Titanium sponge market analysis in 2020

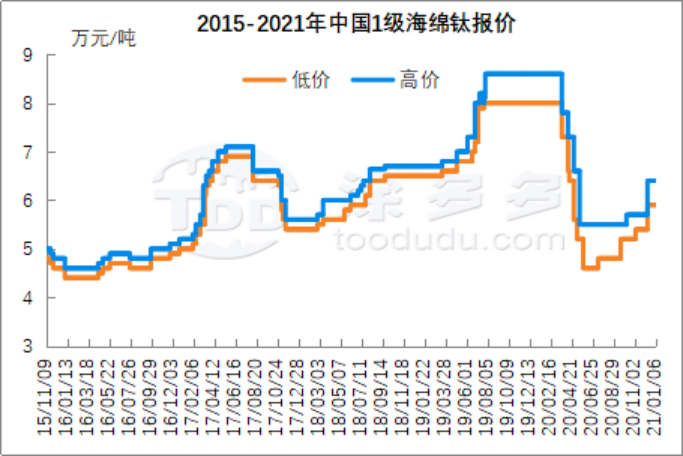

1. Price analysis

In 2020, China's titanium sponge prices were down and up, the market price than the beginning of the year overall 14,000 yuan / ton decline.

The first half of the decline phase: affected by the new crown epidemic, titanium sponge market demand decline, the market oversupply, manufacturers shipments have pressure. At the end of February market prices have loosened, coupled with the decline in raw material prices, followed by a sustained decline in prices. Market a level of titanium sponge from the beginning of the mainstream transaction 78,000 yuan / ton down to 48,000 yuan / ton in May, two months during the price decline of 40%, the market price has hit a new low of nearly four years, the whole industry is in a state of loss. June with the market rebound and low prices, downstream purchases have increased, while the market oversupply, prices are still low hover.

The second half of the rising stage: Since July, with the enterprise to inventory and downstream demand to enhance and raw material prices, titanium sponge prices began to stop rising, as of the end of December, manufacturers 1 level mainstream offer in 64,000 yuan / ton, the market price rose 39% compared to the low.

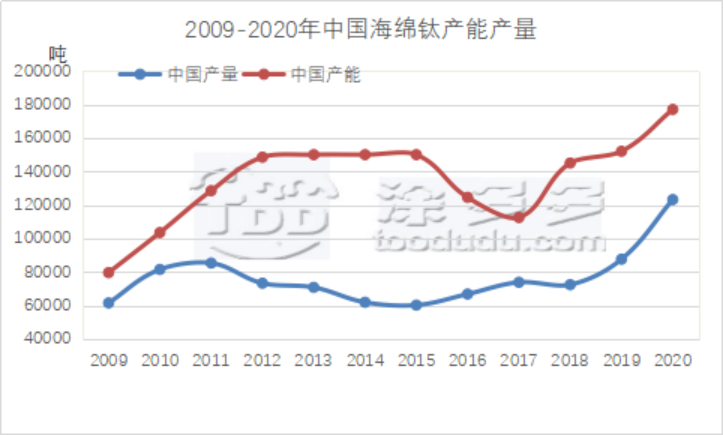

2. Yield analysis

According to Tuoduo statistics, titanium sponge production in 2020 at 121,000 tons, an increase of 38% year-on-year, the current market still has production capacity under construction, with the old capacity to resume production and the release of new production capacity construction, titanium sponge 2021 production is expected to continue to maintain a relatively large growth.

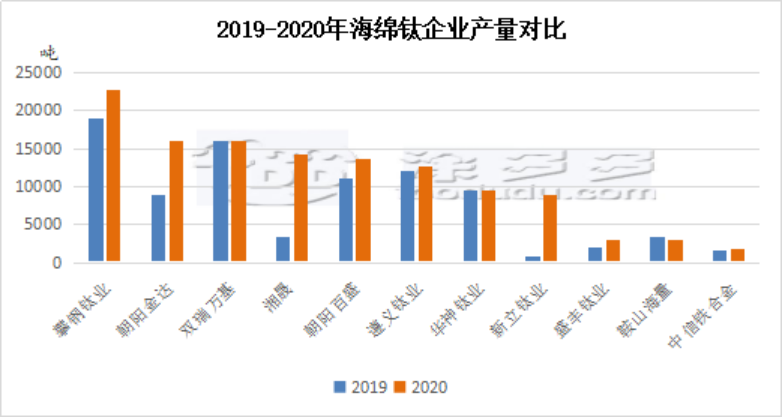

2020 production ranking of the top three enterprises Sichuan Pangang, Chaoyang Jinda, Shuangrui Wanji, titanium sponge production increase in the top three enterprises Xinli, Xiangsheng, Jinda.

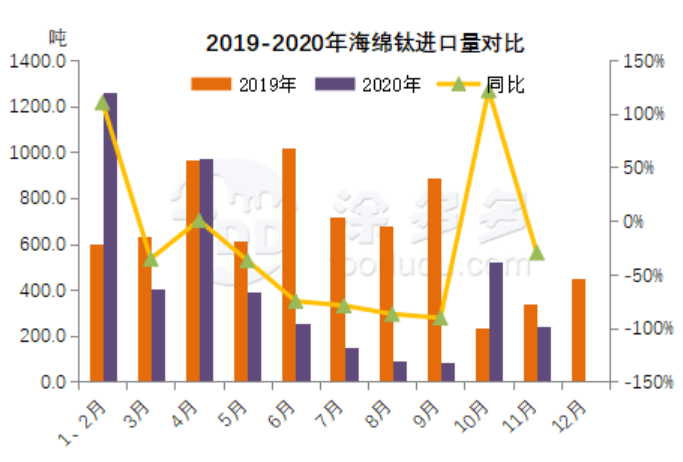

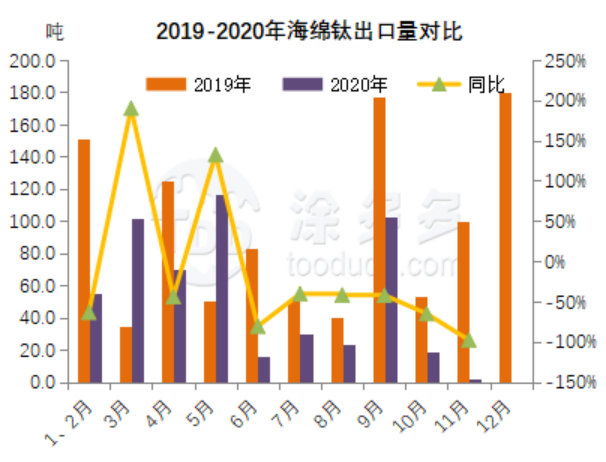

3. Import and export analysis

According to customs data, the cumulative import of 4368.5 tons from January to November 2020, down 34.71% year-on-year.

The main importing countries are Kazakhstan, Ukraine and Japan.

The cumulative export from January to November 2020 was 536.2 tons, down 38.06% year-on-year.

Export regions are mainly South Korea, Taiwan, Sweden, the Netherlands, etc.

4. Post market forecast

In 2020 high-end market demand is still obvious, the military market demand is strong, with the epidemic control, civilian titanium market demand will continue to increase, titanium sponge market demand will also continue to grow; with the release of domestic enterprises production capacity, market competition pressure will also continue to increase, with the cost of each raw material increases, the market price is also expected to continue to improve.