

Domestic News

1. Big news in the venture capital circle: the national venture capital fund led the establishment of aviation

According to the news of the Guoxin Fund on August 13, recently, the National Venture Capital (Beijing) Intelligent Manufacturing Transformation and Upgrading Fund of China's State-owned Venture Capital Fund led the investment and establishment of Aviation Co., Ltd. financing of more than 100 million yuan. The company is a high-tech enterprise and a state-level specialized and new "little giant" enterprise, with the competitiveness of verification design and development, system engineering manufacturing, test and debugging testing technology as the core, and has successfully developed and produced fuel injection systems, other components and units of combustion chambers, and has now become the main supplier of leading customers in the field of domestic aero engines and gas turbines.

2. Report: The year-on-year decline in the transaction volume of new homes in China's 50 cities has narrowed for five consecutive months

According to a report released by the Shanghai E-House Real Estate Research Institute on the 13th, in July, the year-on-year decline in the transaction volume of new houses in China's 50 cities narrowed for five consecutive months, and market transactions showed a trend of stabilization. According to the report, in July, the transaction area of newly built commercial residential buildings in China's 50 key cities was 11.41 million square meters, down 13% year-on-year. In February this year, this indicator fell by 69% year-on-year. However, in the following months, the decline of this indicator has generally narrowed month by month. The report predicts that in August, the transaction area of new houses in 50 cities is expected to "turn positive" year-on-year, the first "negative to positive" in 15 months.

3. Chinese ships damaged the Baltic gas pipelines? The Ministry of Foreign Affairs responded

Foreign Ministry Spokesperson Lin Jian answers a reporter's question. Foreign Ministry spokesperson Lin Jian said that China has always advocated that the international community should strengthen cooperation and jointly safeguard the security of seabed infrastructure. China is advancing the investigation in accordance with the facts and the law, and is in close communication with relevant countries. It is hoped that all parties will continue to promote the investigation in a professional, objective and cooperative manner, and jointly ensure that the incident is handled in a sound manner.

4. Xiaopeng Motors: The SOP delivery of the acquisition of the asset of Didi's smart car development business took place on August 13, 2024

Xiaopeng Motors (09868.HK) announced that the Board of Directors is pleased to announce that the company has commenced production of the production-based vehicle Mona for sale and delivery to general customers on July 30, 2024, so the SOP milestone under the share purchase agreement has been reached. From August 1, 2024, the first batch of exhibition cars of the intelligent pure electric hatchback Xpeng MONAM03 have arrived at Xpeng Motors showrooms across the country. Accordingly, the SOP delivery took place on August 13, 2024.

5. A number of securities firms have been fined and the regulatory situation is obvious

Since the beginning of this year, a number of securities firms and practitioners have been punished by regulators. According to incomplete statistics, in the first half of this year alone, the regulator issued more than 200 "fines" to 50 brokerages, pointing to brokerage, investment banking, asset management, self-operation and other businesses, of which brokerage business and investment banking business are the "hardest hit areas" for brokerages to be punished. A brokerage business person told reporters that some securities practitioners have a weak sense of compliance and a strong luck mentality, and some brokerage compliance training is not normalized, and most of the energy is spent on KPI assessment, coupled with the low cost of violations, the punishment is not enough, resulting in frequent violations of various violations. Industry participates believe that in line with the new "National Nine Articles" to strengthen supervision and create a high-quality capital market, brokerages can not only look at benefits and profits, but also need to improve compliance, professionalism and service levels in the long run.

International News

1. In the face of trade tensions, Chinese and American officials will meet to discuss financial issues

According to Bloomberg on the 12th, the Sino-US financial working group will hold meeting in Shanghai from August 15 to 16, which is also the fifth meeting of the working group since its establishment in September last year. A spokesman of the United States Treasury Department said the meeting will focus on macroeconomics, financial stability, IMF governance and capital market issues. According to the New York Times, the United States delegation was led by Brent·Naiman, assistant secretary of the Treasury for international financial affairs at the United States Treasury Department, and included officials from the Federal Reserve and the United States Securities and Exchange Commission. They are expected to meet with Xuan Changneng, deputy governor of the People's Bank of China, and other senior Chinese officials.

