July 19th Macroeconomic Index: China's Third Plenary Session Outlines Comprehensive Reform Plan, ECB Keeps Rates Unchanged

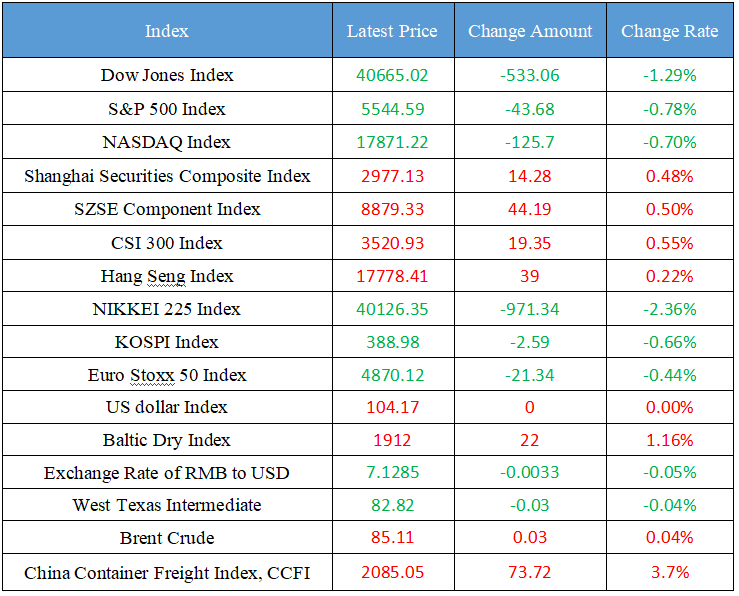

Latest Global Major Index

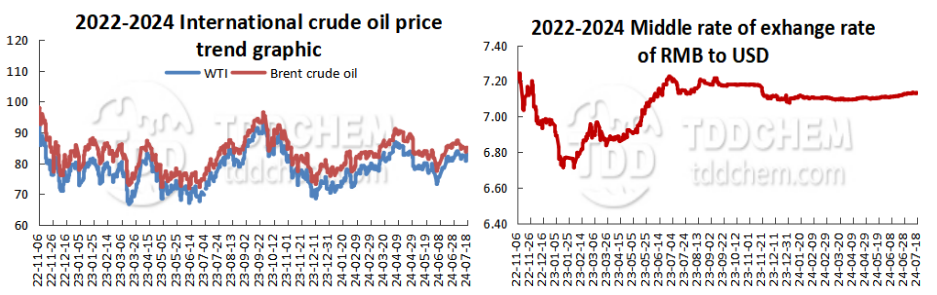

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Communiqué of the Third Plenary Session of the 20th CPC Central Committee: Make systematic deployment for further deepening reform in an all-round way

2. Communiqué of the Third Plenary Session of the 20th CPC Central Committee: By 2035, a high-level socialist market economy system will be built in an all-round way

3. Is the price war in the car market over? NIO and other discounts have declined, and industry people call it a "seasonal break"

4. Shanghai will issue 24.0197 billion yuan of special bonds for refinancing

5. The establishment of the National Medical Security Standardization Working Group will accelerate the construction of medical security standardization

International News

1. The ECB kept interest rates unchanged and did not provide guidance on next steps

2. The United States announced that it would deploy long-range firepower in Germany, and Russia said that the response measures would "not rule out any options"

3. Institutions: In the medium and long term, we are still optimistic about the Japan stock market

4. Deutsche Bank: The United Kingdom labor market should reassure the United Kingdom Central Bank

5. OPEC+ representatives: The August meeting will not change the production increase plan

Domestic News

1. Communiqué of the Third Plenary Session of the 20th CPC Central Committee: Make systematic deployment for further deepening reform in an all-round way

The plenary meeting made systematic arrangements for further deepening reform in an all-round way, emphasizing the construction of a high-level socialist market economy system, improving the institutional mechanism for promoting high-quality economic development, building an institutional mechanism to support comprehensive innovation, improving the macroeconomic governance system, improving the institutional mechanism for urban-rural integrated development, the institutional mechanism for high-level opening-up, and the whole-process people's democratic institutional system, improving the socialist rule of law system with Chinese characteristics, deepening the reform of the cultural institutional mechanism, and improving the institutional system for safeguarding and improving people's livelihood. We will deepen the reform of the ecological civilization system, promote the modernization of the national security system and capabilities, continue to deepen the reform of national defense and the armed forces, and improve the party's leadership level for further deepening reform in an all-round way and advancing Chinese-style modernization. (Xinhua News Agency)

