July 17th Macroeconomic Index: China's Real Estate M&A Activity Surges, Eurozone Consumer Loan Demand Rises

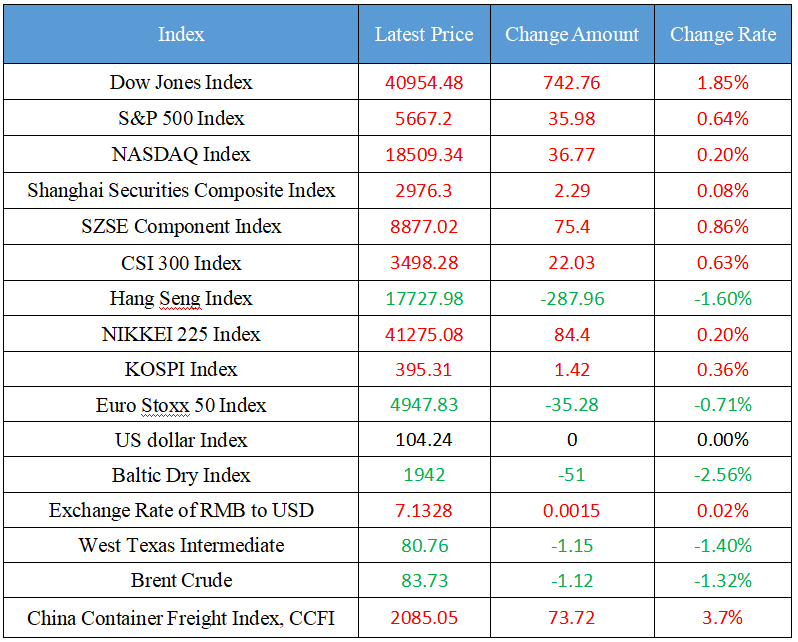

Latest Global Major Index

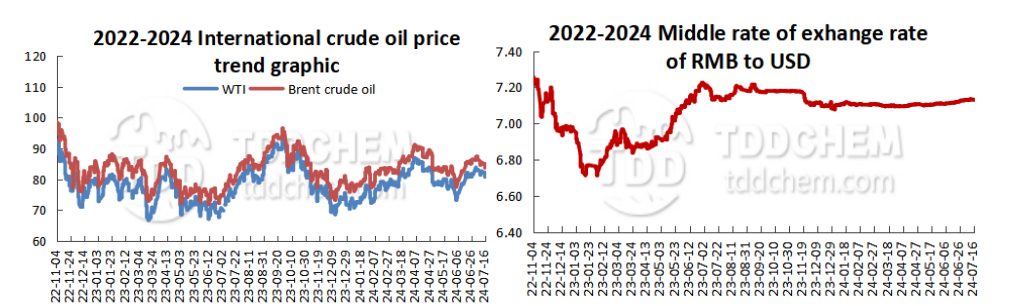

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. National Energy Administration: Select some counties and townships to carry out the promotion activities of charging infrastructure construction and application

2. The enthusiasm for mergers and acquisitions in the real estate industry continued to increase, and the total disclosed transaction size increased by 11.5% month-on-month

3. Ministry of Foreign Affairs: China's economy has handed over a commendable "semi-annual report" report card

4. A number of cities with car purchase restrictions will optimize the regulation and control policies for passenger cars in a timely manner and actively release the potential of automobile consumption

5. The Department of Foreign Investment of the National Development and Reform Commission visited and investigated foreign-funded enterprises in Shanghai and Shaanxi Province

International News

1. Japan may spend $13.5 billion on Friday to intervene in the yen

2. Eurozone consumer loan demand rose for the first time in two years

3. Market analysis: The modest rebound of USD/JPY may be blocked

4. HSBC postponed India's interest rate cut expectations to the fourth quarter

5. The latest survey by the European Central Bank shows that the wage growth of enterprises in the euro area has slowed down

Domestic News

1. National Energy Administration: Select some counties and townships to carry out the promotion activities of charging infrastructure construction and application

The General Department of the National Energy Administration announced that in order to build a high-quality charging infrastructure system, accelerate the construction of a charging network in rural areas with effective coverage, and support new energy vehicles to go to the countryside and promote rural revitalization, the National Energy Administration organized and selected some counties and townships to carry out charging infrastructure construction and application promotion activities. It was decided to select 33 counties (county-level cities, counties, autonomous counties, regions) including Daming County, Handan City, Hebei Province, and 74 townships (towns) such as Dabeijian Gu Town, Ninghe District, Tianjin City to carry out charging infrastructure construction and application promotion activities. (National Energy Administration)

2. The enthusiasm for mergers and acquisitions in the real estate industry continued to increase, and the total disclosed transaction size increased by 11.5% month-on-month