2. United States PPI rose less than expected in July

United States producer prices rose less than expected in July, highlighting the continued easing of inflationary pressures. Data released on Tuesday showed that the PPI index, which represents final demand, rose 0.1% from the previous month. The median forecast of economists surveyed by institutions was 0.2 percent growth. In addition, the PPI rose by 2.2% compared to a year ago. Excluding the volatile food and energy categories, the PPI in July was unchanged from the previous month and the mildest reading in four months. The more closely watched CPI data will be released on Wednesday and the index is expected to show a slight increase. Against the backdrop of receding inflationary pressures, weak employment data for July prompted economists to expect the Fed to make a series of rate cuts starting next month.

3. Nomura: Amid tensions in the Middle East, the yen's weakness will be temporary

Nomura said the yen's renewed weakness will be short-lived as increased volatility, geopolitical tensions and safe-haven buying support the yen. Nomura strategists Yujiro Goto, Yusuke Miyairi and Jin Moteki wrote in a note on Tuesday that Monday's retracement of the yen and the Swiss franc showed that investors were increasingly willing to trade the yen carry again. However, it is too early to say that USD or JPY is in a V-shaped move, as the pair's three-month implied volatility is as high as it was in 2022, which is a sub-optimal carry environment. Analysts note that the yen's weakness may be limited to around 150 yen per dollar. Nomura said there is growing news of an escalation in the Middle East, which could increase demand for the yen as a safe-haven currency, at least in the short term. In addition, Nomura believes that investors are underestimating the risk of the Bank of Japan's hawkish stance going forward, "because we believe that the Japan Bank of Japan's interest rate hike cycle has not yet reached an inflection point." ”

4. Optimism of small business in the United States rose to its highest level since February 2022

Small business optimism in the United States rose to a more than two-year high in July, adding more optimism about the economic and sales outlook. The National Federation of Independent Business (NFIB)'s Small and Medium Business Optimism Index rose 2.2 points to 93.7 points, rising for the fourth consecutive month and the longest streak since before the pandemic. While remaining pessimistic about future business conditions, the proportion of companies that expect the economy to deteriorate has fell to its lowest level since November 2020. This factor was almost entirely responsible for the rise in the confidence index, while the other four of the 10 sub-indicators that make up the overall confidence index also improved in July. In addition to economic expectations, the net share of companies that expect sales growth in the coming months rose to its highest level this year. While the optimism index is still below pre-pandemic levels, the rise in the index is accompanied by good news on inflation. According to the report, the net percentage of companies planning to raise prices fell to 24%, the lowest since April 2023. A smaller percentage of companies said they had raised their selling prices in the last month.

5. Bank of America survey: The yen is still undervalued after rising

The latest survey of global fund managers conducted by Bank of United States shows that despite the recent sharp rise in the yen against the dollar, most investors still believe that the yen is undervalued. According to the survey, 63% of investors still believed that the yen was undervalued in August, compared to 72% in July. Since the last survey, the yen's rally has been supported by widespread risk aversion in favor of safe-haven assets and the Bank of Japan's decision to raise interest rates at its July meeting and signal further rate hikes.

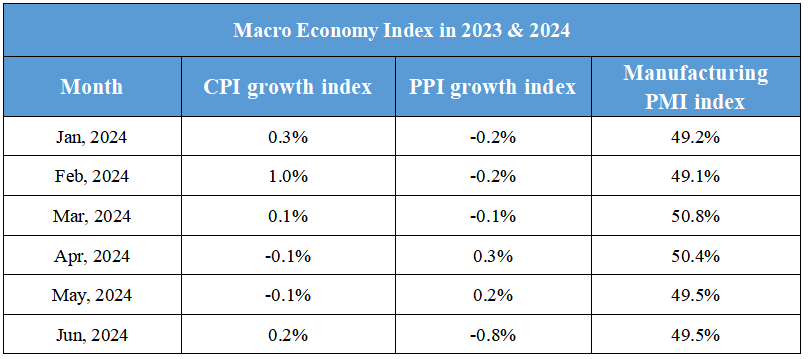

Domestic Macro Economy Index