2. Communiqué of the Third Plenary Session of the 20th CPC Central Committee: By 2035, a high-level socialist market economy system will be built in an all-round way

The plenary session pointed out that the overall goal of further comprehensively deepening reform is to continue to improve and develop the socialist system with Chinese characteristics and promote the modernization of the national governance system and governance capacity. By 2035, we will build a high-level socialist market economy in an all-round way, further improve the socialist system with Chinese characteristics, basically modernize the national governance system and governance capacity, and basically realize socialist modernization, so as to lay a solid foundation for building China into a great modern socialist country in all respects by the middle of this century. It is necessary to focus on building a high-level socialist market economic system, focusing on the development of whole-process people's democracy, focusing on building a socialist cultural power, focusing on improving the quality of people's lives, focusing on building a beautiful China, focusing on building a higher level of peace in China, focusing on improving the party's leadership level and long-term governing ability, and continue to push forward reform. By the 80th anniversary of the founding of the People's Republic of China in 2029, the reform tasks set forth in this decision will be completed. (Xinhua News Agency)

3. Is the price war in the car market over? NIO and other discounts have declined, and industry people call it a "seasonal break"

Recently, some media reported that Volkswagen, Toyota, Honda, Volvo and other car brands followed BMW to withdraw from the price war. On July 18, the reporter contacted and visited a number of auto brand stores as a consumer and found that some auto brands did stop cutting prices or reduce discounts, and many brands also revealed their expectations for price stability. According to online news, NIO will increase its price on July 22, of which ET5/5T will increase by 3,000 yuan and ES6/EC6 by 5,000 yuan. In this regard, a sales staff of a NIO store in Shanghai said that the news of the price increase spread on the Internet is actually a preferential decline. However, industry people pointed out to The Paper that car companies are "entering a seasonal break" this time, which does not mean that the price war is over. (surging)

4. Shanghai will issue 24.0197 billion yuan of special bonds for refinancing

According to the announcement of the Shanghai Finance Bureau, in order to support the economic and social development of Shanghai, the Shanghai Municipal Government decided to issue special bonds for refinancing in 2024, including four bonds, with a total face value of 24.0197 billion yuan. The bonds will be issued through the national inter-bank bond market and the stock exchange bond market in the form of book-entry fixed-rate interest-bearing bonds. The tender is scheduled for the morning of July 25, 2024, and interest accrual and distribution will begin on July 26. The bonds have maturities of 3, 5, 7 and 10 years, and interest payments are made annually or semi-annually. The interest income from bonds will be exempt from corporate income tax and personal income tax.

5. The establishment of the National Medical Security Standardization Working Group will accelerate the construction of medical security standardization

On July 18, the National Medical Security Standardization Working Group was established in Beijing. China will accelerate the standardization of medical security, formulate various medical security standards as a whole, promote the implementation of various standards, and provide strong support for the high-quality development of medical insurance. (CCTV News)

International News

1. The ECB kept interest rates unchanged and did not provide guidance on next steps

The ECB kept interest rates unchanged as expected and did not give guidance on next steps, adding that domestic price pressures remain high and inflation will be above target for a longer time next year. The ECB sent a balanced message that corporate profits are digesting some of the price pressures, but risks remain, and further evidence is needed before policymakers pull the "trigger" for a second rate cut, and said that the upcoming information generally supports the Governing Council's previous assessment of the medium-term inflation outlook. The bank also stressed that the Governing Council will continue to follow a data-driven and meeting-by-meeting approach to determine the appropriate level and duration of restrictive interest rates.