According to data from the China Index Research Institute, there were 17 M&A transactions in the real estate sector in June, an increase of two from the previous month. Among them, 15 transactions disclosed transaction amounts, with a total transaction size of about 16.93 billion yuan, an increase of 11.5% month-on-month, and an average single transaction size of 1.13 billion yuan, a decrease of 10.8% month-on-month. The China Index Research Institute believes that from the perspective of the total number and scale of M&A transactions, the enthusiasm of M&A activities continued to increase in June. At present, the market is still in the adjustment period, the industry continues to survive the fittest, and it is expected that the phenomenon of real estate enterprises and real estate-related enterprises withdrawing from the real estate business will still occur in the future. (Securities Times)

3. Ministry of Foreign Affairs: China's economy has handed over a commendable "semi-annual report" report card

On July 16, Foreign Ministry Spokesperson Lin Jian held a regular press conference. Lin Jian said that in the first half of the year, China's economy handed over a commendable "semi-annual report" report card, withstanding the pressure in the global economy of rising instability and uncertainty, and playing an important role as a "stabilizer" and "power source". The "first half", which has been steady and smooth, both in quantity and quality, has laid a solid foundation for China's economy to achieve its expected development target for the whole year this year. China's economy has a solid foundation, strong resilience, great potential and sufficient momentum, and its development trend of stability and long-term improvement has not changed, the forward momentum of maintaining high-quality development has not changed, and the direction of adhering to high-level opening-up has not changed. With the foundation and confidence laid in the "first half", coupled with the strong impetus injected into further deepening reform to promote high-quality development, we have the determination, ability and conditions to continue to promote the qualitative and effective improvement of China's economy and reasonable quantitative growth. We are full of confidence in the future development of China's economy! (CCTV News)

4. A number of cities with car purchase restrictions will optimize the regulation and control policies for passenger cars in a timely manner and actively release the potential of automobile consumption

Since the beginning of this year, the relevant ministries and commissions of the state have repeatedly mentioned "encouraging cities with purchase restrictions to relax vehicle purchase restrictions". At present, the existing regions such as Beijing, Shanghai, Guangzhou, Tianjin, Hangzhou, Shenzhen and others across the country have not completely lifted the restrictions on car purchases. Among them, the reporter was informed that in the next step, Tianjin will optimize and adjust the passenger car regulation and control policies in a timely manner according to the relevant national policies and the demand for small passenger cars, so as to better meet the needs of economic and social development; At the same time, Hangzhou also said that from March 20, 2023, the "Notice of 6 Departments including the Hangzhou Municipal Transportation Bureau on Issuing Several Policy Measures (Trial) to Optimize Other Indicators of Passenger Cars for Benefiting People's Livelihood" was officially released and implemented, which clarified that individuals and key enterprises such as those who have been unable to win for a long time, talents, and multi-child families can directly apply for passenger car indicators. The Municipal Regulation and Control Office actively pays attention to and studies the implementation of the new policy last year, and will optimize the regulation and control policies in a timely manner according to the implementation effect; In addition, Guangzhou will continue to give policy preferences to new energy vehicle indicators in the context of promoting consumption. (Securities Times)

5. The Department of Foreign Investment of the National Development and Reform Commission visited and investigated foreign-funded enterprises in Shanghai and Shaanxi Province

In order to implement the deployment requirements of the recent meeting of the leading comrades of the State Council and further do a good job in attracting and utilizing foreign investment, the Department of Foreign Investment of the National Development and Reform Commission went to Shanghai and Shaanxi Province from July 9 to 12 to visit and investigate foreign-funded enterprises and carry out "one-to-one" exchange and discussions, actively publicize China's policy on the use of foreign capital, gain an in-depth understanding of the current problems and difficulties faced by foreign-funded enterprises and relevant work suggestions, and give positive responses to their key concerns, so as to further boost the expectations and confidence of foreign-funded enterprises.

International News

1. Japan may spend $13.5 billion on Friday to intervene in the yen

Japan may have intervened in the currency market last Friday to support the yen, based on an institutional comparison of Japan's current account data and money broker estimates. Comparisons suggest that the size of the intervention could be around 2.14 trillion yen ($13.5 billion). The Bank of Japan estimated last Wednesday that its current account could fall by 2.74 trillion yen due to government fiscal factors. Private money brokers, including Central Tanshi and Ueda Yagi Tanshi, expect an average decline of 600 billion yen in their current account funds.

2. Eurozone consumer loan demand rose for the first time in two years

The European Central Bank's quarterly bank lending survey showed that demand for consumer loans and housing loans in the eurozone has increased for the first time since 2022. The survey also showed that demand for corporate loans continued to decline in the three months to June, but regional conditions varied significantly, with business lending willingness rising in Germany and Spain, while France and Italy continued to decline. "Rising interest rates and falling fixed investment continue to dampen corporate demand for loans," the ECB said. At the same time, improvements in the housing market outlook, consumer confidence and spending on consumer durables have positively supported household demand. "According to the survey, banks expect net demand for all types of loans to increase in the third quarter; Credit standards "remained broadly at a tightening level", with a slight tightening of credit standards for companies but a slight relaxation of credit standards for housing; For the third quarter, business loans is expected to tighten modestly and credit standards for household loans remain unchanged.

3. Market analysis: The modest rebound of USD/JPY may be blocked

According to foreign media analysis, the USD/JPY pair has rebounded to a maximum of 158.79 boosted by the "Trump trade", which is nothing too worrying considering the 162.00 level that was traded earlier this month. Overnight, Powell said he was more confident that inflation would reach his 2% target, which was seen as a clear signal that a rate cut was imminent. Key inflation data for Japan will be released this Friday, with national CPI data expected to rise 2.9% year-on-year, the highest since October last year. Core CPI is also expected to move higher, well above the Bank of Japan's 2% target, providing a case for the Bank of Japan to raise interest rates at its July meeting. The yield difference between Japan and the US is likely to continue to hamper USD/JPY, at least in the near term.

4. HSBC postponed India's interest rate cut expectations to the fourth quarter

hSBC postponed its interest rate cut expectations for the Bank of India by one quarter to the fourth quarter. Pranjul Bhandari, chief economist for India at HSBC, said in a note that some of the preconditions for rate cuts, such as fiscal consolidation and slowing unsecured loan growth, are in place, but one more – lower food prices – still needs to be implemented. As a result, HSBC expects India central bank to cut interest rates by 25 basis points in Q4 and Q1 next year, and believes the easing cycle will be shallow given the strong growth. HSBC expects the government to target the fiscal deficit at 4.9 percent of GDP, down from 5.1 percent announced in the medium-term budget, with net borrowing falling by Rs. 500 billion ($5.98 billion) compared to the medium-term budget, against the backdrop of declining fiscal deficits.

5. The latest survey by the European Central Bank shows that the wage growth of enterprises in the euro area has slowed down

According to a survey by the European Central Bank, eurozone companies believe that the growth of workers' wages will be more modest over the next 12 months. The European Central Bank said in a survey on Monday that it expects wages to rise by 3.3 percent, down from 3.8 percent in the previous survey three months ago. Companies also lowered their selling price forecasts to 3% from 3.3%. A drop in wage growth expectations would be seen as a positive sign, as the 3% level is generally considered in line with the target for consumer price growth. In the survey, service companies expect greater growth in selling prices, wage costs, non-labor input costs and employment rates over the next 12 months than other industries. The ECB also said that business inflation expectations have declined, with median annual inflation expectations of 3% for one--year, three--year and five-year periods, and 50% of companies see upside risks to the inflation outlook within five years.

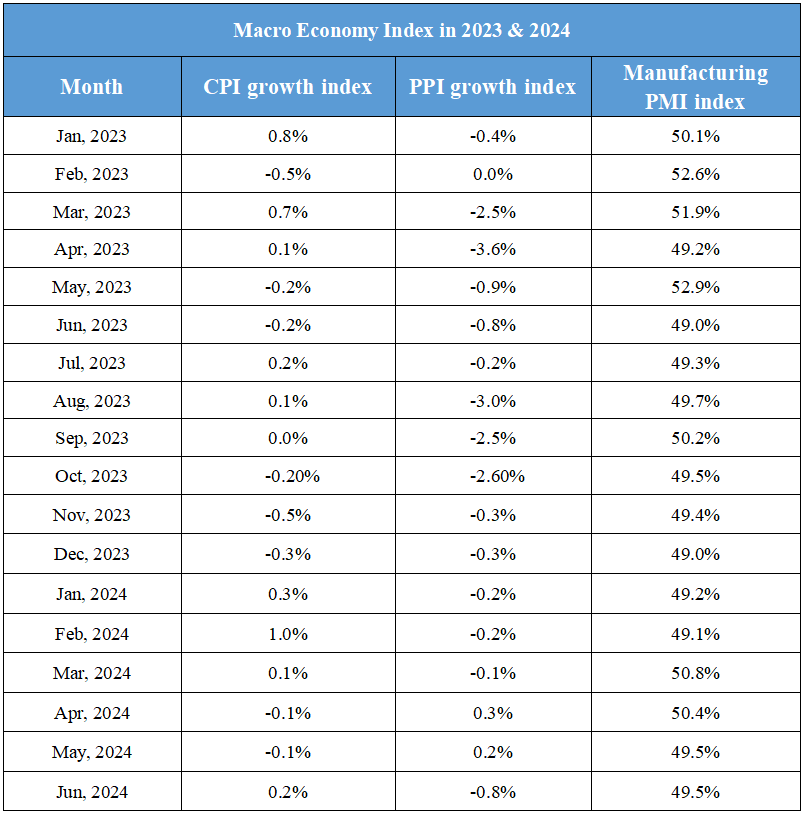

Domestic Macro Economy Index