2. The United States announced that it would deploy long-range firepower in Germany, and Russia said that the response measures would "not rule out any options"

On July 18, local time, on the question of whether Russia's response to the deployment of long-range firepower in Germany by United States will involve the deployment of nuclear weapons, Russia Deputy Foreign Minister Ryabkov said, "I do not rule out any options." Ryabkov said that considering the overall strength of NATO members, Russia must adjust its response measures without any internal constraints on the where, when, possibility and necessity of deploying the corresponding weapons, "with the widest possible range of options." Ryabkov stressed that this is not a threat to any country. This is how Russia finds the most effective response to changing challenges, and Russia must be prepared for a variety of scenarios.

3. Institutions: In the medium and long term, we are still optimistic about the Japan stock market

Lazard Asset Management said the current pullback in Japan's stock market is an opportunity for investors after a very strong period. The company believes the market is underestimating the long-term potential of the structural changes underway in the country. In the medium to long term, Lazard remains optimistic about Japan's stock market as it believes two key themes will continue to play a role: improved corporate governance driving capital efficiency and improved shareholder returns, and a shift from deflation to inflation that has changed consumer behavior. Any progress in yields in the coming months should boost investor sentiment, while another rate hike by the Bank of Japan would also be a positive.

4. Deutsche Bank: The United Kingdom labor market should reassure the United Kingdom Central Bank

Sanjay Raja, chief economist at Deutsche Bank United Kingdom, said in the report that after the severe inflation situation in the United Kingdom, the labor market data painted a more encouraging picture, with the pace of wage growth falling back in the three months to May and job openings continuing to decline. For the United Kingdom's central bank, wage data should confirm its forecast for a 5.1% increase in regular wages in the private sector in the second quarter. "While this is always a immediate decision, today's data should keep the August rate cut on the table," he noted. He said that while the unemployment rate remained at 4.4 percent, there were actually signs of cooling.

5. OPEC+ representatives: The August meeting will not change the production increase plan

According to foreign media reports, OPEC+ representatives expect that the meeting that the organization will hold on August 1 will be a regular meeting and will not change the plan to increase production from the fourth quarter. OPEC+ agreed last month to cancel a voluntary 2.2 million b/d production cut starting in October. When oil prices fell immediately, officials stressed that the committee could postpone production increases if necessary, and the market rebounded after that, easing the sense of urgency. Delegates expressed the view that there were no plans for the Joint Ministerial Monitoring Committee to make any recommendations on the output policy. As a result, OPEC+ still has a few weeks to consider whether to continue to increase supply, theoretically until the distribution of goods for customers needs to be determined in early September.

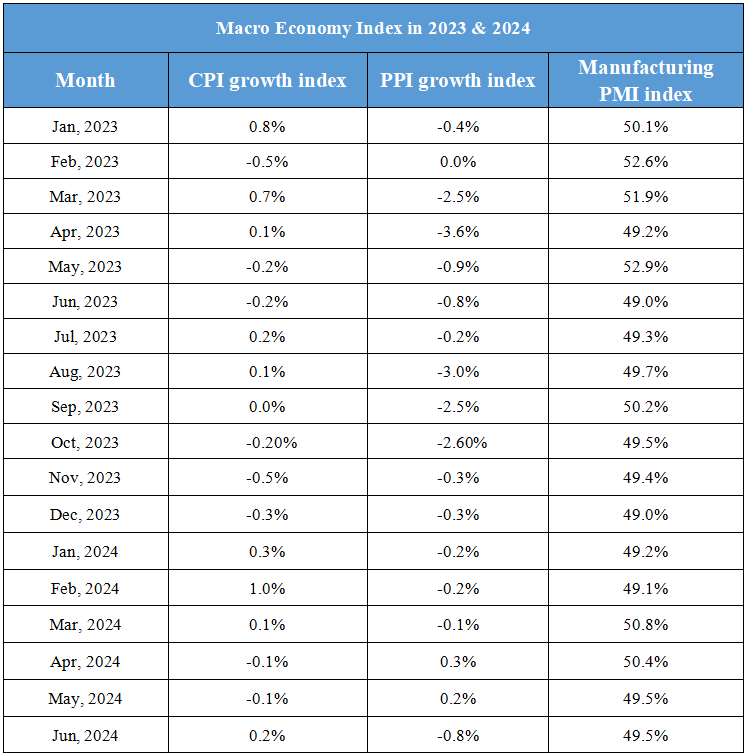

Domestic Macro Economy Index